Property Tax In Travis County

Property taxes in Travis County, Texas, are a significant concern for property owners, as they directly impact their financial obligations and planning. Understanding the intricacies of property tax assessments, rates, and potential exemptions is crucial for managing these expenses effectively. This article aims to provide a comprehensive guide to property taxes in Travis County, offering valuable insights and strategies to navigate the complex tax landscape.

Unraveling the Property Tax System in Travis County

The property tax system in Travis County operates under a set of regulations and processes that determine the tax liability of each property owner. Here’s an in-depth look at the key aspects of this system:

Assessment Process

The Travis Central Appraisal District (TCAD) is responsible for appraising all taxable property within the county. This process involves estimating the market value of each property, which forms the basis for calculating property taxes. TCAD employs a team of appraisers who inspect properties, consider recent sales data, and analyze various factors to determine an accurate valuation.

Property owners have the right to review their appraisal notices and file protests if they believe the assessed value is incorrect. The appraisal review board (ARB) handles these protests, ensuring a fair and transparent process. Property owners can present evidence and arguments to support their case, and the ARB makes final decisions regarding property valuations.

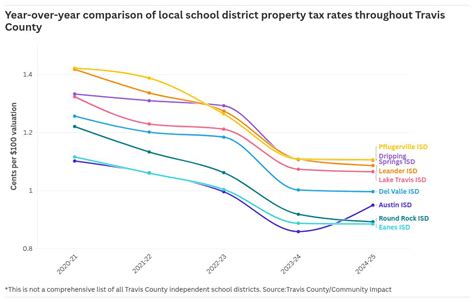

Tax Rates and Calculations

Property taxes in Travis County are calculated by multiplying the appraised value of the property by the tax rate set by various taxing entities. These entities include the county, cities, school districts, and special districts. Each entity has its own tax rate, which is typically expressed as a percentage. The total tax rate for a property is the sum of these individual rates.

For instance, consider a residential property with an appraised value of $300,000. If the combined tax rate for the property is 2.5%, the annual property tax would be calculated as follows:

| Entity | Tax Rate | Tax Amount |

|---|---|---|

| County | 0.5% | $1,500 |

| City | 1.2% | $3,600 |

| School District | 0.8% | $2,400 |

| Special District | 0.05% | $150 |

| Total Tax | 2.5% | $7,650 |

It's important to note that tax rates can vary significantly depending on the location and type of property. Commercial properties, for example, may face higher tax rates than residential properties.

Tax Exemptions and Discounts

Travis County offers various tax exemptions and discounts to eligible property owners, which can significantly reduce their tax burden. Some common exemptions include:

- Homestead Exemption: Property owners who use their property as their primary residence can apply for a homestead exemption. This exemption reduces the appraised value of the property for tax purposes, resulting in lower taxes. The amount of reduction depends on the specific exemption and the property's value.

- Over-65 Exemption: Property owners who are 65 years or older may qualify for an exemption that limits the increase in their property's appraised value for tax purposes. This exemption helps seniors maintain affordability as property values rise.

- Disability Exemption: Individuals with disabilities may be eligible for an exemption that reduces their property's appraised value. This exemption aims to provide financial relief to those with special needs.

Additionally, Travis County offers discounts for early tax payments and provides payment plans for those facing financial difficulties.

Strategies for Managing Property Taxes

Navigating the property tax landscape in Travis County requires careful planning and understanding. Here are some strategies to consider:

Regularly Review Appraisal Notices

Stay informed by reviewing your appraisal notices carefully. Ensure that the appraised value aligns with your property’s actual market value. If you disagree with the assessment, gather evidence and prepare a strong case for your protest.

Explore Tax Exemptions and Discounts

Research and apply for relevant tax exemptions and discounts. These can provide significant savings and make property ownership more affordable. Stay updated on any changes to exemption requirements and ensure you meet the necessary criteria.

Consider Tax Rate Trends

Monitor tax rate changes in your area. While individual tax rates may fluctuate, understanding the overall trend can help you budget effectively. Rising tax rates may indicate a need to reassess your financial plan or explore alternatives.

Engage with Local Authorities

Build a relationship with your local taxing entities. Attend public meetings, stay informed about budget proposals, and provide feedback on tax-related matters. Active participation can influence tax policies and ensure a more equitable distribution of tax burdens.

Seek Professional Advice

If you find the property tax system complex or have unique circumstances, consider seeking advice from tax professionals or financial advisors. They can provide tailored strategies and ensure you’re taking advantage of all available benefits.

The Future of Property Taxes in Travis County

The property tax system in Travis County is continually evolving, influenced by economic trends, demographic changes, and legislative decisions. Here are some potential future implications:

Impact of Economic Growth

Travis County’s robust economic growth may lead to increased property values, impacting tax assessments. As the county attracts new businesses and residents, property owners should anticipate potential adjustments in tax rates and valuations.

Potential Tax Reform

Legislative discussions around tax reform could bring significant changes to the property tax system. Proposals for flattening tax rates, adjusting exemptions, or implementing new tax structures may emerge. Staying informed about these discussions is crucial for adapting to potential changes.

Technology and Efficiency

Advancements in technology may streamline the property tax assessment and collection process. Digital tools and data analytics could enhance accuracy and efficiency, reducing administrative burdens for both property owners and taxing entities.

Community Engagement

Travis County’s diverse community can play a vital role in shaping the future of property taxes. Active citizen engagement, through public forums and participation in local government, can influence tax policies and ensure they align with the needs and aspirations of the community.

How often are property taxes assessed in Travis County?

+

Property taxes are assessed annually in Travis County. The appraisal process typically occurs in the spring, and property owners receive their appraisal notices by May 1st. This allows sufficient time for protests and reviews before the final tax rolls are prepared.

Are there any online tools to estimate my property taxes?

+

Yes, Travis Central Appraisal District provides an online tax estimator tool. This tool allows property owners to input their property details and get an estimate of their potential tax liability based on the current tax rates.

What happens if I miss the deadline to protest my appraisal notice?

+

Missing the protest deadline may limit your options for challenging the appraisal. However, you can still contact the appraisal district to discuss your concerns and explore alternative resolutions.

Are there any resources for low-income property owners to reduce their tax burden?

+

Yes, Travis County offers a variety of programs and resources for low-income property owners. These include the Homestead Exemption, which reduces the taxable value of your property, and the Tax Relief for Older or Disabled Homeowners program, which provides assistance for those facing financial hardships.

How can I stay updated on tax rate changes and legislative proposals?

+

Stay connected with local news sources, follow the activities of your city council and county commissioners, and subscribe to newsletters from relevant government agencies. These sources provide regular updates on tax-related matters and legislative proposals.