Tax/O Medical Term

In the complex world of medical terminology, understanding the intricacies of specific terms is essential for accurate communication and documentation. Among these terms, "Tax/O" stands out as a unique and fascinating concept, with a wide range of applications and implications in the healthcare industry. This article aims to delve into the depths of this medical term, exploring its origins, definitions, and the crucial role it plays in various medical contexts.

Unraveling the Enigma: The Origins of Tax/O

The term “Tax/O” finds its roots in ancient Greek and Latin languages, reflecting the rich history of medical terminology. Derived from the Greek word “taxos,” meaning “arrangement” or “order,” and the Latin suffix “o,” which denotes an action or process, “Tax/O” embodies the concept of classification and organization in the medical field.

In its early usage, "Tax/O" was employed to describe the systematic arrangement of medical knowledge, particularly in the realm of pharmacology and botany. Scholars and physicians of ancient times recognized the need for a structured approach to categorize and identify medicinal plants and their therapeutic properties. Thus, "Tax/O" became an essential tool for organizing and understanding the vast array of natural remedies available to them.

The Modern Definition: A Multifaceted Concept

In contemporary medical practice, “Tax/O” has evolved into a versatile term with multiple interpretations, each serving a distinct purpose within the healthcare landscape.

Taxonomy and Classification

One of the primary uses of “Tax/O” remains its association with taxonomy, the scientific practice of classifying and naming organisms. In medicine, this classification extends beyond the biological realm, encompassing diseases, conditions, and even medical specialties. For instance, the International Statistical Classification of Diseases and Related Health Problems (ICD), a globally recognized system, utilizes “Tax/O” principles to categorize and code various health conditions, facilitating accurate diagnosis and statistical analysis.

Furthermore, the concept of "Tax/O" plays a crucial role in pharmacology, where it aids in the systematic organization of drugs based on their chemical structure, mechanism of action, and therapeutic uses. This taxonomic approach ensures that healthcare professionals can quickly identify and prescribe the most suitable medications for their patients, contributing to better patient outcomes.

Therapeutic Applications

Beyond classification, “Tax/O” has found its way into therapeutic practices, particularly in the field of complementary and alternative medicine (CAM). Here, “Tax/O” refers to the process of balancing and harmonizing the body’s energy systems, often through techniques like acupuncture, herbal medicine, and energy healing. By understanding the “Tax/O” of the body, CAM practitioners aim to restore equilibrium and promote healing.

In this context, "Tax/O" serves as a holistic framework, considering the interconnectedness of the physical, mental, and spiritual aspects of health. By addressing imbalances and blockages in the body's energy flow, CAM therapies aim to prevent and treat a wide range of conditions, from chronic pain to emotional disorders.

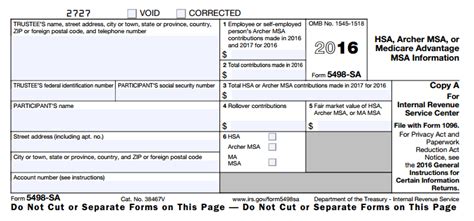

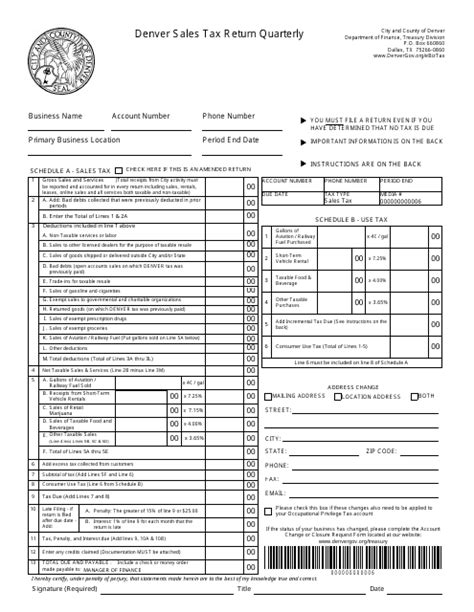

Administrative and Billing Procedures

In the administrative side of healthcare, “Tax/O” takes on a more practical role. Medical billing and coding professionals often utilize “Tax/O” codes to accurately describe medical procedures, diagnoses, and treatments. These codes are essential for insurance reimbursement, statistical analysis, and healthcare research, ensuring that medical services are properly documented and compensated.

