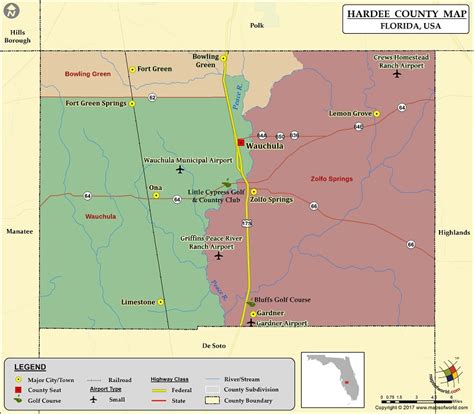

Hardee County Tax Collector

Welcome to the comprehensive guide on the Hardee County Tax Collector, an essential service provider in the heart of Florida. This article will delve into the various aspects of the Hardee County Tax Collector's Office, exploring its services, responsibilities, and the impact it has on the community. With a focus on accuracy and depth, we aim to provide an insightful and informative read for all those interested in understanding the crucial role this office plays.

An Overview of the Hardee County Tax Collector

The Hardee County Tax Collector’s Office is a vital administrative body, responsible for a wide array of services that directly impact the residents and businesses of Hardee County. From vehicle registration and titling to property tax collection and various other financial transactions, the office acts as a key facilitator for the county’s operations.

Led by the elected Tax Collector, this office operates under the guidelines set by the Florida Department of Revenue, ensuring compliance with state laws and regulations. The Tax Collector, through their team of dedicated professionals, strives to deliver efficient and transparent services to the community, making the often complex process of tax and registration simpler and more accessible.

The Hardee County Tax Collector's Office is not merely a transactional entity but a crucial part of the county's administrative framework. It plays a pivotal role in generating revenue for the county, which is then utilized for essential public services, infrastructure development, and community projects. The office's operations are a reflection of the county's commitment to financial transparency and efficient governance.

Services Offered by the Hardee County Tax Collector

The range of services provided by the Hardee County Tax Collector’s Office is extensive and diverse, catering to the varied needs of the community. Here’s an in-depth look at some of the key services:

Vehicle Registration and Titling

One of the primary responsibilities of the Tax Collector’s Office is managing vehicle registration and titling. This process involves the issuance of vehicle registration stickers, titles, and the collection of associated fees and taxes. Residents can visit the office to register their vehicles, transfer titles, or renew existing registrations. The office also assists with specialized vehicle registrations, such as for motorcycles, trailers, and recreational vehicles.

For the convenience of residents, the Tax Collector's Office provides an online platform for vehicle registration renewal, allowing users to complete the process from the comfort of their homes. This digital service not only saves time but also reduces the need for in-person visits, streamlining the registration process.

Property Tax Collection

Property tax collection is a critical function of the Hardee County Tax Collector’s Office. The office is responsible for assessing property values, calculating tax amounts, and collecting these taxes from homeowners and businesses. This process is integral to the county’s revenue generation, ensuring the smooth operation of various public services and projects.

The Tax Collector's Office offers a user-friendly online platform for property tax payments, allowing taxpayers to make payments, view their tax bills, and track their payment history. This digital service enhances transparency and accessibility, making it easier for taxpayers to manage their financial obligations.

Business Tax Receipts

For businesses operating in Hardee County, the Tax Collector’s Office plays a vital role in issuing and renewing business tax receipts. These receipts are mandatory for most businesses and are required for various operations, including opening a bank account, obtaining permits, and advertising services. The office provides a streamlined process for applying for and renewing these receipts, ensuring that businesses can operate efficiently within the county.

The Tax Collector's Office also offers guidance and support to new businesses, helping them understand the necessary tax requirements and compliance procedures. This assistance is invaluable for entrepreneurs, ensuring they can focus on their core business activities without legal or financial complications.

Other Financial Services

In addition to the aforementioned services, the Hardee County Tax Collector’s Office provides a range of other financial services to the community. These include:

- Motor Vehicle Crash Reports: The office maintains records of motor vehicle crashes and provides copies of these reports to the public upon request.

