South Carolina Sales Tax Charleston

South Carolina's sales tax is an essential component of the state's revenue system, contributing significantly to its economy. The sales tax, a consumption tax, is levied on the sale of goods and some services within the state. It is a vital source of income for local governments and plays a crucial role in funding various public services and infrastructure development.

This article will delve into the specifics of South Carolina's sales tax system, focusing on the city of Charleston, a prominent economic hub in the state. We will explore the tax rates, exemptions, and their impact on businesses and consumers in this vibrant city.

Understanding South Carolina's Sales Tax Structure

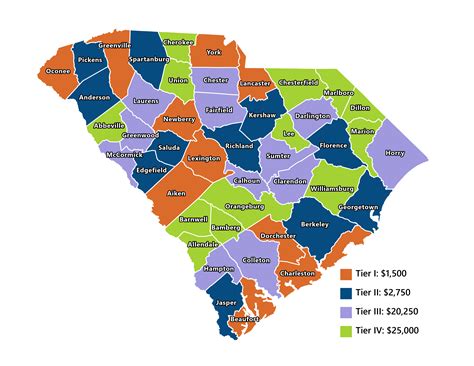

South Carolina has a comprehensive sales tax system, with taxes imposed at both the state and local levels. The state sales tax rate is a flat rate applicable across the state, while local governments, including counties and municipalities, have the authority to impose additional sales taxes.

The state sales tax rate in South Carolina is 6%, one of the lower rates among U.S. states. However, when combined with local taxes, the total sales tax rate can vary significantly across the state. For instance, in Charleston County, the local sales tax rate is 1%, bringing the total sales tax rate to 7% for most purchases within the county.

The state's sales tax is administered by the South Carolina Department of Revenue (SCDOR), which is responsible for collecting and distributing the tax revenue to the appropriate entities.

Exemptions and Special Rates

South Carolina's sales tax system includes several exemptions and special rates for specific goods and services. These exemptions are designed to encourage certain economic activities, support specific industries, or provide relief to certain consumer groups.

-

Food and Groceries: Most unprepared food items, including staple groceries, are exempt from sales tax. This exemption aims to reduce the tax burden on essential food items, making them more affordable for consumers.

-

Prescription Drugs: Sales tax is not applied to prescription drugs, ensuring that essential medical items remain accessible to those in need.

-

Manufacturing: To promote industrial growth, certain manufacturing equipment and machinery are exempt from sales tax when purchased for manufacturing purposes.

-

Tourism: Some tourism-related activities and services are taxed at a lower rate. For instance, the sales tax on prepared food served in restaurants is 9% in Charleston County, with the additional 2% dedicated to tourism-related initiatives.

Sales Tax in Charleston: A Local Perspective

Charleston, with its rich history, vibrant culture, and thriving economy, serves as an excellent case study for understanding the impact of sales tax on a local level.

Economic Impact

Charleston's economy is diverse, with significant contributions from tourism, manufacturing, and the service industry. The city's sales tax revenue plays a vital role in funding essential public services and infrastructure projects, directly impacting the city's growth and development.

For instance, the additional 1% local sales tax in Charleston County generates substantial revenue, which is utilized for various public initiatives. These include funding for public transportation, parks and recreation, and cultural programs, enhancing the quality of life for residents and the city's appeal to visitors.

Business Implications

Sales tax is a significant consideration for businesses operating in Charleston. While the city's vibrant economy offers numerous opportunities, the sales tax system can impact business strategies and operations.

Businesses must ensure compliance with sales tax regulations, accurately collecting and remitting taxes to the appropriate authorities. This involves understanding the tax rates, exemptions, and potential penalties for non-compliance. Many businesses utilize sales tax software and accounting services to streamline this process and ensure accuracy.

Additionally, businesses must consider the impact of sales tax on their pricing strategies. While increasing prices to cover tax liabilities is an option, it can impact consumer behavior and market competitiveness. Some businesses choose to absorb the tax liability, while others pass it on to consumers. This decision often depends on the industry, market position, and consumer expectations.

