What Are The Sales Tax In Illinois

Illinois, a diverse state in the Midwest region of the United States, is known for its vibrant cities, picturesque landscapes, and a thriving business climate. When it comes to sales tax, Illinois follows a comprehensive tax system that varies across different jurisdictions. Understanding the sales tax landscape in Illinois is crucial for both residents and businesses alike. In this comprehensive guide, we delve into the intricacies of Illinois sales tax, providing you with all the information you need to navigate this complex yet vital aspect of the state's economy.

Illinois Sales Tax: An Overview

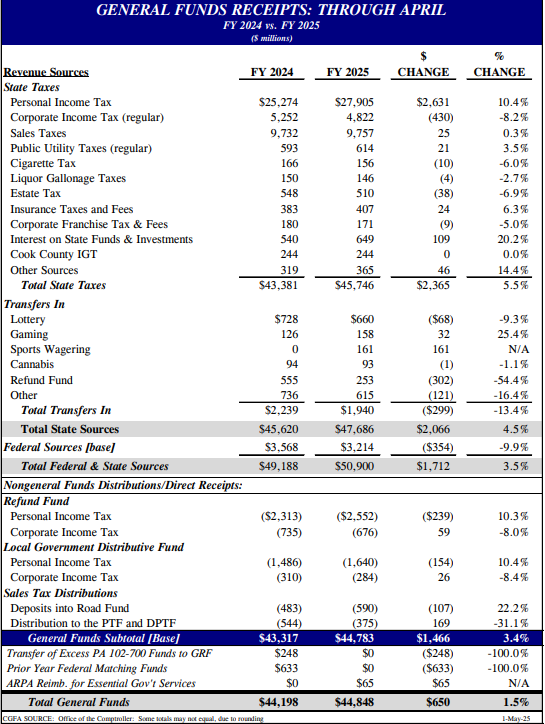

The sales tax in Illinois is a consumption tax imposed on the retail sale of tangible personal property and certain services. It is administered by the Illinois Department of Revenue and plays a significant role in funding state and local government operations. The tax is applied at multiple levels, including the state, county, and municipal levels, leading to varying tax rates across the state.

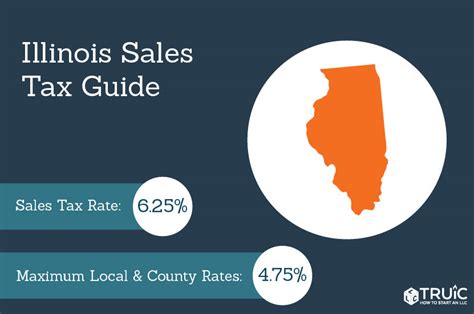

State Sales Tax Rate

The statewide sales tax rate in Illinois is currently set at 6.25%. This rate is applicable to most tangible personal property and certain services provided within the state. The state sales tax provides a substantial revenue stream for the Illinois government, supporting essential public services and infrastructure development.

Local Sales Tax Rates

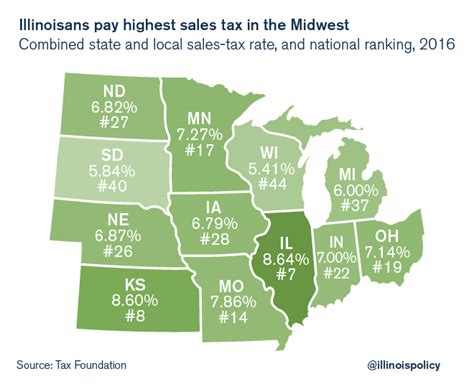

In addition to the state sales tax, Illinois allows local jurisdictions, including counties and municipalities, to levy their own sales taxes. These local sales tax rates can vary significantly, adding complexity to the overall tax structure. Local sales taxes are typically used to fund specific projects or initiatives within a particular area.

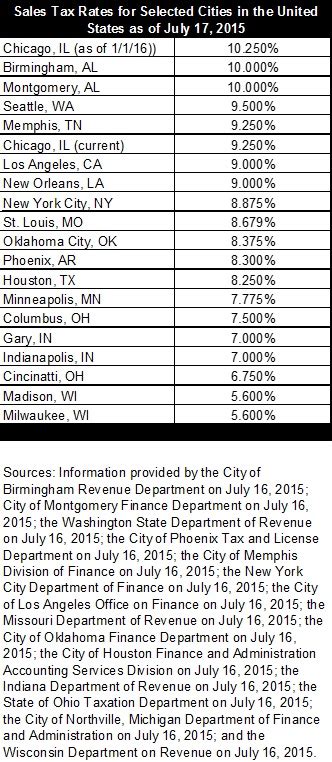

For instance, Cook County, which includes the city of Chicago, imposes an additional 1.25% sales tax, bringing the total sales tax rate to 7.5% within the county. Other counties may have different rates, and some municipalities within counties may also have their own sales tax rates on top of the county and state taxes.

