New York State Tax Return

Welcome to a comprehensive guide on the intricate process of filing your New York State Tax Return. Navigating the tax landscape can be challenging, but with the right information and guidance, you'll be able to tackle this annual task with confidence. As a resident of New York State, understanding the tax regulations and processes is crucial for ensuring compliance and optimizing your financial well-being.

Understanding the New York State Tax System

New York State operates a complex tax system that encompasses various types of taxes, including income tax, sales tax, property tax, and corporate tax. Each of these tax categories has its own set of rules, exemptions, and deadlines. For individual taxpayers, the most common interaction with the state’s tax system is through the personal income tax, which is the focus of this guide.

New York State's personal income tax is progressive, meaning that the tax rate increases as your income rises. This structure aims to ensure that higher-income earners contribute a larger share of their income to the state's revenue. The state tax rates can vary from year to year, and they are typically announced by the New York State Department of Taxation and Finance ahead of the tax season.

For the 2023 tax year, the state income tax rates range from 4% for the lowest tax bracket to 8.82% for the highest income earners. These rates are applied to your taxable income, which is calculated after accounting for various deductions, exemptions, and credits.

| Tax Rate | Taxable Income Range |

|---|---|

| 4% | $0 - $11,999 |

| 4.5% | $12,000 - $24,999 |

| 5.25% | $25,000 - $49,999 |

| 5.9% | $50,000 - $100,000 |

| 6.45% | $100,001 - $250,000 |

| 6.85% | $250,001 - $500,000 |

| 7.85% | $500,001 - $1,000,000 |

| 8.82% | Over $1,000,000 |

These rates and brackets may be subject to change, so it's important to refer to the official tax guidelines issued by the state each year.

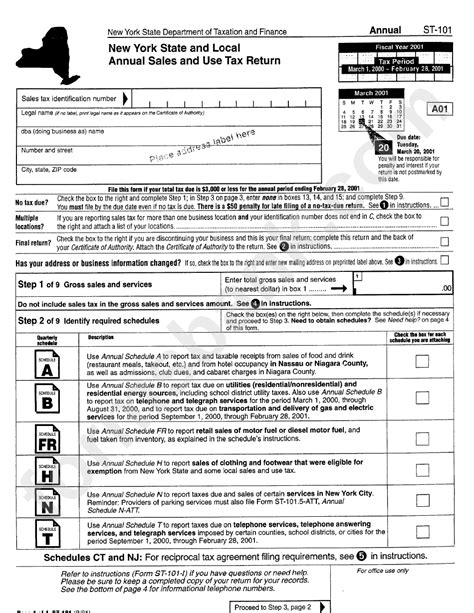

Filing Your New York State Tax Return

The process of filing your New York State tax return can be broken down into several key steps. By following these steps diligently, you can ensure an accurate and timely submission.

Gathering Your Tax Documents

Before you begin, ensure you have all the necessary documents and information. This includes your Social Security Number, W-2 forms from all your employers, 1099 forms for any independent contracting work, and any tax-deductible expenses you may have incurred during the tax year.

Other important documents might include statements for interest and dividend income, real estate tax receipts, charitable contribution records, and receipts for other deductions you plan to claim.

Choosing Your Filing Status

Your filing status is an important factor in determining your tax liability and any potential refunds or credits you may be eligible for. In New York State, the filing status options are single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Your choice should reflect your marital status and living situation accurately.

Calculating Your Taxable Income

Your taxable income is calculated by subtracting any applicable deductions and exemptions from your total income. New York State offers various deductions and credits to help reduce your tax burden. These include deductions for personal exemptions, standard deductions, itemized deductions (such as medical expenses, state and local taxes, and charitable contributions), and credits for things like child care expenses, retirement contributions, and education.

It's important to carefully review your expenses and consider which deductions and credits you are eligible for to ensure you're not overpaying on your taxes.

