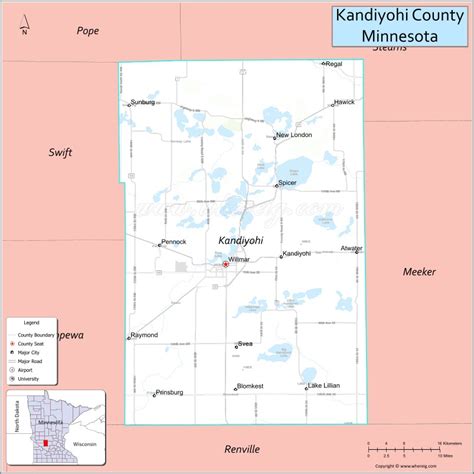

Kandiyohi County Property Tax

Property taxes are an essential component of local government funding, contributing significantly to the financial health and development of communities. In Kandiyohi County, Minnesota, property taxes play a crucial role in supporting various public services and infrastructure. This article aims to provide an in-depth analysis of Kandiyohi County's property tax system, exploring its assessment process, rates, exemptions, and the impact it has on the local community.

Understanding Kandiyohi County’s Property Tax System

Kandiyohi County, located in the heart of Minnesota, boasts a diverse landscape of rolling hills, lakes, and vibrant communities. The property tax system in this county is governed by state laws and regulations, with the county assessor’s office playing a pivotal role in ensuring fair and accurate assessments.

The property tax in Kandiyohi County is based on the assessed value of real estate properties, including residential homes, commercial buildings, agricultural lands, and other taxable assets. This value is determined through a comprehensive assessment process, which involves the following key steps:

Assessment Process

- Data Collection: The county assessor’s office gathers information on all taxable properties within the county. This includes physical inspections, researching property records, and analyzing sales data.

- Market Analysis: Assessors evaluate the market value of properties by considering factors such as location, size, age, condition, and recent sales of similar properties.

- Classification: Properties are classified into different categories, such as residential, commercial, or agricultural, which influence the applicable tax rates.

- Assessment Notices: Once the assessments are completed, property owners receive assessment notices detailing the estimated value of their properties.

It's important to note that Kandiyohi County, like many other counties, utilizes a market-based assessment approach, aiming to ensure that property values are assessed fairly and equitably.

Property Tax Rates and Calculation

The property tax rate in Kandiyohi County is determined by the county commissioners and other local governing bodies. These rates are expressed as a percentage of the assessed value of the property. For instance, if the tax rate is set at 1.5%, a property with an assessed value of 200,000 would have a property tax bill of 3,000.

The tax rate is influenced by the revenue needs of the county, as well as various local government entities, including school districts, cities, townships, and special taxing districts. Each of these entities has the authority to set their own tax rates, resulting in a combined tax rate for property owners.

| Taxing Authority | Tax Rate (%) |

|---|---|

| Kandiyohi County | 0.75 |

| Willmar School District | 1.2 |

| City of Willmar | 0.6 |

| Lake Lillian Township | 0.3 |

| Total Combined Rate | 2.85 |

In the above example, a property owner in the City of Willmar within Lake Lillian Township would have a combined tax rate of 2.85%, resulting in a tax bill of $5,700 for a property assessed at $200,000.

Exemptions and Special Considerations

Kandiyohi County offers various exemptions and special provisions to certain property owners, providing relief from the full property tax burden. These exemptions include:

- Homestead Exemption: Eligible homeowners can receive a reduction in their taxable property value if they meet certain residency and ownership criteria. This exemption encourages homeownership and provides financial relief to residents.

- Veteran's Exemption: Qualified veterans or surviving spouses may be eligible for property tax exemptions, recognizing their service and sacrifice.

- Agricultural Land Exemption: Certain agricultural lands are assessed at a lower rate, supporting the local farming community and promoting sustainable agriculture.

- Senior Citizen Exemption: Senior citizens who meet specific income and residency requirements may qualify for a partial exemption, reducing their property tax liability.

Impact on the Local Community

The property tax system in Kandiyohi County has a significant impact on the local community, influencing economic development, infrastructure improvements, and the overall quality of life.