| County | Sales Tax Rate |

|---|---|

| Cook County | 7.25% |

| DuPage County | 7.00% |

| Lake County | 7.00% |

| McHenry County | 6.75% |

| Will County | 7.25% |

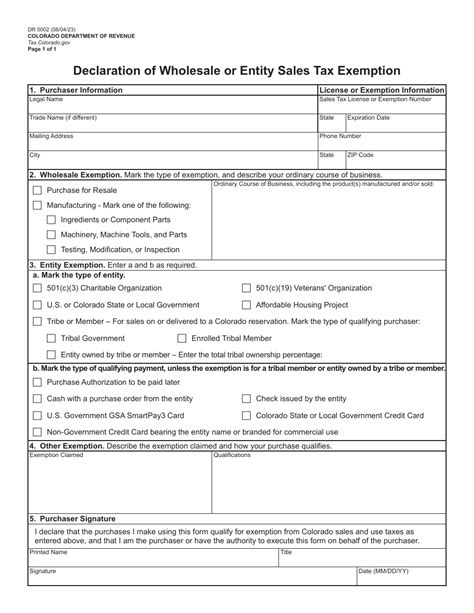

Exemptions and Special Considerations

Illinois sales tax applies to a wide range of goods and services, but there are certain exemptions and special considerations to be aware of. Some common exemptions include:

- Food and beverages for home consumption.

- Prescription drugs and certain medical devices.

- Residential rents and leases.

- Sales of machinery and equipment used in manufacturing and research and development.

- Sales of certain agricultural products.

Additionally, Illinois offers tax holidays during specific periods, where certain items are exempt from sales tax. These tax-free events typically target back-to-school shopping and emergency preparedness items.

Sales Tax Collection and Remittance

Businesses operating in Illinois are responsible for collecting and remitting sales tax on behalf of the state and local governments. The sales tax is typically added to the purchase price of goods or services at the point of sale. It is the buyer’s responsibility to pay the tax, and businesses act as tax collectors.

Sales tax collection is particularly crucial for online retailers, as Illinois has a click-through nexus law. This means that out-of-state retailers can be considered to have a physical presence in Illinois if they have affiliate links on local websites, triggering sales tax collection obligations.

Businesses are required to register with the Illinois Department of Revenue and obtain a Sales and Use Tax Number. The frequency of sales tax remittance depends on the business's sales volume and can range from monthly to quarterly filings.

Sales Tax Compliance and Penalties

Ensuring compliance with Illinois sales tax regulations is essential to avoid penalties and legal consequences. Failure to collect and remit sales tax can result in significant fines and interest charges. Additionally, businesses found to be non-compliant may face audits and legal actions.

The Illinois Department of Revenue offers resources and guidance to help businesses understand their sales tax obligations. Staying informed about tax laws, using accurate tax calculation tools, and keeping detailed records are key strategies for maintaining compliance.

The Impact of Sales Tax on Businesses and Consumers

The sales tax system in Illinois has a direct impact on both businesses and consumers. For businesses, particularly those with multiple locations or online operations, managing varying tax rates can be complex. It requires precise tax calculation, accurate record-keeping, and timely remittance to avoid penalties.

From a consumer perspective, the varying sales tax rates across the state can influence purchasing decisions. Shoppers may compare prices and tax rates when making significant purchases, especially for high-value items. Additionally, online shoppers may need to account for sales tax when purchasing from out-of-state retailers, as Illinois requires tax collection based on the destination of the shipment.

Sales Tax and Economic Development

Sales tax plays a critical role in funding public services and infrastructure projects in Illinois. The revenue generated from sales tax supports essential services such as education, healthcare, transportation, and public safety. Local sales taxes, in particular, provide flexibility for communities to address specific development needs.

Furthermore, the sales tax structure can influence economic development strategies. Local governments may use sales tax incentives to attract businesses and stimulate economic growth within their jurisdictions. These incentives can take the form of tax holidays, reduced tax rates, or tax exemptions for specific industries or types of businesses.

Looking Ahead: Sales Tax Reform and Future Trends

As the economic landscape evolves, discussions around sales tax reform are gaining traction in Illinois. One of the key considerations is the impact of e-commerce on sales tax collection. With the growth of online retail, ensuring fair tax collection from out-of-state sellers is a priority for state governments.

Additionally, there are ongoing debates about the fairness and equity of the current sales tax system. Some advocate for a broader base of taxable goods and services to alleviate the burden on certain industries or consumers. Others propose a shift towards a consumption-based tax system that could include services, which are currently partially taxed in Illinois.

Staying informed about these potential reforms is crucial for businesses and consumers alike. Being aware of legislative changes and their potential impact can help stakeholders plan for the future and adapt their strategies accordingly.

What is the current state sales tax rate in Illinois?

+The current state sales tax rate in Illinois is 6.25%.

Are there any local sales taxes in addition to the state sales tax?

+Yes, Illinois allows local jurisdictions, including counties and municipalities, to levy their own sales taxes. These local sales tax rates can vary significantly, adding complexity to the overall tax structure.

What are some common sales tax exemptions in Illinois?

+Common sales tax exemptions in Illinois include food and beverages for home consumption, prescription drugs, residential rents, and sales of certain agricultural products.

How often do businesses need to remit sales tax in Illinois?

+The frequency of sales tax remittance in Illinois depends on the business’s sales volume. It can range from monthly to quarterly filings, and businesses are required to register with the Illinois Department of Revenue and obtain a Sales and Use Tax Number.

What are the potential consequences of non-compliance with sales tax regulations in Illinois?

+Non-compliance with sales tax regulations in Illinois can result in significant fines, interest charges, and legal actions. It is crucial for businesses to understand their sales tax obligations and maintain accurate records to avoid penalties.