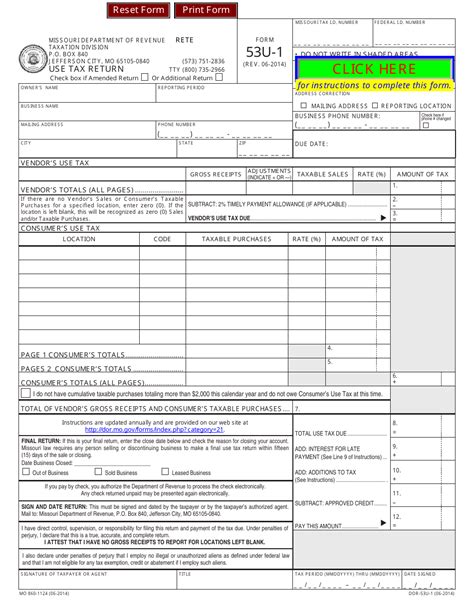

Missouri Tax Return Status

Staying informed about your tax return status is essential for effective financial planning. In this article, we will explore how to check the status of your Missouri tax return, providing you with a comprehensive guide to ensure a smooth and stress-free process. Whether you're awaiting a refund or have questions about your return, we'll cover all the necessary steps and resources to keep you up-to-date.

Understanding the Missouri Tax Return Process

Missouri's Department of Revenue handles the processing of state tax returns. The department aims to provide timely and accurate services to taxpayers, including prompt refunds when applicable. Understanding the typical timeline and procedures can help manage expectations and identify any potential delays.

Here's a breakdown of the key stages in the Missouri tax return process:

- Filing: Taxpayers must submit their returns by the deadline, which is typically April 15th. However, this date may vary depending on the year and any extensions granted.

- Processing: Once received, the Department of Revenue begins processing returns. This involves verifying information, calculating taxes owed or refunds due, and identifying any errors or discrepancies.

- Refund Issuance: If a refund is owed, the department aims to issue it within a specified timeframe. The method of refund, such as direct deposit or check, is determined by the taxpayer's preference indicated on the return.

- Notice of Assessment: In cases where taxes are owed, taxpayers will receive a notice outlining the amount due and the payment deadline. It's crucial to review this notice carefully and make the payment by the due date to avoid penalties and interest.

- Audit or Further Review: In some instances, the Department of Revenue may select returns for audit or further review. This process ensures compliance with tax laws and may require additional documentation from the taxpayer.

By familiarizing yourself with these stages, you can better understand where your return stands in the process and take appropriate actions if needed.

Checking Your Missouri Tax Return Status

The Missouri Department of Revenue offers several convenient methods for taxpayers to check the status of their returns. These options provide real-time updates, ensuring you stay informed without the need for constant phone calls or visits to tax offices.

Online Status Check

The most efficient way to check your Missouri tax return status is through the Department of Revenue's online portal. This secure platform allows you to access your account information and track the progress of your return.

To use the online status check, follow these steps:

- Visit the Department of Revenue Website: Go to the official Missouri Department of Revenue website at https://dor.mo.gov.

- Navigate to the Online Services: On the homepage, look for the "Online Services" section or a similar link. This will direct you to a page with various taxpayer services.

- Select "Individual Income Tax Account Lookup": From the list of services, choose the option to look up your individual income tax account information.

- Enter Your Information: You'll need to provide your Social Security Number or Individual Taxpayer Identification Number (ITIN) along with your date of birth and the amount of your refund or taxes owed. This ensures secure access to your account.

- Review Your Return Status: Once logged in, you'll be able to view the current status of your return. The portal provides real-time updates, indicating whether your return is being processed, a refund has been issued, or if there are any issues requiring attention.

The online status check is an excellent tool for staying informed and allows you to quickly address any potential delays or errors.

Phone Inquiry

If you prefer a more personal approach or encounter issues with the online portal, the Department of Revenue provides a dedicated phone line for tax return status inquiries.

Here's how to use the phone inquiry service:

- Call the Taxpayer Assistance Line: The number to call for tax return status inquiries is 1-800-525-0771. This line is specifically for taxpayer assistance and can provide real-time updates on your return.

- Have Your Information Ready: When calling, have your Social Security Number or ITIN, date of birth, and the amount of your refund or taxes owed readily available. This information is necessary to access your account and obtain accurate status updates.

- Follow the Automated Prompt: After dialing, you'll likely encounter an automated system. Follow the prompts to navigate to the option for checking tax return status. You may need to enter your Social Security Number or ITIN using the keypad.

- Speak to a Representative: If you require further assistance or have specific questions, you can choose to speak to a live representative. They can provide more detailed information and guidance based on your individual circumstances.

The phone inquiry service is particularly useful for taxpayers who prefer a personal touch or encounter issues with the online portal.

Email and Mail Correspondence

While less common, the Department of Revenue also accepts inquiries via email and mail. However, these methods may result in longer response times compared to online or phone inquiries.

If you choose to use email or mail, ensure you provide all necessary details, including your full name, Social Security Number or ITIN, date of birth, and a clear description of your inquiry. The department will respond with an update on your tax return status.

Timelines and Processing Times

Understanding the typical timelines and processing times for Missouri tax returns can help manage expectations and identify potential delays.

Regular Processing Times

Under normal circumstances, the Department of Revenue aims to process tax returns within a specific timeframe. While exact times may vary depending on the volume of returns and other factors, here's a general overview:

- Paper Returns: Processing times for paper returns can take up to 12 weeks from the date of receipt. This longer timeframe is due to the manual handling and verification required for these returns.

