Realtor Tax Deductions

Maximizing tax deductions is a critical aspect of real estate investing, and for realtors, it's an essential strategy to enhance their bottom line and overall financial success. In the dynamic world of real estate, understanding and utilizing the various tax deductions available can significantly impact a realtor's financial health and long-term prosperity. This article delves into the intricate world of realtor tax deductions, offering a comprehensive guide to help professionals in the industry navigate the complexities and optimize their tax strategies.

Navigating the Complex Landscape of Realtor Tax Deductions

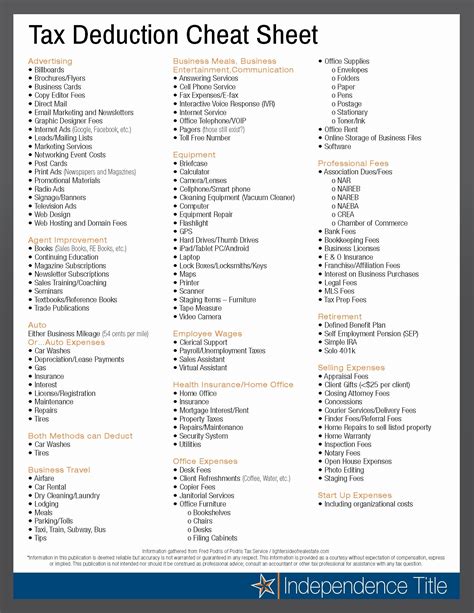

The realm of tax deductions for realtors is intricate and multifaceted, encompassing a wide range of expenses and unique circumstances. From home office deductions to vehicle mileage, understanding what qualifies and how to maximize these deductions is crucial for any realtor aiming to minimize their tax liabilities and maximize their returns. This section provides an in-depth exploration of the key areas and considerations in this complex landscape.

Home Office Deductions: Unlocking the Benefits

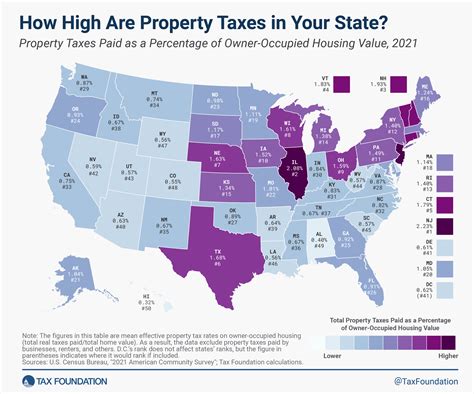

One of the most significant tax advantages for realtors is the home office deduction. This deduction allows realtors who work from home to deduct a portion of their living expenses, such as mortgage interest, property taxes, and utilities, based on the percentage of their home used exclusively for business purposes. For instance, if a realtor designates a specific room or area as their office, they can claim a percentage of their overall home expenses as a business deduction.

| Home Office Expense | Deduction Potential |

|---|---|

| Mortgage Interest | Up to the percentage of the home used for business |

| Property Taxes | Proportional to the business use of the home |

| Utilities | Calculated based on square footage or room usage |

However, it's important to note that the home office deduction is subject to certain criteria and limitations. The IRS requires that the home office be the primary place of business and that it be used exclusively and regularly for business purposes. This means that a spare bedroom converted into an office could qualify, but a kitchen table used occasionally for paperwork may not meet the criteria.

Vehicle Mileage and Travel Expenses: Maximizing Deductions on the Move

As realtors often spend a significant amount of time on the road, showing properties and meeting clients, vehicle mileage and travel expenses are key areas for potential tax deductions. The IRS allows realtors to deduct a standard mileage rate for business-related travel, which covers expenses such as gas, maintenance, and depreciation.

