Richmond Personal Property Tax

In the city of Richmond, Virginia, personal property tax is an important revenue stream for the local government, funding essential services and infrastructure. This article aims to provide an in-depth analysis of Richmond's personal property tax, its workings, and its impact on residents and businesses. By exploring the tax's history, current structure, and future prospects, we aim to offer a comprehensive understanding of this crucial aspect of Richmond's financial landscape.

Understanding Richmond’s Personal Property Tax

Richmond’s personal property tax is a levy imposed on tangible personal property, which includes items like vehicles, boats, aircraft, and business equipment. It is distinct from real property tax, which applies to real estate and land. The tax plays a significant role in Richmond’s fiscal framework, contributing to the city’s overall revenue base and helping to maintain its financial stability.

The history of personal property tax in Richmond can be traced back to the early 20th century when the city, like many others, began to diversify its revenue sources beyond traditional real estate taxes. Over the years, the tax has undergone various reforms and adjustments to align with changing economic conditions and the evolving needs of the city.

Currently, Richmond's personal property tax operates under a system where the assessed value of personal property is multiplied by a tax rate set by the city government. The assessed value is determined by the City Assessor's Office, which considers factors such as the property's age, condition, and market value. This assessment process ensures that the tax is levied fairly and in accordance with the property's actual worth.

Tax Rate and Assessment Process

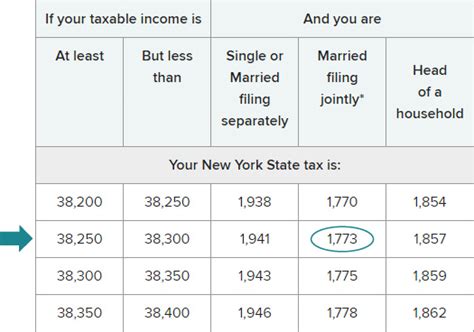

The tax rate for Richmond’s personal property tax is set annually by the city council. This rate is expressed as a percentage and is applied uniformly to all personal property within the city limits. For the current fiscal year, the tax rate stands at 4.5%, which is in line with recent years’ rates.

The assessment process begins with the City Assessor's Office conducting a comprehensive evaluation of personal property within Richmond. This includes conducting on-site inspections, reviewing sales and purchase records, and utilizing other data sources to accurately determine the property's value. The assessed value is then multiplied by the tax rate to calculate the amount owed by the property owner.

| Tax Rate (%) | Assessed Value | Tax Amount |

|---|---|---|

| 4.5 | $50,000 | $2,250 |

| 4.5 | $100,000 | $4,500 |

| 4.5 | $200,000 | $9,000 |

As the table illustrates, the tax amount increases proportionally with the assessed value of the personal property. This ensures that those with higher-value property contribute more to the city's revenue, reflecting the principle of progressive taxation.

Impact on Residents and Businesses

Richmond’s personal property tax has a direct impact on both residents and businesses within the city. For residents, the tax applies to vehicles, boats, and other personal property they own. The tax amount can vary significantly based on the value and type of property, affecting individuals’ financial planning and budgeting.

Businesses, on the other hand, are subject to personal property tax on their business equipment, machinery, and other tangible assets. This can represent a significant cost for businesses, especially those with substantial investments in equipment and machinery. However, it's important to recognize that the tax also contributes to the city's overall economic health, funding vital services and infrastructure that benefit businesses and residents alike.

One of the key benefits of Richmond's personal property tax is its role in maintaining a stable and reliable revenue stream for the city. This stability is crucial for long-term planning and investment in essential services, including education, public safety, and infrastructure development. By providing a consistent source of revenue, the tax helps ensure that Richmond can effectively address the needs of its residents and businesses.

Comparative Analysis: Richmond vs. Other Cities

To gain a broader perspective on Richmond’s personal property tax, it’s beneficial to compare it with similar taxes in other cities across the United States. This comparative analysis provides insight into Richmond’s tax structure, rates, and overall competitiveness.

Tax Rates Across Major Cities

When examining personal property tax rates in major cities, Richmond’s 4.5% rate places it in the middle of the pack. Some cities, such as New York City and Los Angeles, have significantly higher rates, while others, like Houston and Phoenix, have lower rates. This variation is influenced by a range of factors, including the city’s economic conditions, fiscal needs, and the types of property subject to taxation.

| City | Tax Rate (%) |

|---|---|

| New York City | 7.5 |

| Los Angeles | 5.5 |

| Chicago | 4.75 |

| Houston | 3.5 |

| Phoenix | 2.5 |

| Richmond | 4.5 |

As the table shows, Richmond's tax rate is comparable to that of Chicago, another major metropolitan area. This indicates that Richmond's tax structure is competitive and aligns with the rates of similar cities.