- Electronic Returns: Returns filed electronically, whether through tax preparation software or directly on the Department of Revenue's website, are typically processed more quickly. The department aims to process these returns within 45 days from the date of filing.

It's important to note that these timelines are estimates and may be subject to change based on various factors. For the most accurate and up-to-date information, it's best to check your return status using the methods outlined above.

Delays and Common Issues

While the Department of Revenue strives for timely processing, certain factors can lead to delays. Being aware of these potential issues can help you identify and address them promptly.

- Errors or Discrepancies: If your return contains errors, missing information, or discrepancies, it may be flagged for further review. This can delay the processing of your return until the issues are resolved.

- Identity Verification: In some cases, the department may require additional identity verification measures to ensure the security of your tax information. This process can slow down the return's progress.

- System Updates or Technical Issues: Like any organization, the Department of Revenue may experience technical issues or system updates that temporarily impact processing times.

- Peak Seasons: Tax return processing tends to be slower during peak seasons, such as around the filing deadline or during tax season. It's essential to plan accordingly and file your return as early as possible to avoid potential delays.

By being proactive and staying informed about your return status, you can address any potential delays and take appropriate actions to minimize their impact.

Receiving Your Missouri Tax Refund

If you're expecting a refund, the Department of Revenue offers several convenient options for receiving your funds.

Direct Deposit

The most popular and efficient method for receiving your Missouri tax refund is through direct deposit. This option ensures that your refund is quickly and securely deposited into your designated bank account.

When filing your return, indicate your preference for direct deposit by providing your bank account and routing numbers. This method is not only faster but also reduces the risk of lost or stolen checks.

Check by Mail

If you prefer a traditional method or do not have access to a bank account, the Department of Revenue can mail your refund as a check. This option may take slightly longer than direct deposit, and there is a risk of delays or loss during transit.

When opting for a mailed check, ensure that your mailing address is accurate and up-to-date. You can update your address through the Department of Revenue's online portal or by contacting them directly.

Where's My Refund Tool

To provide additional convenience, the Department of Revenue offers a "Where's My Refund" tool on its website. This tool allows you to track the status of your refund and provides estimated dates for when you can expect to receive your funds.

To use the "Where's My Refund" tool, you'll need to provide your Social Security Number or ITIN, the exact amount of your refund, and the tax year in question. This information ensures that the tool provides accurate and personalized updates.

What to Do If Your Return Is Delayed

In some cases, your Missouri tax return may experience delays beyond the typical processing times. If you find that your return is taking longer than expected, there are steps you can take to investigate and address the issue.

Check Your Status Regularly

The first step is to regularly check your tax return status using the methods outlined earlier in this article. By staying informed, you can quickly identify any potential delays and take action.

Contact the Department of Revenue

If you notice that your return is significantly delayed or if you have specific questions about the status, contact the Department of Revenue directly. They can provide more detailed information and guidance based on your individual circumstances.

You can reach the Department of Revenue's taxpayer assistance line at 1-800-525-0771. Have your tax return information ready when calling, including your Social Security Number or ITIN, date of birth, and the tax year in question.

Review Your Return for Errors

Delays in processing can sometimes be caused by errors or discrepancies on your tax return. Review your return carefully to ensure that all information is accurate and complete. If you identify any mistakes, amend your return as soon as possible to avoid further delays.

Consider Professional Assistance

If you're unsure about the status of your return or need assistance with complex tax issues, consider seeking professional help. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, can provide expert guidance and representation.

These professionals can help you understand the status of your return, identify potential issues, and take appropriate actions to resolve delays. They can also assist with more complex tax matters, ensuring that your return is accurate and compliant with tax laws.

Frequently Asked Questions (FAQ)

How long does it typically take to receive my Missouri tax refund after filing electronically?

+The Department of Revenue aims to process electronic returns within 45 days from the date of filing. However, it's important to note that this timeframe is an estimate and may vary based on factors such as the volume of returns and potential issues with your return.

What should I do if I haven't received my refund within the estimated timeframe?

+If your refund hasn't arrived within the estimated timeframe, it's recommended to check your return status using the online portal or by calling the taxpayer assistance line. This will provide you with real-time updates on your refund's progress. If further assistance is needed, consider contacting the Department of Revenue directly.

Can I track my refund status if I filed my return by mail?

+Yes, you can track the status of your refund regardless of how you filed your return. Use the online status check or call the taxpayer assistance line to obtain updates on your refund's progress. Provide your tax return information, including your Social Security Number or ITIN, date of birth, and the tax year in question.

What if I receive a notice indicating an error on my return, and I disagree with it?

+If you receive a notice indicating an error or discrepancy on your return, carefully review the notice and the corresponding sections of your return. If you disagree with the department's findings, you have the right to request a review or appeal. Contact the Department of Revenue for guidance on the appropriate steps to take.

How can I update my mailing address with the Department of Revenue to ensure accurate refund delivery?

+You can update your mailing address with the Department of Revenue through their online portal or by contacting them directly. Ensure that your new address is accurate and up-to-date to avoid delays or misdelivery of your refund.

Staying informed about your Missouri tax return status is essential for effective financial planning and peace of mind. By utilizing the resources provided by the Department of Revenue, you can easily track your return’s progress and address any potential delays or issues. Remember to regularly check your status, especially during peak tax seasons, and seek professional assistance if needed.