Sales Tax Vehicle California

Understanding the Complex World of Vehicle Sales Tax in California

When it comes to purchasing a vehicle in California, understanding the sales tax process is crucial. The state's sales tax system for vehicles is intricate and can significantly impact your overall purchase cost. This guide aims to demystify the vehicle sales tax in California, providing you with a comprehensive understanding of the process and its implications.

The Fundamentals of Vehicle Sales Tax in California

In California, sales tax is levied on the purchase of vehicles, including cars, motorcycles, trucks, and recreational vehicles. This tax is collected by the California Department of Motor Vehicles (DMV) and is based on the purchase price or the value of the vehicle, whichever is higher. The sales tax is calculated as a percentage of the vehicle’s value and is an essential consideration when budgeting for a vehicle purchase.

The sales tax rate in California varies depending on the location of the purchase and the specific county. The state sales tax rate is a 7.25% base rate, but counties and cities can add additional tax rates on top of this. For instance, in Los Angeles County, the total sales tax rate can reach 10.25%, including the state and local taxes.

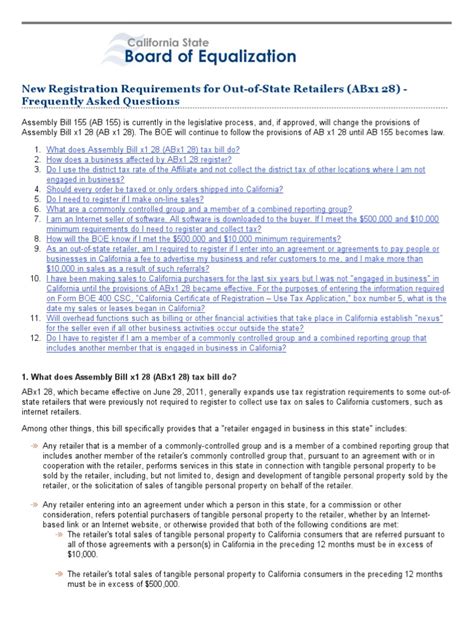

It's important to note that California also has a Use Tax applicable to vehicle purchases. Use Tax is charged when a vehicle is purchased outside of California but registered within the state. This tax ensures that regardless of where the vehicle is purchased, the same tax is paid. Use Tax is calculated in the same way as sales tax and is due at the time of vehicle registration.

How Sales Tax is Calculated

The sales tax calculation for vehicles in California involves a few key steps. Firstly, the purchase price or the value of the vehicle is determined. This value includes the base price of the vehicle, any optional equipment, and any additional fees or charges associated with the purchase. It’s crucial to understand that the sales tax is calculated on the total value, not just the base price.

Once the vehicle's value is established, the applicable sales tax rate is identified. This rate, as mentioned earlier, depends on the location of the purchase. The tax rate is then multiplied by the vehicle's value to determine the sales tax amount. For example, if you purchase a vehicle with a value of $30,000 in a county with a 9.5% sales tax rate, the sales tax due would be $2,850 ($30,000 x 0.095).

| Vehicle Value | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $20,000 | 8.0% | $1,600 |

| $35,000 | 9.75% | $3,412.50 |

| $50,000 | 10.25% | $5,125 |

Sales Tax Exemptions and Special Cases

While the general rule is that vehicle purchases are subject to sales tax, there are certain exemptions and special cases to consider. These exemptions can provide relief from the sales tax burden for specific individuals or situations.

Exemptions for Certain Purchases

California offers sales tax exemptions for specific types of vehicle purchases. These include:

- Vehicle Trades: If you trade in your old vehicle as part of the purchase of a new one, the sales tax is calculated based on the difference in value between the two vehicles. This means you pay sales tax only on the amount by which the new vehicle exceeds the trade-in value.

- Disabled Persons: Individuals with disabilities may be eligible for a sales tax exemption when purchasing a vehicle adapted to their specific needs. This exemption is designed to encourage accessibility and independence.

- Government Purchases: Government entities, such as state or local agencies, are generally exempt from paying sales tax on vehicle purchases.

- Charitable Organizations: Non-profit organizations and charities may also be exempt from sales tax on vehicle purchases, provided they meet specific criteria and use the vehicles for their charitable purposes.

Sales Tax for Out-of-State Purchases

When purchasing a vehicle out-of-state and registering it in California, you are still required to pay sales tax. However, the process differs slightly. In this case, you would pay the Use Tax at the time of registration. The Use Tax is calculated in the same way as sales tax, based on the vehicle’s value and the applicable tax rate in the county where you register the vehicle.

Sales Tax for Leased Vehicles

For individuals leasing a vehicle, the sales tax is typically included in the monthly lease payments. The leasing company pays the sales tax on behalf of the lessee, and this cost is factored into the lease agreement. However, it’s important to review the lease terms carefully to understand how sales tax is incorporated into the monthly payments.

Sales Tax and Vehicle Registration

Sales tax and vehicle registration in California are closely intertwined. When you purchase a vehicle, you are responsible for paying the sales tax at the time of purchase. This tax is collected by the DMV and is a necessary step before registering your vehicle.

