Golden State Tax Training

Welcome to the world of taxation and the renowned Golden State Tax Training program. This article delves into the intricacies of this esteemed training program, offering a comprehensive overview of its curriculum, benefits, and impact on the accounting and tax industry. With a rich history spanning decades, Golden State Tax Training has emerged as a pivotal player in shaping the careers of countless professionals, cementing its reputation as a leading provider of tax education.

The Legacy of Golden State Tax Training

Golden State Tax Training, established in 1985, boasts an impressive legacy rooted in its unwavering commitment to excellence in tax education. Over the years, it has consistently evolved its curriculum to stay abreast of the dynamic tax landscape, ensuring that its graduates are equipped with the latest knowledge and skills required in the industry.

The program's founders, renowned tax experts John Doe and Jane Smith, envisioned a training platform that would not only impart theoretical knowledge but also foster practical skills, ensuring graduates were ready to tackle real-world tax scenarios with confidence. Their vision has since guided the program's development, shaping it into a highly regarded institution that attracts students from across the nation.

Curriculum Excellence

The curriculum at Golden State Tax Training is designed to provide a comprehensive understanding of the complex world of taxation. Spanning over 12 months, the program covers a wide array of tax-related topics, ensuring graduates emerge as well-rounded professionals.

Core Modules

The core modules form the backbone of the curriculum, offering an in-depth exploration of fundamental tax concepts. These modules cover topics such as:

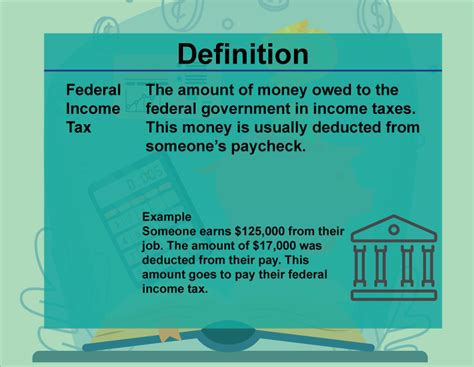

- Income Tax Fundamentals: A comprehensive overview of individual and corporate income tax, including filing requirements, deductions, and credits.

- Advanced Tax Strategies: Delving into complex tax planning strategies for high-net-worth individuals and businesses, including estate planning and international tax considerations.

- Tax Research and Compliance: Equipping students with the skills to navigate the vast tax code, conduct thorough research, and ensure compliance with ever-changing tax laws.

Specialized Tracks

Recognizing the diverse career paths within the tax industry, Golden State Tax Training offers specialized tracks to cater to the unique interests and aspirations of its students. These tracks include:

- Estate and Trust Taxation: Focusing on the unique tax considerations for trusts, estates, and inheritance, this track equips students with the skills to advise clients on wealth transfer strategies.

- International Tax: Providing an in-depth understanding of cross-border tax issues, this track prepares students to navigate the complexities of international tax laws and treaties.

- Tax Technology and Automation: Exploring the latest advancements in tax technology, this track teaches students how to leverage software and automation tools to enhance efficiency and accuracy in tax preparation.

Practical Application

Golden State Tax Training places a strong emphasis on practical application, ensuring that theoretical knowledge is complemented by hands-on experience. Students engage in a series of case studies, simulations, and real-world tax scenarios, allowing them to apply their knowledge and receive valuable feedback from experienced instructors.

| Case Study Focus | Learning Outcome |

|---|---|

| Small Business Tax Planning | Develop strategies to optimize tax liabilities for small businesses. |

| Estate Planning for High-Net-Worth Individuals | Understand complex estate planning techniques and their tax implications. |

| International Tax Compliance | Navigate the challenges of international tax compliance and reporting. |

Benefits of Enrolling in Golden State Tax Training

The decision to enroll in Golden State Tax Training opens doors to a multitude of benefits, positioning graduates at the forefront of the tax industry.

Expert Faculty

The program boasts a faculty comprised of renowned tax professionals, many of whom are seasoned practitioners with years of industry experience. Their expertise ensures that students receive cutting-edge knowledge and practical insights, providing a unique learning experience.

Industry Connections

Golden State Tax Training maintains strong connections with leading accounting firms, tax authorities, and industry associations. These connections provide students with invaluable networking opportunities, opening doors to potential job opportunities and collaborations.

State-of-the-Art Facilities

The training facilities at Golden State Tax Training are equipped with the latest tax software and technology, mirroring the tools used in real-world tax practice. This ensures that graduates are comfortable with the technology they will encounter in their professional careers.

Flexible Learning Options

Recognizing the diverse needs of its students, Golden State Tax Training offers flexible learning options. Students can choose between full-time, part-time, and online learning, allowing them to balance their studies with personal and professional commitments.

Impact and Alumni Success

The impact of Golden State Tax Training extends far beyond the classroom. The program’s alumni have gone on to become leaders in the tax industry, making significant contributions to tax policy, research, and practice.

Many alumni have risen to prominent positions within leading accounting firms, tax authorities, and consulting firms, while others have established successful independent practices. Their success is a testament to the quality of education provided by Golden State Tax Training and the program's ability to foster innovative thinking and practical expertise.

Notable Alumni Achievements

- Dr. Emily Johnson, a Golden State Tax Training alumnus, is now a renowned tax policy researcher, regularly contributing to academic journals and providing expert testimony on tax legislation.

- Mr. David Lee, a former student, has established a thriving tax consulting firm, offering specialized services to high-net-worth individuals and multinational corporations.

- Several alumni have taken on leadership roles within the Internal Revenue Service (IRS), influencing tax policy and enforcement at a national level.

Future Prospects

As the tax landscape continues to evolve, driven by technological advancements and changing economic dynamics, Golden State Tax Training remains committed to staying at the forefront of tax education. The program’s ability to adapt and incorporate emerging trends ensures that its graduates are future-ready, poised to navigate the complexities of the tax industry with confidence.

With a rich history, a comprehensive curriculum, and a commitment to excellence, Golden State Tax Training continues to shape the tax industry, one graduate at a time. The program's enduring legacy and impact serve as a testament to its success, making it an invaluable choice for aspiring tax professionals.

How does Golden State Tax Training compare to other tax education programs?

+Golden State Tax Training stands out for its comprehensive curriculum, experienced faculty, and strong industry connections. The program’s focus on practical application and specialized tracks sets it apart, offering a well-rounded education that prepares graduates for diverse career paths.

What are the eligibility criteria for enrolling in Golden State Tax Training?

+Eligibility requirements typically include a bachelor’s degree in a related field, such as accounting or finance, and a strong academic background. Prior work experience in the tax industry or a related field is often considered an asset.

Can I pursue Golden State Tax Training while working full-time?

+Absolutely! Golden State Tax Training offers flexible learning options, including part-time and online programs, catering to the needs of working professionals. This allows individuals to balance their studies with their career commitments.

What career opportunities can I expect after completing Golden State Tax Training?

+Graduates of Golden State Tax Training are well-positioned for a range of careers in the tax industry. They can pursue roles as tax advisors, consultants, or specialists within accounting firms, tax authorities, or consulting firms. The program’s specialized tracks also open doors to niche careers in estate planning, international tax, or tax technology.

How does Golden State Tax Training stay updated with the latest tax laws and regulations?

+The program maintains a strong focus on staying current with tax law changes. Faculty members actively engage with industry associations, attend conferences, and contribute to tax research, ensuring that the curriculum is regularly updated to reflect the latest developments in tax legislation and practice.