Do Churches Pay Property Tax

When discussing the tax status of churches and religious organizations, it's important to delve into the intricate world of tax law and its varying interpretations. The question of whether churches pay property tax is a complex one, with answers that often depend on the specific jurisdiction and the unique characteristics of the religious organization in question.

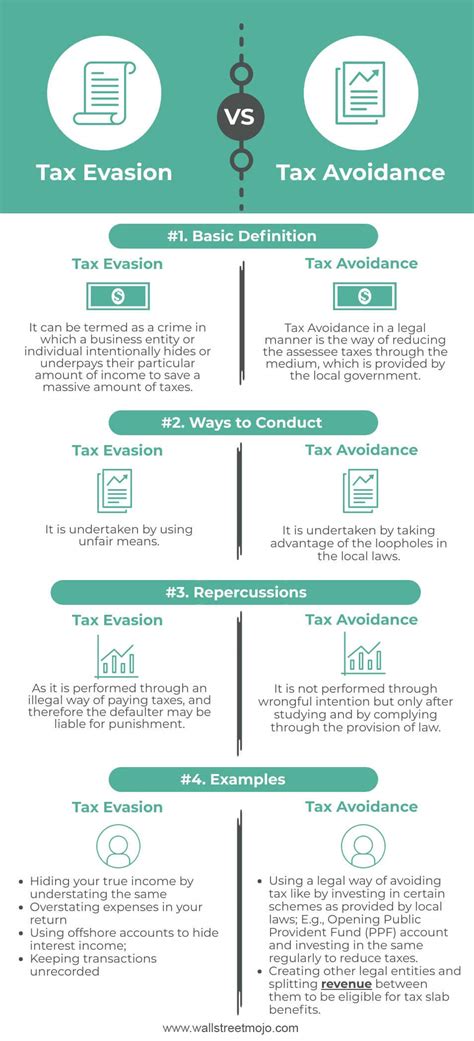

To navigate this topic effectively, we must first understand the fundamental principles of tax law as they relate to religious entities. The tax treatment of churches and similar organizations is influenced by a combination of constitutional principles, statutory provisions, and judicial interpretations, all of which can vary significantly across different jurisdictions.

Understanding the Tax Status of Churches

The tax status of churches and religious organizations is often intertwined with the concept of tax-exempt status, which can lead to misconceptions about their obligations regarding property taxes. In many jurisdictions, religious organizations, including churches, are granted tax-exempt status for certain types of income and assets. This exemption is rooted in the constitutional principle of separation of church and state, aiming to protect religious freedom and ensure that religious organizations are not unduly burdened by the state.

However, it is crucial to note that tax-exempt status does not automatically equate to complete immunity from all forms of taxation. While religious organizations may be exempt from certain federal, state, or local taxes, their specific tax obligations can vary greatly depending on a multitude of factors.

Tax-Exempt Status and Property Taxes

The question of whether churches pay property tax often revolves around the interpretation of the term “property tax.” Property taxes are typically levied on real estate and personal property, with the specific definition and scope varying by jurisdiction. Religious organizations may be granted exemptions from certain types of property taxes, but this does not universally apply to all forms of property tax.

For instance, churches often own and operate a variety of properties, including church buildings, parsonages, schools, and other facilities. While some of these properties may be exempt from certain property taxes due to their religious use, others may not be eligible for such exemptions. The tax status of these properties is often determined by a combination of factors, including the primary use of the property, its ownership structure, and the specific tax laws of the jurisdiction.

| Property Type | Tax Exemption Status |

|---|---|

| Church Buildings (Worship Space) | Often Exempt |

| Parsonages (Residences for Clergy) | May be Exempt, but Conditions Apply |

| Church-Operated Schools | Varies by Jurisdiction and Use |

| Commercial Properties | Typically Not Exempt |

Factors Influencing Church Property Tax Obligations

The tax obligations of churches regarding property taxes are influenced by a myriad of factors, each of which can significantly impact the final tax liability.

Jurisdictional Variations

Tax laws can vary significantly from one jurisdiction to another. What may be a standard practice in one state or country could be entirely different in another. For instance, while some jurisdictions may offer broad exemptions for religious properties, others may have more restrictive criteria, requiring a specific use or ownership structure to qualify for exemptions.

