Unrelated Business Income Tax

The Unrelated Business Income Tax (UBIT) is a crucial aspect of tax legislation in the United States, impacting a wide range of organizations and entities. Introduced in 1950, UBIT has evolved significantly over the years, shaping the way certain businesses and tax-exempt organizations operate and manage their finances. This article delves into the intricacies of UBIT, exploring its historical context, its applicability, and its implications for various stakeholders.

Understanding the Unrelated Business Income Tax

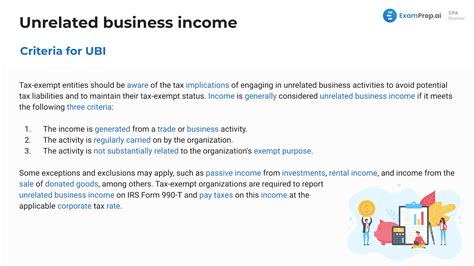

UBIT is a federal tax imposed on certain income generated by tax-exempt organizations and entities from activities that are deemed unrelated to their primary purpose. This tax aims to ensure that these organizations do not gain an unfair competitive advantage over their taxable counterparts by engaging in commercial activities that fall outside their exempt purposes.

The Internal Revenue Service (IRS) defines an unrelated business activity as one that is regularly carried on and produces income that is not substantially related to the organization's tax-exempt purpose. This definition has led to a nuanced understanding of what constitutes taxable activity for tax-exempt entities.

Historical Context and Evolution

The origins of UBIT can be traced back to the Revenue Act of 1950, which was enacted to address concerns about tax-exempt organizations engaging in commercial activities that competed with taxable businesses. The legislation aimed to create a level playing field by ensuring that these organizations did not have an unfair tax advantage.

Over the years, UBIT has undergone several amendments and interpretations. The Tax Reform Act of 1969 brought significant changes, refining the definition of unrelated business income and clarifying the tax treatment of certain activities. These amendments have shaped the current understanding of UBIT and its application.

Applicability and Exemptions

UBIT applies to a wide range of tax-exempt entities, including but not limited to: charitable organizations, educational institutions, religious groups, fraternal societies, and certain government entities. It is important to note that not all income generated by these entities is subject to UBIT; only income from unrelated business activities falls within the tax’s scope.

The IRS provides specific guidelines on what constitutes an unrelated business activity. Generally, it is an activity that is: conducted regularly, operated for profit, and not substantially related to the entity's exempt purpose. Activities that are incidental to the primary purpose of the organization, such as fundraising events, are often exempt from UBIT.

| Entity Type | Applicable Income |

|---|---|

| Charitable Organizations | Income from activities unrelated to charitable purpose, e.g., advertising revenue. |

| Educational Institutions | Income from commercial ventures not integral to the educational mission, e.g., operating a bookstore. |

| Religious Groups | Income from non-religious activities, such as operating a for-profit business. |

Calculation and Tax Rates

The calculation of UBIT involves determining the gross income from unrelated business activities and then deducting the allowable expenses associated with those activities. The resulting net income is then subject to the applicable tax rate. The tax rates for UBIT are the same as those for regular business income, with the income being taxed at the entity’s applicable tax bracket.

For example, if a charitable organization generates $100,000 in unrelated business income with $20,000 in allowable expenses, the net income subject to UBIT would be $80,000. This income would then be taxed according to the organization's tax bracket, which could vary depending on its status and other factors.

Implications and Case Studies

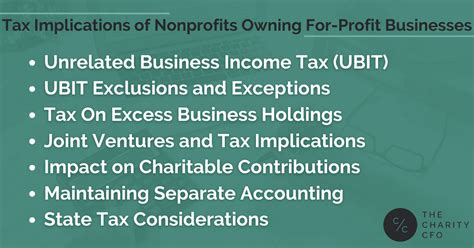

Impact on Tax-Exempt Organizations

UBIT has significant implications for tax-exempt organizations, as it requires them to carefully consider and manage their business activities. Organizations must ensure that their commercial ventures align with their exempt purposes and do not fall within the scope of unrelated business income. Failure to comply with UBIT regulations can result in substantial tax liabilities and penalties.

