Inheritance Tax In California

Welcome to an in-depth exploration of Inheritance Tax in California, a topic that holds significant relevance for residents and stakeholders alike. California's unique approach to estate planning and taxation warrants a comprehensive understanding, particularly given the state's diverse demographics and the ever-evolving nature of tax laws. As we delve into this complex yet critical aspect of financial planning, we aim to provide a clear and informative guide that demystifies the process of inheritance taxation in the Golden State.

Understanding Inheritance Tax in California

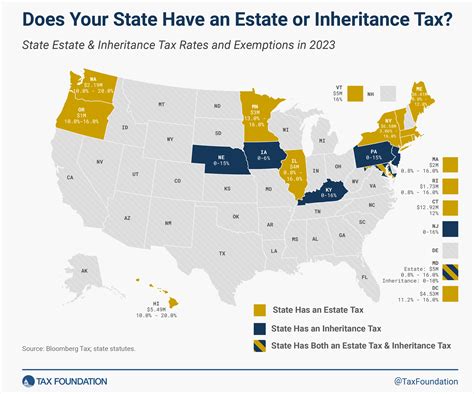

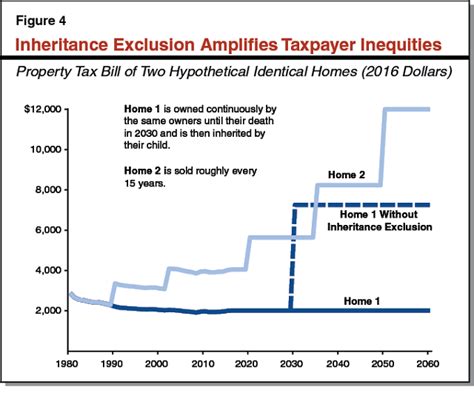

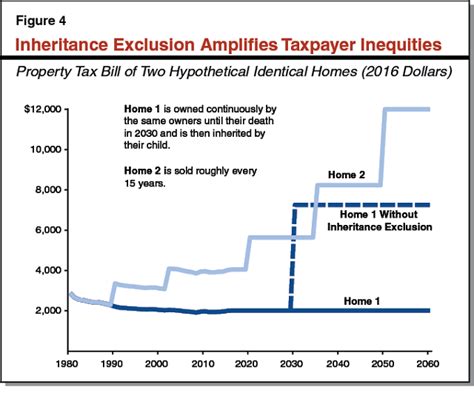

Inheritance tax, often used interchangeably with estate tax, is a crucial component of California’s revenue system. Unlike many other states that have abolished estate taxes, California maintains a robust system to tax the transfer of property upon death. This system ensures that the state’s wealth is distributed fairly and contributes to essential public services and infrastructure.

The inheritance tax in California is levied on the value of property that an individual inherits from a deceased person. It is important to note that this tax is distinct from the federal estate tax, which is a tax on the transfer of a person's entire estate at the time of their death. In California, the inheritance tax is more focused on the beneficiaries' perspective, taxing the value of property they receive from the deceased.

The state's inheritance tax system is designed to be progressive, meaning that the tax rate increases as the value of the inherited property increases. This ensures that those who receive larger inheritances contribute more to the state's revenue, fostering a sense of equity in the distribution of wealth.

Exemptions and Thresholds

California’s inheritance tax law provides certain exemptions and thresholds to protect smaller estates and ensure that only substantial inheritances are taxed. The current threshold is set at $150,000, meaning that any property inherited below this value is exempt from the inheritance tax. This exemption threshold is generous compared to many other states, providing relief to a significant portion of estates.

| Inheritance Value | Tax Rate |

|---|---|

| $150,001 - $250,000 | 8% |

| $250,001 - $350,000 | 10% |

| $350,001 - $600,000 | 12% |

| $600,001 - $1,000,000 | 14% |

| $1,000,001 and above | 16% |

These thresholds and rates demonstrate California's commitment to a fair and balanced taxation system, ensuring that the tax burden is distributed proportionately among beneficiaries.

Who Pays Inheritance Tax in California

The responsibility of paying inheritance tax in California falls on the beneficiaries of the estate, not the deceased individual. This means that the individuals who receive property or assets from the deceased are liable for the tax, based on the value of what they inherit.

It's crucial to understand that the tax is not a one-size-fits-all scenario. The tax rate depends on the relationship between the beneficiary and the deceased. California's inheritance tax law recognizes various relationships, including spouses, children, parents, siblings, and distant relatives, and each relationship has a unique tax rate associated with it.

Tax Rates Based on Relationship

- Spouse or Registered Domestic Partner: No inheritance tax is due for transfers to a surviving spouse or registered domestic partner, regardless of the value of the inheritance.

- Children and Grandchildren: Transfers to children and grandchildren are taxed at a rate of 16% for values above 100,000. However, this rate is only applicable for estates valued at 1,000,000 or more.

- Parents, Grandparents, and Lineal Descendants: Inheritances to parents, grandparents, or other lineal descendants are taxed at a rate of 16% for values above 50,000.</li> <li><strong>Siblings and Half-Siblings:</strong> Transfers to siblings or half-siblings are taxed at a rate of 16% for values above 10,000.

- Aunts, Uncles, Nieces, Nephews, and Cousins: Inheritances to aunts, uncles, nieces, nephews, or cousins are taxed at a rate of 16% for all values.

These rates illustrate the state's recognition of the varying degrees of familial relationships and the potential impact of inheritances on each.

Inheritance Tax Filing and Payment Process

The process of filing and paying inheritance tax in California is relatively straightforward but requires careful attention to detail. The executor or personal representative of the estate is responsible for filing the necessary forms and ensuring timely payment.

