Inheritance Tax Nj

Inheritance tax is a topic that often raises questions and concerns among individuals and families, especially when it comes to estate planning and the distribution of assets. In the state of New Jersey, the inheritance tax system operates with specific rules and regulations that impact how property is transferred upon the death of a resident. Understanding these laws is crucial for anyone with assets in the state, as it can help ensure a smooth transition and minimize potential tax burdens.

Understanding Inheritance Tax in New Jersey

New Jersey’s inheritance tax is a levy imposed on the recipients of property, rather than the estate itself. This means that the beneficiaries of an estate may be required to pay tax on the assets they receive. The tax applies to various forms of property, including real estate, personal belongings, cash, stocks, and more. It’s important to note that New Jersey’s inheritance tax is distinct from federal estate taxes, which are levied on the estate itself before assets are distributed.

One key aspect of New Jersey's inheritance tax is the classification of beneficiaries into different groups, each with its own tax rate. This classification system plays a significant role in determining the amount of tax owed by the recipients.

Beneficiary Groups and Tax Rates

New Jersey categorizes beneficiaries into three primary groups, with each group subject to a different tax rate. Understanding these groups is essential for estimating potential inheritance tax liabilities.

| Beneficiary Group | Tax Rate |

|---|---|

| Class A: Immediate Family | 0% |

| Class B: Distant Relatives and Friends | 11%-16% |

| Class C: All Other Individuals | 15%-16% |

Class A beneficiaries, which include immediate family members such as spouses, children, parents, and grandparents, are exempt from inheritance tax in New Jersey. This means that when a resident passes away, their direct family can inherit property without incurring any tax burden.

Class B beneficiaries, consisting of distant relatives and close friends, face a tax rate ranging from 11% to 16%. The exact rate depends on the value of the inherited property. For instance, if the inheritance is valued at $25,000 or less, the tax rate is 11%. However, for amounts over $700,000, the tax rate jumps to 16%.

Class C beneficiaries, which include all other individuals not covered by Classes A or B, face the highest tax rates. Their inheritance is taxed at a rate of 15% to 16%, again depending on the value of the property. For inheritances of $25,000 or less, the rate is 15%, while for amounts over $700,000, it increases to 16%.

It's important to note that these tax rates are cumulative. This means that if an individual inherits property from multiple sources, the tax is calculated based on the combined value of all inheritances, not just the individual inheritances.

Tax Exemptions and Credits

New Jersey offers certain exemptions and credits to reduce the inheritance tax burden on beneficiaries. These provisions can significantly lower the tax liability for some recipients.

- Marital Deduction: Property inherited by a surviving spouse is typically exempt from inheritance tax, similar to the federal estate tax. This deduction ensures that a spouse can inherit assets without facing tax consequences.

- Charitable Contributions: Gifts made to qualified charities are generally exempt from inheritance tax. This provision encourages philanthropy and supports charitable organizations.

- Family Farm Exemption: New Jersey offers an exemption for family farms and agricultural land. This provision aims to preserve family-owned farms by reducing the tax burden when the property is passed on to heirs.

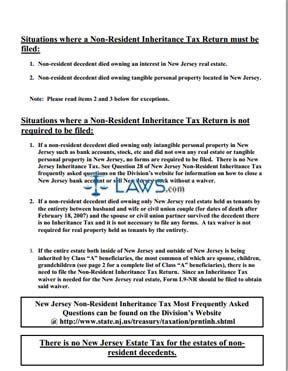

- Residency Exemption: Individuals who are not residents of New Jersey may be eligible for an exemption if they meet specific criteria. This exemption is designed to prevent the state from taxing non-residents' inheritances.

It's crucial to consult with a tax professional or estate planning attorney to understand how these exemptions and credits apply to your specific situation.

Strategies for Minimizing Inheritance Tax

While inheritance tax is a complex and often unavoidable aspect of estate planning, there are strategies that can help minimize the tax burden. Here are some approaches to consider when navigating New Jersey’s inheritance tax landscape.

