Jackson County Mo Taxes

Jackson County, located in the state of Missouri, is a vibrant and diverse region with a rich history and a thriving economy. The county's tax system plays a crucial role in funding essential services and contributing to the overall growth and development of the area. In this comprehensive guide, we will delve into the intricacies of Jackson County Mo Taxes, exploring the various tax types, rates, and their impact on the community.

Understanding Jackson County's Tax Structure

Jackson County operates under a comprehensive tax system that encompasses a range of tax types to generate revenue for local government operations and services. The primary tax categories include property taxes, sales taxes, and various other taxes and fees. Let's explore each of these in detail.

Property Taxes: The Backbone of County Funding

Property taxes are a significant source of revenue for Jackson County. These taxes are assessed on both real estate and personal property owned within the county. The property tax system is designed to ensure that property owners contribute to the funding of local services based on the value of their property.

The property tax rate in Jackson County is determined by the assessed value of the property and the tax rate set by the local taxing authorities. The assessed value is established through a rigorous process that considers factors such as location, property type, and recent sales data. Property owners receive an assessment notice annually, detailing the assessed value and the corresponding tax amount.

Jackson County utilizes a mill levy system to calculate property taxes. A mill is one-thousandth of a dollar, and the mill levy is the rate per thousand dollars of assessed property value. For instance, if the mill levy is set at 100 mills, a property with an assessed value of $200,000 would incur a property tax of $2,000.

It's important to note that the mill levy can vary depending on the specific taxing district in which the property is located. Jackson County is divided into various taxing districts, each with its own tax rate. These districts include the county itself, school districts, fire districts, and other special districts.

| Taxing District | Mill Levy (as of 2023) |

|---|---|

| Jackson County | 41.60 mills |

| Kansas City School District | 48.84 mills |

| Independence School District | 47.49 mills |

| Blue Springs School District | 57.36 mills |

| Lee's Summit School District | 52.68 mills |

Property owners can calculate their estimated property taxes by multiplying their assessed value by the applicable mill levy. It's worth mentioning that property taxes are subject to change annually, as assessed values and tax rates may be adjusted by the local taxing authorities.

To ensure transparency and provide property owners with valuable information, Jackson County offers an online Property Tax Calculator. This tool allows residents to input their property details and obtain an estimate of their annual property tax obligation. The calculator takes into account the property's assessed value, applicable mill levies, and any applicable tax exemptions or abatements.

Sales Taxes: Supporting Local Businesses and Services

In addition to property taxes, Jackson County also imposes sales taxes on various goods and services. These taxes are collected at the point of sale and contribute to the funding of essential public services and infrastructure projects.

The sales tax rate in Jackson County is composed of both state and local taxes. The current state sales tax rate in Missouri is 4.225%, while the local sales tax rate in Jackson County is 1.775%, bringing the total sales tax rate to 6% for most transactions.

It's important to note that certain jurisdictions within Jackson County have additional sales tax rates. For instance, the city of Kansas City imposes a 1% local sales tax, resulting in a total sales tax rate of 7% within the city limits. Similarly, other municipalities and special districts may have their own supplemental sales tax rates.

The sales tax revenue generated in Jackson County is allocated to various purposes, including funding for local government operations, public safety, education, transportation, and economic development initiatives. The distribution of sales tax revenue is carefully planned to ensure that the proceeds benefit the community as a whole.

Other Taxes and Fees: Supporting Specific Initiatives

Beyond property and sales taxes, Jackson County also collects various other taxes and fees to support specific initiatives and programs. These additional taxes and fees are designed to address unique needs and provide dedicated funding for specific projects or services.

One notable example is the Jackson County Earned Income Tax, which is a local income tax levied on individuals and businesses operating within the county. The earned income tax rate is currently set at 1%, and it is collected alongside state and federal income taxes. The revenue generated from this tax is allocated to support county operations and initiatives.

Another important tax is the Landfill Tax, which is imposed on solid waste disposal within the county. The landfill tax is designed to promote recycling efforts and encourage responsible waste management practices. The revenue generated from this tax is used to fund solid waste management programs and infrastructure.

