Utah Automobile Sales Tax

Utah's automobile sales tax is an essential aspect of the state's revenue generation and economic landscape. This tax, applied to the purchase of vehicles, contributes significantly to the state's overall fiscal health and plays a crucial role in funding various public services and infrastructure projects.

Understanding the nuances of Utah's automobile sales tax is vital for both residents and businesses alike. It not only affects individuals looking to buy a new car but also influences the automotive industry's operations and strategies within the state. This comprehensive guide aims to delve deep into the intricacies of Utah's automobile sales tax, exploring its mechanics, rates, exemptions, and its broader impact on the state's economy.

Understanding Utah’s Automobile Sales Tax

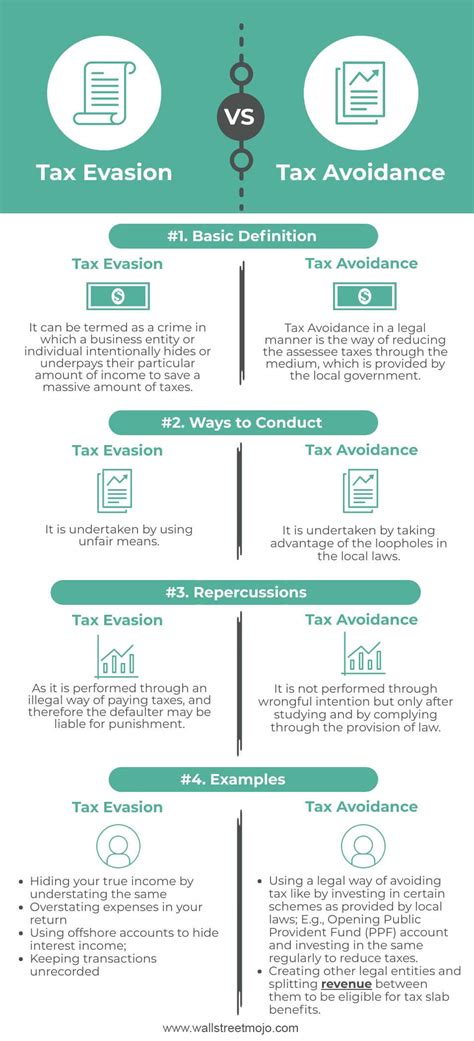

The automobile sales tax in Utah is a type of excise tax, which is levied on the sale of motor vehicles. This tax is distinct from other taxes, such as income tax or property tax, as it is a specific consumption tax applied to a particular good—in this case, motor vehicles.

Utah's Department of Revenue is responsible for administering and collecting this tax. It is calculated based on the purchase price of the vehicle, including any additional costs like dealer preparation, delivery, and handling fees. However, certain items like sales tax, trade-in value, and interest are typically excluded from the taxable amount.

Tax Rate and Calculation

As of [current year], the automobile sales tax rate in Utah stands at 5.15% of the total purchase price. This rate is uniform across the state, meaning that regardless of where you purchase your vehicle in Utah, the sales tax percentage remains the same.

To calculate the sales tax, you simply multiply the purchase price of the vehicle by the tax rate. For instance, if you buy a car for $30,000, the sales tax would be $30,000 x 0.0515 = $1,545.

| Vehicle Purchase Price | Sales Tax Amount |

|---|---|

| $20,000 | $1,030 |

| $35,000 | $1,797.50 |

| $50,000 | $2,575 |

It's important to note that the sales tax is typically not included in the advertised price of the vehicle. So, when negotiating a vehicle's price, ensure you factor in the sales tax to understand the total cost accurately.

Exemptions and Special Cases

While the standard sales tax rate applies to most vehicle purchases, certain transactions are exempt from this tax. For instance, vehicles purchased by qualifying tax-exempt entities, such as charitable organizations or religious institutions, are not subject to the automobile sales tax.

Additionally, Utah offers a temporary registration option for out-of-state residents. This allows individuals who are temporarily living in Utah, such as students or those on work assignments, to register their vehicles for a limited period without paying the full sales tax. Instead, they pay a lower, temporary registration fee.

Impact on Automotive Industry and Consumers

Utah’s automobile sales tax has a significant impact on both the automotive industry and consumers. For car dealerships and automotive businesses, the tax affects their pricing strategies and overall profitability. While the tax is passed on to the consumer, dealerships often absorb a portion of the tax to make their vehicles more competitive in the market.

For consumers, the sales tax adds a substantial amount to the final cost of a vehicle. This can be a significant consideration when budgeting for a new car purchase. However, Utah's relatively lower sales tax rate compared to some other states can make it more attractive for car buyers.

Furthermore, the automobile sales tax revenue plays a crucial role in funding various public services and infrastructure projects in Utah. It contributes to road maintenance, public transportation improvements, and other vital public works projects, ensuring a smoother and safer transportation network across the state.

Frequently Asked Questions

How often does Utah’s automobile sales tax rate change?

+Utah’s sales tax rate is not subject to frequent changes. It is set by the state legislature and typically remains stable for extended periods. However, it’s advisable to check for any updates before making a significant vehicle purchase, as occasional adjustments might occur.

Are there any discounts or incentives for purchasing an electric vehicle in Utah?

+Yes, Utah offers tax incentives for the purchase of electric vehicles (EVs). These incentives can significantly reduce the overall cost of owning an EV. Check the Utah Clean Energy website for the latest information on EV tax credits and rebates.

Can I negotiate the sales tax when purchasing a vehicle in Utah?

+The sales tax is a state-mandated tax and cannot be negotiated directly with the dealership. However, dealerships might offer incentives or discounts on the vehicle’s purchase price, which can indirectly reduce the overall tax amount. It’s always beneficial to ask about any ongoing promotions or discounts.