Federal Income Tax Definition

Federal income tax is a fundamental component of the United States tax system, playing a crucial role in funding government operations and services. Understanding this tax is essential for every American taxpayer, as it directly impacts personal finances and the overall economic landscape of the country.

In this comprehensive guide, we will delve into the intricacies of federal income tax, exploring its definition, history, calculation methods, and its significance in the broader context of the U.S. tax system. By the end of this article, you will have a thorough understanding of this essential aspect of financial responsibility.

The Essence of Federal Income Tax

Federal income tax is a mandatory financial levy imposed by the Internal Revenue Service (IRS), a bureau of the Department of the Treasury, on the income earned by individuals, businesses, and other entities within the United States. This tax is a critical source of revenue for the federal government, enabling it to finance various public services and infrastructure projects that benefit the nation as a whole.

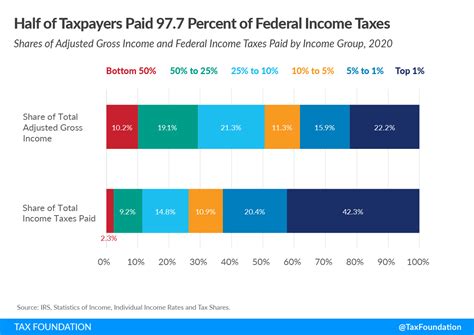

The federal income tax system operates on a progressive basis, meaning that higher income earners are subject to higher tax rates. This structure aims to promote fairness and ensure that those with greater financial means contribute a larger proportion of their income to support government operations.

The tax rates and brackets are determined by Congress and are subject to periodic adjustments to account for inflation and economic changes. These adjustments are essential to maintaining the integrity of the tax system and ensuring that it remains responsive to the evolving financial landscape.

A Historical Perspective

The history of federal income tax in the United States dates back to the early 20th century. The Revenue Act of 1913, also known as the Underwood Tariff Act, established the modern federal income tax system. This act was a significant milestone in the nation's fiscal policy, introducing a progressive tax structure that has since become a cornerstone of the U.S. tax system.

Prior to the enactment of the Revenue Act, the federal government relied primarily on tariffs and excise taxes to generate revenue. However, as the country's economy grew and became more complex, the need for a more robust and equitable tax system became apparent. The Revenue Act addressed this need by imposing a tax on personal income, with rates ranging from 1% to 7% based on income levels.

Over the decades, the federal income tax system has undergone numerous modifications and adjustments to reflect changing economic conditions and societal needs. Notable amendments include the introduction of the Social Security tax in 1935, which aimed to provide a safety net for retired workers, and the creation of tax brackets during World War II to fund the war effort.

Calculating Federal Income Tax

Calculating federal income tax involves a multi-step process that takes into account various factors, including taxable income, deductions, credits, and the applicable tax rates. While the exact calculation can be complex, the fundamental principle remains consistent: taxable income is taxed at progressive rates, with higher incomes facing higher tax percentages.

Step 1: Determining Taxable Income

Taxable income is the starting point for federal income tax calculations. It represents the amount of income that is subject to taxation after various deductions and adjustments have been applied. To determine taxable income, taxpayers must first calculate their gross income, which includes wages, salaries, interest, dividends, and other sources of income.

From the gross income, taxpayers can deduct certain expenses and adjustments, such as business expenses, contributions to retirement accounts, and certain personal deductions. These deductions reduce the gross income to arrive at the taxable income, which is the basis for calculating federal income tax liability.

Step 2: Applying Tax Rates and Brackets

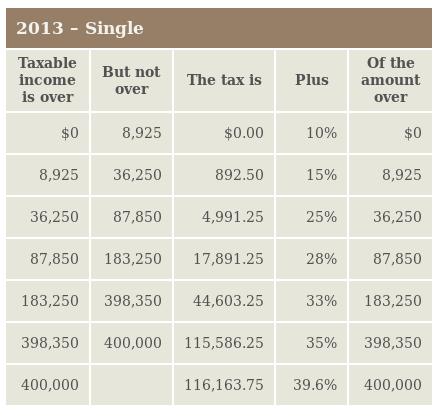

Once taxable income is established, the applicable tax rates and brackets come into play. The federal income tax system utilizes a progressive tax structure, which means that as taxable income increases, the tax rate applied to that income also increases. The tax rates and brackets are determined by Congress and are subject to periodic updates.

For example, as of the 2023 tax year, the federal income tax brackets and corresponding tax rates for single filers are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 10% | $0 - $10,275 |

| 12% | $10,276 - $41,775 |

| 22% | $41,776 - $89,075 |

| 24% | $89,076 - $170,050 |

| 32% | $170,051 - $215,950 |

| 35% | $215,951 - $539,900 |

| 37% | $539,901 and above |

Taxpayers calculate their federal income tax liability by applying the appropriate tax rate to each bracket of their taxable income. This process, known as tax bracket layering, ensures that income is taxed progressively, with higher incomes facing higher tax percentages.

Step 3: Applying Deductions and Credits

After determining the initial tax liability using the applicable tax rates and brackets, taxpayers can further reduce their tax burden by claiming deductions and credits. Deductions and credits are designed to provide tax relief for specific expenses, charitable contributions, or personal circumstances.

Deductions reduce the taxable income, thus lowering the tax liability. Common deductions include the standard deduction, which is a fixed amount that taxpayers can claim, or itemized deductions, which allow taxpayers to deduct specific expenses such as medical costs, state and local taxes, and mortgage interest.

Credits, on the other hand, provide a dollar-for-dollar reduction in the tax liability. Some common credits include the Child Tax Credit, which provides a credit for each qualifying child, and the Earned Income Tax Credit, which is available to low- and moderate-income workers.

The Impact and Significance of Federal Income Tax

Federal income tax is a vital component of the U.S. tax system, serving as a primary source of revenue for the federal government. The funds generated through this tax support a wide range of public services and programs, including national defense, social welfare programs, infrastructure development, and scientific research.

The progressive nature of federal income tax ensures that those with higher incomes contribute a larger share of their earnings to support government operations. This structure promotes economic fairness and helps to address income inequality by redistributing wealth to fund essential public services that benefit all Americans.

Moreover, federal income tax plays a critical role in stimulating the economy. By providing tax incentives and credits, the government can encourage investment, job creation, and economic growth. Additionally, the tax system promotes financial responsibility and discourages excessive speculation or risk-taking by imposing penalties on certain financial activities.

Frequently Asked Questions

How often are federal income tax rates and brackets updated?

+Federal income tax rates and brackets are typically updated annually to account for inflation and economic changes. These updates are determined by Congress and are announced before the start of each tax year.

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between a tax deduction and a tax credit?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>A tax deduction reduces the amount of taxable income, thus lowering the tax liability. In contrast, a tax credit provides a direct reduction in the amount of tax owed, dollar for dollar. Deductions are subtracted from taxable income, while credits are subtracted from the tax liability itself.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax-free income sources in the United States?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Certain types of income are not subject to federal income tax. These include municipal bond interest, certain types of retirement plan distributions, and some foreign earned income. However, it's important to note that state and local taxes may still apply to these income sources.</p>

</div>

</div>

</div>