Additionally, Jackson County imposes a Hotel/Motel Tax on accommodations provided within the county. This tax is levied at a rate of 5% and is collected from guests staying in hotels, motels, and other lodging establishments. The revenue generated from this tax supports tourism promotion and related initiatives, benefiting the local hospitality industry.

The Impact of Jackson County Taxes on the Community

The tax system in Jackson County plays a pivotal role in shaping the community's growth, development, and overall well-being. Let's explore how the various taxes impact different aspects of life in the county.

Funding Essential Services

The revenue generated from Jackson County taxes is crucial for funding a wide range of essential services that directly benefit residents. These services include public safety, such as law enforcement, fire protection, and emergency response. Property taxes, in particular, play a significant role in ensuring that these critical services are adequately funded and equipped to serve the community effectively.

Sales taxes also contribute to the funding of essential services. A portion of the sales tax revenue is allocated to support public education, ensuring that schools have the necessary resources to provide quality education to students across the county. Additionally, sales taxes support the maintenance and improvement of public infrastructure, including roads, bridges, and transportation systems, making it safer and more efficient for residents to commute and travel.

Economic Development and Job Creation

Jackson County taxes play a vital role in fostering economic growth and job creation within the region. The tax revenue generated is utilized to develop and enhance the local business environment, attract new investments, and support existing businesses. This, in turn, leads to the creation of job opportunities, boosting the county's economy and improving the standard of living for residents.

The county's tax incentives and economic development initiatives, funded by tax revenue, provide a supportive environment for businesses to thrive. These initiatives may include tax abatements, grants, and infrastructure improvements, all aimed at attracting new businesses and retaining existing ones. As a result, Jackson County experiences a thriving business landscape, with a diverse range of industries contributing to its economic vitality.

Community Initiatives and Programs

Beyond funding essential services and economic development, Jackson County taxes also support a variety of community initiatives and programs that enhance the overall quality of life for residents. These initiatives encompass a wide range of areas, including healthcare, social services, arts and culture, and environmental sustainability.

The tax revenue is utilized to fund healthcare programs that provide access to quality healthcare services for residents, especially those who are underserved or uninsured. Social services programs, such as food assistance, housing support, and mental health services, receive funding to ensure that vulnerable members of the community receive the necessary support.

Additionally, Jackson County invests in arts and culture, recognizing the importance of these sectors in enriching the community's cultural fabric. Tax revenue supports the development of arts infrastructure, funding for cultural events and festivals, and grants for artistic endeavors, fostering a vibrant and diverse artistic community.

Environmental sustainability is another key focus area for Jackson County, and tax revenue plays a crucial role in funding initiatives that promote eco-friendly practices and protect the county's natural resources. These initiatives may include recycling programs, green infrastructure projects, and conservation efforts, all aimed at creating a sustainable and environmentally conscious community.

Taxpayer Resources and Assistance

Jackson County recognizes the importance of providing comprehensive resources and assistance to taxpayers to ensure a smooth and transparent tax-paying experience. Here are some valuable resources and services available to taxpayers in Jackson County.

