Income Tax In Michigan

Income tax is a crucial aspect of any state's financial system, and Michigan, like many other states, has its own set of income tax laws and regulations. Understanding the intricacies of Michigan's income tax system is essential for individuals and businesses operating within the state. This comprehensive guide will delve into the various aspects of income tax in Michigan, covering everything from the tax rates and brackets to the unique features and considerations specific to the state.

Michigan’s Income Tax: An Overview

Michigan’s income tax system operates under a progressive structure, meaning that higher income earners are subject to higher tax rates. The state imposes a personal income tax on various sources of income, including wages, salaries, commissions, bonuses, and other forms of compensation. Additionally, Michigan levies taxes on income derived from investments, pensions, and certain retirement accounts.

The state's income tax system aims to provide a stable revenue source for essential government services while ensuring fairness and equity for its residents. By implementing a progressive tax structure, Michigan aims to strike a balance between taxation and economic growth, promoting a healthy business environment while also supporting public initiatives.

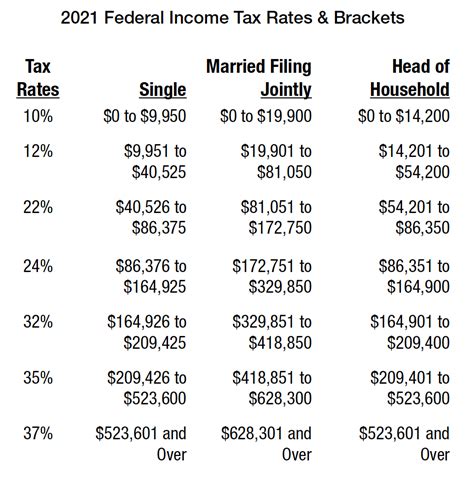

Tax Rates and Brackets

Michigan’s income tax rates are divided into multiple brackets, each with its own applicable tax rate. As of [insert latest year], the state’s income tax brackets and corresponding rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| Up to $3,000 | 4.25% |

| $3,001 - $5,000 | 4.00% |

| $5,001 - $23,000 | 3.90% |

| $23,001 - $75,000 | 4.25% |

| $75,001 - $500,000 | 4.275% |

| Over $500,000 | 4.6% |

These tax brackets and rates are subject to periodic adjustments by the Michigan Department of Treasury to account for inflation and economic changes. It is crucial for taxpayers to stay updated on any modifications to ensure accurate tax calculations.

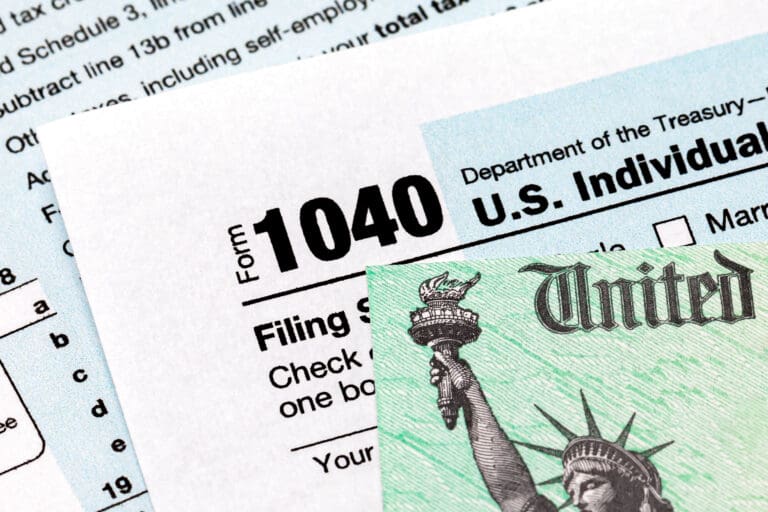

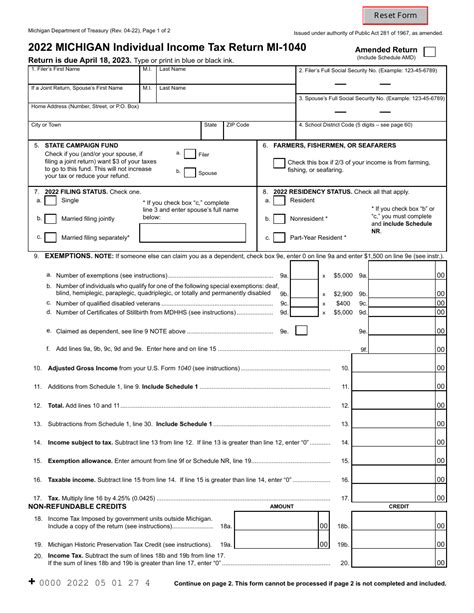

Filing and Payment Options

Michigan offers a range of convenient filing and payment options for taxpayers. Residents can choose to file their income tax returns electronically through the state’s official website, which provides a secure and efficient process. The state also allows taxpayers to file paper returns, although electronic filing is generally recommended for its accuracy and speed.

Payment options include direct debit, credit card, or electronic funds transfer. Taxpayers can also opt for installment plans or request extensions if they are unable to meet the payment deadline. The Michigan Department of Treasury provides detailed guidelines and resources to assist taxpayers in navigating the filing and payment process smoothly.

E-filing Benefits

Electronic filing offers several advantages, including reduced processing time, increased accuracy, and the ability to track the status of returns and refunds online. It also allows taxpayers to receive notifications and updates regarding any changes or adjustments to their tax obligations.

Payment Deadlines and Penalties

Michigan’s income tax returns are typically due on April 15th of each year. However, certain circumstances may warrant an extension, which can be requested through the appropriate channels. Failure to file or pay taxes on time may result in penalties and interest charges, so it is crucial to stay informed about the deadlines and meet them promptly.

