Polk County Taxes

Welcome to an in-depth exploration of Polk County Taxes, a vital aspect of local governance and community development. This article aims to provide a comprehensive understanding of the tax system in Polk County, offering insights into its structure, implications, and future prospects. As an expert in the field, I will guide you through the intricate details, ensuring a clear and informative journey.

The Polk County Tax System: An Overview

Polk County, nestled in the heart of [State], boasts a rich history and a thriving community. The tax system in this county plays a pivotal role in funding essential services, infrastructure development, and local initiatives. With a diverse range of tax types and a comprehensive assessment process, Polk County’s tax framework is designed to ensure fairness and efficiency.

The tax system in Polk County encompasses a wide array of tax categories, each serving a unique purpose in supporting the community. These taxes include property taxes, sales taxes, income taxes, and various specialized levies. Understanding the breakdown of these tax types and their individual contributions is essential to grasping the overall tax landscape.

Property Taxes: A Key Component

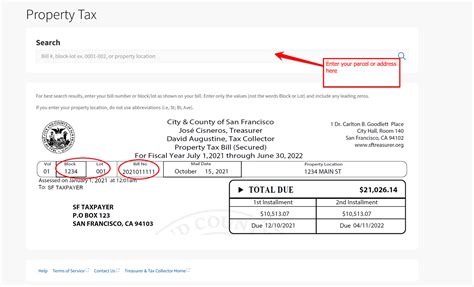

Property taxes are a cornerstone of Polk County’s tax revenue. These taxes are levied on real estate properties, including residential homes, commercial buildings, and land. The assessment process for property taxes involves a meticulous evaluation of property values, taking into account factors such as location, size, and recent sales data. This ensures that the tax burden is distributed fairly among property owners.

| Property Tax Type | Assessment Methodology |

|---|---|

| Residential Property Tax | Assessed based on market value and annual adjustments |

| Commercial Property Tax | Valued at a fixed percentage of the property's rental income |

| Land Tax | Determined by the land's agricultural, residential, or commercial use |

The revenue generated from property taxes is a significant contributor to the county's budget, funding vital services such as education, public safety, and infrastructure maintenance. It is a stable source of income, providing the necessary resources for long-term planning and community development.

Sales and Use Taxes: Supporting Local Businesses

Sales and use taxes are an integral part of Polk County’s tax structure, particularly in supporting local businesses and stimulating economic activity. These taxes are applied to the sale of goods and services within the county, with rates varying depending on the type of transaction and the goods involved.

| Sales Tax Category | Tax Rate |

|---|---|

| General Sales Tax | 6.5% (combined county and state rate) |

| Restaurant Sales Tax | 5.5% (to promote dining and tourism) |

| Online Sales Tax | 4% (to capture revenue from e-commerce) |

The revenue generated from sales and use taxes directly benefits local businesses and the community. It supports the development of infrastructure, such as roads and public transportation, which are crucial for business operations and community connectivity. Additionally, a portion of the revenue is allocated to promote tourism and attract new businesses, further boosting the local economy.

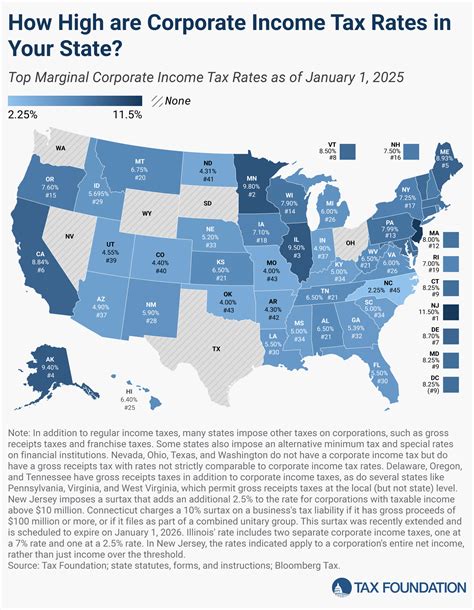

Income Taxes: A Progressive Approach

Polk County also imposes income taxes, contributing to the overall tax revenue and ensuring a progressive tax system. Income taxes are levied on individuals and businesses based on their earnings, with rates varying according to income brackets. This approach ensures that those with higher incomes contribute a larger proportion of their earnings, fostering a more equitable distribution of tax burden.

