Sales Tax On Cars In Illinois

Understanding the intricacies of sales tax is essential, especially when it comes to significant purchases like vehicles. Illinois, with its diverse landscape and vibrant cities, offers a unique set of regulations when it comes to taxing automotive sales. This article delves into the specifics of sales tax on cars in Illinois, providing an in-depth analysis of the rates, exemptions, and processes involved.

The Landscape of Sales Tax in Illinois

Illinois operates under a state-wide sales tax system, which is applied to a wide range of goods and services. When it comes to vehicles, the sales tax rate is not uniform across the state. Instead, it is a combination of both state and local taxes, resulting in varying rates depending on the specific location of the sale.

The state sales tax rate in Illinois stands at 6.25%, which serves as the base rate for all sales. However, this is just the beginning of the story. Local governments, including municipalities and counties, are authorized to impose additional taxes, known as local option taxes, on top of the state rate. These local taxes can vary significantly, with some areas levying no additional tax while others impose a rate as high as 3.75%.

| Tax Rate Category | Tax Rate |

|---|---|

| State Sales Tax | 6.25% |

| Maximum Local Option Tax | 3.75% |

| Potential Total Tax | 10% |

This variation in local taxes can lead to a wide range of effective tax rates across the state. For instance, in the city of Chicago, the combined state and local sales tax rate is 10.25%, making it one of the highest rates in the state. In contrast, areas like Cook County have a total sales tax rate of 7%, providing a more affordable purchasing environment.

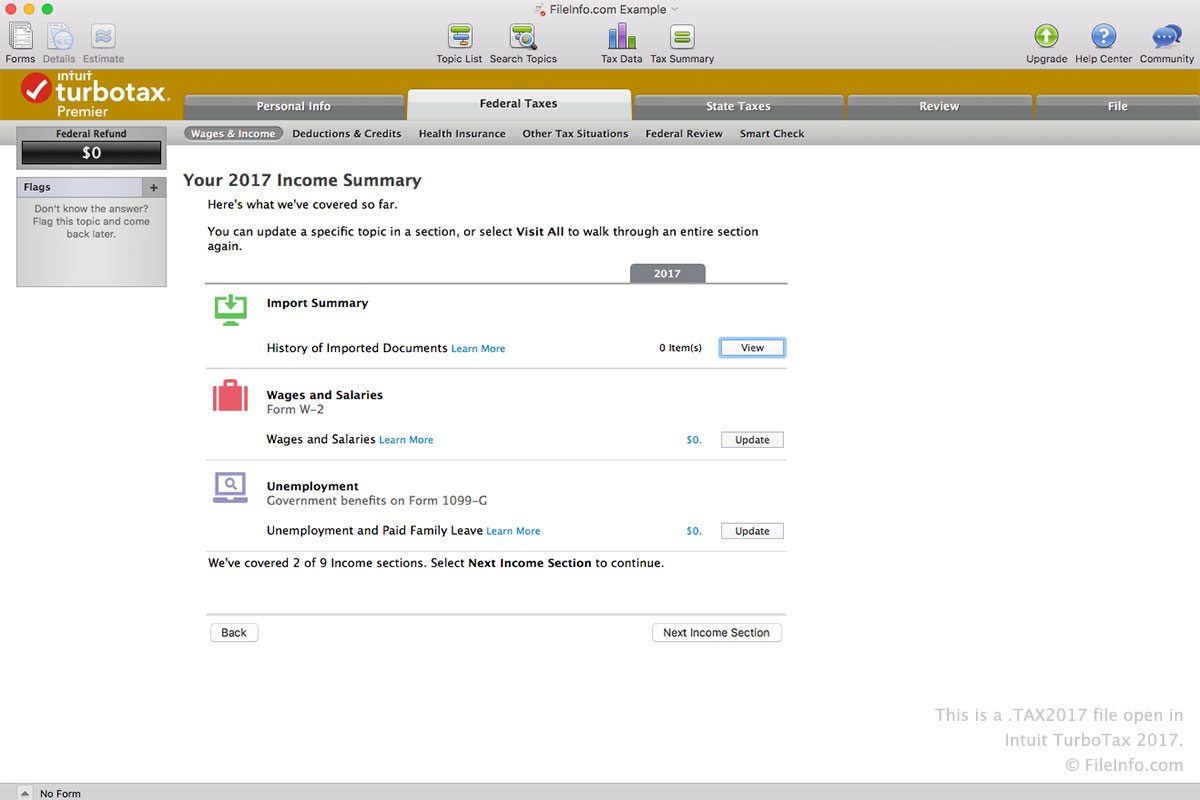

The Process of Calculating Sales Tax on Vehicles

Calculating the sales tax on a vehicle in Illinois involves a multi-step process. Firstly, the base price of the vehicle is determined, which serves as the starting point for tax calculations. This price includes the manufacturer’s suggested retail price (MSRP), any additional features or options, and any applicable fees such as destination charges.

Once the base price is established, the applicable sales tax rate is applied. As mentioned earlier, this rate is a combination of the state and local taxes, which can vary depending on the location of the sale. The tax is calculated as a percentage of the base price, and the resulting amount is added to the total cost of the vehicle.

For instance, consider a scenario where a car with a base price of $30,000 is purchased in an area with a combined sales tax rate of 8%. The tax amount would be calculated as follows: $30,000 x 0.08 = $2,400. Thus, the total cost of the vehicle, including tax, would be $32,400.

Trade-In Vehicles and Tax Calculations

When a vehicle is traded in as part of the purchase of a new car, the tax calculation process becomes slightly more complex. In Illinois, the trade-in value is subtracted from the base price of the new vehicle before applying the sales tax. This ensures that tax is only applied to the net purchase price, providing a financial benefit to those who choose to trade in their old vehicles.