Selecting Your Filing Method

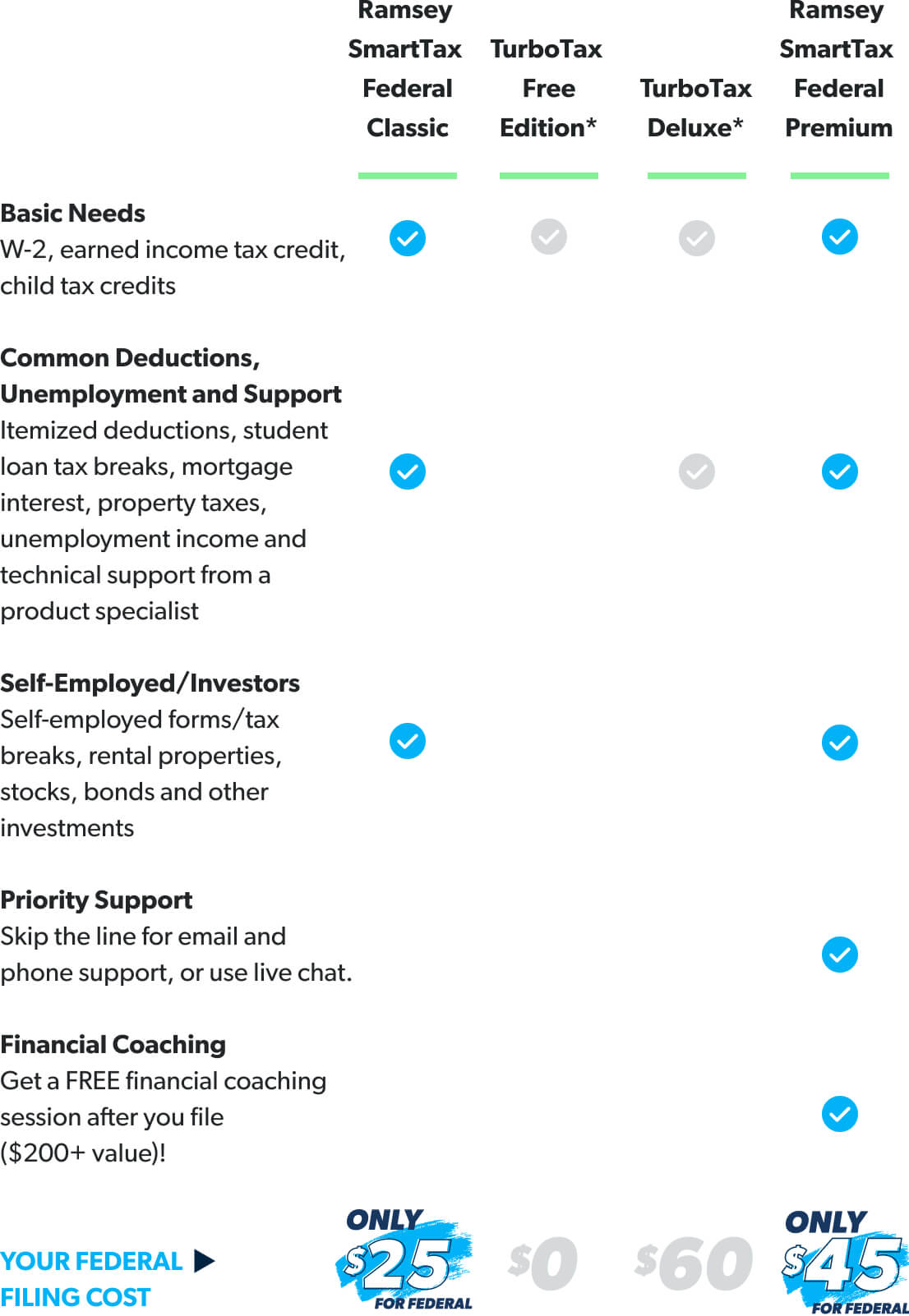

New York State offers several ways to file your tax return. You can choose to file electronically through the state’s online portal, use tax preparation software, or opt for the traditional method of filing by mail. Each method has its own advantages and considerations.