Deductions and Credits

Michigan provides a range of deductions and tax credits to help reduce the tax burden for its residents. These deductions and credits aim to provide financial relief to individuals and families, promote specific initiatives, and encourage certain behaviors.

Standard Deductions

Michigan allows taxpayers to claim a standard deduction, which reduces the taxable income. The standard deduction amount varies based on the taxpayer’s filing status. For instance, as of [insert latest year], the standard deduction for single filers is 4,400, while it is 8,800 for married couples filing jointly.

Itemized Deductions

In addition to the standard deduction, Michigan taxpayers can opt for itemized deductions. These deductions allow individuals to claim specific expenses, such as mortgage interest, state and local taxes, charitable contributions, and medical expenses, among others. Itemized deductions can significantly reduce taxable income, especially for those with substantial eligible expenses.

Tax Credits

Michigan offers various tax credits to support specific initiatives and provide relief to certain groups. These credits include, but are not limited to:

- Homestead Property Tax Credit: This credit aims to reduce the property tax burden for homeowners, especially those with lower incomes.

- Low-Income Tax Credit: Designed to assist low-income earners, this credit provides a refundable tax credit to eligible individuals and families.

- Earned Income Tax Credit: Similar to the federal credit, Michigan's EITC aims to boost the income of working individuals and families with low to moderate incomes.

- Senior Citizens Property Tax Credit: This credit provides relief to senior citizens by reducing their property taxes.

Unique Features of Michigan’s Income Tax

Michigan’s income tax system has several unique features that distinguish it from other states.

Single Business Tax

Until its abolition in 2011, Michigan imposed a Single Business Tax (SBT) on business entities. The SBT was a value-added tax that applied to the gross receipts of a business, regardless of its profitability. While the SBT was designed to provide a stable revenue source for the state, it was criticized for its complexity and impact on small businesses. Its abolition led to the introduction of the Corporate Income Tax (CIT) and the Michigan Business Tax (MBT) in its place.

Michigan Business Tax

The Michigan Business Tax (MBT) was introduced as a replacement for the Single Business Tax. The MBT was a multi-factor tax that considered various aspects of a business’s operations, including payroll, sales, and assets. However, the MBT was also criticized for its complexity, and in 2011, it was replaced by the Corporate Income Tax (CIT), which aligned more closely with federal income tax principles.

Corporate Income Tax

The Corporate Income Tax (CIT) is the current tax system for businesses in Michigan. The CIT applies to all corporations, including S-corporations, partnerships, and limited liability companies (LLCs). The tax rate for the CIT is 6%, which is applied to the net income of the business after deductions and allowances.

Income Tax for Non-Residents

Michigan also imposes income tax on non-residents who earn income within the state. Non-residents are required to file a Michigan income tax return and pay taxes on any income earned within the state’s borders. The tax rates and brackets for non-residents are the same as those for residents.

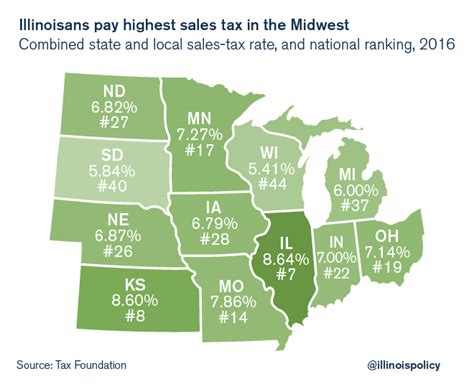

Reciprocal Agreements

Michigan has entered into reciprocal agreements with certain neighboring states, including Indiana, Illinois, and Ohio. These agreements allow individuals who work in one state but reside in another to pay income tax only to the state where they reside. This prevents double taxation and simplifies the tax filing process for commuters and remote workers.

Future Implications and Considerations

Michigan’s income tax system is subject to ongoing discussions and potential reforms. As the state’s economic landscape evolves, policymakers and stakeholders continuously evaluate the effectiveness and fairness of the tax structure. Some proposed changes include simplifying the tax code, adjusting tax rates, and exploring new sources of revenue to support critical public services.

Furthermore, Michigan's income tax system may be influenced by federal tax reforms and changes in other states. Staying informed about these developments is crucial for taxpayers, businesses, and policymakers to adapt and navigate the evolving tax landscape effectively.

Conclusion

Understanding Michigan’s income tax system is vital for residents and businesses operating within the state. By providing a comprehensive overview of tax rates, filing options, deductions, and unique features, this guide aims to empower individuals and businesses with the knowledge they need to navigate the tax landscape successfully. As the state’s tax policies continue to evolve, staying informed and seeking professional guidance when needed will ensure compliance and financial well-being.

How often are Michigan’s income tax rates and brackets updated?

+Michigan’s income tax rates and brackets are typically reviewed annually by the Michigan Department of Treasury. Adjustments are made to account for inflation and economic changes. Taxpayers should refer to the official state website or consult tax professionals for the most up-to-date information.

Are there any income tax exemptions in Michigan?

+Yes, Michigan offers certain income tax exemptions. For instance, Social Security benefits and some forms of public assistance are exempt from state income tax. Additionally, certain retirement plans, such as pension income, may be partially or fully exempt. It is important to consult with a tax professional to understand the specific exemptions applicable to your situation.

How does Michigan’s income tax compare to other states?

+Michigan’s income tax system is relatively competitive compared to other states. While it has a progressive tax structure, the top tax rate is lower than in many other states. Additionally, Michigan offers various deductions and credits, which can significantly reduce the tax burden for individuals and businesses. However, it is essential to compare the overall tax climate, including property taxes and sales taxes, when evaluating Michigan’s tax competitiveness.