Arizona Sales Tax By City

Sales tax is an essential aspect of any economy, contributing significantly to the revenue generation of states and municipalities. In the state of Arizona, sales tax is a complex yet crucial component of its financial ecosystem. Each city in Arizona has its own unique sales tax rate, which can be a challenge for businesses and consumers alike to keep track of. This comprehensive guide aims to unravel the intricacies of Arizona sales tax, city by city, providing a clear understanding of the rates and their implications.

Unraveling Arizona's Sales Tax Landscape

Arizona, known for its vibrant cities and diverse landscape, boasts a unique sales tax system. The state sales tax rate stands at 5.6%, but this is just the beginning. Each city in Arizona is permitted to levy additional sales taxes, resulting in a wide range of rates across the state. These local rates can be influenced by various factors, including the city's budget, infrastructure projects, and the need for funding specific initiatives.

The variation in sales tax rates can have a significant impact on businesses, particularly those with multiple locations or those that serve customers across different cities. For consumers, it means that the price of goods and services can vary depending on where they make their purchases. This guide aims to shed light on these variations, providing a comprehensive overview of sales tax rates in Arizona's key cities.

Sales Tax Rates in Major Arizona Cities

Let's delve into the sales tax rates of some of Arizona's most populous and economically significant cities.

- Phoenix - As the state capital and largest city, Phoenix has a sales tax rate of 8.3%, which includes the state base rate of 5.6% and a local rate of 2.7%. This additional local rate is utilized to fund various city projects and initiatives.

- Tucson - In the sunny city of Tucson, the sales tax rate stands at 7.1%. This comprises the state sales tax and an additional local rate of 1.5%, allocated towards supporting the city's infrastructure and community development.

- Mesa - With a population of over 500,000, Mesa has a sales tax rate of 7.3%. This rate includes a local addition of 1.7%, which is dedicated to funding essential city services and community programs.

- Chandler - Chandler, known for its thriving tech industry, has a sales tax rate of 7.8%. This rate incorporates a local addition of 2.2%, which plays a crucial role in funding the city's economic development initiatives and maintaining its infrastructure.

- Glendale - In Glendale, the sales tax rate is 7.6%, with a local addition of 2%. These funds are directed towards supporting the city's operations and maintaining its public services.

| City | Sales Tax Rate | Local Addition |

|---|---|---|

| Phoenix | 8.3% | 2.7% |

| Tucson | 7.1% | 1.5% |

| Mesa | 7.3% | 1.7% |

| Chandler | 7.8% | 2.2% |

| Glendale | 7.6% | 2% |

The Impact of Local Sales Tax Rates

The local additions to the state sales tax rate have a profound impact on the financial landscape of Arizona's cities. These additional funds are a critical source of revenue for cities, enabling them to invest in infrastructure, economic development, and community projects.

For instance, in Phoenix, the additional 2.7% local sales tax rate contributes significantly to the city's budget. This funding supports various initiatives, such as transportation projects, community development programs, and the maintenance of public spaces. Similarly, in Tucson, the 1.5% local rate is a vital source of funding for infrastructure improvements and community initiatives.

However, these local sales tax rates can also present challenges. For businesses with multiple locations, managing varying sales tax rates can be complex and time-consuming. It requires precise record-keeping and a deep understanding of the tax laws in each city. Additionally, for consumers, the varying rates can lead to confusion and may influence their purchasing decisions.