- Electronic Filing: This is the most common and efficient method, offering quick processing times and the option to receive your refund via direct deposit.

- Tax Preparation Software: Using software can simplify the filing process, especially if you have a complex tax situation. It can guide you through the process and ensure accuracy.

- Filing by Mail: While less common, filing by mail can be a suitable option for those who prefer a more traditional approach or who do not have access to the internet.

Review and Submit Your Return

Before submitting your tax return, it’s crucial to review it carefully. Check all the information for accuracy, ensuring that your personal details, income figures, deductions, and credits are correct. Double-check the math and make sure you’ve included all the necessary forms and schedules.

Once you're confident that your return is accurate, submit it to the New York State Department of Taxation and Finance by the filing deadline, which is typically April 15th for the previous tax year.

Special Considerations for New York State Taxpayers

In addition to the standard income tax considerations, New York State taxpayers should be aware of some unique aspects of the state’s tax system.

New York City Residents

If you reside in New York City, you are subject to an additional City Income Tax on top of the state income tax. The city tax rates are similar to the state rates but may have slight variations. It’s important to factor in both the state and city taxes when calculating your total tax liability.

Estate and Gift Taxes

New York State imposes estate taxes on the transfer of property at the time of death and gift taxes on certain transfers of property during a person’s lifetime. These taxes are separate from income taxes and have their own set of rules and exemptions.

Tax Credits and Incentives

New York State offers various tax credits and incentives to promote economic development and support specific industries. These can include credits for research and development, film production, renewable energy initiatives, and more. If you are involved in any of these sectors, it’s worth exploring whether you are eligible for any of these credits.

Resources for Taxpayers

Navigating the complexities of New York State’s tax system can be daunting, but there are resources available to help. The New York State Department of Taxation and Finance provides a wealth of information and guidance on their website. They offer detailed explanations of tax laws, forms, and instructions, as well as a help center with answers to common questions.

Additionally, the state's tax department provides assistance by phone and in-person at tax offices across the state. They can help with specific tax-related queries and provide guidance on filing your return.

Conclusion

Filing your New York State Tax Return is a crucial responsibility for all residents. By understanding the state’s tax system, gathering the necessary documents, and following the filing process diligently, you can ensure compliance and potentially optimize your tax situation. Remember to stay informed about any changes to tax laws and take advantage of the resources available to you.

What is the deadline for filing my New York State Tax Return?

+

The deadline for filing your New York State Tax Return is typically April 15th for the previous tax year. However, it’s important to note that this deadline may be extended in certain circumstances, such as during times of natural disasters or if you’re serving in a combat zone. Always check the official tax calendar for any updates.

Can I file my New York State Tax Return electronically?

+

Yes, New York State offers electronic filing as a convenient and efficient way to submit your tax return. You can file electronically through the state’s online portal or use tax preparation software that supports electronic filing. Electronic filing often provides faster processing times and the option for direct deposit refunds.

What if I miss the filing deadline for my New York State Tax Return?

+

If you miss the filing deadline, it’s important to file your return as soon as possible to avoid penalties and interest charges. The New York State Department of Taxation and Finance may impose late filing penalties, which can range from a minimum of 10 to a maximum of 2,500, depending on the severity of the late filing. It’s best to file your return promptly to minimize any potential penalties.

Are there any tax breaks or deductions available for New York State taxpayers?

+

Yes, New York State offers various tax breaks and deductions to help reduce your tax burden. These include deductions for personal exemptions, standard deductions, itemized deductions, and credits for things like child care expenses, retirement contributions, and education. It’s important to review your eligibility for these deductions and credits to ensure you’re maximizing your tax savings.

How can I estimate my New York State tax liability before filing my return?

+

Estimating your New York State tax liability can be done using tax estimation tools provided by the state’s Department of Taxation and Finance. These tools take into account your income, deductions, and credits to provide an estimate of your tax liability. It’s a useful way to get an idea of what you may owe or be eligible for in refunds before officially filing your return.