What Is The Sales Tax In Tennessee

Welcome to our comprehensive guide on the sales tax system in Tennessee, a state renowned for its vibrant economy and diverse industries. Understanding the intricacies of sales tax is crucial for businesses and consumers alike, as it directly impacts financial planning and compliance. In this expert-led article, we delve into the specifics of Tennessee's sales tax structure, providing an in-depth analysis and insights that are essential for navigating the state's tax landscape.

The Basics of Sales Tax in Tennessee

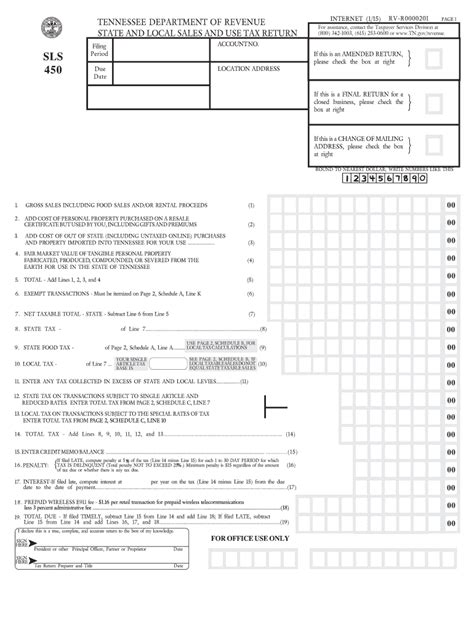

Sales tax in Tennessee is a consumption tax levied on the sale of tangible goods and some services. It is an essential revenue stream for the state, contributing significantly to its overall fiscal health. The Tennessee Department of Revenue is responsible for administering and collecting sales tax, ensuring compliance, and providing guidance to taxpayers.

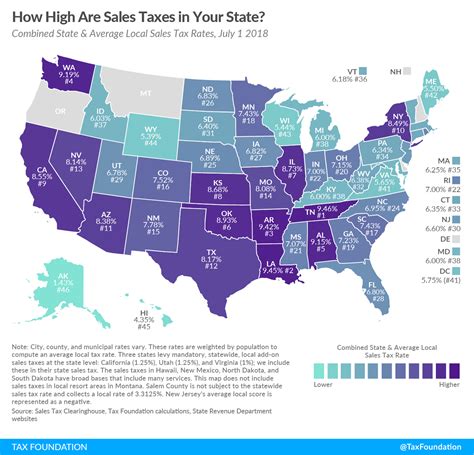

Tennessee's sales tax system operates under a combined rate structure, where the state sales tax rate is applied uniformly across the state, and local jurisdictions can add their own local sales tax rates. This combined rate ensures a consistent tax environment for businesses and consumers, simplifying tax calculations and compliance.

State Sales Tax Rate

The statewide sales tax rate in Tennessee is currently set at 7%. This rate applies uniformly to all taxable goods and services across the state, providing a stable and predictable tax environment for businesses and consumers.

Local Sales Tax Rates

In addition to the state sales tax rate, Tennessee allows local jurisdictions, such as counties and municipalities, to impose their own local sales taxes. These local sales tax rates vary depending on the location, with some areas having higher rates than others. The local sales tax rates are typically used to fund specific projects or services within the community, such as infrastructure development or public transportation.

| County | Local Sales Tax Rate |

|---|---|

| Davidson County | 2.25% |

| Shelby County | 2.50% |

| Hamilton County | 2.25% |

| Knox County | 2.125% |

| Madison County | 2.25% |

| ... | ... |

Taxable Goods and Services

In Tennessee, sales tax is applied to a wide range of goods and services. Tangible personal property, such as clothing, electronics, and furniture, is generally subject to sales tax. Additionally, certain services, including telecommunications, repair services, and entertainment services, are taxable in Tennessee.

However, it's essential to note that there are some exemptions and special tax treatments for specific goods and services. For instance, some food items, prescription drugs, and certain medical devices are exempt from sales tax. Additionally, Tennessee offers sales tax holidays during specific periods, allowing consumers to purchase certain items tax-free.

Exemptions and Special Provisions

Tennessee’s sales tax system includes various exemptions and special provisions to accommodate specific industries and promote economic development.

- Agricultural Sales: Sales of agricultural products, such as livestock, feed, and farm equipment, are generally exempt from sales tax.

- Manufacturing and Resale: Items purchased for manufacturing or resale purposes are not subject to sales tax. This provision encourages industrial growth and supports the state's manufacturing sector.

- Business-to-Business Transactions: Sales between businesses, where the goods are used for business operations or further production, are often exempt from sales tax.

- Nonprofit Organizations: Certain nonprofit entities, such as charitable organizations and educational institutions, may be eligible for sales tax exemptions on qualifying purchases.

Sales Tax Compliance and Registration

Ensuring compliance with Tennessee’s sales tax regulations is crucial for businesses to avoid penalties and maintain a positive relationship with the Department of Revenue. Businesses that meet certain criteria, such as having a physical presence in the state or making remote sales to Tennessee residents, are required to register for a sales tax permit with the Tennessee Department of Revenue.