Step-by-Step Guide

- Determine the Value of the Estate: Calculate the total value of the deceased’s assets, including real estate, personal property, investments, and any other valuables. Ensure you accurately assess the market value of each asset.

- Identify Beneficiaries and Their Relationships: Determine who the beneficiaries are and their relationship to the deceased. This information is crucial for applying the correct tax rates.

- Calculate the Inheritance Tax: Use the tax rates based on the relationship of the beneficiary to calculate the tax due for each individual. Sum up these amounts to get the total inheritance tax liability.

- File Form DE-162: This is the California Inheritance and Gift Tax Return form. It must be filed within nine months of the date of death or the date the property was transferred, whichever is later. Ensure all relevant information is included, such as the name and address of the decedent, the total value of the estate, and the amount of tax due.

- Make Payment: The inheritance tax is due at the time of filing. You can make the payment using a credit card, debit card, or electronic funds transfer. Alternatively, you can mail a check or money order made payable to the “Franchise Tax Board” to the address provided on the form.

- Recordkeeping: Retain copies of all filed forms and payment receipts. These documents serve as proof of compliance and may be required for future reference.

Penalties and Interest

Failure to file the inheritance tax return on time or pay the tax due can result in penalties and interest. The Franchise Tax Board may charge a late filing penalty of 5% of the tax due, plus an additional 0.5% per month for each month (or part of a month) that the return is late. Interest on the unpaid tax is also charged at a rate of 5% per year, compounded daily.

Planning Strategies to Minimize Inheritance Tax

While California’s inheritance tax system is designed to be fair, it can still represent a significant burden for some estates and beneficiaries. Fortunately, there are several strategies that can be employed to minimize the impact of inheritance tax, allowing families to preserve more of their wealth for future generations.

Gifting During Lifetime

One of the most effective strategies to reduce inheritance tax is to make gifts during the lifetime of the donor. California, like the federal government, allows individuals to make annual gifts of up to $15,000 per recipient without incurring gift tax. This means that you can effectively reduce the size of your estate by making annual gifts to family members, thereby reducing the potential inheritance tax liability upon your death.

Establishing Trusts

Trusts are powerful estate planning tools that can help manage and protect assets while reducing potential tax liabilities. There are several types of trusts that can be beneficial for minimizing inheritance tax, including:

- Revocable Living Trust: This type of trust allows the grantor (the person establishing the trust) to retain control over the assets during their lifetime, while also providing for the management and distribution of those assets after their death. Assets held in a revocable living trust typically avoid probate, which can save time and money, and may also reduce inheritance tax liability.

- Irrevocable Trust: An irrevocable trust is a permanent arrangement where the grantor transfers assets into the trust and generally cannot change the terms or take the assets back. While this type of trust has certain drawbacks, such as the loss of control over the assets, it can be beneficial for inheritance tax planning. Assets held in an irrevocable trust are typically removed from the grantor's estate, which can reduce the overall value of the estate and, therefore, the potential inheritance tax liability.

- Charitable Remainder Trust (CRT): A CRT is a type of irrevocable trust that can provide income to the grantor or a designated beneficiary for a set period of time, after which the remaining assets are donated to a charity. CRTs can offer significant tax benefits, including a potential reduction in capital gains tax and a charitable deduction on the grantor's income tax return.

Joint Ownership and Other Strategies

There are several other strategies that can be employed to minimize inheritance tax, including joint ownership of property, which can pass directly to the surviving owner without going through probate. Additionally, life insurance policies can be structured in a way that allows the proceeds to be paid to beneficiaries free of inheritance tax. It’s important to consult with a qualified estate planning attorney or financial advisor to determine which strategies are most appropriate for your specific situation.

Conclusion

Inheritance tax in California is a critical aspect of the state’s tax system, designed to ensure equitable distribution of wealth and contribute to the public good. While it can represent a significant burden for some estates, a thorough understanding of the law and strategic planning can help mitigate this burden, allowing families to preserve more of their wealth for future generations. As with any complex tax issue, seeking professional advice is essential to ensure compliance and to take advantage of all available strategies.

Are there any exceptions or special considerations for family farms or businesses in terms of inheritance tax in California?

+California does recognize the unique circumstances of family farms and businesses when it comes to inheritance tax. The state allows for a special-use valuation, which can significantly reduce the value of the estate for tax purposes. This special-use valuation applies when property is used for agricultural or business purposes and meets certain criteria, allowing for a more favorable tax treatment. It’s important to consult with a tax professional to determine eligibility and navigate the specific requirements for this valuation.

Can you explain the difference between inheritance tax and estate tax in California, and when each applies?

+Inheritance tax and estate tax are related but distinct concepts. Estate tax is levied on the value of the entire estate of the deceased person, regardless of who inherits the assets. It’s a tax on the transfer of the decedent’s entire estate. Inheritance tax, on the other hand, is levied on the value of property that an individual inherits from a deceased person. It’s a tax on the transfer of specific property to a beneficiary. In California, the focus is primarily on inheritance tax, which is applied to the value of property received by beneficiaries.

Are there any potential pitfalls or traps that individuals should be aware of when planning to minimize inheritance tax in California?

+While minimizing inheritance tax is a common goal, it’s important to approach tax planning with caution. Some strategies, such as gifting or establishing trusts, can have unintended consequences if not implemented properly. For instance, certain gifts may trigger gift tax, and trusts may have complex rules and requirements that, if not followed, can lead to unintended tax consequences or legal issues. It’s crucial to seek professional advice to ensure that any tax planning strategies are appropriate for your specific situation and comply with all relevant laws and regulations.