Property Tax Calculator Texas

Texas, a state renowned for its diverse landscapes, vibrant cities, and thriving businesses, is also known for its unique approach to property taxation. Understanding the intricacies of property taxes is essential for homeowners, investors, and businesses alike. In this comprehensive guide, we delve into the world of property tax calculations in Texas, shedding light on the processes, factors, and tools that play a pivotal role in determining your tax liability.

The Texas property tax system, often considered complex, is a vital component of the state's revenue stream. It not only impacts individual homeowners but also influences the economic landscape, shaping the decisions of investors and businesses. With a deep understanding of this system, you can make informed choices, manage your finances effectively, and navigate the property market with confidence.

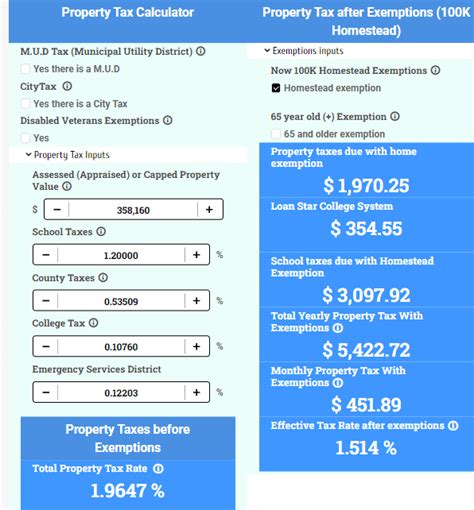

At the heart of this journey lies the Property Tax Calculator, a powerful tool designed to provide accurate estimates of your tax liability. This calculator, an essential resource for anyone dealing with Texas property, is a gateway to clarity and financial planning. By unraveling the mysteries of property taxes, we aim to empower you with knowledge, ensuring you're equipped to make the best decisions for your real estate endeavors.

Demystifying Property Taxes in Texas

Texas' property tax system is unique, differing significantly from other states. It's a local assessment system, where the responsibility for property tax collection lies with local governments, primarily counties and municipalities. This means property tax rates and assessment methods can vary greatly, even within the same county.

Key Factors Influencing Property Taxes

Several critical factors influence the property tax you pay in Texas:

- Appraised Value: This is the estimated market value of your property, determined by the Appraisal District in your county. It takes into account recent sales of similar properties, property improvements, and other factors.

- Tax Rate: Each local government sets its own tax rate, often expressed as dollars per $100 of assessed value. This rate is applied to the appraised value to calculate your tax liability.

- Taxing Entities: Your property tax bill includes charges from various entities, such as your city, county, school district, and special districts like hospitals or water districts.

- Exemptions and Discounts: Texas offers several exemptions and discounts, such as the Homestead Exemption and Over-65 Exemption, which can significantly reduce your tax bill.

The Power of the Property Tax Calculator

In the vast landscape of Texas property taxes, the Property Tax Calculator stands as a beacon of clarity and precision. This innovative tool, meticulously designed by tax experts, is your gateway to understanding the complex world of property taxation. By inputting specific details about your property, you unlock a wealth of information, guiding you through the intricate web of tax assessments and calculations.

At its core, the Property Tax Calculator operates on a foundation of advanced algorithms, drawing upon a vast database of historical tax data, market trends, and local regulations. This enables it to provide highly accurate estimates of your property's appraised value, an essential step in determining your tax liability. Whether you're a homeowner, investor, or business owner, this tool empowers you with the knowledge to make informed decisions, plan effectively, and navigate the complexities of Texas property taxes with confidence.

With a user-friendly interface, the calculator simplifies the often-daunting task of tax estimation, making it accessible to all. Whether you're curious about the potential tax implications of a new property purchase, assessing the impact of recent improvements, or simply wanting to understand your current tax burden, the Property Tax Calculator is your trusted companion. Its versatility extends to providing valuable insights for a range of scenarios, from long-term financial planning to strategic real estate decisions.

By leveraging the power of this advanced calculator, you not only gain a deeper understanding of your tax obligations but also unlock the potential for strategic tax planning. Whether it's optimizing your property's value, exploring exemption opportunities, or simply staying ahead of potential tax increases, the Property Tax Calculator equips you with the tools to make the most of your Texas property ownership.

Navigating the Texas Property Tax System

Understanding how to navigate the Texas property tax system is crucial for effective financial planning. Here's a step-by-step guide to help you through the process:

- Check Your Property's Appraised Value: This is typically done through the Appraisal District in your county. You can access this information online or by visiting their office.