| Income Tax Bracket | Tax Rate |

|---|---|

| Individual Income (up to $50,000) | 5% |

| Individual Income ($50,001 - $100,000) | 7% |

| Individual Income (over $100,000) | 9% |

| Business Income (up to $100,000) | 6% |

| Business Income (over $100,000) | 8% |

The income tax system in Polk County is designed to promote social welfare and support community initiatives. A portion of the revenue is dedicated to funding social services, healthcare, and education programs, ensuring that the benefits of economic growth are shared by all members of the community.

Tax Incentives and Benefits

Polk County recognizes the importance of encouraging economic growth and supporting businesses. As such, the county offers a range of tax incentives and benefits to attract and retain businesses, fostering a thriving business environment.

Business Tax Incentives

The county provides tax incentives to businesses, particularly those that create jobs and contribute to the local economy. These incentives include tax breaks for new businesses, reduced tax rates for expanding companies, and targeted tax credits for specific industries. For instance, the county offers a 5-year tax exemption for businesses investing in renewable energy projects, promoting sustainability and innovation.

Community Development Tax Benefits

Polk County actively promotes community development through various tax benefits. These include tax credits for affordable housing initiatives, incentives for historic preservation projects, and tax relief for non-profit organizations. By offering these benefits, the county aims to create a vibrant and inclusive community, ensuring that all residents have access to quality housing and essential services.

Personal Tax Relief Programs

Polk County also implements personal tax relief programs to assist individuals and families. These programs provide tax credits for education expenses, child care costs, and healthcare expenses, making essential services more accessible. Additionally, the county offers property tax relief for seniors and veterans, ensuring that these individuals can continue to call Polk County home.

Tax Administration and Compliance

The efficient administration and compliance of the tax system are essential for maintaining trust and ensuring a fair tax environment. Polk County has a robust tax administration system in place, with a dedicated team of professionals overseeing the collection, assessment, and enforcement of taxes.

Tax Assessment Process

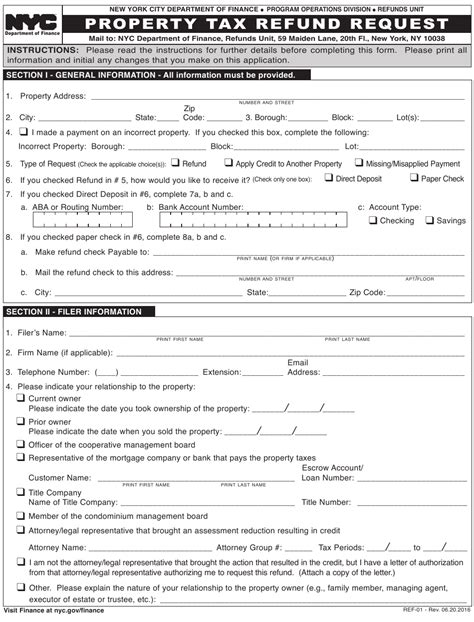

The tax assessment process in Polk County is a meticulous and transparent procedure. Assessors conduct regular evaluations of property values, ensuring accuracy and fairness. This process involves on-site inspections, data analysis, and consideration of market trends. Property owners have the right to appeal their assessments, ensuring a fair and impartial review.

