Johnston County Tax Office

Welcome to an in-depth exploration of the Johnston County Tax Office, a vital administrative entity that plays a crucial role in the financial and administrative landscape of Johnston County. This office, responsible for assessing and collecting taxes, holds immense significance for the county's residents and businesses, shaping the local economy and community development. With a commitment to efficiency, transparency, and equitable taxation, the Johnston County Tax Office serves as a cornerstone of the county's financial system, ensuring the provision of essential public services and infrastructure.

Navigating the Services Offered by the Johnston County Tax Office

The Johnston County Tax Office is a comprehensive hub, offering a wide array of services that cater to the diverse needs of taxpayers. Here’s an overview of some of the key services provided:

- Property Tax Assessments: The tax office assesses property values annually, ensuring fair and accurate taxation for residential, commercial, and agricultural properties. This process involves thorough inspections and evaluations to determine the appropriate tax rate for each property.

- Tax Payment Processing: Residents and businesses can rely on the tax office for efficient and secure tax payment processing. Whether it's real estate taxes, personal property taxes, or other tax obligations, the office provides various payment options, including online payments, direct deposits, and traditional mailing methods.

- Tax Appeals and Grievance Procedures: Understanding the importance of taxpayer rights, the Johnston County Tax Office has established a fair and transparent appeals process. Taxpayers who believe their property assessments are incorrect can file an appeal, and the office provides guidance and support throughout this process.

- Tax Exemptions and Incentives: To encourage economic growth and support specific community initiatives, the tax office administers various tax exemption programs. These include exemptions for seniors, veterans, and those with disabilities, as well as incentives for businesses investing in the local economy.

- Tax Research and Information: The tax office serves as a valuable resource for taxpayers seeking information about tax laws, regulations, and procedures. Its website and staff offer detailed explanations, ensuring taxpayers have the knowledge they need to comply with tax obligations and take advantage of available benefits.

Empowering Taxpayers with Digital Innovation

In an era of technological advancement, the Johnston County Tax Office has embraced digital transformation to enhance its services and improve taxpayer experience. Here’s a glimpse at some of the innovative solutions implemented:

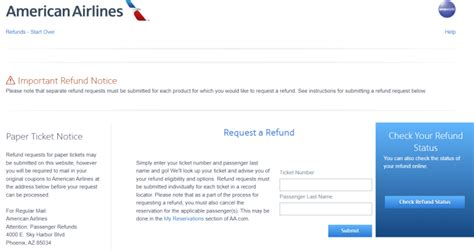

Online Tax Portal

The introduction of an online tax portal has revolutionized taxpayer engagement. This user-friendly platform allows taxpayers to access their account information, view tax bills, make payments, and even estimate future tax obligations. The portal’s convenience and efficiency have been instrumental in streamlining tax administration, especially during peak tax seasons.

E-Filing and E-Payment Options

To cater to the digital preferences of modern taxpayers, the tax office offers electronic filing (e-filing) and electronic payment (e-payment) options. Taxpayers can now submit their tax returns and make payments online, reducing the need for physical paperwork and in-person visits. This not only saves time but also minimizes the risk of errors and delays.

Mobile Apps and Text Alerts

Recognizing the importance of mobile technology, the Johnston County Tax Office has developed dedicated mobile apps for iOS and Android devices. These apps provide taxpayers with on-the-go access to their tax information, payment options, and important notifications. Additionally, taxpayers can opt-in for text alerts, ensuring they stay informed about critical tax deadlines and updates.

Data Analytics for Efficient Tax Administration

Behind the scenes, the tax office leverages advanced data analytics to optimize tax administration processes. By analyzing historical data and trends, the office can forecast tax revenue, identify potential errors or fraud, and make data-driven decisions to improve efficiency and taxpayer satisfaction. This analytical approach has proven instrumental in enhancing the overall tax collection process.

Community Engagement and Outreach

Beyond its administrative duties, the Johnston County Tax Office actively engages with the community, fostering a culture of transparency and collaboration. Here are some notable initiatives:

Taxpayer Education Workshops

The tax office conducts regular taxpayer education workshops, aiming to demystify complex tax concepts and procedures. These workshops provide valuable insights into property assessments, tax payment options, and available tax benefits. By empowering taxpayers with knowledge, the office fosters a sense of trust and collaboration.

Community Partnership Programs

In an effort to give back to the community, the tax office actively partners with local charities and organizations. Through these partnerships, the office contributes to community development initiatives, sponsors local events, and supports programs that enhance the quality of life for Johnston County residents.

Volunteer Tax Assistance Programs

Recognizing that tax preparation can be challenging for some residents, the tax office coordinates volunteer tax assistance programs. These programs offer free tax preparation services to low-income individuals and families, ensuring they have the support they need to navigate the tax system and access available tax credits and deductions.

Future Prospects and Continuous Improvement

As the world continues to evolve, the Johnston County Tax Office remains committed to staying at the forefront of tax administration. Here’s a glimpse at some of the future prospects and ongoing initiatives:

Implementing AI and Machine Learning

The tax office is exploring the potential of artificial intelligence (AI) and machine learning to further enhance its services. By leveraging these technologies, the office aims to automate repetitive tasks, improve data accuracy, and provide even more personalized taxpayer experiences. This cutting-edge approach has the potential to revolutionize tax administration, making it more efficient and effective.

Expanding Online Services and Resources

In an effort to meet the evolving needs of taxpayers, the tax office is continually expanding its online services and resources. This includes enhancing the functionality of its online tax portal, introducing new interactive tools, and providing additional tax-related resources and guides. By embracing a digital-first approach, the office aims to make tax administration more accessible and convenient for all.

Strengthening Data Security Measures

With the increasing sophistication of cyber threats, the tax office places a strong emphasis on data security. Ongoing initiatives include implementing advanced cybersecurity measures, conducting regular security audits, and educating staff on best practices to protect sensitive taxpayer information. By staying ahead of potential threats, the office ensures the confidentiality and integrity of taxpayer data.

Collaborating with Industry Experts

To stay abreast of the latest advancements in tax administration, the Johnston County Tax Office actively engages with industry experts, researchers, and thought leaders. By participating in conferences, workshops, and collaborative initiatives, the office gains valuable insights and best practices, ensuring it remains a leader in its field.

What are the operating hours of the Johnston County Tax Office?

+

The office is typically open from 8:00 AM to 5:00 PM, Monday through Friday. However, it’s advisable to check their website or call the office for the most up-to-date information, especially during holiday periods.

How can I pay my taxes online through the Johnston County Tax Office portal?

+

To pay your taxes online, you’ll need to visit the Johnston County Tax Office’s official website and navigate to the Online Tax Portal section. From there, you can create an account (if you don’t have one already) and follow the prompts to make a payment. The portal accepts major credit cards and electronic checks.

What are the tax rates for residential properties in Johnston County?

+

Tax rates for residential properties vary depending on the location and specific characteristics of the property. It’s recommended to contact the Johnston County Tax Office directly or visit their website for detailed information on tax rates, as these can change annually.

Are there any tax incentives or exemptions available for businesses in Johnston County?

+

Yes, the Johnston County Tax Office offers a range of tax incentives and exemptions for businesses. These can include property tax abatements, enterprise zone benefits, and tax credits for job creation. It’s advisable to consult with a tax professional or contact the tax office for detailed information on eligibility and application procedures.

How can I obtain a copy of my property tax bill or assessment?

+

You can obtain a copy of your property tax bill or assessment by visiting the Johnston County Tax Office in person or by requesting it online through their website. You’ll need to provide your property details and any other relevant information as requested.