Roth 401K Vs After Tax 401K

When it comes to retirement planning, individuals have several options to choose from, each with its own set of advantages and considerations. Two popular choices within the 401(k) framework are the Roth 401(k) and the After-Tax 401(k), also known as the Post-Tax 401(k). Understanding the differences between these two options is crucial for making informed decisions about your financial future.

Roth 401(k): Tax-Free Growth and Withdrawal

The Roth 401(k) is a powerful tool for those aiming to maximize their retirement savings. Here's a deeper look into its features and benefits:

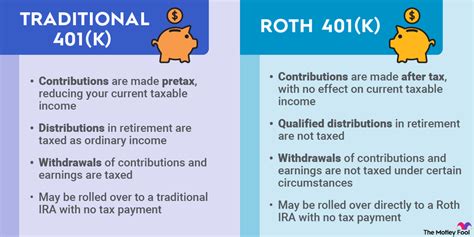

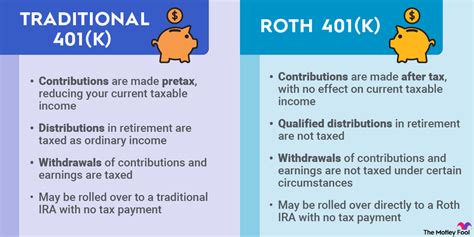

Tax Treatment

The Roth 401(k) stands out for its unique tax structure. Contributions to this account are made with after-tax dollars, meaning the money used to fund the account has already been taxed. This is in contrast to traditional 401(k) plans, where contributions are made with pre-tax dollars, reducing your taxable income in the contribution year.

However, the real advantage of the Roth 401(k) lies in the tax-free growth of your investments. Any earnings, including capital gains, interest, and dividends, are not subject to federal income tax when withdrawn. This means you can let your investments grow without worrying about tax implications, potentially leading to substantial gains over time.

Withdrawal Flexibility

Another notable feature of the Roth 401(k) is its flexibility in withdrawals. While there are certain rules and restrictions, Roth 401(k) accounts generally offer more freedom compared to traditional 401(k)s. You can access your contributions at any time without penalty, providing a source of funds for emergencies or other financial needs.

Furthermore, if you've had the account for at least five years and meet certain conditions, withdrawals of earnings are also tax-free and penalty-free. This can be especially beneficial if you've made substantial gains and want to access your funds during retirement without incurring additional taxes.

Eligibility and Contribution Limits

Roth 401(k)s are typically offered as an option within employer-sponsored retirement plans. To contribute, you must meet the eligibility requirements set by your employer and the IRS. The contribution limits for Roth 401(k)s are the same as traditional 401(k)s, which are subject to annual adjustments. For the tax year 2023, the maximum contribution limit is $22,500, with an additional $6,500 allowed for those aged 50 and above as catch-up contributions.

After-Tax 401(k): Tax Deferral and Potential Benefits

The After-Tax 401(k), also known as the Post-Tax 401(k), offers a different set of advantages and considerations. Here's a closer examination of its features:

Tax Deferral

The After-Tax 401(k) operates on the principle of tax deferral. Contributions to this account are made with after-tax dollars, similar to the Roth 401(k). However, unlike the Roth, the earnings on your contributions are tax-deferred until withdrawal. This means that while you don't get an immediate tax deduction for your contributions, you also don't pay taxes on the growth of your investments during the accumulation phase.

This tax deferral can be particularly beneficial if you expect to be in a lower tax bracket during retirement, as you'll pay taxes on your withdrawals at that future, potentially lower rate.

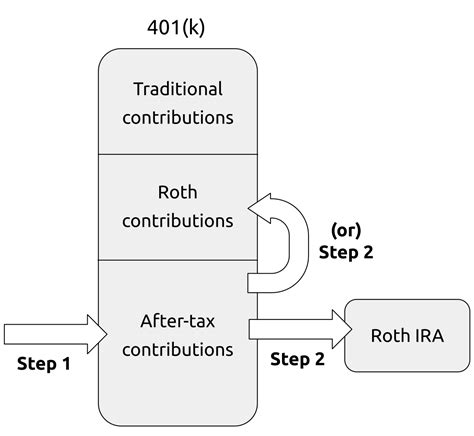

Conversion to Roth

One of the significant advantages of the After-Tax 401(k) is the ability to convert your account to a Roth 401(k) at a later date. This option provides flexibility and allows you to potentially benefit from both types of accounts. By converting, you can take advantage of the tax-free growth and withdrawal benefits of the Roth while still enjoying the tax deferral during the accumulation phase.