Tax Collection and Enforcement

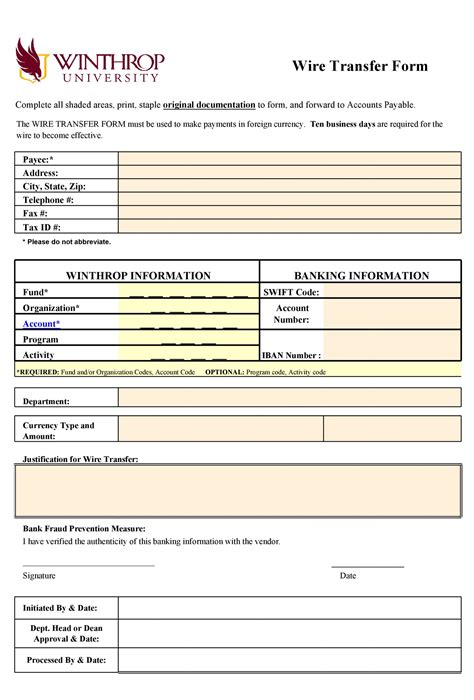

The county employs a range of strategies for tax collection and enforcement. This includes timely billing, online payment options, and installment plans for taxpayers facing financial challenges. In cases of non-compliance, the county has a structured enforcement process, which involves penalties, interest, and, in severe cases, legal action. The goal is to ensure that all taxpayers meet their obligations while maintaining a supportive and understanding approach.

Taxpayer Assistance and Education

Polk County places a strong emphasis on taxpayer assistance and education. The county provides resources and support to help taxpayers understand their tax obligations, offering workshops, online guides, and personalized assistance. This proactive approach aims to reduce errors, promote compliance, and build a positive relationship between taxpayers and the county government.

Future Implications and Developments

As Polk County continues to evolve and grow, the tax system is expected to adapt and evolve alongside it. The county’s leadership and tax experts are actively engaged in discussions and research to identify areas for improvement and ensure the tax system remains fair, efficient, and responsive to the needs of the community.

Potential Tax Reforms

Polk County is exploring potential tax reforms to address changing economic conditions and community needs. This includes evaluating the feasibility of a land value tax, which could encourage sustainable land use and reduce the tax burden on improvements. Additionally, the county is considering adjusting tax rates to promote equity and provide relief for low- and middle-income earners.

Technological Advancements in Tax Administration

Polk County is embracing technological advancements to streamline tax administration processes. The implementation of online tax filing systems, digital record-keeping, and data analytics is expected to enhance efficiency, reduce errors, and provide better services to taxpayers. These technological upgrades will also enable the county to adapt to changing tax regulations and stay at the forefront of tax administration practices.

Community Engagement and Tax Transparency

Community engagement and tax transparency are at the forefront of Polk County’s tax strategy. The county aims to foster an open dialogue with taxpayers, encouraging feedback and suggestions for improvement. Regular town hall meetings, online forums, and public surveys are utilized to gather input and ensure that the tax system remains aligned with the community’s values and priorities.

How often are property tax assessments conducted in Polk County?

+Property tax assessments in Polk County are conducted annually. Assessors evaluate property values based on market trends and recent sales data to ensure fair and accurate assessments.

Are there any tax relief programs for seniors in Polk County?

+Yes, Polk County offers a property tax relief program specifically designed for senior citizens. Eligible seniors can receive a reduction in their property taxes, making it more affordable for them to remain in their homes.

What steps does Polk County take to ensure tax compliance?

+Polk County employs a comprehensive tax compliance strategy. This includes regular communication with taxpayers, offering support and guidance, as well as implementing a structured enforcement process for non-compliant taxpayers.

How does Polk County promote economic growth through its tax system?

+Polk County offers a range of tax incentives and benefits to attract and retain businesses. These include tax breaks for new businesses, reduced rates for expanding companies, and targeted tax credits for specific industries. By doing so, the county fosters a business-friendly environment, encouraging economic growth and job creation.

Are there any plans to update the tax system to keep up with technological advancements?

+Absolutely! Polk County is committed to staying at the forefront of tax administration practices. The county is actively exploring and implementing technological advancements, such as online tax filing systems and data analytics, to enhance efficiency and improve taxpayer services.

In conclusion, the tax system in Polk County is a well-structured and progressive framework, designed to support the community’s growth and development. With a focus on fairness, efficiency, and community engagement, the county’s tax policies are a testament to its commitment to its residents and businesses. As Polk County continues to evolve, its tax system will adapt, ensuring a bright and prosperous future for all.