Canada United States Tax Convention

The Canada-United States Tax Convention, also known as the Canada-U.S. Tax Treaty, is a vital agreement between two of the world's largest economies, aimed at mitigating double taxation and fostering cross-border trade and investment. This treaty, in force since 1984, has undergone several amendments, with the latest significant update in 2016. It covers a wide range of taxes, including income, capital gains, and inheritance taxes, providing clarity and structure for individuals and businesses operating in both countries.

Historical Context and Significance

The Canada-U.S. Tax Convention is an essential component of the broader economic relationship between the two nations. With a shared border and a long history of economic cooperation, this treaty addresses the complexities that arise when individuals and businesses operate in multiple jurisdictions. By preventing double taxation and providing a clear framework for tax obligations, the treaty encourages cross-border activities, supports business growth, and promotes international trade.

The treaty's historical development is marked by a series of amendments, each addressing emerging economic and tax-related issues. The latest update in 2016 was particularly significant, introducing provisions to address tax evasion and tax avoidance, aligning with the global push for transparency and fairness in international tax practices.

Key Provisions and Benefits

Tax Residence and Double Taxation Relief

A fundamental aspect of the treaty is the establishment of rules to determine tax residency. This ensures that individuals and entities are taxed fairly, preventing double taxation where an individual or entity is considered a resident of both countries for tax purposes. The treaty provides a “tie-breaker” rule, considering factors like place of birth, citizenship, and permanent home, to determine an individual’s tax residence.

For businesses, the treaty outlines rules for corporate residency, addressing the tax obligations of corporations operating in both countries. This clarity is crucial for multinational enterprises, ensuring they are not subject to double taxation on their income.

Tax Rates and Withholding

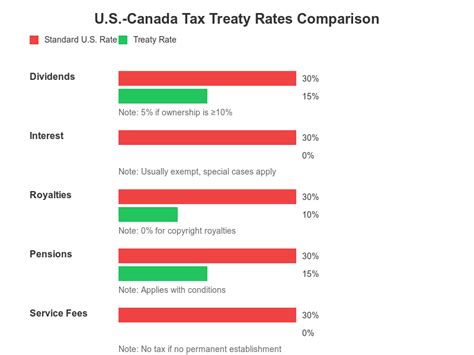

The treaty sets out maximum tax rates that each country can impose on certain types of income. For instance, it caps the rate of tax that Canada can apply to U.S. source dividends and interest, and vice versa. This provision encourages cross-border investments by reducing the tax burden on income flowing between the two countries.

Additionally, the treaty addresses withholding taxes, which are taxes deducted at the source. It specifies the maximum rates for withholding taxes on various types of income, such as dividends, interest, and royalties. This transparency helps businesses and individuals accurately estimate their tax liabilities when engaging in cross-border transactions.

Capital Gains Taxation

The treaty provides specific rules for the taxation of capital gains, which can arise from the sale of property, including real estate, shares, and other assets. It outlines the conditions under which a country can tax the capital gains of residents of the other country, ensuring that such gains are taxed fairly and in line with international norms.

Exchange of Information

To combat tax evasion and ensure the integrity of the tax system, the treaty includes provisions for the exchange of information between Canadian and U.S. tax authorities. This allows for better detection of tax evasion, particularly in cases where taxpayers may be attempting to hide assets or income in the other country.

Practical Implementation and Case Studies

The Canada-U.S. Tax Convention has had a profound impact on the operations of businesses and individuals with cross-border interests. For instance, a Canadian company with significant operations in the U.S. would benefit from the treaty’s provisions on tax rates and residency, ensuring they are not overburdened by double taxation. Similarly, an American citizen with investments in Canada can rely on the treaty to clarify their tax obligations and maximize their after-tax returns.

In a specific case study, ABC Inc., a Canadian tech company, expanded its operations to the U.S. market. The tax treaty played a crucial role in facilitating this expansion by providing clarity on tax rates for the company's U.S. income. ABC Inc. was able to structure its operations in a way that minimized its tax liability, thanks to the treaty's provisions on withholding taxes and capital gains.

Future Implications and Potential Amendments

As the global tax landscape continues to evolve, the Canada-U.S. Tax Convention will likely undergo further amendments to address emerging issues. One potential area of focus could be the treatment of digital services and the taxation of digital economy players, which has become a critical issue in international tax policy.

Additionally, with the increasing emphasis on environmental sustainability, future amendments might explore the potential for "green" tax provisions, encouraging cross-border investments in sustainable technologies and practices. The treaty's flexibility and adaptability will be crucial in ensuring it remains relevant and effective in the face of these evolving challenges.

| Tax Category | Key Provisions |

|---|---|

| Income Tax | Maximum tax rates on income, including dividends, interest, and royalties. Clear guidelines for corporate residency. |

| Capital Gains | Rules for the taxation of capital gains from the sale of property, including real estate and shares. |

| Withholding Taxes | Maximum rates for withholding taxes on various types of income, providing transparency for cross-border transactions. |

| Exchange of Information | Provisions for the exchange of tax-related information between Canadian and U.S. tax authorities to combat tax evasion. |

How does the treaty handle cases where an individual is considered a resident of both countries for tax purposes?

+The treaty includes a “tie-breaker” rule to determine tax residency in such cases. It considers factors like place of birth, citizenship, and permanent home to establish an individual’s primary tax residence.

What are the maximum tax rates for dividends and interest under the treaty?

+The treaty caps the tax rate on dividends at 15% and on interest at 10%, though these rates can be reduced based on the specific circumstances and the provisions of the treaty.

How does the treaty address the taxation of digital services and the digital economy?

+While the treaty does not specifically address digital services, it provides a framework for the taxation of income from various sources, including royalties and other forms of income that could apply to the digital economy. However, as the digital economy continues to evolve, future amendments may be needed to address this issue more directly.