Gifting During Lifetime

One effective strategy to reduce inheritance tax is to make gifts during your lifetime. New Jersey, like many other states, allows individuals to make tax-free gifts up to a certain annual limit. By giving away assets while alive, you can reduce the size of your taxable estate and potentially lower the inheritance tax liability for your heirs.

Establishing Trusts

Trusts can be powerful tools for estate planning and tax minimization. By setting up a trust, you can transfer ownership of assets to the trust, which then holds and manages those assets for the benefit of your beneficiaries. Trusts offer several advantages, including the potential for tax savings. For instance, an irrevocable life insurance trust (ILIT) can own a life insurance policy, ensuring that the proceeds are not subject to inheritance tax.

Utilizing Joint Ownership

Joint ownership of property can also help minimize inheritance tax. When property is owned jointly with rights of survivorship, the surviving owner inherits the entire property upon the death of the other owner. This transfer is typically not subject to inheritance tax, as it is considered a non-taxable event. However, it’s essential to carefully consider the potential drawbacks of joint ownership, such as the loss of control over the property during your lifetime.

Charitable Giving

Donating to qualified charities not only supports important causes but can also provide tax benefits. Charitable gifts are generally exempt from inheritance tax, and they may also reduce your taxable estate for federal estate tax purposes. By including charitable giving in your estate plan, you can ensure that your wealth has a positive impact beyond your lifetime.

Conclusion: Navigating Inheritance Tax in New Jersey

Inheritance tax in New Jersey is a complex but important consideration for anyone with assets in the state. By understanding the beneficiary groups, tax rates, and available exemptions, you can make informed decisions about your estate plan. Additionally, implementing strategies such as gifting during your lifetime, establishing trusts, utilizing joint ownership, and charitable giving can help minimize the tax burden on your heirs.

Remember, estate planning is a highly personalized process, and it's crucial to seek professional advice to ensure your wishes are carried out and your beneficiaries are protected. With careful planning and a thorough understanding of the laws, you can navigate the inheritance tax landscape in New Jersey with confidence and ensure a smooth transition of your assets.

How often does New Jersey revise its inheritance tax laws?

+New Jersey’s inheritance tax laws are subject to change, and revisions can occur periodically. It’s important to stay updated with the latest regulations to ensure compliance and accurate tax planning. Consult with a tax professional or attorney for the most current information.

Are there any penalties for underpayment or non-payment of inheritance tax in New Jersey?

+Yes, failure to pay inheritance tax in New Jersey can result in penalties and interest charges. It’s crucial to calculate the tax liability accurately and make timely payments to avoid additional financial burdens.

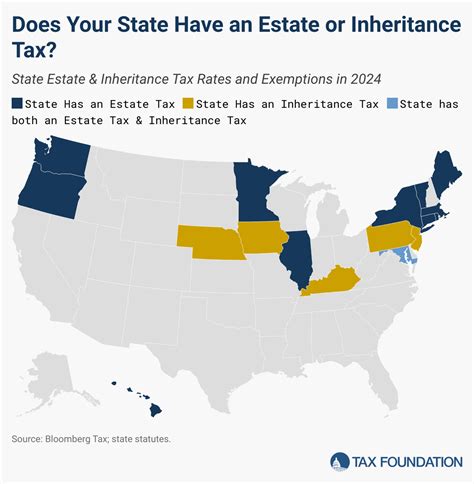

Can I transfer my residence to another state to avoid New Jersey’s inheritance tax?

+Transferring your residence to another state may help avoid New Jersey’s inheritance tax, but it’s important to carefully consider the tax implications in your new state of residence. Some states have their own inheritance or estate tax laws, so it’s crucial to understand the tax landscape in your new location.

Are there any tax advantages to owning property jointly with my spouse in New Jersey?

+Yes, owning property jointly with your spouse in New Jersey can have tax advantages. Joint ownership with rights of survivorship means that upon the death of one spouse, the surviving spouse inherits the entire property without triggering inheritance tax. This strategy can help minimize tax liabilities and ensure a smooth transfer of assets.