- Calculate Your Tax Bill: Use the Property Tax Calculator to estimate your tax liability. Input your property's appraised value, tax rate, and any applicable exemptions.

- Review Your Tax Bill: When you receive your tax bill, ensure it aligns with your calculations. If there are discrepancies, contact your local tax assessor's office for clarification.

- Pay Your Taxes: Taxes are typically due twice a year. Make sure to pay on time to avoid penalties and interest.

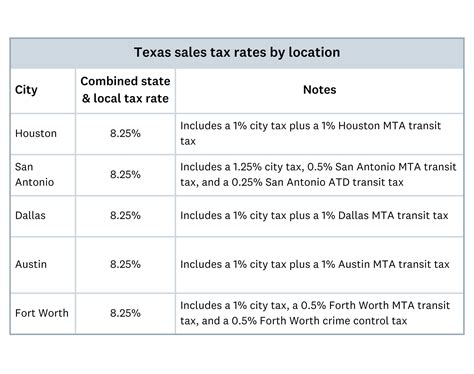

Understanding the Tax Rate

The tax rate is a critical component of your tax liability. It's a complex calculation that involves various taxing entities, each with its own rate. The combined rate determines your overall tax burden. Understanding how these rates are set and their impact on your tax bill is essential for effective financial planning.

| Taxing Entity | Tax Rate (per $100) |

|---|---|

| County | 0.35 |

| City | 0.20 |

| School District | 1.20 |

| Special District | 0.15 |

| Total Tax Rate | 1.90 |

Exemptions and Discounts

Texas offers several exemptions and discounts to reduce your property tax burden. These include:

- Homestead Exemption: This exemption reduces the taxable value of your primary residence. It's available to homeowners who occupy their property as their primary residence.

- Over-65 Exemption: If you're 65 or older and meet certain income requirements, you may qualify for this exemption, which can significantly reduce your tax bill.

- Disability Exemption: Those with disabilities may be eligible for this exemption, which reduces the taxable value of their property.

- Veterans Exemption: Texas offers various exemptions for veterans, including a partial exemption and a total exemption for those with a 100% disability rating.

Real-World Case Study: Calculating Property Taxes in Texas

Let's walk through a real-world example to illustrate how the Property Tax Calculator works. Imagine you own a home in Austin, Texas, with an appraised value of $300,000. The local tax rate is set at $1.90 per $100 of assessed value.

Using the Property Tax Calculator, you can estimate your tax liability as follows:

Appraised Value: $300,000

Tax Rate: $1.90 per $100

Taxable Value (after exemptions): $280,000 (assuming a $20,000 Homestead Exemption)

Estimated Tax Liability: $5,320

This calculation provides you with a clear understanding of your tax obligations, enabling you to plan your finances effectively.

Future Implications and Strategic Planning

Understanding the Texas property tax system and utilizing tools like the Property Tax Calculator can have significant implications for your financial and real estate strategies. Here's how:

- Financial Planning: Accurate tax estimates help you budget effectively, ensuring you have the necessary funds to pay your taxes on time.

- Real Estate Decisions: When considering property purchases or investments, tax calculations can influence your decision-making, helping you assess the true cost of ownership.

- Long-Term Planning: By understanding your tax obligations, you can make informed decisions about property improvements, renovations, or even relocation.

- Exemption Strategies: Exploring and applying for exemptions can significantly reduce your tax burden, making your property more affordable.

Conclusion

In the complex world of Texas property taxes, the Property Tax Calculator emerges as a powerful tool, offering clarity and precision in tax estimation. By understanding the factors that influence your tax liability, navigating the tax system effectively, and utilizing exemptions and discounts, you can manage your tax obligations efficiently. This comprehensive guide, coupled with the insights of the Property Tax Calculator, equips you with the knowledge to make informed decisions, plan strategically, and unlock the full potential of your Texas property ownership.

How often are property taxes assessed in Texas?

+

Property taxes in Texas are typically assessed annually. The appraisal districts in each county determine the appraised value of properties, which forms the basis for tax calculations.

Can I appeal my property’s appraised value?

+

Yes, if you believe your property’s appraised value is inaccurate, you have the right to appeal. The process involves submitting an appeal to the Appraisal Review Board in your county. It’s important to gather evidence and prepare your case carefully.

What happens if I miss the tax payment deadline?

+

Missing the tax payment deadline can result in penalties and interest. It’s crucial to pay your taxes on time to avoid these additional costs. If you’re facing financial difficulties, consider contacting your local tax office to explore potential payment plans.