Costco Tax Exempt

Costco Wholesale Corporation, the renowned membership-only warehouse club, has been a trusted name in the retail industry for decades. With its vast array of products, bulk purchasing options, and competitive pricing, Costco has gained a loyal customer base worldwide. One aspect that often sparks curiosity and attracts attention is Costco's tax-exempt status. In this comprehensive article, we delve into the intricacies of Costco's tax exemption, exploring its implications, benefits, and the specific conditions under which it applies.

Understanding Costco’s Tax-Exempt Status

Costco operates under a unique business model, offering its members exclusive access to a wide range of products at wholesale prices. This membership-based structure is a key factor in Costco’s success, as it allows the company to maintain low operating costs and pass on significant savings to its members. However, Costco’s tax-exempt status is a separate and distinct aspect of its operations, and it is essential to understand the nuances of this exemption to appreciate its impact on the retail giant’s business operations.

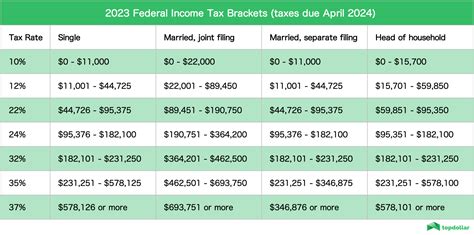

The tax-exempt status granted to Costco is a result of the company's compliance with specific tax regulations and its adherence to certain conditions outlined by the Internal Revenue Service (IRS) in the United States. This status applies to both federal and state taxes, meaning Costco is exempt from paying certain taxes that are typically levied on retail businesses.

Federal Tax Exemption

Costco’s federal tax exemption is governed by Section 501©(12) of the Internal Revenue Code. This section provides tax-exempt status to organizations that are primarily engaged in providing services, goods, or insurance to their members on a mutual or cooperative basis. As a membership-based warehouse club, Costco falls under this category, as it operates as a mutual benefit corporation.

To qualify for this exemption, Costco must meet several criteria. Firstly, the organization must have a substantial number of members, and these members must actively participate in the organization's governance. Secondly, the benefits provided to members must be primarily related to their use of the organization's services or products. Lastly, the organization's earnings must be distributed among its members based on their usage or participation.

By adhering to these conditions, Costco is exempt from federal income tax on its operations. This exemption applies to the company's net income generated from its sales to members. However, it is important to note that Costco is still subject to other federal taxes, such as employment taxes and certain excise taxes.

State Tax Exemptions

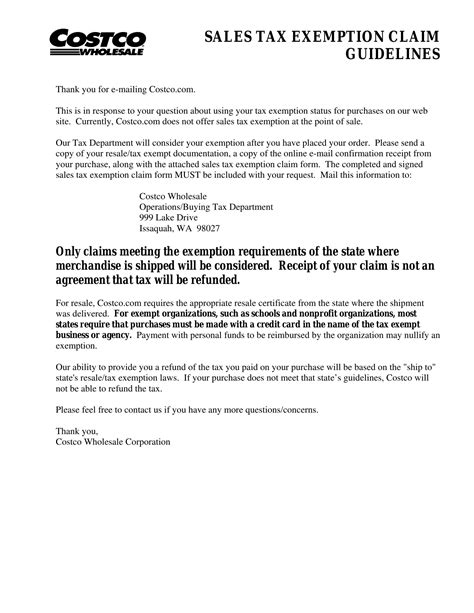

In addition to federal tax exemption, Costco also enjoys state-level tax exemptions in various jurisdictions across the United States. These state-specific exemptions can vary significantly, as each state has its own tax regulations and policies. While the principles governing state tax exemptions are generally similar to those at the federal level, the exact requirements and benefits can differ.

For instance, some states grant Costco a sales tax exemption, meaning the company does not have to collect sales tax from its members on eligible purchases. This exemption can be a significant advantage for members, as it further reduces the overall cost of goods purchased at Costco. However, it is crucial to understand that state tax exemptions are not uniform across all states, and the specific conditions and benefits can vary widely.

Moreover, state tax exemptions may not only apply to sales tax but could also extend to other taxes such as property taxes or franchise taxes. The scope and applicability of these exemptions depend on the individual state's tax laws and the specific circumstances of Costco's operations within that state.

