Are Churches Tax Exempt

The tax exemption status of churches is a complex and multifaceted topic that varies across jurisdictions and legal frameworks. In many countries, churches and religious organizations are granted certain tax benefits and exemptions due to their unique role in society and the services they provide. However, the specifics of these exemptions, the eligibility criteria, and the extent of the benefits can differ significantly. This article aims to delve into the world of church tax exemptions, exploring the legal foundations, the benefits they offer, the responsibilities that come with them, and the implications for both religious institutions and the state.

Understanding the Legal Framework

The legal basis for church tax exemptions typically stems from a country’s constitution, legislation, or even international treaties. For instance, in the United States, the First Amendment of the Constitution establishes the principle of separation of church and state, which forms the foundation for many tax-related privileges granted to religious organizations. The Internal Revenue Service (IRS) has outlined specific criteria that religious entities must meet to qualify for tax-exempt status under Section 501©(3) of the Internal Revenue Code.

In Europe, the legal landscape is more diverse. Some countries, like the United Kingdom, have a long-standing tradition of established churches (such as the Church of England) that enjoy various privileges, including tax exemptions. Other countries, like France, have a more secular approach, where religious organizations must meet specific criteria to be recognized as associations cultuelles and gain tax-exempt status.

Key Criteria for Tax Exemption

While the specific criteria can vary, there are several common factors that religious organizations must typically meet to be eligible for tax exemption:

- Religious Purpose: The organization must be primarily engaged in religious activities, worship, and the propagation of religious beliefs.

- Non-Profit Status: Religious entities must operate as non-profit organizations, meaning they do not distribute profits to individuals or entities outside the organization.

- Public Benefit: The organization’s activities should provide a public benefit, such as charitable work, education, or community services.

- Governance and Transparency: There are often requirements for democratic governance, financial transparency, and adherence to certain ethical standards.

Tax Exemptions and Their Impact

Churches and religious organizations benefit from a range of tax exemptions, each with its own implications. These benefits can be significant and impact the financial health and operational capabilities of these institutions.

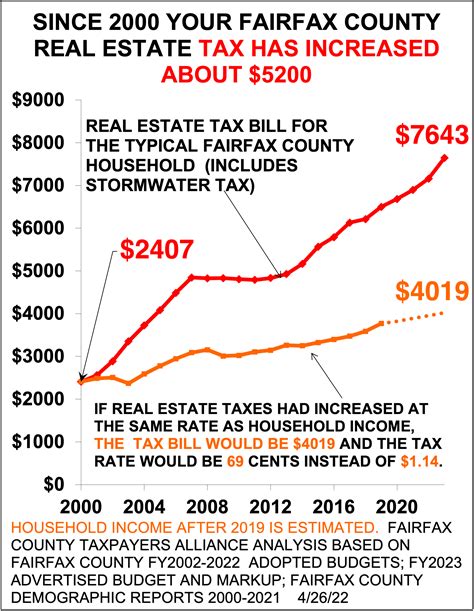

Property Tax Exemption

One of the most notable tax exemptions for churches is the property tax exemption. Religious entities are often exempt from paying property taxes on their places of worship, educational facilities, and other assets used for religious activities. This exemption can result in substantial savings for churches, especially those with large properties or multiple locations.

For instance, consider a hypothetical case study of a large cathedral in a major city. Without the property tax exemption, this cathedral might be liable for hundreds of thousands of dollars in annual property taxes. However, with the exemption, the church can redirect these funds towards its mission, whether it's maintaining the cathedral's historical integrity, supporting charitable initiatives, or expanding its community outreach programs.

| Cathedral | Estimated Annual Property Tax |

|---|---|

| St. John's Cathedral | $250,000 |

Income Tax Exemption

Religious organizations are also generally exempt from income taxes on revenue generated from their core religious activities. This exemption applies to income derived from membership dues, donations, and other offerings. However, income generated from unrelated business activities is typically taxable.