Primary Use of the Property

The primary use of a property is often a critical factor in determining its tax status. For instance, a church building used primarily for worship services and religious activities is more likely to be exempt from property taxes than a building used for commercial activities, such as rental space or retail operations.

Ownership and Management Structure

The ownership and management structure of a property can also influence its tax status. In some cases, properties owned by a church but managed by a separate entity may not be eligible for the same tax exemptions. Similarly, properties owned by a religious organization but leased to a commercial entity may be subject to different tax rules.

Specific Tax Laws and Regulations

Each jurisdiction has its own set of tax laws and regulations, which can be complex and detailed. These laws often provide guidelines and criteria for tax exemptions, including those for religious organizations. Understanding these laws is crucial for churches to determine their tax obligations accurately.

The Impact of Church Property Taxes

The tax obligations of churches, including their property tax liabilities, can have significant implications for both the church and the community it serves. Understanding these implications is essential for church leaders and members to make informed decisions regarding their tax obligations.

Financial Implications for Churches

Property taxes can be a significant financial burden for churches, especially those with large properties or multiple facilities. The cost of property taxes can impact a church’s budget, potentially reducing the funds available for ministries, community outreach, and other vital activities. However, when churches are exempt from property taxes, it can provide a substantial financial benefit, allowing them to allocate more resources towards their mission.

Community Impact and Equity

The tax status of church properties can also have an impact on the broader community. When churches are exempt from property taxes, it can result in a loss of revenue for local governments, which may impact the funding of public services such as education, infrastructure, and public safety. This dynamic raises questions of fairness and equity, particularly in communities with a significant number of tax-exempt properties.

Legal and Administrative Considerations

Navigating the tax obligations of churches requires a thorough understanding of the legal and administrative processes. Churches must ensure they are compliant with all relevant tax laws and regulations to avoid legal issues and penalties. This often involves staying informed about changes in tax laws, filing necessary tax forms, and maintaining accurate financial records.

Case Studies: Church Property Tax Scenarios

To illustrate the complexity of church property tax obligations, let’s examine a few real-world scenarios.

Scenario 1: Worship Space and Community Center

Imagine a church that owns a large property, which includes a worship space, administrative offices, and a community center that hosts various non-religious activities, such as a daycare and a fitness center. In this scenario, the worship space may be exempt from property taxes, while the community center could be subject to taxation due to its non-religious use.

Scenario 2: Commercial Properties

A church owns a building that is leased out to a retail store. In this case, the property is likely to be subject to property taxes, as it is being used for commercial purposes. Even though the church is a religious organization, the commercial nature of the lease agreement may not qualify for tax exemptions.

Scenario 3: Multiple Jurisdictions

Consider a church with properties spread across different states or countries. The tax obligations for each property will depend on the specific tax laws of each jurisdiction. For instance, a church with properties in both the United States and Canada would need to navigate the tax laws of both countries, which could result in varying tax obligations.

Conclusion: Navigating the Complexities

The question of whether churches pay property tax is a multifaceted one, with no single answer applicable to all situations. The tax obligations of churches are influenced by a myriad of factors, including jurisdictional laws, the primary use of the property, and ownership structures. Understanding these complexities is essential for churches to ensure compliance with tax laws and to make informed decisions regarding their financial obligations.

As tax laws continue to evolve, it is crucial for churches and religious organizations to stay informed and seek expert advice when needed. This ensures they can navigate the complexities of tax obligations while fulfilling their mission and serving their communities effectively.

Are all church properties exempt from property taxes?

+No, not all church properties are exempt from property taxes. The tax status of a property depends on various factors, including its primary use, ownership structure, and the specific tax laws of the jurisdiction. While some properties, like church buildings used for worship, may be exempt, others, such as commercial properties or those with non-religious uses, may not be eligible for exemptions.

How can churches stay informed about their tax obligations?

+Churches should stay informed by regularly consulting with tax professionals who specialize in religious organizations. They can also stay updated by following tax law changes and regulations specific to their jurisdiction. Additionally, many religious organizations provide resources and guidance to help churches navigate their tax obligations.

What happens if a church fails to pay its property taxes?

+Failure to pay property taxes can result in penalties, interest, and potentially the loss of the property through tax sale or foreclosure. It’s important for churches to understand their tax obligations and to seek professional advice if they have any questions or concerns.