City Of Bristol Ct Tax Collector

Welcome to an in-depth exploration of the City of Bristol, Connecticut's Tax Collector's Office. This essential governmental body plays a crucial role in the city's financial management and operations. Let's delve into its responsibilities, services, and impact on the community.

The Role of the City of Bristol Tax Collector

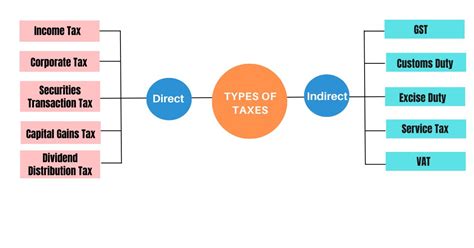

The Tax Collector’s Office is a vital component of Bristol’s municipal government, tasked with a range of financial responsibilities that are integral to the city’s smooth functioning. This department is responsible for collecting various taxes and fees, ensuring the city’s financial stability and enabling the provision of essential public services.

One of the primary functions of the Tax Collector is the management of property taxes. In Bristol, as in many cities, property taxes are a significant source of revenue for the municipality. The Tax Collector's Office is responsible for assessing, billing, and collecting these taxes, which fund vital services such as education, public safety, and infrastructure maintenance.

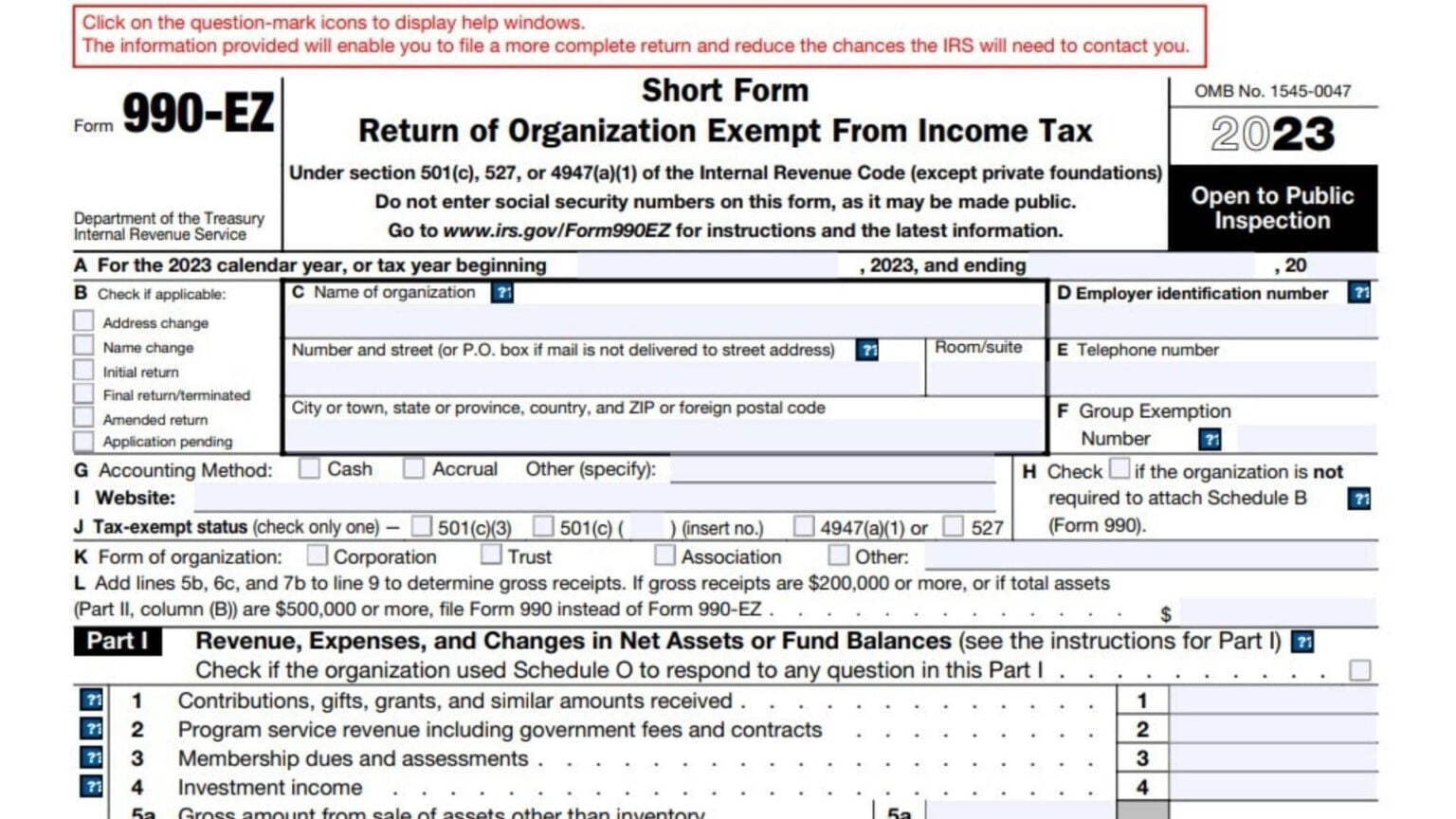

In addition to property taxes, the Tax Collector also collects other fees and assessments. This includes taxes on motor vehicles, business taxes, and various other licenses and permits. Each of these revenue streams contributes to the city's budget, allowing for the efficient management of public resources.