Consumer Perspective

For consumers in Charleston, understanding the sales tax system is crucial for making informed purchasing decisions. The total sales tax rate, currently at 7% in Charleston County, can significantly impact the final cost of goods and services.

Consumers can benefit from understanding the exemptions and special rates. For instance, the exemption on unprepared food items can encourage consumers to purchase more groceries, potentially saving money in the long run. Similarly, the lower tax rate on certain tourism-related activities can make vacation planning more affordable.

Additionally, consumers can advocate for themselves by ensuring businesses accurately calculate and apply sales tax. This involves reviewing receipts and questioning any discrepancies. By being vigilant, consumers can ensure they are not overcharged and contribute to a fair and transparent sales tax system.

Future Implications and Potential Changes

South Carolina's sales tax system, like many other states, is subject to potential changes and reforms. These changes can be driven by various factors, including economic trends, political priorities, and public opinion.

Potential Rate Adjustments

One of the most significant changes that could impact Charleston and the state is a potential adjustment to the sales tax rate. While the current state rate of 6% is relatively low, there have been discussions about increasing it to generate more revenue for various state initiatives.

An increase in the state sales tax rate would directly impact businesses and consumers in Charleston. Businesses might need to adjust their pricing strategies, potentially impacting their competitive position and consumer demand. Consumers, on the other hand, would face higher prices for goods and services, affecting their purchasing power and overall economic well-being.

Sales Tax Reform

In recent years, there have been calls for sales tax reform in South Carolina. Some advocates propose a more simplified tax structure, potentially eliminating some of the current exemptions and special rates. This reform could lead to a more uniform tax system, making it easier for businesses to comply and reducing the administrative burden.

However, simplifying the tax system might also result in a loss of revenue from certain sectors. For instance, the tourism industry, which benefits from the current lower tax rate on certain activities, could face challenges if this rate is increased or standardized. Such changes would require careful consideration of the economic impact on various industries and the state's overall revenue stream.

Online Sales Tax

The rise of e-commerce has brought about significant changes in sales tax collection, particularly for online sales. South Carolina, like many other states, has implemented laws to ensure that online retailers collect and remit sales tax on transactions made within the state. This has had a notable impact on both businesses and consumers.

For businesses, especially online retailers, the requirement to collect sales tax on online transactions can be a complex and resource-intensive process. They must ensure compliance with the state's tax laws, which can vary depending on the location of the buyer and the nature of the goods or services sold.

Consumers, on the other hand, have become accustomed to seeing sales tax included in their online purchases. While this provides transparency and predictability, it also means that the final cost of online goods and services is often higher than initially displayed, especially when shipping and handling fees are included.

Conclusion

South Carolina's sales tax system, particularly in Charleston, is a complex yet vital component of the state's economy. It plays a significant role in funding public services, infrastructure, and economic development initiatives. Understanding the sales tax rates, exemptions, and potential future changes is crucial for businesses, consumers, and policymakers alike.

As Charleston continues to thrive and evolve, the sales tax system will remain a key factor in shaping its economic landscape. By staying informed and engaged, stakeholders can ensure that the sales tax system remains fair, efficient, and aligned with the city's and state's economic goals.

What is the current sales tax rate in Charleston, South Carolina?

+The current sales tax rate in Charleston County is 7%, which includes the state sales tax rate of 6% and the local sales tax rate of 1%.

Are there any sales tax exemptions in South Carolina?

+Yes, South Carolina offers several sales tax exemptions. These include exemptions for unprepared food items, prescription drugs, certain manufacturing equipment, and some tourism-related activities.

How do sales tax rates impact businesses in Charleston?

+Sales tax rates can impact businesses in Charleston by influencing their pricing strategies, competitive position, and compliance obligations. Businesses must ensure they collect and remit sales tax accurately to avoid penalties.

What are the potential future changes to South Carolina’s sales tax system?

+Potential future changes include adjustments to the sales tax rate, reforms to simplify the tax structure, and ongoing developments in online sales tax collection. These changes can significantly impact businesses and consumers in Charleston.