To illustrate this, consider a situation where a consumer trades in a vehicle with a value of $5,000 towards the purchase of a new car with a base price of $35,000. The net purchase price would be $30,000, and the sales tax would be calculated on this amount. If the applicable tax rate is 8%, the tax amount would be $2,400, resulting in a total cost of $32,400 for the new vehicle.

Exemptions and Special Considerations

Illinois offers certain exemptions and special considerations when it comes to sales tax on vehicles. One notable exemption is for those who qualify for the Illinois Veteran’s Exemption. This exemption applies to veterans who meet specific criteria and can result in a reduced or eliminated sales tax liability.

Additionally, Illinois provides a Motor Vehicle Tax Exemption for Individuals with Disabilities. This exemption applies to individuals with certain disabilities who use their vehicles for transportation purposes. To qualify, individuals must meet specific disability criteria and provide appropriate documentation.

It's important to note that while these exemptions can provide significant savings, they are not applicable to all vehicle purchases. Each exemption has its own set of eligibility criteria and documentation requirements, which must be carefully reviewed and met to ensure compliance.

Lease Vehicles and Sales Tax

When leasing a vehicle in Illinois, the sales tax is calculated differently compared to purchasing. Instead of applying the tax to the entire value of the vehicle, it is typically calculated as a percentage of the monthly lease payment. This means that the sales tax is spread out over the duration of the lease, resulting in a lower upfront cost.

For instance, if a vehicle is leased with a monthly payment of $500 and the applicable sales tax rate is 8%, the tax amount would be $40 per month. Over the course of a 36-month lease, the total sales tax paid would be $1,440, which is added to the overall cost of the lease.

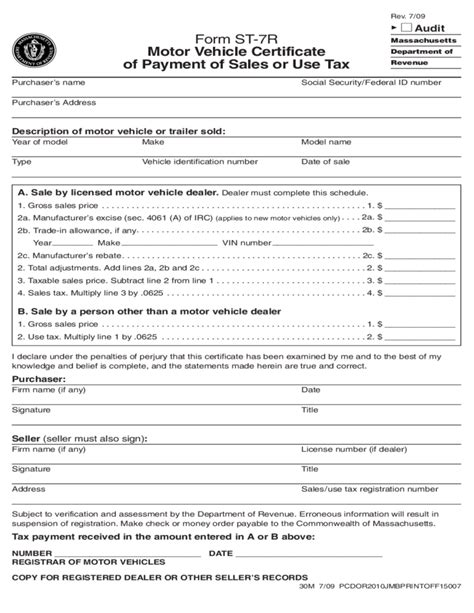

Sales Tax and Vehicle Registration

In Illinois, the process of registering a vehicle involves the payment of various fees and taxes. While the sales tax is one component of this process, there are other charges that come into play. These include title fees, registration fees, and in some cases, additional surcharges or emissions fees.

The registration process typically involves submitting the necessary documentation, such as the vehicle's title and proof of insurance, to the Illinois Secretary of State's office. The specific fees and taxes applicable to each vehicle will depend on its make, model, and the county in which it is registered.

Online Vehicle Sales and Tax

With the rise of online marketplaces, the purchase of vehicles through these platforms has become increasingly common. When it comes to sales tax on online vehicle purchases in Illinois, the process is largely the same as traditional in-person purchases. The applicable sales tax rate is determined based on the location of the buyer, and the tax is calculated as a percentage of the vehicle’s base price.

However, there are some unique considerations when it comes to online sales. For instance, if the vehicle is purchased from a private seller located in a different state, the buyer may be required to pay use tax on the vehicle. This tax is similar to sales tax but is applied when a purchase is made in one state and the item is used in another.

The Future of Sales Tax on Vehicles in Illinois

As technology and purchasing habits evolve, the landscape of sales tax on vehicles is likely to undergo changes. One potential development is the increased adoption of electric vehicles (EVs) and the associated infrastructure. Illinois, like many other states, offers incentives and tax credits for the purchase of EVs, which could lead to a shift in the tax structure for these vehicles.

Additionally, with the growing popularity of ride-sharing and subscription-based vehicle services, the concept of vehicle ownership may evolve. This could impact the sales tax system, potentially leading to new regulations and tax structures to accommodate these changing dynamics.

Furthermore, advancements in technology may lead to more efficient and accurate tax collection methods. For instance, the use of digital platforms and data analytics could streamline the tax calculation process, ensuring compliance and reducing the administrative burden on both consumers and businesses.

What is the current sales tax rate for vehicles in Illinois?

+

The current sales tax rate for vehicles in Illinois is a combination of state and local taxes. The state sales tax rate is 6.25%, and local governments can impose additional taxes, resulting in varying rates across the state. The maximum combined rate can reach up to 10% in some areas.

Are there any exemptions or special considerations for sales tax on vehicles in Illinois?

+

Yes, Illinois offers certain exemptions and special considerations. These include the Illinois Veteran’s Exemption and the Motor Vehicle Tax Exemption for Individuals with Disabilities. Each exemption has specific eligibility criteria and documentation requirements.

How is sales tax calculated on leased vehicles in Illinois?

+

Sales tax on leased vehicles in Illinois is typically calculated as a percentage of the monthly lease payment. This means the tax is spread out over the duration of the lease, resulting in a lower upfront cost compared to purchasing.

What are the potential future developments in sales tax on vehicles in Illinois?

+

Potential future developments include changes to accommodate the increased adoption of electric vehicles and evolving vehicle ownership models, such as ride-sharing and subscription services. Additionally, advancements in technology may lead to more efficient tax collection methods.