Iowa Sales Tax Exemption Form

Iowa's sales tax exemption forms are a crucial aspect of the state's tax system, offering relief to certain entities and individuals from the standard sales and use tax. These exemptions play a significant role in the state's economy and can greatly impact businesses and consumers alike. This comprehensive guide aims to delve into the specifics of Iowa's sales tax exemption forms, providing an in-depth understanding of the process, requirements, and benefits.

Understanding Iowa’s Sales Tax Exemption Process

Iowa’s sales tax exemption forms serve as a mechanism for eligible entities to avoid paying the standard sales tax on purchases. This exemption is not a blanket exclusion but rather a targeted relief measure with specific criteria. Understanding the exemption process is essential for businesses and individuals to navigate the state’s tax landscape effectively.

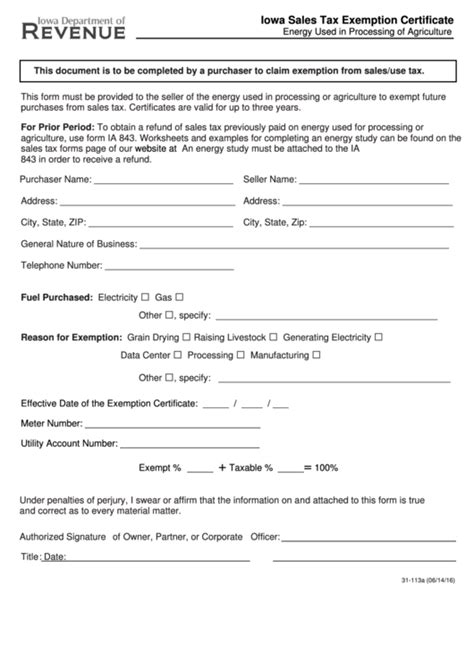

The sales tax exemption process in Iowa is initiated by completing and submitting the appropriate exemption form. This form, known as the Iowa Sales Tax Exemption Certificate, is a legal document that certifies the purchaser's eligibility for tax-exempt status. The certificate must be completed accurately and submitted to the seller before the tax-exempt purchase can be made.

Who Qualifies for Sales Tax Exemption in Iowa?

Iowa’s sales tax exemption forms are available to a range of entities and individuals. The primary qualification criteria include:

- Resale Exemption: Businesses that purchase goods for resale are eligible for this exemption. This includes retailers, wholesalers, and other entities involved in the supply chain. The goods must be purchased with the intention of being resold, and the purchaser must provide a valid resale certificate to the seller.

- Industrial Processing Exemption: Manufacturers and industrial processors may qualify for this exemption if they use the purchased goods directly in their manufacturing or processing operations. This exemption is designed to promote economic development and encourage industrial growth in the state.

- Governmental Entities: Iowa's state and local government agencies, as well as certain nonprofit organizations, are eligible for sales tax exemption. This includes schools, universities, hospitals, and other public institutions. The exemption is aimed at reducing the financial burden on these entities and ensuring efficient use of public funds.

- Agricultural Producers: Iowa's agricultural producers, including farmers and ranchers, may qualify for sales tax exemption on certain purchases related to their agricultural operations. This exemption aims to support the state's agricultural industry and encourage investment in farming equipment and supplies.

- Nonprofit Organizations: Certain nonprofit organizations, such as charitable institutions, religious organizations, and educational institutions, may be eligible for sales tax exemption. The exemption is granted based on the organization's purpose and its impact on the community.

It's important to note that while these are the primary categories of eligibility, there may be other specific circumstances under which an entity or individual can qualify for sales tax exemption in Iowa. Consulting with a tax professional or referencing the official guidelines provided by the Iowa Department of Revenue is recommended to ensure accurate understanding and compliance.

The Role of the Iowa Department of Revenue

The Iowa Department of Revenue plays a pivotal role in the sales tax exemption process. They are responsible for:

- Issuing and administering sales tax exemption forms.

- Providing guidance and support to taxpayers regarding exemption eligibility.

- Reviewing and processing exemption applications.

- Enforcing sales tax regulations and ensuring compliance.

The Department's website offers a wealth of resources, including detailed instructions, frequently asked questions, and up-to-date information on tax laws and regulations. They also provide assistance through various channels, such as online portals, phone support, and in-person meetings, ensuring that taxpayers have access to the support they need.

The Benefits of Iowa’s Sales Tax Exemption

Iowa’s sales tax exemption forms offer a range of benefits to eligible entities and individuals. These benefits can significantly impact their financial health and overall operations.

Cost Savings

The most immediate benefit of sales tax exemption is cost savings. Eligible entities can avoid paying the standard sales tax, which in Iowa is currently set at 6% (as of [current date]). This can result in substantial savings, especially for large-scale purchases or businesses with high turnover rates. For example, a business purchasing goods worth 1 million with a 6% sales tax would save 60,000 by utilizing the exemption.

| Purchase Amount | Sales Tax (6%) | Exemption Savings |

|---|---|---|

| $50,000 | $3,000 | $3,000 |

| $100,000 | $6,000 | $6,000 |

| $500,000 | $30,000 | $30,000 |

| $1,000,000 | $60,000 | $60,000 |

These savings can be reinvested into the business, used to lower prices for customers, or allocated towards other operational expenses, ultimately improving the entity's financial position.