Exemptions and Deductions

In addition to tax rates, the range of exemptions and deductions offered by a city’s personal property tax system is another important factor in the overall competitiveness and fairness of the tax. Richmond’s personal property tax offers a variety of exemptions and deductions, which help to reduce the tax burden on certain types of property and certain taxpayers.

- Inventory Exemption: Richmond exempts certain types of inventory from personal property tax, which can be a significant relief for businesses with large amounts of inventory.

- Manufacturing Equipment Deduction: The city also offers a deduction for manufacturing equipment, which encourages investment in manufacturing and industrial activities within Richmond.

- Depreciation Deduction: Property owners can deduct depreciation from their assessed value, ensuring that the tax reflects the actual value of the property over time.

These exemptions and deductions demonstrate Richmond's commitment to supporting businesses and ensuring that the tax system is fair and equitable for all taxpayers.

The Future of Richmond’s Personal Property Tax

Looking ahead, Richmond’s personal property tax is poised to continue playing a vital role in the city’s fiscal health and economic development. As the city’s population and economy grow, the tax will need to adapt to meet the changing needs and expectations of residents and businesses.

Potential Reforms and Adjustments

One potential area of reform is the assessment process. While Richmond’s current assessment system is robust and fair, advancements in technology and data analytics could further enhance its accuracy and efficiency. By leveraging advanced data tools and predictive modeling, the city could improve its ability to assess property values accurately, ensuring that the tax remains fair and up-to-date.

Additionally, Richmond may consider exploring alternative tax structures, such as a value-added tax (VAT) or a sales tax, to supplement its personal property tax revenue. These additional revenue streams could provide the city with greater financial flexibility and help fund specific initiatives or address emerging needs.

Economic Development and Tax Incentives

Richmond’s personal property tax also has a role to play in the city’s economic development strategy. By offering tax incentives and exemptions, the city can attract new businesses and encourage existing businesses to expand. This, in turn, can lead to job creation, increased economic activity, and a more vibrant local economy.

For example, Richmond could consider offering tax incentives for businesses that invest in renewable energy or sustainable practices. Such incentives would not only promote economic growth but also align with the city's sustainability goals and its commitment to environmental stewardship.

Community Engagement and Transparency

Finally, Richmond’s personal property tax system can benefit from increased community engagement and transparency. By actively involving residents and businesses in the tax decision-making process, the city can foster a greater sense of trust and understanding. This engagement could take the form of public hearings, online surveys, or other interactive platforms where taxpayers can provide input and feedback on tax policies.

Additionally, the city can enhance transparency by providing clear and accessible information about the personal property tax, including online resources, educational materials, and regular updates on tax rates and assessment processes. This transparency can help build trust and ensure that taxpayers feel confident in the fairness and effectiveness of the tax system.

Conclusion

Richmond’s personal property tax is a critical component of the city’s fiscal framework, providing a stable and reliable source of revenue to fund essential services and infrastructure. By understanding the tax’s history, current structure, and future prospects, residents and businesses can better appreciate its role in the city’s economic health and development.

As Richmond continues to evolve and grow, its personal property tax will need to adapt to meet the changing needs of the community. Through potential reforms, economic development initiatives, and increased community engagement, Richmond can ensure that its personal property tax remains fair, efficient, and effective in serving the city's residents and businesses.

How is the assessed value of personal property determined in Richmond?

+The assessed value is determined by the City Assessor’s Office, which considers factors such as the property’s age, condition, and market value. The office conducts on-site inspections and reviews sales and purchase records to accurately assess the property’s value.

What types of personal property are exempt from taxation in Richmond?

+Richmond offers exemptions for certain types of personal property, including inventory and machinery used in manufacturing. These exemptions are designed to support businesses and encourage economic growth.

How does Richmond’s personal property tax rate compare to other major cities?

+Richmond’s 4.5% tax rate is comparable to that of Chicago and falls within the middle range of major cities. Some cities, like New York City and Los Angeles, have higher rates, while others, like Houston and Phoenix, have lower rates.