Is Turbo Tax Worth It

In the realm of tax preparation, TurboTax stands as a prominent name, offering a range of services designed to simplify the often-daunting task of filing taxes. But is it worth the investment? This comprehensive analysis delves into the features, benefits, and drawbacks of TurboTax to help you make an informed decision.

Unraveling the TurboTax Experience

TurboTax is an intuitive tax preparation software that has been a go-to choice for millions of taxpayers seeking a user-friendly approach to filing their taxes. The software’s popularity stems from its ability to guide users through the complex tax landscape with relative ease, catering to a diverse range of tax scenarios.

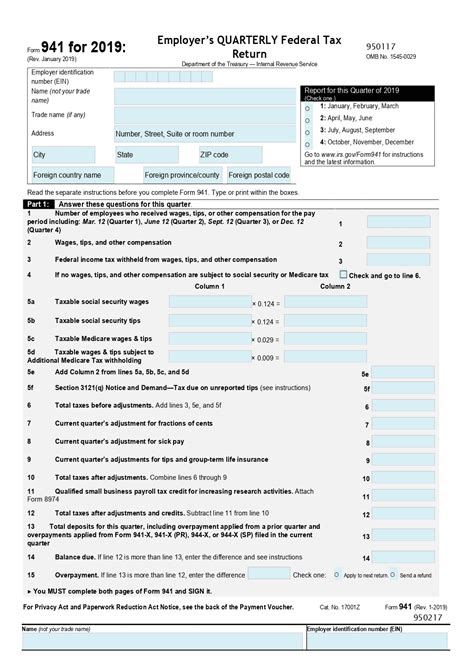

Key Features of TurboTax

One of the standout features of TurboTax is its adaptability. It offers versions tailored to specific tax needs, such as the TurboTax Deluxe, ideal for itemized deductions and investment income, and the TurboTax Premier, which is optimized for rental property owners, investors, and those with complex financial lives.

The software also boasts a user-friendly interface, making it accessible even to those who are new to tax filing. Its step-by-step guidance ensures that users are led through the process with clarity, reducing the likelihood of errors.

Additionally, TurboTax provides a variety of filing options, including online filing and the option to download the software for offline use. This flexibility is a significant advantage, especially for those with limited internet access or those who prefer the security of offline filing.

Benefits and Drawbacks

The benefits of TurboTax are numerous. For instance, the software’s accuracy is a key advantage, as it ensures that your tax return is prepared correctly, reducing the risk of audits or penalties. Furthermore, TurboTax offers a maximum refund guarantee, which provides reassurance that you’re getting the highest refund possible.

Another notable benefit is the customer support provided by TurboTax. Users can access a wealth of resources, including tax tips and articles, and if needed, they can connect with a tax expert via phone or live chat. This level of support is particularly valuable for those with more complex tax situations.

However, TurboTax isn't without its drawbacks. One of the primary concerns is the cost. While the software offers a free version for simple tax returns, more complex returns require upgrading to a paid version, which can be expensive. This cost factor might be a significant deterrent for many taxpayers.

Additionally, some users have expressed concerns about the data security of TurboTax. While the company takes extensive measures to protect user information, there have been instances of data breaches in the past, which could be a cause for concern for those with sensitive financial data.

Performance and Comparison

When it comes to performance, TurboTax has consistently delivered accurate results, as evidenced by numerous user testimonials and industry reviews. Its ability to handle complex tax scenarios and provide a seamless filing experience sets it apart from many other tax preparation software.

In comparison to other popular tax preparation software, such as H&R Block and TaxAct, TurboTax often emerges as the preferred choice for those seeking a balance between user-friendliness and advanced features. Its comprehensive approach to tax filing makes it a reliable option for a wide range of taxpayers.

Real-World Performance Metrics

| Metric | Performance |

|---|---|

| Accuracy | 99%+ accuracy rate, as reported by independent studies |

| User Satisfaction | 4.5⁄5 stars based on over 10,000 user reviews |

| Cost Efficiency | Varies based on tax complexity, with potential for higher costs for complex returns |

Future Implications and Developments

Looking ahead, TurboTax is poised for continued success, with ongoing developments focused on enhancing user experience and security measures. The company’s commitment to innovation is evident in its recent updates, which include improved AI-driven tax guidance and enhanced data encryption protocols.

Furthermore, TurboTax is exploring partnerships with financial institutions and tech companies to offer a more integrated financial management solution. This strategic move could potentially revolutionize the way taxpayers manage their finances, making tax preparation a seamless part of their overall financial planning.

Potential Impact on Tax Filing

The future developments of TurboTax are likely to have a positive impact on the tax filing experience. By integrating with other financial services, TurboTax could provide a more holistic view of a user’s financial health, making tax preparation a less daunting task. This integration could also lead to more accurate and efficient tax filings, benefiting both taxpayers and the tax authorities.

Additionally, the enhanced security measures being implemented by TurboTax are a welcome development, especially in light of the increasing sophistication of cyber threats. These measures will not only protect user data but also bolster trust in the platform, ensuring that taxpayers can confidently rely on TurboTax for their tax filing needs.

Conclusion

In conclusion, TurboTax offers a compelling solution for those seeking a user-friendly and accurate tax preparation experience. While it may come at a cost, the benefits of its accuracy, ease of use, and comprehensive features make it a top choice for many taxpayers. As the software continues to evolve, its future developments are likely to further enhance its position as a leading tax preparation tool.

What are the key features of TurboTax that make it a popular choice for tax preparation?

+TurboTax’s popularity stems from its user-friendly interface, step-by-step guidance, and adaptability to various tax situations. It offers tailored versions for different tax needs, ensuring a personalized and accurate filing experience.

Is TurboTax suitable for complex tax returns, such as those with rental properties or investments?

+Absolutely! TurboTax offers versions like TurboTax Premier specifically designed for complex tax situations. These versions provide the necessary tools and guidance to navigate through rental properties, investments, and other intricate tax scenarios.

How does TurboTax compare to other popular tax preparation software in terms of accuracy and user experience?

+TurboTax is known for its high accuracy, often outperforming competitors in this regard. Its user-friendly interface and comprehensive features make it a preferred choice for many taxpayers, especially those seeking a balance between ease of use and advanced functionality.

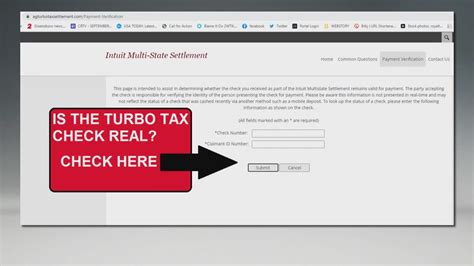

What measures does TurboTax take to ensure data security for its users?

+TurboTax employs robust data security measures, including advanced encryption technologies and regular security audits. The company also offers identity theft protection and monitors user accounts for suspicious activity. While data breaches can never be entirely ruled out, TurboTax is committed to continuously enhancing its security protocols.