For instance, consider a charitable organization that operates a gift shop to raise funds for its cause. If the shop's operations are conducted regularly and are not incidental to the charity's primary purpose, the income generated may be subject to UBIT. The organization would need to carefully track and report this income to ensure compliance with tax regulations.

Industry-Specific Considerations

The application of UBIT varies across different industries and sectors. For example, in the educational sector, universities and colleges often engage in a wide range of activities, including research, publishing, and providing services to the public. The IRS provides specific guidelines on which activities are considered exempt and which may be subject to UBIT.

In the religious sector, churches and religious organizations may operate businesses such as bookstores or gift shops. The IRS has issued guidance on when these activities are considered substantially related to the organization's religious purpose and when they constitute unrelated business activities.

Complexities and Challenges

Determining whether an activity is subject to UBIT can be complex, especially for organizations with diverse operations. The IRS provides guidance and resources to help entities understand their obligations, but the interpretation of UBIT can be nuanced and may require professional advice.

Additionally, the tax implications of UBIT can be significant, especially for larger organizations with substantial unrelated business income. These entities must carefully plan and manage their finances to minimize tax liabilities and ensure compliance with UBIT regulations.

Future Outlook and Considerations

The Unrelated Business Income Tax continues to evolve, and its impact on tax-exempt organizations is a subject of ongoing discussion and analysis. As the tax landscape changes, organizations must stay informed and adapt their strategies to ensure compliance and optimize their financial operations.

Potential Reforms and Updates

Proposals for UBIT reform have emerged, with some suggesting that the tax could be simplified or modified to better align with the changing nature of tax-exempt organizations’ activities. These proposals often aim to reduce administrative burdens and provide clearer guidelines for organizations.

However, any changes to UBIT would need to strike a balance between ensuring a level playing field for taxable and tax-exempt entities and allowing tax-exempt organizations to fulfill their missions effectively.

Impact on Nonprofit Innovation

The existence of UBIT has implications for the innovation and entrepreneurial activities of nonprofit organizations. While UBIT is designed to prevent unfair competition, it may also create barriers for nonprofits seeking to explore new revenue streams or engage in innovative ventures. Finding the right balance between encouraging nonprofit innovation and ensuring fair taxation is a delicate task.

Technological Advances and Tax Compliance

With the increasing use of technology in tax administration, the IRS is enhancing its ability to monitor and enforce UBIT regulations. This includes the use of data analytics and machine learning to identify potential non-compliance. Tax-exempt organizations must stay updated with these technological advancements and ensure they have robust systems in place to accurately report and manage their unrelated business income.

Frequently Asked Questions

How does UBIT affect charitable donations and fundraising activities?

+

UBIT generally does not apply to charitable donations or fundraising activities directly related to an organization’s exempt purpose. However, if an organization engages in commercial activities to raise funds, such as operating a for-profit business, the income generated from those activities may be subject to UBIT.

Are there any exceptions or exemptions to UBIT for certain organizations?

+

Yes, there are certain exceptions and exemptions to UBIT. For example, income from certain activities, such as the sale of inventory acquired primarily for resale, is generally exempt from UBIT. Additionally, certain organizations, such as veterans’ organizations, may have specific exemptions or reduced tax rates for certain activities.

What are the consequences of non-compliance with UBIT regulations?

+

Non-compliance with UBIT regulations can result in significant tax liabilities and penalties. The IRS may impose penalties for underpayment of tax, failure to file the required forms, or inaccurate reporting. Organizations should ensure they understand their obligations and seek professional advice if needed to avoid potential penalties.

Can UBIT be avoided entirely by tax-exempt organizations?

+

While tax-exempt organizations cannot entirely avoid UBIT, they can minimize its impact by carefully structuring their business activities and ensuring they align with their exempt purposes. Seeking professional advice and staying informed about UBIT regulations can help organizations navigate this complex area of tax law effectively.