- Hunting and Fishing Licenses: Residents can obtain hunting and fishing licenses through the Tax Collector's Office, making it a one-stop shop for outdoor enthusiasts.

- Voter Registration: The office assists with voter registration, ensuring residents can participate in the democratic process seamlessly.

- Passport Services: Residents can apply for or renew their passports at the Tax Collector's Office, providing a convenient and efficient service.

By offering these additional services, the Hardee County Tax Collector's Office becomes a central hub for various administrative and transactional needs, simplifying the lives of residents and businesses.

Performance and Impact

The Hardee County Tax Collector’s Office has consistently demonstrated a high level of efficiency and transparency in its operations. Through its dedicated team and effective use of technology, the office has streamlined various processes, making tax payments and registrations more accessible and less time-consuming. This has not only improved the overall experience for taxpayers and registrants but has also contributed to increased compliance and revenue generation for the county.

The office's digital platforms have been particularly impactful, providing residents with 24/7 access to various services. This digital transformation has reduced wait times, eliminated the need for physical visits, and enhanced overall customer satisfaction. The Tax Collector's Office has also received positive feedback for its friendly and knowledgeable staff, who are always ready to assist with any queries or concerns.

Beyond its transactional role, the Hardee County Tax Collector's Office actively engages with the community, participating in local events and initiatives. This community involvement fosters a sense of trust and collaboration, ensuring that the office is seen as a supportive partner rather than just an administrative body. The office's commitment to transparency and accountability has further strengthened its relationship with the residents, making it a trusted and valued institution within the county.

Future Outlook and Innovations

Looking ahead, the Hardee County Tax Collector’s Office is committed to continuous improvement and innovation. With a focus on enhancing digital services and further streamlining processes, the office aims to stay at the forefront of administrative excellence. By leveraging technology and adopting best practices, the Tax Collector’s Office aims to make its services even more efficient, secure, and user-friendly.

The office is also exploring new avenues to engage with the community, utilizing digital platforms and social media to reach a wider audience. By embracing these modern communication channels, the Tax Collector's Office aims to increase awareness about its services and ensure that residents are well-informed about their financial obligations and entitlements.

In addition to these digital initiatives, the office is committed to maintaining its high standards of customer service. This includes continuous training and development of staff, ensuring they are equipped with the latest knowledge and skills to assist residents effectively. The Tax Collector's Office also plans to expand its community outreach programs, aiming to build stronger relationships and foster a deeper understanding of the county's financial landscape.

Conclusion

The Hardee County Tax Collector’s Office is an indispensable pillar of the county’s administrative framework, providing essential services and financial support to the community. Through its commitment to efficiency, transparency, and community engagement, the office has earned the trust and appreciation of residents and businesses alike. As it continues to innovate and adapt, the Tax Collector’s Office is well-positioned to meet the evolving needs of the county, ensuring a bright and prosperous future for all.

How can I contact the Hardee County Tax Collector’s Office?

+

You can contact the Hardee County Tax Collector’s Office by phone at (863) 773-4151 or visit their website for more contact information and online services.

What are the office hours of the Hardee County Tax Collector’s Office?

+

The Hardee County Tax Collector’s Office is open from Monday to Friday, 8:30 a.m. to 5:00 p.m. However, it’s always best to check their website or contact them directly for any changes or updates.

Can I renew my vehicle registration online through the Hardee County Tax Collector’s Office?

+

Yes, the Hardee County Tax Collector’s Office offers an online platform for vehicle registration renewal. You can visit their website to access this service and complete the process from the comfort of your home.

How can I pay my property taxes in Hardee County?

+

You can pay your property taxes online through the Hardee County Tax Collector’s Office website, by mail, or in person at their office. They accept various payment methods, including credit cards, e-checks, and cash.

What other services does the Hardee County Tax Collector’s Office provide?

+

In addition to vehicle registration and property tax collection, the Hardee County Tax Collector’s Office offers a range of services, including business tax receipts, hunting and fishing licenses, voter registration assistance, and passport services.