Funding Public Services and Infrastructure

Property taxes are a primary source of revenue for local governments, including Kandiyohi County. These funds are utilized to support a wide range of public services and infrastructure projects, such as:

- Education: Property taxes contribute to the funding of local schools, ensuring quality education for students.

- Public Safety: Police and fire protection services rely on property tax revenue to maintain a safe and secure community.

- Road Maintenance: Property taxes help fund road repairs, snow removal, and other transportation infrastructure needs.

- Parks and Recreation: Funding for parks, trails, and recreational facilities is often derived from property tax revenue.

- Social Services: Local social services, including healthcare, elder care, and support for vulnerable populations, are partly funded by property taxes.

Economic Development and Growth

A well-managed and fair property tax system can attract businesses and encourage economic growth. Kandiyohi County’s approach to property taxation aims to create a stable and predictable environment for businesses, which can lead to job creation and economic prosperity.

Additionally, the exemptions and special provisions in the property tax system can provide incentives for homeownership, encouraging residents to invest in their community and contribute to its long-term growth.

Community Engagement and Transparency

Kandiyohi County’s property tax system fosters community engagement and transparency. Property owners have the opportunity to participate in public meetings, voice their concerns, and provide feedback on tax-related matters. This engagement ensures that the tax system remains fair and responsive to the needs of the community.

Future Implications and Considerations

As Kandiyohi County continues to evolve and grow, the property tax system will play a critical role in shaping its future. Here are some key considerations and potential implications for the county’s property tax landscape:

Population Growth and Development

Kandiyohi County’s population is expected to increase, which will put pressure on existing infrastructure and services. The property tax system will need to adapt to accommodate the growing demands, ensuring that funding is available for necessary expansions and improvements.

Economic Fluctuations

Economic downturns or fluctuations can impact property values and, consequently, property tax revenue. Kandiyohi County may need to develop strategies to mitigate the impact of economic cycles on its revenue streams, ensuring the stability of essential services.

Technological Advancements

Advancements in technology, such as digital assessment tools and online tax payment systems, can enhance the efficiency and accuracy of the property tax system. Embracing these technologies can improve taxpayer experience and reduce administrative burdens.

Community Engagement and Equity

Continuing to prioritize community engagement and ensuring equitable tax policies will be crucial. Kandiyohi County should strive to maintain transparency and fairness in its property tax system, addressing any concerns or disparities that may arise.

Collaborative Governance

Kandiyohi County’s property tax system involves multiple taxing authorities. Collaborative governance and effective communication among these entities will be essential to ensure a cohesive and well-managed tax structure.

How often are property assessments conducted in Kandiyohi County?

+Property assessments in Kandiyohi County are conducted every year to ensure accurate and up-to-date valuations. This annual assessment process allows the county to keep pace with market changes and maintain fairness in the property tax system.

Can property owners appeal their assessments?

+Yes, property owners have the right to appeal their assessments if they believe the valuation is inaccurate or unfair. The appeal process involves submitting evidence and attending a hearing before the county board of appeal and equalization. This provides an opportunity for property owners to present their case and potentially reduce their assessed value.

How are property tax rates determined in Kandiyohi County?

+Property tax rates in Kandiyohi County are set by the county commissioners and other local governing bodies. These rates are determined based on the revenue needs of various entities, such as school districts, cities, and townships. The combined tax rate reflects the collective decisions of these authorities.

What are the benefits of the Homestead Exemption in Kandiyohi County?

+The Homestead Exemption in Kandiyohi County provides eligible homeowners with a reduction in their taxable property value. This exemption encourages homeownership, reduces the financial burden on residents, and contributes to the stability of the local housing market. It’s an important incentive for homeowners to invest in their community.

How does Kandiyohi County ensure transparency in its property tax system?

+Kandiyohi County prioritizes transparency by providing accessible information about the property tax system, including assessment processes, tax rates, and exemption guidelines. Public meetings and engagement opportunities allow residents to voice their concerns and participate in the decision-making process, ensuring a fair and open tax structure.