Competitive Advantage

Sales tax exemption can provide a competitive advantage to businesses operating in Iowa. By avoiding sales tax, businesses can offer more competitive pricing compared to their taxed counterparts. This can attract more customers, increase market share, and enhance the business’s overall competitiveness in the marketplace.

Cash Flow Management

For businesses, particularly those with tight cash flow, sales tax exemption can provide a significant boost to their financial management. By not having to pay sales tax upfront, businesses can allocate their funds more efficiently, potentially improving their liquidity and financial stability.

Compliance and Administrative Efficiency

Sales tax exemption also brings administrative efficiency and compliance benefits. Eligible entities can streamline their tax obligations, reducing the time and resources spent on tax-related paperwork and compliance. This can free up valuable resources for other critical business functions.

Applying for Iowa Sales Tax Exemption

Applying for sales tax exemption in Iowa is a straightforward process, although it requires careful attention to detail to ensure eligibility and compliance. The steps involved include:

- Determine Eligibility: Review the eligibility criteria outlined by the Iowa Department of Revenue to determine if your entity or organization qualifies for sales tax exemption. Consider consulting with a tax professional for guidance.

- Obtain the Exemption Form: The Iowa Sales Tax Exemption Certificate can be obtained online from the Iowa Department of Revenue's website. The form is typically available in a fillable PDF format, making it convenient to complete.

- Complete the Form: Carefully fill out the exemption form, providing accurate and complete information. Ensure that all required fields are populated and that the form is signed by an authorized representative of your entity.

- Submit the Form: Submit the completed exemption form to the Iowa Department of Revenue using the preferred method outlined on their website. This may include online submission, mailing, or in-person delivery to their offices.

- Wait for Approval: Once the form is submitted, the Iowa Department of Revenue will review your application. The processing time may vary, but you should receive a response within a reasonable timeframe. If approved, you will receive a certificate of exemption, which should be kept on file and presented to sellers when making tax-exempt purchases.

Maintaining Compliance

Maintaining compliance with Iowa’s sales tax exemption requirements is crucial. This involves:

- Keeping accurate records of all tax-exempt purchases and the corresponding exemption certificates.

- Ensuring that the exemption certificate is valid and up-to-date. Exemption certificates may have expiration dates, and it's essential to renew them as required.

- Providing the exemption certificate to sellers before making tax-exempt purchases. Sellers are required to accept valid exemption certificates and will not charge sales tax if presented with a valid certificate.

- Understanding the limitations of the exemption. While sales tax exemption offers significant benefits, it does not exempt the purchaser from all taxes. For example, Iowa's use tax may still apply in certain circumstances.

Conclusion: Iowa’s Sales Tax Exemption – A Key Tool for Businesses

Iowa’s sales tax exemption forms are a valuable tool for businesses and entities operating within the state. By understanding the exemption process, eligibility criteria, and benefits, these entities can effectively utilize the exemption to their advantage. From cost savings to competitive advantages, sales tax exemption offers a range of benefits that can significantly impact an entity’s financial health and operational success.

While the process may seem daunting at first, with careful planning and compliance, Iowa's sales tax exemption can be a powerful mechanism for growth and development. As always, seeking professional advice and staying updated with the latest tax regulations is essential to ensure a smooth and successful exemption experience.

Frequently Asked Questions

How often do I need to renew my Iowa sales tax exemption certificate?

+

The renewal frequency for Iowa sales tax exemption certificates varies based on the type of entity and the purpose of the exemption. Some certificates may have an expiration date, while others may be valid indefinitely. It’s essential to review the terms of your specific exemption certificate and renew it as required to maintain compliance.

Are there any penalties for misuse of the Iowa sales tax exemption?

+

Yes, misuse or abuse of the Iowa sales tax exemption can result in penalties. This includes using an expired or invalid exemption certificate, providing false information, or attempting to evade sales tax. Penalties may range from monetary fines to revocation of the exemption certificate and potential legal consequences. It’s crucial to use the exemption responsibly and in accordance with the law.

Can I use my Iowa sales tax exemption certificate in other states?

+

No, Iowa sales tax exemption certificates are only valid within the state of Iowa. Each state has its own sales tax exemption laws and requirements. If you need to make tax-exempt purchases in another state, you must obtain an exemption certificate specific to that state and comply with their regulations.

How can I verify the validity of a sales tax exemption certificate presented to me by a customer?

+

To verify the validity of a sales tax exemption certificate, you can contact the Iowa Department of Revenue directly. They can provide guidance and assistance in determining the authenticity and validity of the certificate. It’s important to ensure that the certificate is not expired and that it matches the customer’s details.

What happens if I make a taxable purchase using an Iowa sales tax exemption certificate by mistake?

+

If you mistakenly make a taxable purchase using an Iowa sales tax exemption certificate, you may be required to pay the sales tax. It’s essential to carefully review the terms of your exemption certificate and consult with the Iowa Department of Revenue if you have any doubts about the applicability of the exemption. In some cases, you may be able to rectify the mistake and avoid penalties.