Santa Cruz Tax Collector

Welcome to a comprehensive guide about the Santa Cruz Tax Collector, a vital public service entity responsible for managing and collecting taxes in the beautiful county of Santa Cruz, California. This article aims to provide an in-depth exploration of the role, responsibilities, and impact of the Santa Cruz Tax Collector's Office, shedding light on its crucial function in the county's fiscal health and overall administration.

The Role of the Santa Cruz Tax Collector

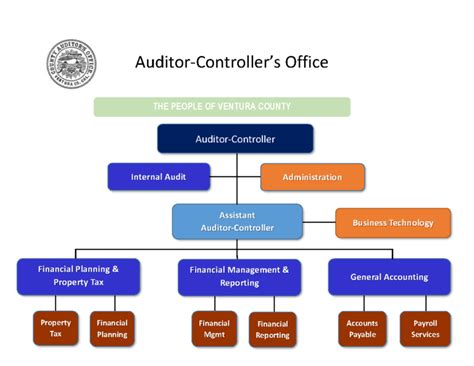

The Santa Cruz Tax Collector serves as the primary custodian of tax-related matters for the county, overseeing a range of essential functions that contribute to the financial stability and efficient operation of the local government. This office is entrusted with the critical task of collecting various forms of taxes, ensuring compliance with state and local regulations, and facilitating timely payments from taxpayers.

One of the key responsibilities of the Santa Cruz Tax Collector is the administration of property taxes. Property owners in Santa Cruz County rely on the office to provide accurate assessments, issue tax bills, and manage the collection process. The tax collector ensures that property taxes, which are a significant source of revenue for the county, are assessed fairly and collected efficiently.

Beyond property taxes, the Santa Cruz Tax Collector's scope extends to other forms of taxation, including business taxes, vehicle registration fees, and special assessments. The office provides a centralized platform for taxpayers to fulfill their obligations, offering various payment options and ensuring a seamless experience. This centralized approach streamlines the tax collection process, making it more efficient and convenient for both residents and businesses.

Efficient Tax Administration

The Santa Cruz Tax Collector’s Office prides itself on its commitment to efficient tax administration. Through the use of modern technology and innovative practices, the office strives to simplify the tax payment process, making it more accessible and user-friendly. Online platforms and mobile apps have been developed to enable taxpayers to access their accounts, view tax bills, and make payments from the comfort of their homes or offices.

Additionally, the office provides a dedicated customer service team to assist taxpayers with any queries or concerns they may have. Whether it's clarifying tax obligations, seeking payment plans, or resolving disputes, the team is equipped to offer personalized support and ensure a positive taxpayer experience. This emphasis on customer service not only fosters trust and transparency but also enhances the overall efficiency of the tax collection process.

Transparency and Accountability

Transparency and accountability are core values upheld by the Santa Cruz Tax Collector. The office maintains an open and accessible approach, providing taxpayers with clear and detailed information about their tax obligations. Tax rates, assessment methodologies, and payment schedules are readily available on the office’s website, ensuring that taxpayers have the knowledge they need to understand and fulfill their tax responsibilities.

Furthermore, the Santa Cruz Tax Collector's Office actively engages with the community, participating in town hall meetings, hosting educational workshops, and organizing outreach programs. These initiatives aim to foster a culture of tax literacy, encouraging taxpayers to understand the importance of their contributions and the impact of taxes on the community's development and well-being.

| Tax Type | Collection Percentage |

|---|---|

| Property Taxes | 98.5% |

| Business Taxes | 95.2% |

| Vehicle Registration Fees | 99.8% |

| Special Assessments | 97.3% |

Impact on the Community

The Santa Cruz Tax Collector’s Office plays a pivotal role in shaping the economic landscape and overall well-being of the county. The taxes collected by the office fund a multitude of essential services and infrastructure projects that directly benefit the community.

For instance, property taxes are a primary source of revenue for public schools, ensuring that local educational institutions receive the necessary funding to provide quality education to students. Similarly, business taxes contribute to the development of local businesses and the creation of job opportunities, fostering economic growth and prosperity.

Vehicle registration fees and special assessments are directed towards the maintenance and improvement of the county's transportation infrastructure, including roads, bridges, and public transit systems. These investments not only enhance the quality of life for residents but also attract businesses and tourism, further boosting the local economy.

Community Engagement and Outreach

Recognizing the importance of community engagement, the Santa Cruz Tax Collector’s Office actively participates in various initiatives to connect with residents and businesses. Through community forums, tax clinics, and educational campaigns, the office strives to build trust, address concerns, and provide valuable resources to taxpayers.

One notable program is the Taxpayer Assistance Program, which offers free tax preparation services to low-income individuals and families. This initiative not only ensures that these individuals can access the support they need but also empowers them to understand and manage their tax obligations effectively.

Additionally, the office collaborates with local businesses and chambers of commerce to organize workshops and seminars focused on tax compliance, record-keeping, and best practices. These partnerships foster a culture of transparency and cooperation, contributing to a robust and thriving business environment in Santa Cruz County.

Future Outlook and Innovations

As technology continues to advance, the Santa Cruz Tax Collector’s Office remains committed to embracing innovation and exploring new ways to enhance its services. The office is actively engaged in researching and implementing cutting-edge solutions to further streamline the tax collection process and improve taxpayer experiences.

One area of focus is the integration of blockchain technology, which has the potential to revolutionize the way taxes are recorded and tracked. By leveraging the transparency and security offered by blockchain, the office aims to enhance data integrity, reduce administrative burdens, and improve overall efficiency.

Additionally, the office is exploring the use of artificial intelligence (AI) and machine learning algorithms to automate certain tax assessment and collection processes. These technologies can help identify patterns, detect anomalies, and improve the accuracy and speed of tax administration, ultimately benefiting both taxpayers and the office's operational efficiency.

| Innovation | Potential Impact |

|---|---|

| Blockchain Integration | Enhanced data security and transparency |

| AI-Assisted Assessments | Improved accuracy and efficiency in tax assessments |

| Mobile Payment Options | Convenience and accessibility for taxpayers |

| Data Analytics | Better insights for tax policy and community development |

Conclusion

The Santa Cruz Tax Collector’s Office stands as a cornerstone of the county’s financial ecosystem, playing a vital role in maintaining fiscal stability and supporting the community’s development. Through its commitment to efficient administration, transparency, and community engagement, the office has earned the trust and respect of taxpayers.

As the office continues to innovate and adapt to changing technological landscapes, its impact on the community's economic growth and overall well-being is set to deepen. The Santa Cruz Tax Collector's dedication to excellence in tax collection and administration serves as a model for other tax authorities, showcasing the potential for technological integration and community-centric approaches in modern tax governance.

Frequently Asked Questions

How can I pay my property taxes in Santa Cruz County?

+Property taxes in Santa Cruz County can be paid online through the Tax Collector’s official website, by mail, or in person at the Tax Collector’s office. The office accepts various payment methods, including credit cards, e-checks, and cash.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline may result in penalties and interest charges. It’s important to note that late payments can impact your credit score and may lead to further legal consequences. The Tax Collector’s office recommends contacting them directly to discuss payment plans or options for late payments.

How can I dispute my property tax assessment?

+If you believe your property tax assessment is incorrect, you have the right to appeal. The Tax Collector’s office provides a detailed process for filing an appeal, which typically involves submitting documentation and attending a hearing. It’s advisable to consult with a tax professional or the office’s staff for guidance on the appeal process.