Washington Dc State Income Tax

The District of Columbia, often referred to as Washington D.C., has a unique status as the capital of the United States and operates as a federal district rather than a state. While it doesn't have the same tax structures as individual states, Washington D.C. imposes its own income tax, known as the District of Columbia Income Tax, which is an important revenue source for the local government and plays a significant role in funding public services and infrastructure.

Understanding the District of Columbia Income Tax

The District of Columbia’s income tax system is designed to generate revenue for the city’s operations and services. It applies to both residents and non-residents who earn income within the district. The tax is progressive, meaning the tax rate increases as income rises, ensuring a fair contribution from higher earners.

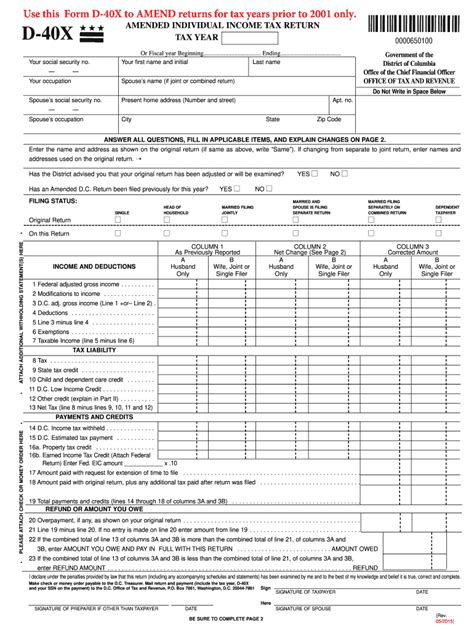

The District's income tax is managed by the Office of Tax and Revenue (OTR), which is responsible for administering and collecting taxes, as well as enforcing tax laws. The OTR ensures that individuals and businesses comply with the tax regulations and provides resources for taxpayers to understand their obligations.

Tax Rates and Brackets

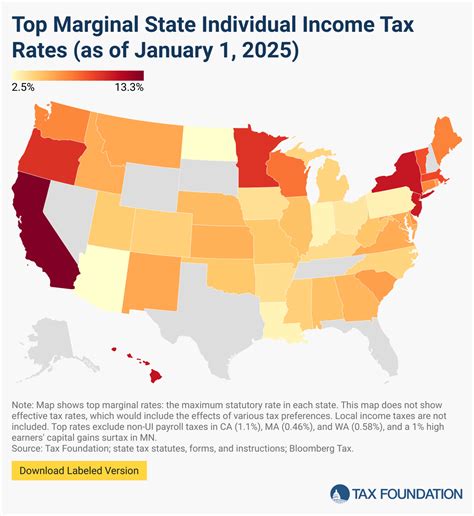

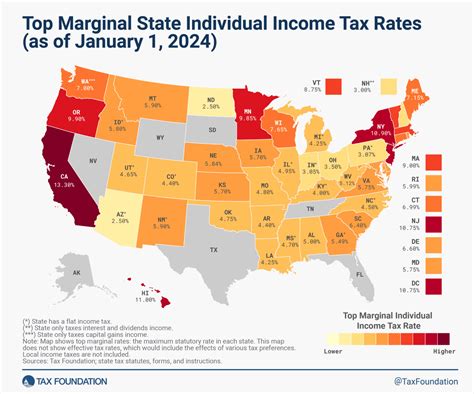

As of the most recent tax year, the District of Columbia’s income tax rates range from 4.00% to 8.75%, depending on an individual’s taxable income. The tax brackets are as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 4.00% | $0 - $10,000 |

| 6.00% | $10,001 - $40,000 |

| 8.25% | $40,001 - $60,000 |

| 8.50% | $60,001 - $100,000 |

| 8.75% | Over $100,000 |

These rates are subject to change, so it's essential to refer to the official District of Columbia tax guidelines for the most current information.

Taxable Income and Deductions

The District of Columbia taxes various types of income, including wages, salaries, bonuses, commissions, tips, self-employment income, and investment income. However, certain types of income are exempt from taxation, such as interest from government bonds and some types of pension income.

Residents of the District can also benefit from tax deductions and credits, which can reduce their taxable income. Common deductions include charitable contributions, mortgage interest, and medical expenses. Additionally, the District offers various tax credits for eligible taxpayers, such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit.

Filing and Payment

The District of Columbia operates on a fiscal year that runs from October 1 to September 30. Taxpayers are required to file their income tax returns and pay their taxes by April 15 of the following year, similar to the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

Taxpayers can file their District of Columbia income tax returns online using the OTR's eFile system, which is a secure and convenient method. The OTR also provides options for paper filing and in-person assistance for those who prefer it.

Payment Options

The District of Columbia offers various payment options for income tax. Taxpayers can choose to pay by credit or debit card, electronic funds transfer (EFT), check, or money order. The OTR also provides a payment plan option for taxpayers who are unable to pay their taxes in full by the due date.

Tax Refunds

If a taxpayer overpays their taxes or is eligible for deductions and credits that reduce their tax liability, they may be entitled to a tax refund. The District of Columbia aims to process tax refunds within 45 days of receiving a complete and accurate return. Refunds are typically issued via the same method used for payment, such as direct deposit or check.

Compliance and Enforcement

The District of Columbia takes tax compliance seriously and has measures in place to ensure taxpayers meet their obligations. The OTR conducts audits and investigations to verify the accuracy of tax returns and may impose penalties for non-compliance, such as late payment penalties and interest charges.

Taxpayers who are unsure about their tax obligations or who require assistance can access resources through the OTR's website, which provides detailed information on tax laws, forms, and payment options. The OTR also offers taxpayer assistance centers where individuals can receive in-person help with their tax matters.

Future Implications

The District of Columbia’s income tax system is an integral part of the city’s financial stability and the provision of public services. As the city continues to grow and evolve, the tax system may undergo changes to adapt to economic shifts and ensure it remains fair and efficient.

One potential area of change is the consideration of a flat tax rate, which would simplify the tax system and reduce the administrative burden on both taxpayers and the OTR. However, this would require careful analysis to ensure it doesn't disproportionately affect lower-income residents.

Additionally, as remote work becomes more prevalent, the District may need to clarify its tax regulations for non-residents who work remotely within the District. This could impact the tax obligations of individuals and businesses and may require new legislation to ensure fair taxation.

Conclusion

The District of Columbia’s income tax is a critical component of the city’s financial framework, providing revenue for essential services and infrastructure. By understanding the tax rates, brackets, and deductions, taxpayers can ensure they meet their obligations and take advantage of available credits and deductions. As the District continues to adapt to changing economic conditions, the income tax system will play a vital role in its financial stability and future growth.

What is the District of Columbia’s fiscal year for income tax purposes?

+The District’s fiscal year runs from October 1 to September 30.

When is the deadline for filing District of Columbia income tax returns?

+The deadline for filing District of Columbia income tax returns is April 15, unless this date falls on a weekend or holiday, in which case the deadline is extended to the next business day.

What payment options are available for District of Columbia income tax?

+The District of Columbia offers various payment options, including credit/debit card, electronic funds transfer (EFT), check, and money order. It also provides a payment plan option for taxpayers unable to pay in full by the due date.

How long does it take to receive a tax refund from the District of Columbia?

+The District of Columbia aims to process tax refunds within 45 days of receiving a complete and accurate return.

What resources are available for taxpayers seeking assistance with their District of Columbia income tax obligations?

+Taxpayers can access resources through the OTR’s website, which provides detailed information on tax laws, forms, and payment options. The OTR also offers taxpayer assistance centers for in-person help.