Does The Fda Pay Taxes

The Food and Drug Administration (FDA) is a critical government agency in the United States, tasked with protecting public health by ensuring the safety, efficacy, and security of a wide range of products, including food, pharmaceuticals, biologics, medical devices, and more. While the FDA plays a vital role in regulating and overseeing various industries, the question arises: does this federal agency pay taxes like other entities and individuals in the country? This article delves into the intricate details surrounding the FDA's tax status, its funding structure, and the broader implications for the healthcare industry and consumers.

Understanding the FDA’s Role and Funding

The FDA, established in 1906, operates under the Department of Health and Human Services (HHS) and is one of the most influential regulatory bodies in the world. Its primary mission is to safeguard the public by enforcing the Federal Food, Drug, and Cosmetic Act (FD&C Act) and other related laws. The agency’s responsibilities encompass a vast array of tasks, from approving new drugs and medical devices to monitoring food safety and nutrition, ensuring the safety of cosmetics and dietary supplements, and even regulating tobacco products.

In terms of funding, the FDA's budget is a matter of public record and is primarily derived from annual appropriations by Congress. The agency's budget is typically divided into various categories, including administrative expenses, regulatory activities, research and development, and user fees. It's essential to note that the FDA's budget is not generated from taxes paid by the agency itself but rather from the federal government's general funds and specific user fees imposed on regulated industries.

Tax Exemptions and the FDA

When it comes to taxes, the FDA, as a federal government agency, enjoys certain tax exemptions that set it apart from private entities and individuals. Here’s a closer look at the tax status of the FDA:

- Income Tax Exemption: The FDA, like other federal agencies, is not subject to federal income taxes. This exemption stems from the fact that the agency is an integral part of the federal government, and its operations are funded through taxpayer dollars. As such, it would be redundant for the FDA to pay taxes on the funds it already receives from the government.

- Property Tax Exemption: The FDA's facilities and properties are also exempt from local property taxes. This exemption is common for federal government buildings and ensures that the agency's resources are not diverted towards local taxes, allowing for more efficient allocation of funds towards its regulatory and public health missions.

- Sales and Use Taxes: In most cases, the FDA is exempt from paying sales and use taxes on goods and services purchased for official use. This exemption is granted to ensure that the agency's purchasing power is not diminished by additional taxes, thus enabling it to maximize its budget for regulatory activities.

User Fees and the FDA’s Budget

While the FDA is exempt from various taxes, it does collect user fees from regulated industries to supplement its budget. These user fees are mandated by Congress and are typically assessed on specific types of applications, such as new drug approvals or medical device submissions. The fees are intended to provide the FDA with additional resources to expedite its review processes and enhance its regulatory capacity.

For instance, pharmaceutical companies submitting new drug applications (NDAs) are required to pay substantial user fees, which can amount to millions of dollars. These fees are calculated based on factors like the complexity of the application, the type of drug, and the urgency of the review. Similarly, medical device manufacturers and food producers may also be subject to user fees, depending on the nature of their interactions with the FDA.

The user fee program has been a crucial component of the FDA's funding strategy, allowing the agency to maintain its regulatory standards and adapt to the evolving needs of the healthcare industry. However, it's essential to note that these fees do not cover the FDA's entire budget, and the agency still relies heavily on federal appropriations for its core functions.

The Impact on the Healthcare Industry

The FDA’s tax-exempt status and its user fee structure have significant implications for the healthcare industry and consumers. Here are some key considerations:

- Industry Costs: The user fees imposed on regulated industries can be substantial, and they are often passed on to consumers through higher prices for pharmaceuticals, medical devices, and other FDA-regulated products. While these fees are intended to enhance the FDA's regulatory capabilities, they can also create financial burdens for companies, potentially impacting innovation and access to new treatments.

- Resource Allocation: The FDA's budget, which includes both appropriations and user fees, allows the agency to allocate resources strategically. The agency can prioritize certain regulatory activities, such as expedited reviews for breakthrough therapies or enhanced inspections of high-risk facilities. However, critics argue that the user fee program may create incentives for the FDA to prioritize certain applications over others, potentially impacting the fairness of the regulatory process.