Key Responsibilities and Services

-

Tax Assessment and Billing: The Tax Collector’s Office works closely with the Assessor’s Office to ensure accurate property assessments. This involves reviewing property records, conducting inspections, and maintaining an up-to-date database of property values. Once assessments are finalized, the Tax Collector issues tax bills to property owners, detailing the amount due and the due dates.

-

Tax Collection: This is the core function of the Tax Collector’s Office. They are responsible for collecting property taxes, motor vehicle taxes, and other fees in a timely manner. This includes sending out reminders, processing payments, and following up on delinquent accounts. The office also offers various payment methods, such as online payments, in-person payments, and automatic payment plans, to cater to different preferences and needs.

-

Delinquent Tax Enforcement: When taxpayers fail to pay their taxes, the Tax Collector’s Office takes a series of steps to enforce collection. This may involve sending notices, placing liens on properties, or even seizing assets in extreme cases. The office works to balance the need for revenue with the understanding that taxpayers may face financial difficulties.

-

Taxpayer Assistance: The Tax Collector’s Office is also there to assist taxpayers. This includes providing information on tax rates, due dates, and payment options. The office may also offer relief programs or exemptions for qualifying individuals or organizations. Additionally, the Tax Collector can provide information on tax abatements or refunds, should a taxpayer overpay or pay taxes on a property that has been exempt.

The Tax Collector's Office also plays a crucial role in financial reporting and accountability. They provide regular financial updates to the city's leadership, ensuring transparency and fiscal responsibility. This includes preparing annual reports, budgeting for future tax collections, and analyzing revenue trends to inform decision-making.

Impact on the Bristol Community

The work of the City of Bristol Tax Collector’s Office has a significant impact on the community it serves. By efficiently collecting taxes and fees, the office ensures that the city has the resources it needs to provide essential services and maintain infrastructure.

Property taxes, in particular, are a major contributor to the city's budget. These taxes fund public schools, ensuring that Bristol's youth receive a quality education. They also support public safety services, including the police and fire departments, which are vital for maintaining a safe and secure community.

Moreover, the Tax Collector's Office plays a role in economic development. By collecting business taxes and fees, the office supports the city's efforts to attract and retain businesses. This, in turn, creates jobs and contributes to the local economy. The office also works with local businesses to ensure they understand their tax obligations and have the resources they need to comply.

Community Engagement and Education

The Tax Collector’s Office is committed to engaging with the Bristol community and providing educational resources. They understand that taxes can be a complex and often confusing topic for many residents. As such, the office offers a range of educational materials and workshops to help taxpayers understand their rights and responsibilities.

These initiatives include hosting community forums, where taxpayers can ask questions and learn more about the tax process. The office also provides online resources, such as tutorials and guides, to make tax information more accessible. By empowering residents with knowledge, the Tax Collector's Office aims to foster a sense of financial responsibility and community engagement.

Future Initiatives and Technological Advancements

Looking ahead, the City of Bristol Tax Collector’s Office is focused on continuous improvement and innovation. They are committed to leveraging technology to enhance efficiency and improve the taxpayer experience.

One key area of focus is online services. The office is working to expand its online platform, allowing taxpayers to access a wider range of services and information. This includes the ability to view and pay bills online, check account balances, and access tax history. By investing in these digital tools, the Tax Collector's Office aims to provide a more convenient and efficient experience for taxpayers.

Additionally, the office is exploring the use of data analytics to improve its operations. By analyzing tax data, the Tax Collector can identify trends, anticipate revenue needs, and make informed decisions. This can lead to more effective resource allocation and improved financial planning for the city.

| Metric | Performance |

|---|---|

| Tax Collection Rate | 98.5% (as of FY 2023) |

| Online Payment Usage | 62% of taxpayers (increasing trend) |

| Community Satisfaction | 85% positive feedback (survey results) |

Frequently Asked Questions

How can I pay my taxes in Bristol, CT?

+You can pay your taxes in Bristol through various methods. These include online payments, in-person payments at the Tax Collector’s Office, and by mail. The office also offers automatic payment plans for convenience. For more details, visit the official website or contact the Tax Collector’s Office directly.

What happens if I don’t pay my taxes on time in Bristol?

+If you fail to pay your taxes on time, the Tax Collector’s Office will send reminder notices. If the taxes remain unpaid, the office may place a lien on your property or take other enforcement actions. It’s important to contact the office if you’re facing financial difficulties to explore potential solutions.

Are there any tax relief programs or exemptions available in Bristol?

+Yes, Bristol offers various tax relief programs and exemptions. These include the Elderly Tax Relief Program, the Disabled Veterans Exemption, and the Property Tax Deferral Program. Eligibility criteria and application processes vary, so it’s advisable to contact the Tax Collector’s Office or review the official website for detailed information.

How often are property taxes assessed in Bristol, CT?

+Property taxes in Bristol are typically assessed annually. The assessment process involves reviewing property values and making adjustments based on market trends and other factors. Once the assessments are complete, tax bills are issued, detailing the amount due and the due dates.

Can I dispute my property tax assessment in Bristol?

+Yes, if you believe your property tax assessment is incorrect, you have the right to appeal. The process involves submitting a formal appeal to the Board of Assessment Appeals. You’ll need to provide evidence to support your claim. It’s recommended to consult with a tax professional or the Tax Collector’s Office for guidance on the appeal process.