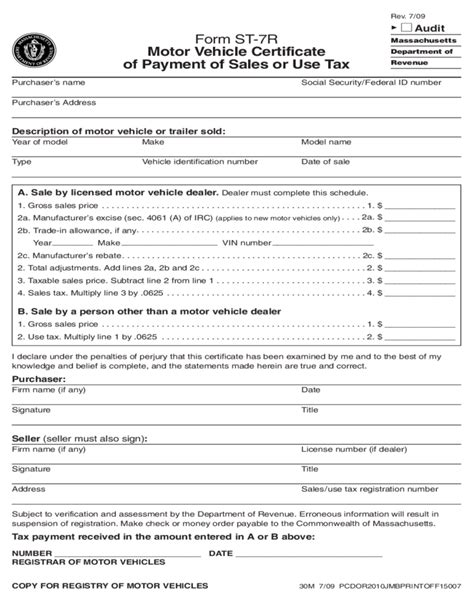

Upon paying the sales tax, you will receive a receipt or a document indicating that the tax has been paid. This document is crucial for the vehicle registration process. You will need to present this proof of payment when registering your vehicle, either online, by mail, or in person at a DMV office.

Online Registration and Sales Tax

California offers the convenience of online vehicle registration. When registering your vehicle online, you will be guided through a step-by-step process that includes providing information about your vehicle, such as the make, model, and VIN. You will also be prompted to enter the sales tax amount or provide proof of payment. This ensures that your registration is completed accurately and that the sales tax is accounted for.

DMV Office Registration

If you choose to register your vehicle in person at a DMV office, you will need to bring the necessary documentation, including proof of sales tax payment. The DMV representative will verify your information and ensure that the sales tax has been paid before completing the registration process.

Tips for Navigating Vehicle Sales Tax in California

Understanding the intricacies of vehicle sales tax in California can be challenging, but with the right approach, you can navigate the process efficiently.

Research Local Sales Tax Rates

Before purchasing a vehicle, research the sales tax rates in the county or city where you plan to make the purchase. This information is readily available on the California Board of Equalization’s website, which provides a comprehensive breakdown of sales tax rates by location. Being aware of the specific tax rate can help you budget accurately and understand the potential impact on your purchase.

Negotiate and Understand Fees

When negotiating the purchase price of a vehicle, be mindful of additional fees and charges that can impact the overall value. These fees, such as dealer preparation fees, destination charges, and documentation fees, are often negotiable and can significantly affect the sales tax due. Understanding these fees and negotiating them down can result in a more favorable purchase experience.

Consider Trade-Ins

If you’re trading in your old vehicle, be sure to understand the trade-in value and how it affects the sales tax calculation. Trading in a vehicle can reduce the overall purchase price and, consequently, the sales tax due. It’s a strategy that can save you money and simplify the tax calculation process.

Utilize Sales Tax Exemptions

If you believe you qualify for a sales tax exemption, such as for a disability-related vehicle adaptation or as a government entity, be sure to research the requirements and documentation needed. Exemptions can provide significant savings, so it’s worthwhile to explore these options if applicable.

Future Implications and Changes

The landscape of vehicle sales tax in California is subject to change, and staying informed about potential future developments is essential.

Potential Sales Tax Increases

California’s sales tax rates can fluctuate based on various factors, including economic conditions and legislative decisions. While it’s challenging to predict future rate changes, staying aware of any proposed tax increases is crucial. Monitoring local news and following updates from the California Board of Equalization can help you anticipate potential changes and adjust your purchasing plans accordingly.

Emerging Technologies and Sales Tax

The rise of electric and autonomous vehicles is transforming the automotive industry. As these technologies become more prevalent, they may bring about changes in the sales tax landscape. For instance, incentives or tax breaks for electric vehicles could impact the overall sales tax structure. Staying informed about these technological advancements and their potential tax implications is vital for making informed purchasing decisions.

Legislative Changes and Exemptions

California’s legislature regularly reviews and updates its tax laws. This means that exemptions and special provisions for vehicle sales tax could change over time. Keeping an eye on legislative updates and proposed bills can help you understand any potential changes to the sales tax system, ensuring you’re prepared for any adjustments that may impact your vehicle purchase.

What is the average sales tax rate for vehicle purchases in California?

+

The average sales tax rate for vehicle purchases in California varies depending on the county. The state sales tax rate is a base of 7.25%, but counties and cities can add additional rates. The average total sales tax rate, including state and local taxes, can range from 8% to 10.25% or more.

How can I calculate the sales tax on my vehicle purchase?

+

To calculate the sales tax on your vehicle purchase, multiply the purchase price or the vehicle’s value by the applicable sales tax rate. For example, if the sales tax rate is 8.75% and the vehicle’s value is 25,000, the sales tax would be 2,187.50 ($25,000 x 0.0875). Remember to consider any additional fees or charges that may impact the vehicle’s value.

Are there any online tools to estimate sales tax for vehicle purchases?

+

Yes, several online calculators and tools are available to estimate the sales tax for vehicle purchases in California. These tools typically require you to input the vehicle’s value and the applicable sales tax rate. They provide a quick and convenient way to estimate the sales tax due. However, it’s always recommended to verify the tax calculation with official sources like the California Board of Equalization.

Can I negotiate the sales tax on my vehicle purchase?

+

The sales tax on vehicle purchases in California is set by law and is non-negotiable. However, you can negotiate the purchase price of the vehicle, which, in turn, can impact the sales tax due. By negotiating a lower purchase price, you may be able to reduce the overall sales tax burden.

What happens if I don’t pay the sales tax on my vehicle purchase?

+

Failing to pay the sales tax on your vehicle purchase can result in significant penalties and legal consequences. The California DMV may refuse to register your vehicle until the tax is paid, and you may face fines and interest charges. It’s crucial to ensure that the sales tax is paid in full at the time of purchase or registration.