For instance, a physician may use a specific "Tax/O" code when billing for a patient's office visit, indicating the nature of the visit, any diagnostic procedures performed, and the subsequent treatment plan. This precise coding system allows for efficient communication between healthcare providers, insurance companies, and patients, streamlining the administrative processes that support medical care.

The Impact of Tax/O: A Real-World Example

To illustrate the practical implications of “Tax/O” in healthcare, let’s consider a hypothetical scenario involving a patient named Emily.

Emily, a 35-year-old woman, presents with a range of symptoms, including fatigue, headaches, and gastrointestinal issues. After a thorough examination, her physician diagnoses her with a complex condition known as "chronic fatigue syndrome" (CFS), a disorder characterized by persistent exhaustion and a multitude of associated symptoms.

In this case, "Tax/O" comes into play at various stages of Emily's journey towards recovery. Firstly, the diagnosis itself relies on a taxonomic approach, as CFS is classified under the broader category of "medically unexplained symptoms" in the ICD system. This classification allows healthcare professionals to understand and communicate the nature of Emily's condition effectively.

| Condition | ICD-10 Code |

|---|---|

| Chronic Fatigue Syndrome | G93.3 |

Additionally, the therapeutic aspect of "Tax/O" becomes relevant as Emily explores complementary treatments. She decides to incorporate acupuncture and herbal remedies into her treatment plan, aiming to restore her body's natural balance. By understanding the "Tax/O" principles underlying these therapies, Emily's practitioners can tailor their approaches to her specific needs, potentially improving her overall well-being.

Lastly, the administrative procedures associated with "Tax/O" come into play when billing for Emily's medical services. Her physician uses specific "Tax/O" codes to describe her diagnosis, office visits, and any additional procedures performed. These codes ensure that Emily's insurance company can process her claims accurately, providing financial support for her ongoing care.

The Future of Tax/O: Innovations and Challenges

As medical knowledge continues to expand and evolve, the role of “Tax/O” in healthcare is poised for further innovation and refinement. With advancements in genomics, proteomics, and other cutting-edge fields, the classification and understanding of diseases and conditions are likely to become even more precise.

However, challenges remain. The complexity of certain medical conditions, coupled with the diverse array of therapeutic approaches, can make the task of classification and coding increasingly intricate. Ensuring that "Tax/O" systems remain up-to-date, comprehensive, and accessible to all healthcare professionals is a continuous endeavor.

Moreover, as healthcare systems worldwide strive for interoperability and data sharing, harmonizing "Tax/O" frameworks becomes crucial. Standardization efforts, such as the development of universal coding systems, will play a pivotal role in facilitating seamless communication and collaboration among healthcare providers, researchers, and policymakers.

How does “Tax/O” impact patient care and outcomes?

+“Tax/O” impacts patient care by providing a structured framework for diagnosis, treatment planning, and documentation. Accurate classification and coding ensure that patients receive appropriate care and that their medical records are comprehensive and useful for future reference.

Are there any controversies surrounding the use of “Tax/O” in alternative medicine practices?

+While “Tax/O” is widely accepted in mainstream medicine, its application in alternative medicine practices can be a point of debate. Some practitioners and researchers question the scientific basis of certain “Tax/O” principles, particularly in the context of energy healing and other non-conventional therapies. However, many CAM practitioners argue that “Tax/O” provides a valuable framework for understanding the body’s energy systems and promoting holistic healing.

How can healthcare professionals stay updated with the latest “Tax/O” developments and standards?

+Healthcare professionals can stay informed by participating in continuing education programs, attending conferences and workshops, and engaging with professional organizations that specialize in medical terminology and coding. Additionally, keeping abreast of the latest research and publications in medical journals can provide valuable insights into emerging “Tax/O” trends and innovations.