Benefits and Implications of Costco’s Tax Exemption

The tax-exempt status enjoyed by Costco brings several benefits to the company and its members. Firstly, it allows Costco to maintain competitive pricing, as the company does not have to factor in certain tax obligations when setting its wholesale prices. This can result in lower prices for members, making Costco an attractive option for bulk purchasing.

Additionally, the tax exemption enables Costco to allocate its resources more efficiently. By not paying certain taxes, the company can reinvest those funds into improving its operations, expanding its product offerings, or enhancing member benefits. This can lead to better services, improved store layouts, and a more enjoyable shopping experience for members.

For members, the tax exemption translates into significant savings. The absence of sales tax on eligible purchases can result in substantial cost reductions, especially for high-value items or frequent shoppers. Moreover, the tax exemption can make Costco a more appealing choice for businesses and organizations that are also tax-exempt, as they can take advantage of the tax-free nature of their purchases.

However, it is important to note that the tax-exempt status is not a blanket exemption. Costco still has to comply with various tax regulations and report its income and expenses to the IRS and state tax authorities. The company must also ensure that it maintains its eligibility for tax exemption by continuing to meet the specific criteria outlined by the IRS and state tax laws.

Costco’s Commitment to Tax Compliance

Despite its tax-exempt status, Costco takes its tax obligations seriously and strives to maintain the highest standards of tax compliance. The company understands the importance of adhering to tax regulations to ensure the continued success and integrity of its business operations.

Costco's commitment to tax compliance is evident in its thorough understanding of the tax laws and regulations that apply to its operations. The company has dedicated teams of tax professionals who work tirelessly to ensure that Costco remains in compliance with all applicable tax laws, both at the federal and state levels.

Furthermore, Costco actively engages with tax authorities to stay updated on any changes or amendments to tax regulations. This proactive approach ensures that the company can promptly adapt its operations to comply with any new requirements, maintaining its tax-exempt status and avoiding any potential penalties or legal issues.

Future Outlook and Potential Challenges

As the retail landscape continues to evolve, Costco’s tax-exempt status may face new challenges and opportunities. The increasing trend of online shopping and the rise of e-commerce platforms present both advantages and disadvantages for Costco’s tax-exempt operations.

On the one hand, the expansion of Costco's online presence can attract a wider customer base and provide an additional channel for tax-exempt purchases. This can enhance the convenience and accessibility of Costco's offerings, particularly for members who prefer online shopping. However, the online sales channel also brings regulatory complexities, as the tax treatment of online transactions can vary depending on the jurisdiction and the specific nature of the sale.

Moreover, as tax regulations continue to evolve and become more complex, Costco must stay abreast of any changes that may impact its tax-exempt status. This includes keeping track of legislative updates, court rulings, and administrative guidance issued by tax authorities. By remaining vigilant and proactive, Costco can ensure that it continues to qualify for tax exemption and avoid any potential pitfalls.

Conclusion

Costco’s tax-exempt status is a unique aspect of its business operations, offering both benefits and challenges. By understanding the specific conditions and requirements for tax exemption, Costco can leverage its position to provide exceptional value to its members. However, maintaining tax-exempt status requires ongoing compliance and a deep understanding of the evolving tax landscape.

As Costco continues to thrive and adapt to the changing retail environment, its tax-exempt status will remain a key differentiator and a competitive advantage. By staying committed to tax compliance and embracing the opportunities presented by the digital age, Costco can ensure that its tax-exempt operations remain a cornerstone of its success for years to come.

Is Costco exempt from all taxes?

+No, Costco is not exempt from all taxes. While it enjoys tax-exempt status for certain taxes, such as federal income tax and state sales tax in some jurisdictions, it is still subject to other taxes like employment taxes and certain excise taxes.

How does Costco’s tax-exempt status benefit its members?

+Costco’s tax-exempt status allows it to offer competitive pricing and pass on savings to its members. The absence of certain taxes results in lower prices for members, making Costco an attractive option for bulk purchasing. Additionally, the tax exemption can provide significant savings for tax-exempt businesses and organizations.

What are the criteria for Costco to maintain its tax-exempt status?

+Costco must adhere to specific criteria outlined by the IRS and state tax laws. This includes having a substantial number of participating members, providing benefits primarily related to member usage, and distributing earnings based on member participation. Costco’s tax professionals work diligently to ensure ongoing compliance with these requirements.