Jackson County Tax Assessor's Office

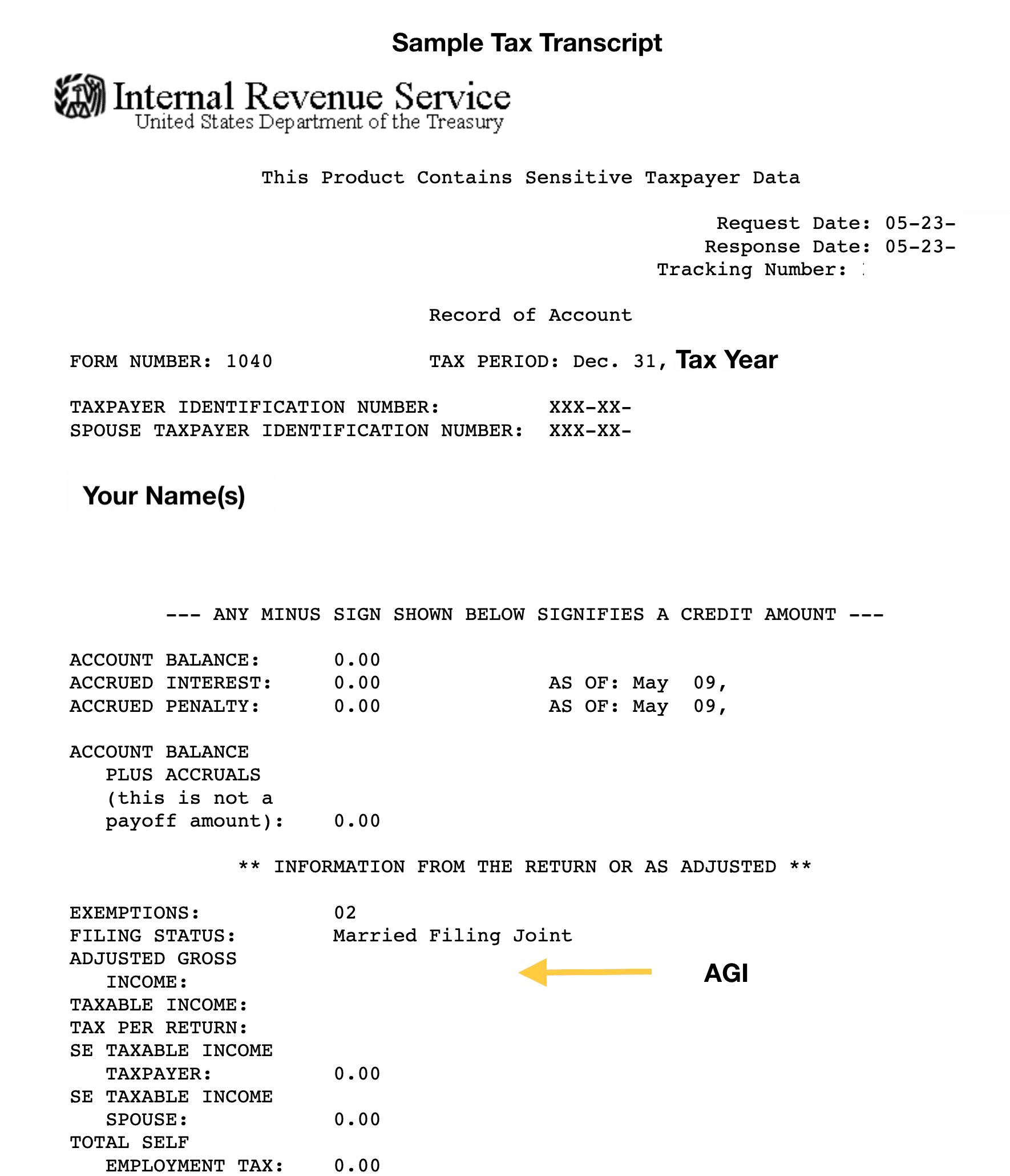

The Jackson County Tax Assessor's Office plays a crucial role in the county's tax system. This office is responsible for assessing the value of properties within the county, ensuring accurate and fair taxation. Property owners can visit the Tax Assessor's Office to address any concerns or inquiries regarding their property assessments.

The Tax Assessor's Office provides a wealth of information and resources on its official website, Jackson County Assessor. Residents can access valuable tools, such as the aforementioned Property Tax Calculator, to estimate their property tax obligations. The website also offers detailed explanations of the assessment process, tax rates, and important deadlines.

Additionally, the Tax Assessor's Office provides assistance to taxpayers who may be facing financial difficulties or have unique circumstances. They offer information on tax exemptions, abatements, and deferments, helping taxpayers understand their options and navigate the tax system effectively.

Jackson County Treasurer's Office

The Jackson County Treasurer's Office is responsible for collecting and managing tax payments. This office ensures that taxpayers have a seamless experience when it comes to paying their taxes. Residents can visit the Treasurer's Office or its official website, Jackson County Treasurer, to obtain information on tax payment options, deadlines, and any applicable penalties or discounts.

The Treasurer's Office also provides online services, allowing taxpayers to make payments electronically, view their tax records, and receive notifications regarding upcoming deadlines. This online platform streamlines the tax payment process, making it more convenient and efficient for residents.

