How Much Is Inheritance Tax In Pa

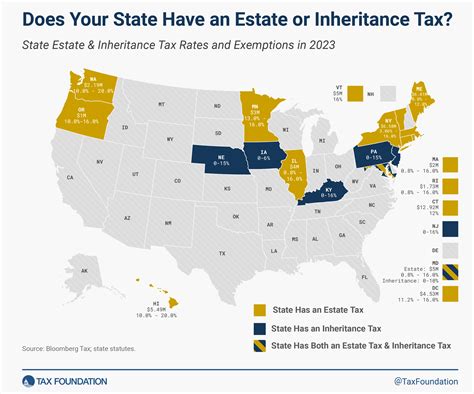

Inheritance tax is a topic that often sparks curiosity and concern among residents and prospective estate planners in Pennsylvania. The state's inheritance tax structure can be complex, with rates varying based on the relationship between the deceased and the beneficiary, and it is essential to understand these nuances to navigate the process effectively.

Inheritance Tax Structure in Pennsylvania

Pennsylvania imposes an inheritance tax on certain individuals who receive property from a deceased resident's estate. The tax is separate from federal estate taxes and is a direct tax on beneficiaries, not on the estate itself. The state's inheritance tax law aims to ensure that beneficiaries contribute to the state's revenue when they receive assets from a deceased individual's estate.

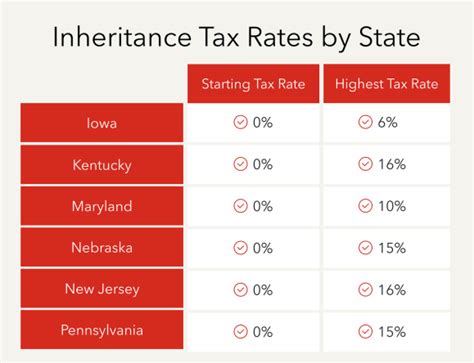

The inheritance tax rate in Pennsylvania is determined by the relationship between the beneficiary and the deceased. This unique structure means that closer relatives typically pay less tax, while more distant relatives and non-relatives pay more.

Inheritance Tax Rates Based on Relationship

| Relationship to Deceased | Inheritance Tax Rate |

|---|---|

| Spouse | 0% |

| Direct Descendants (Children, Grandchildren, etc.) | 0% for the first $3,500; 4.5% above $3,500 |

| Parents, Grandparents, and Lineal Ascendants | 0% for the first $3,500; 12% above $3,500 |

| Siblings | 0% for the first $3,500; 12% above $3,500 |

| Other Relatives | 0% for the first $3,500; 15% above $3,500 |

| Non-Relatives and Entities | 0% for the first $3,500; 15% above $3,500 |

It's important to note that these rates apply to the total value of property inherited from a single individual. If a beneficiary receives property from multiple Pennsylvania residents within the same degree of relationship, the exemption and tax rate are applied separately for each decedent.

Inheritance Tax Exemptions and Deductions

Pennsylvania provides certain exemptions and deductions to reduce the burden of inheritance tax. These include:

- A marital deduction, allowing an unlimited amount of property to pass from a deceased spouse to a surviving spouse without inheritance tax.

- Family farm exemption, which provides a reduced tax rate of 0% for the first $500,000 of value for family farms.

- Charitable contributions made by the decedent during their lifetime are exempt from inheritance tax.

- Certain business assets may qualify for a reduced tax rate if they are transferred to a business partner or key employee.

Understanding the Inheritance Tax Process

The process of paying inheritance tax in Pennsylvania typically involves the following steps:

- Determining the relationship of the beneficiary to the deceased and the value of the inherited property.

- Calculating the inheritance tax based on the applicable rate and exemptions.

- Filing an inheritance tax return with the Pennsylvania Department of Revenue within nine months of the decedent's death.

- Paying the calculated tax amount to the state.

It's crucial to consult with a tax professional or estate planning attorney to ensure accurate calculations and compliance with the state's inheritance tax laws.

Common Misconceptions

It's important to clarify a few misconceptions about inheritance tax in Pennsylvania:

- Inheritance tax is not the same as estate tax. Estate tax is a tax on the transfer of the entire estate, while inheritance tax is a tax on the beneficiary's share.

- Inheritance tax is not a one-time tax. It is imposed on each beneficiary receiving property from the estate, so multiple beneficiaries may each owe tax.

- The inheritance tax rate is not based solely on the value of the inherited property. It is determined by the relationship between the beneficiary and the deceased.

Planning Strategies to Minimize Inheritance Tax

There are several strategies that individuals can employ to minimize the impact of inheritance tax in Pennsylvania. These strategies may involve careful estate planning and taking advantage of available exemptions and deductions.

Gifts During Lifetime

Making gifts during one's lifetime can reduce the value of the estate and potentially lower the inheritance tax burden. However, it's important to be aware of the annual gift tax exclusion, which allows individuals to gift up to a certain amount ($16,000 in 2023) per recipient without triggering gift taxes.

Use of Trusts

Trusts can be a powerful tool to minimize inheritance tax. By setting up a trust, assets can be transferred to beneficiaries while maintaining control over how and when the assets are distributed. Certain types of trusts, such as irrevocable trusts, can remove assets from the estate for inheritance tax purposes.

Life Insurance Policies

Life insurance policies can be structured to provide liquidity for paying inheritance taxes. By naming the estate as the beneficiary, the proceeds from the policy can be used to cover tax liabilities without depleting other assets.

Conclusion: Navigating Pennsylvania's Inheritance Tax Landscape

Understanding Pennsylvania's inheritance tax structure is crucial for effective estate planning. By familiarizing yourself with the rates, exemptions, and strategies outlined above, you can make informed decisions to minimize the tax burden on your heirs. Remember, consulting with tax and legal professionals is essential to ensure compliance and take advantage of all available opportunities to protect your legacy.

How often must inheritance tax returns be filed in Pennsylvania?

+

Inheritance tax returns must be filed within nine months of the decedent’s death. However, if the estate qualifies for a deferral, the due date can be extended to 15 months.

Are there any penalties for late payment of inheritance tax?

+

Yes, late payment of inheritance tax can result in interest and penalties. The interest rate is 6% per annum, and a 5% penalty is added if the tax is not paid by the due date.

Can I claim a refund for overpaid inheritance tax in Pennsylvania?

+

Yes, you can claim a refund for overpaid inheritance tax if you have overpaid or if the value of the estate is later determined to be less than the amount reported on the inheritance tax return.