Imagine a church that operates a small café within its premises, offering refreshments to visitors and generating additional revenue. While the income from the café may be taxable, the church's primary income from donations and tithes remains exempt, ensuring the financial sustainability of the church's operations.

Sales and Use Tax Exemption

Churches are often exempt from sales and use taxes on purchases made for their religious activities. This exemption can cover a wide range of goods and services, from religious literature and educational materials to maintenance and repair services for church properties.

For example, a church planning a major renovation project might be able to purchase construction materials and hire contractors without incurring sales tax. This exemption can result in significant cost savings, allowing the church to allocate more resources towards the project and minimize the financial burden on its congregation.

Responsibilities and Limitations

While tax exemptions offer significant benefits, they also come with responsibilities and limitations. Religious organizations must adhere to certain rules and regulations to maintain their tax-exempt status, and there are consequences for non-compliance.

Public Accountability

Tax-exempt organizations, including churches, are often required to maintain transparency and accountability in their financial dealings. This may involve filing annual reports, providing financial statements, and ensuring that their activities align with their stated mission and public benefit status.

For instance, the IRS in the United States requires tax-exempt organizations to file Form 990, which provides detailed financial information about the organization's operations and activities. This form is publicly available, allowing donors, the government, and the public to scrutinize the organization's financial health and ensure its compliance with tax-exempt requirements.

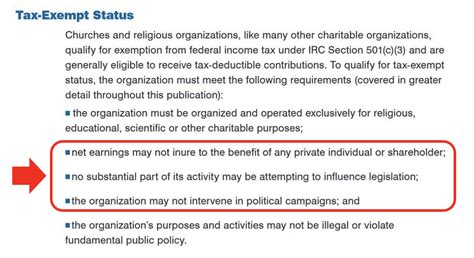

Limitations on Political Activities

A key limitation for tax-exempt religious organizations is the restriction on political activities. Churches and other tax-exempt entities are generally prohibited from engaging in substantial political campaigning or endorsing political candidates. This limitation is designed to maintain the separation of church and state and prevent the misuse of tax-exempt status for political purposes.

Failure to comply with these limitations can result in serious consequences, including the revocation of tax-exempt status and the imposition of substantial penalties. Religious organizations must therefore carefully navigate the boundaries of political engagement to avoid jeopardizing their tax-exempt privileges.

The Future of Church Tax Exemptions

The landscape of church tax exemptions is subject to ongoing debates and legal challenges. As societal values and political landscapes evolve, the balance between religious freedom and tax fairness becomes increasingly complex.

Challenges and Controversies

Critics of church tax exemptions argue that they provide an unfair advantage to religious organizations, potentially diverting funds from public services and creating an imbalance in the tax system. They advocate for a more secular approach to taxation, where all organizations, regardless of their religious affiliation, are treated equally.

On the other hand, proponents of tax exemptions for churches emphasize the unique role of religious institutions in society. They argue that these organizations provide essential services, such as education, social welfare, and community support, which benefit the public and should be supported through tax exemptions.

Potential Reforms

In response to these debates, some jurisdictions are considering reforms to the tax exemption system. These reforms may involve tighter criteria for tax-exempt status, increased transparency requirements, or even the introduction of a charitable choice model, where taxpayers can choose to direct their tax dollars towards religious or secular charities.

Additionally, the rise of online fundraising and digital donations has presented new challenges and opportunities for tax authorities. Regulatory bodies are grappling with how to effectively monitor and tax these new forms of revenue, ensuring that religious organizations continue to meet their tax obligations while maintaining their tax-exempt status.

How do churches qualify for tax exemption?

+Churches typically qualify for tax exemption by meeting specific criteria, such as having a religious purpose, operating as a non-profit, providing public benefit, and adhering to governance and transparency standards.

What are the main tax exemptions for churches?

+Churches benefit from property tax exemption, income tax exemption on religious activities, and sales and use tax exemption on purchases for religious purposes.

Are there any limitations on church tax exemptions?

+Yes, churches must adhere to public accountability standards and are restricted from substantial political activities to maintain their tax-exempt status.