The registration process involves providing detailed information about the business, its operations, and the goods and services it provides. Once registered, businesses must collect and remit sales tax on taxable transactions, file regular sales tax returns, and keep accurate records for audit purposes.

Sales Tax Returns and Payment

Tennessee requires businesses to file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume and registration type. These returns must be filed by the due date to avoid late fees and penalties. Businesses can file their sales tax returns electronically through the Tennessee Department of Revenue’s website, ensuring a streamlined and efficient process.

Along with the sales tax return, businesses must remit the collected sales tax to the state. Tennessee offers various payment options, including electronic funds transfer, credit card payments, and traditional check or money order payments. Businesses should ensure timely payment to avoid interest and penalty charges.

Sales Tax Rates for Specific Industries

Tennessee’s sales tax system accommodates the diverse nature of its industries by offering specific tax rates for certain sectors. These industry-specific tax rates ensure fairness and promote economic growth in targeted areas.

Retail Industry

The retail industry in Tennessee is subject to the standard state sales tax rate of 7%, along with any applicable local sales tax rates. This rate applies to most retail sales, including clothing, electronics, and home goods. However, certain retail items, such as food and beverages, may have different tax treatments or be exempt, depending on their classification.

Hospitality and Tourism

Tennessee’s vibrant hospitality and tourism industry is an economic driver, and the state offers a special sales tax rate for certain hospitality-related transactions. This includes a 9.75% sales tax rate on hotel and motel accommodations, providing a significant revenue stream for the state and local governments.

Additionally, sales tax on prepared food and beverages served in restaurants or other dining establishments is subject to a 9.25% rate, further supporting the state's hospitality sector.

Construction and Real Estate

The construction and real estate industries in Tennessee are subject to the standard state sales tax rate of 7% on tangible personal property used in construction or real estate transactions. This includes materials, fixtures, and equipment purchased for construction projects or property renovations.

However, it's important to note that real estate transactions themselves are not subject to sales tax in Tennessee. Instead, they are typically subject to transfer taxes or other specific fees, which are administered by local governments or other authorities.

Future Outlook and Potential Changes

As Tennessee’s economy continues to evolve, the state’s sales tax system may undergo changes to adapt to new economic realities and emerging industries. The state government regularly reviews and assesses the tax landscape to ensure fairness, simplicity, and competitiveness in the business environment.

Potential future changes to Tennessee's sales tax system could include:

- Rate Adjustments: The state sales tax rate or local sales tax rates may be modified to align with economic trends or budget requirements.

- Tax Base Expansion: The state may consider expanding the tax base to include additional goods and services, ensuring a broader revenue stream.

- Special Tax Initiatives: Tennessee may introduce special tax initiatives to support specific industries or economic development projects, providing targeted tax incentives.

- Simplification Measures: The state could implement simplification measures to reduce administrative burdens on businesses, making the tax system more efficient and user-friendly.

Staying informed about potential changes to Tennessee's sales tax system is crucial for businesses to adapt their financial planning and tax strategies accordingly.

Conclusion

Tennessee’s sales tax system is a critical component of the state’s economic framework, providing a stable and predictable tax environment for businesses and consumers. By understanding the state’s sales tax rates, taxable goods and services, and compliance requirements, businesses can navigate the tax landscape with confidence and ensure compliance.

As Tennessee continues to thrive economically, its sales tax system will evolve to meet the needs of a dynamic business environment. By staying informed and engaged with the state's tax regulations, businesses can contribute to Tennessee's economic growth while maintaining a positive tax compliance record.

What is the state sales tax rate in Tennessee as of the current year?

+

The state sales tax rate in Tennessee as of the current year is 7%.

Are there any counties in Tennessee with a local sales tax rate of 0%?

+

Yes, there are several counties in Tennessee with a local sales tax rate of 0%. These counties do not impose an additional local sales tax on top of the state sales tax rate.

How often do sales tax rates change in Tennessee?

+

Sales tax rates in Tennessee typically change on a less frequent basis compared to other states. Rate changes are usually made on an annual or semi-annual basis, with any adjustments being announced in advance to allow for planning and compliance.

Are there any sales tax holidays in Tennessee, and if so, when do they occur?

+

Yes, Tennessee has designated sales tax holidays during specific periods. These holidays allow consumers to purchase certain items, such as school supplies, clothing, and energy-efficient appliances, tax-free. The dates for sales tax holidays are announced in advance and vary from year to year.

How can businesses stay updated on changes to Tennessee’s sales tax regulations?

+

Businesses can stay updated on changes to Tennessee’s sales tax regulations by regularly checking the Tennessee Department of Revenue’s website, which provides the latest information on tax rates, exemptions, and compliance requirements. Additionally, businesses can subscribe to tax newsletters or alerts to receive timely updates.