Compliance and Strategies for Businesses

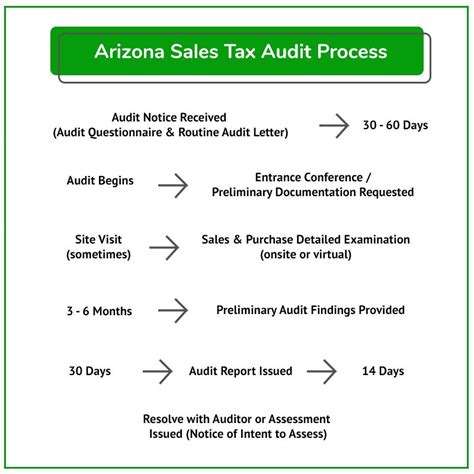

Ensuring compliance with Arizona's sales tax laws is crucial for businesses operating in the state. Here are some strategies and considerations for businesses to navigate the complex sales tax landscape:

- Sales Tax Registration - Businesses are required to register for a sales tax permit with the Arizona Department of Revenue. This permit allows businesses to collect and remit sales tax to the state and local authorities.

- Sales Tax Calculation - Businesses should implement robust systems to calculate sales tax accurately. This involves accounting for the state base rate and any applicable local additions.

- Tax Software - Utilizing sales tax software can simplify the process, ensuring accurate calculations and compliance. These tools can automatically apply the correct rates based on the customer's location.

- Regular Updates - Sales tax rates can change periodically, so it's essential to stay updated with any modifications. This ensures that businesses are always applying the correct rates.

- Location-Based Pricing - For businesses with multiple locations, considering location-based pricing strategies can help manage varying sales tax rates. This involves setting prices that account for the local sales tax, ensuring a consistent customer experience.

The Future of Sales Tax in Arizona

As Arizona continues to grow and evolve, the sales tax landscape is likely to undergo changes. The state's economy is dynamic, and so are the needs of its cities. Here's a look at some potential future developments:

Economic Growth and Infrastructure Development

Arizona's economy is on an upward trajectory, with a focus on innovation and sustainable growth. As cities invest in infrastructure and economic development, the need for funding will likely increase. This could result in potential adjustments to local sales tax rates to support these initiatives.

For instance, Phoenix's ongoing transportation projects and Chandler's focus on attracting tech industries may require additional funding, which could lead to a reconsideration of their local sales tax rates.

Community Initiatives and Social Programs

Arizona's cities are committed to supporting their communities. Local sales tax revenues play a crucial role in funding social programs, community development, and public services. As these initiatives evolve, the allocation of sales tax funds may also change to align with the evolving needs of the communities.

Tucson, for example, has a strong focus on community engagement and sustainable development. The city's sales tax revenue is likely to continue supporting these initiatives, with potential adjustments to ensure long-term sustainability.

Legislative Changes and Tax Reform

Sales tax laws in Arizona are subject to legislative changes and potential reforms. The state's legislature may consider adjustments to the state base rate or allow for further local rate variations. These changes can have a significant impact on the sales tax landscape, affecting businesses and consumers alike.

Staying informed about potential legislative developments is crucial for businesses and consumers to understand the future implications of sales tax in Arizona.

Conclusion

Arizona's sales tax landscape is a dynamic and intricate system, with each city contributing to the state's economic growth and development. Understanding these variations is crucial for businesses and consumers to navigate the financial intricacies of the state. This guide has provided a comprehensive overview, shedding light on the unique sales tax rates of Arizona's key cities.

As Arizona continues to evolve, the sales tax rates are likely to adapt to meet the changing needs of the state and its cities. By staying informed and proactive, businesses and consumers can ensure compliance, manage financial strategies, and contribute to the vibrant economy of Arizona.

How often do sales tax rates change in Arizona cities?

+Sales tax rates can change periodically, typically as a result of legislative decisions or budget adjustments. While there is no set schedule, it is recommended to stay updated with any changes to ensure compliance.

Are there any sales tax holidays in Arizona?

+Yes, Arizona observes sales tax holidays for specific items, usually during certain times of the year. These holidays offer a temporary exemption from sales tax on qualifying purchases. It’s important to stay informed about the dates and eligible items for these holidays.

How do online businesses handle sales tax in Arizona?

+Online businesses are required to collect and remit sales tax based on the location of the customer. This means that online businesses must be aware of the sales tax rates in various cities and apply the correct rate based on the customer’s shipping address.