However, it's important to note that the conversion process can be complex and may have tax implications. Consulting with a financial advisor is recommended before making any decisions.

Withdrawal Considerations

With regard to withdrawals, the After-Tax 401(k) operates similarly to traditional 401(k) plans. When you withdraw funds during retirement, you'll pay ordinary income tax on both the contributions and the earnings. This can result in a larger tax liability compared to the Roth 401(k), especially if you're in a higher tax bracket during retirement.

Contribution Limits

The contribution limits for the After-Tax 401(k) are generally the same as traditional 401(k)s and Roth 401(k)s. For the tax year 2023, the maximum contribution limit is $22,500, with an additional $6,500 allowed for those aged 50 and above as catch-up contributions.

Comparative Analysis: Which is Better for You?

Choosing between a Roth 401(k) and an After-Tax 401(k) depends on several factors, including your current tax bracket, expected tax rates in retirement, and your financial goals. Here's a breakdown to help you decide:

Current Tax Bracket

If you're currently in a higher tax bracket, contributing to a Roth 401(k) might be advantageous. By paying taxes on your contributions now, you lock in that higher tax rate and avoid potentially higher taxes on your earnings in retirement. This strategy can result in significant tax savings over time.

On the other hand, if you're in a lower tax bracket, an After-Tax 401(k) might be more suitable. By deferring taxes, you can potentially grow your investments without immediate tax implications, and you might benefit from a lower tax rate during retirement.

Expected Tax Rates in Retirement

Consider your expected financial situation in retirement. If you anticipate being in a similar or higher tax bracket during retirement, a Roth 401(k) can provide tax-free withdrawals, reducing your overall tax liability. However, if you expect to be in a significantly lower tax bracket, an After-Tax 401(k) might be more beneficial due to the tax deferral.

Flexibility and Conversion

The ability to convert an After-Tax 401(k) to a Roth 401(k) offers flexibility. This option can be particularly attractive if you're uncertain about your future tax situation or want the best of both worlds. By converting, you can enjoy the benefits of tax-free growth and withdrawals while still taking advantage of tax deferral during the accumulation phase.

Withdrawal Needs and Strategies

Think about your withdrawal strategies during retirement. If you plan to make substantial withdrawals and expect a large tax liability, the Roth 401(k) might be preferable due to its tax-free withdrawals. However, if you anticipate smaller withdrawals or have other sources of income, an After-Tax 401(k) might be more suitable.

| Feature | Roth 401(k) | After-Tax 401(k) |

|---|---|---|

| Tax Treatment | Contributions are taxed; earnings are tax-free | Contributions are taxed; earnings are tax-deferred |

| Withdrawal Flexibility | Contributions can be withdrawn at any time; earnings are tax-free after 5 years | Withdrawal of contributions and earnings are taxed |

| Conversion Option | No conversion | Can be converted to a Roth 401(k) |

| Contribution Limits | Same as traditional 401(k): $22,500 (2023) | Same as traditional 401(k): $22,500 (2023) |

Frequently Asked Questions

Can I have both a Roth 401(k) and an After-Tax 401(k) at the same time?

+

Yes, it is possible to have both types of accounts simultaneously. This can provide flexibility and the opportunity to benefit from different tax treatments. However, it’s important to consider your overall contribution limits and consult with a financial advisor to ensure you’re maximizing your retirement savings.

What happens if I convert my After-Tax 401(k) to a Roth 401(k)?

+

Converting your After-Tax 401(k) to a Roth 401(k) involves paying taxes on the conversion amount. This can be a strategic move if you expect to be in a lower tax bracket during retirement, as it allows you to take advantage of tax-free growth and withdrawals in the future.

Are there any age restrictions for contributing to a Roth 401(k) or an After-Tax 401(k)?

+

No, there are no specific age restrictions for contributing to either type of account. However, keep in mind that there are annual contribution limits that apply to all 401(k) plans, and these limits are subject to change each year.

Can I withdraw funds from my Roth 401(k) before retirement age without penalties?

+

Yes, you can withdraw your contributions from a Roth 401(k) at any time without penalty. However, to withdraw earnings tax-free and penalty-free, you must meet certain conditions, including having the account for at least five years and being 59 1⁄2 or older, disabled, or using the funds for a first-time home purchase.

Are there any disadvantages to contributing to an After-Tax 401(k)?

+

One potential disadvantage of contributing to an After-Tax 401(k) is the lack of immediate tax benefits. While you can defer taxes on the growth of your investments, you’ll pay taxes on both contributions and earnings when you withdraw during retirement. This can result in a larger tax liability if you’re in a higher tax bracket during retirement.