Taxpayer Assistance and Education

Jackson County understands the importance of taxpayer education and provides various resources to help residents understand their tax obligations and rights. The county offers taxpayer workshops and seminars, providing valuable insights and guidance on tax-related topics. These workshops cover a range of subjects, including property tax assessments, sales tax compliance, and tax planning strategies.

Additionally, the county's official website, Jackson County Tax Information, serves as a comprehensive resource hub for taxpayers. It provides detailed information on various taxes, including property taxes, sales taxes, and other taxes and fees. Residents can find explanations of tax rates, due dates, and payment options, ensuring they have the necessary knowledge to fulfill their tax responsibilities.

Future Outlook and Tax Initiatives

As Jackson County continues to grow and evolve, its tax system plays a pivotal role in shaping the future of the region. The county's leadership and stakeholders are committed to ensuring that the tax system remains fair, efficient, and aligned with the community's needs and aspirations.

Tax Reform and Modernization

Jackson County recognizes the importance of staying current with modern tax practices and technologies. The county is actively exploring tax reform initiatives to streamline the tax system, enhance transparency, and improve overall efficiency. These reforms may include implementing digital tax filing and payment systems, simplifying tax forms, and modernizing tax collection processes.

By embracing tax modernization, Jackson County aims to reduce administrative burdens on taxpayers and tax administrators alike. This will not only improve the tax-paying experience but also enhance data accuracy and security, ensuring that tax revenue is collected and utilized effectively.

Community Engagement and Tax Equity

Ensuring tax equity and fairness is a top priority for Jackson County. The county is dedicated to engaging with the community to understand their concerns and perspectives on the tax system. Community forums, town hall meetings, and online platforms are utilized to gather feedback and address any issues or suggestions related to taxation.

By actively involving residents in the tax-setting process, Jackson County aims to build trust and ensure that the tax system is responsive to the needs and aspirations of the community. This collaborative approach fosters a sense of ownership and empowers residents to actively participate in shaping the county's fiscal policies.

Sustainable Funding for Critical Initiatives

Jackson County is committed to providing sustainable funding for critical initiatives that enhance the well-being of its residents. The county is exploring innovative ways to generate revenue and ensure the long-term financial stability of essential services and community programs.

One area of focus is the development of a robust economic development strategy. By attracting new businesses, fostering entrepreneurship, and supporting existing industries, Jackson County aims to generate additional tax revenue and create a thriving business environment. This, in turn, will contribute to the county's overall economic vitality and provide a solid foundation for sustainable funding.

Additionally, Jackson County is exploring partnerships and collaborations with local businesses and organizations to leverage their expertise and resources. These partnerships can lead to the development of innovative funding models, such as public-private partnerships, that can support critical initiatives while ensuring long-term financial sustainability.

Frequently Asked Questions

What is the property tax rate in Jackson County, MO for 2023?

+The property tax rate in Jackson County, MO for 2023 is set at 41.60 mills. This rate is subject to change annually and may vary depending on the specific taxing district in which the property is located.

How can I estimate my property taxes in Jackson County?

+You can estimate your property taxes in Jackson County by using the official Property Tax Calculator provided by the county. This online tool allows you to input your property details and obtain an estimate of your annual property tax obligation, taking into account the assessed value, applicable mill levies, and any tax exemptions or abatements.

What is the sales tax rate in Jackson County, MO?

+The total sales tax rate in Jackson County, MO is 6% for most transactions. This rate is composed of the state sales tax rate of 4.225% and the local sales tax rate of 1.775%. However, it’s important to note that certain jurisdictions within the county may have additional sales tax rates, such as the city of Kansas City, which imposes a 1% local sales tax, resulting in a total sales tax rate of 7% within the city limits.

Are there any tax incentives or exemptions available in Jackson County for businesses or homeowners?

+Yes, Jackson County offers various tax incentives and exemptions to support businesses and homeowners. These may include tax abatements, tax credits, and property tax exemptions. It’s recommended to consult with the Jackson County Tax Assessor’s Office or seek professional tax advice to understand the specific incentives and exemptions that may be applicable to your situation.