- Public Health Benefits: The FDA's tax-exempt status and its user fee program ultimately benefit public health by ensuring that the agency has the resources to fulfill its mission. The agency's regulatory oversight helps ensure the safety and efficacy of drugs, medical devices, and food products, protecting consumers from potential harm. Additionally, the FDA's research and development activities contribute to scientific advancements and improved healthcare outcomes.

Future Considerations and Challenges

As the healthcare industry continues to evolve, the FDA’s tax status and funding structure may face new challenges and opportunities. Here are some key considerations for the future:

- Budget Stability: The FDA's budget is subject to annual appropriations by Congress, which can introduce uncertainty into the agency's operations. To ensure long-term stability and continuity, there have been proposals to provide the FDA with multi-year funding or even a dedicated source of revenue, such as a tax on specific industries or products. Such measures could enhance the agency's ability to plan and execute its regulatory activities.

- User Fee Equilibrium: The user fee program has been successful in generating additional revenue for the FDA, but it also raises concerns about fairness and potential conflicts of interest. Striking the right balance between user fees and federal appropriations will be crucial to maintaining the FDA's independence and ensuring that its regulatory decisions are not influenced by financial considerations.

- Technological Advancements: The FDA is increasingly tasked with regulating emerging technologies, such as gene therapies, digital health products, and artificial intelligence-based diagnostics. As these technologies evolve, the agency may require additional resources to develop the expertise and infrastructure necessary to evaluate their safety and efficacy. Finding sustainable funding mechanisms to support these emerging areas of regulation will be essential.

Conclusion: The FDA’s Tax Status and Its Significance

The FDA’s tax-exempt status and its unique funding structure are integral to its role as a federal regulatory agency. While the agency is not subject to certain taxes, it does rely on federal appropriations and user fees to support its operations. This arrangement ensures that the FDA can focus its resources on protecting public health and maintaining the safety and efficacy of regulated products.

As the healthcare industry continues to innovate and evolve, the FDA's tax status and funding mechanisms will remain critical topics of discussion. Balancing the need for robust regulation with the financial realities of the regulated industries and consumers will be an ongoing challenge. Ultimately, the FDA's ability to adapt and innovate in its funding strategies will be crucial to maintaining its position as a leading global regulatory body.

How does the FDA’s budget compare to other federal agencies?

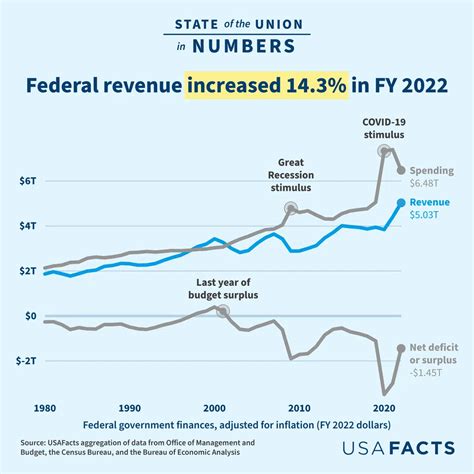

+The FDA’s budget is relatively modest compared to other federal agencies. In FY 2022, the FDA’s budget was approximately $6.4 billion, while larger agencies like the Department of Defense and the Department of Health and Human Services had budgets in the hundreds of billions of dollars.

Are there any proposals to change the FDA’s tax status or funding structure?

+Proposals to change the FDA’s funding structure have been discussed, including ideas like implementing a dedicated tax on specific industries or products to provide a more stable funding source. However, any significant changes would require congressional action and broad consensus.

How does the FDA’s user fee program impact innovation in the healthcare industry?

+The user fee program can provide additional resources for the FDA to expedite reviews and enhance regulatory capabilities. However, it can also create financial burdens for companies, potentially impacting their ability to invest in research and development. Finding the right balance between user fees and industry innovation is a delicate task.