Sales Tax On A Car Missouri

Understanding sales tax on car purchases is crucial, especially when navigating the complex world of automotive transactions. In Missouri, the sales tax system for car purchases is governed by state regulations, offering a unique insight into the financial aspects of car buying. This article delves deep into the specifics of sales tax on cars in Missouri, exploring the rates, exemptions, and processes involved, to provide a comprehensive guide for consumers and businesses alike.

The Mechanics of Sales Tax in Missouri

Missouri’s sales tax system is a critical component of the state’s revenue generation, and it applies to a wide range of goods and services, including vehicle purchases. The tax is imposed on the retail sale or lease of tangible personal property and certain services, with rates varying across the state.

Statewide Sales Tax Rate

The statewide sales tax rate in Missouri is currently set at 4.225%, which is applied uniformly across the state. This base rate forms the foundation for the sales tax calculation on all eligible transactions.

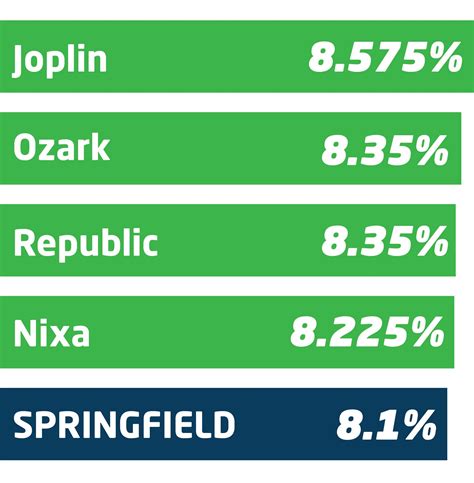

Local Sales Tax Rates

In addition to the statewide rate, Missouri allows local jurisdictions to levy their own sales taxes. These local option taxes can be imposed by cities, counties, and other special districts, leading to varying sales tax rates across different regions of the state. The local option tax rates can add up to 3.775% to the statewide rate, resulting in a maximum combined rate of 8%.

For instance, in the city of St. Louis, the local sales tax rate is 3.225%, bringing the total sales tax rate to 7.45% when combined with the statewide rate. On the other hand, in a place like Boone County, the total sales tax rate is 8%, reflecting the maximum combined rate allowed.

| Location | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| St. Louis | 3.225% | 7.45% |

| Boone County | 3.775% | 8% |

| Kansas City | 3.5% | 7.725% |

| Springfield | 3.25% | 7.475% |

Sales Tax Exemptions

Missouri offers certain exemptions from sales tax to promote specific economic activities or support particular industries. These exemptions can significantly impact the total sales tax liability for car purchases. Here are some notable exemptions:

- Trade-Ins: When trading in a vehicle as part of a purchase, the sales tax is only applied to the difference between the trade-in value and the purchase price of the new vehicle.

- Vehicle Donations: Vehicles donated to charitable organizations are exempt from sales tax.

- Government and Non-Profit Entities: Sales to government agencies and certain non-profit organizations are exempt from sales tax.

- Military Personnel: Active-duty military personnel stationed in Missouri are exempt from sales tax on vehicle purchases.

Calculating Sales Tax on a Car Purchase in Missouri

Calculating the sales tax on a car purchase in Missouri involves a straightforward process. First, determine the total cost of the vehicle, including any applicable fees and additional costs. Then, apply the relevant sales tax rate, which is the sum of the statewide rate and the local option tax rate (if applicable), to this total cost.

For example, if a car is purchased for $30,000 in a location with a combined sales tax rate of 7.45%, the sales tax would be calculated as follows:

Sales Tax = $30,000 x 0.0745 = $2,235

Thus, the total cost of the vehicle, including sales tax, would be $32,235.

Special Considerations for Used Car Sales

When purchasing a used car, the sales tax calculation can be slightly different, especially if the vehicle is being sold by a private party. In such cases, the sales tax is typically based on the vehicle’s assessed value, which is determined by the Missouri Department of Revenue.

Payment and Remittance of Sales Tax

The sales tax on a car purchase is typically due at the time of the transaction. The dealer or seller is responsible for collecting the tax and remitting it to the Missouri Department of Revenue. For private party sales, the buyer is responsible for paying the sales tax directly to the Department of Revenue within a certain timeframe.

Sales Tax Forms and Filing

The Missouri Department of Revenue provides specific forms for the payment and reporting of sales tax. These forms vary depending on the type of transaction and the seller’s status. For instance, dealers typically use Form ST-2 for sales tax remittance, while private sellers may use Form ST-4 to report and pay sales tax on a used car sale.

Sales Tax Audits and Compliance

The Missouri Department of Revenue conducts audits to ensure compliance with sales tax laws. These audits can cover a range of issues, including proper calculation and collection of sales tax, accurate reporting, and timely remittance. Failure to comply with sales tax regulations can result in penalties and interest charges.

Sales Tax Registration and Record-Keeping

Businesses and individuals engaging in taxable sales or purchases in Missouri are required to register with the Department of Revenue and obtain a sales tax license. This registration process ensures that the entity is authorized to collect and remit sales tax. Proper record-keeping is also crucial, as it facilitates accurate tax calculation and reporting.

Future Implications and Considerations

The sales tax system in Missouri is subject to ongoing review and potential changes. While the current rates and regulations provide a stable framework for car purchases, it’s important for buyers and sellers to stay informed about any future amendments. These changes could impact the total cost of car purchases and the overall sales tax landscape in the state.

Additionally, with the evolving nature of the automotive industry, particularly the rise of electric vehicles and autonomous technologies, there may be future considerations for sales tax on these specialized vehicles. The unique characteristics and potential tax benefits or incentives for these vehicles could further influence the sales tax landscape in Missouri.

Conclusion

Understanding the sales tax system in Missouri is a critical aspect of making informed decisions when purchasing a car. By familiarizing themselves with the statewide and local sales tax rates, applicable exemptions, and the calculation and payment processes, buyers can navigate the car-buying process with confidence. For dealers and sellers, staying compliant with sales tax regulations is essential to avoid penalties and maintain a positive relationship with the state’s tax authorities.

Frequently Asked Questions

Are there any sales tax holidays for car purchases in Missouri?

+No, Missouri does not currently have any specific sales tax holidays for car purchases. However, the state may offer general sales tax holidays for certain categories of goods, which could potentially include vehicles.

What happens if I buy a car from a private seller in a different county or city within Missouri?

+In such cases, the sales tax is typically based on the local option tax rate of the county or city where the vehicle is titled and registered. It’s important to determine the correct local sales tax rate to ensure accurate tax payment.

Are there any sales tax incentives for purchasing environmentally friendly vehicles in Missouri?

+Yes, Missouri offers a sales tax exemption for the purchase of alternative fuel vehicles, such as electric, hybrid, and natural gas vehicles. This exemption applies to the statewide sales tax rate, but not to local option taxes.