For the tax year 2023, the standard mileage rate is set at $0.585 per mile for business use of a vehicle. This rate is designed to simplify the process of claiming vehicle expenses, as it includes all the associated costs in a single deduction. To claim this deduction, realtors must keep accurate records of the miles driven for business purposes, ensuring they can substantiate their claims.

| Vehicle Mileage Deduction | 2023 Rate |

|---|---|

| Standard Mileage Rate | $0.585 per mile |

In addition to vehicle mileage, realtors can also deduct other travel expenses when they are away from home for business purposes. This includes costs for meals, lodging, and transportation. It's important to note that these expenses must be primarily related to business and not personal in nature. For instance, a realtor attending a real estate conference in another city could deduct the cost of their hotel stay and meals during the conference.

Client Entertainment and Business Expenses: Navigating the Deduction Landscape

Client entertainment and business expenses are another critical area for realtors to consider when it comes to tax deductions. These expenses can include meals with clients, client gifts, and attendance at networking events or industry conferences. While these expenses can provide valuable opportunities for business development and client relationships, they are subject to specific rules and limitations when it comes to deductions.

The IRS allows a 50% deduction for expenses related to business meals and entertainment. This means that if a realtor takes a client out for a business dinner, they can deduct 50% of the total cost as a business expense. However, it's crucial to maintain accurate records of these expenses, including the date, location, business purpose, and the people involved. Additionally, the IRS requires that the realtor must be present during the entertainment activity to qualify for the deduction.

| Client Entertainment Deduction | Limitations |

|---|---|

| 50% deduction for business meals and entertainment | Must be directly related to business and the realtor must be present |

When it comes to client gifts, the rules are a bit more nuanced. The IRS allows realtors to deduct up to $25 per person per year for business gifts. This means that if a realtor purchases a $50 gift for a client, they can only deduct $25 as a business expense. However, if the realtor purchases multiple gifts for the same client throughout the year, each gift must be valued at $25 or less to qualify for the deduction.

Educational and Professional Development Expenses: Investing in Knowledge

Staying current and enhancing one’s professional skills is essential in the real estate industry, and the IRS recognizes this by allowing realtors to deduct expenses related to educational and professional development. This can include the cost of seminars, conferences, books, and other educational materials that are directly related to their real estate profession.

For instance, if a realtor attends a real estate investment seminar to learn about new market trends and strategies, the cost of the seminar can be deducted as a business expense. Similarly, if a realtor purchases a series of real estate investment books to stay informed about the latest industry developments, these costs can also be claimed as deductions.

| Educational Expense Deduction | Eligible Costs |

|---|---|

| Seminars and Conferences | Registration fees, travel expenses, and accommodation costs directly related to the event |

| Books and Educational Materials | Cost of books, subscriptions, and other resources used for professional development |

It's important to note that the deduction for educational expenses is not limited to formal classroom settings. Realtors can also deduct expenses for online courses, webinars, and other forms of self-study as long as they can demonstrate a clear connection to their real estate profession.

Strategies for Maximizing Realtor Tax Deductions

With a comprehensive understanding of the various tax deductions available to realtors, the next step is to develop effective strategies to maximize these deductions and minimize tax liabilities. This section provides practical tips and insights to help realtors navigate the complex world of tax deductions with confidence and ensure they are taking full advantage of the opportunities available to them.

Accurate Record-Keeping: The Foundation of Successful Tax Deductions

Maintaining meticulous records is the cornerstone of successful tax deductions for realtors. Whether it’s tracking mileage, saving receipts for expenses, or documenting the business purpose of client entertainment, accurate record-keeping is essential to substantiate deductions and avoid potential audits. Here are some key strategies for effective record-keeping:

- Utilize Mileage Tracking Apps: There are numerous apps available that can help realtors track their business mileage accurately. These apps can automatically calculate mileage, provide maps of routes traveled, and generate reports for tax purposes.

- Scan and Save Receipts: Instead of relying on physical receipts, consider scanning and storing them digitally. This ensures that important documentation is always accessible and reduces the risk of losing key records.

- Document Business Purpose: For expenses like client entertainment and business travel, it's crucial to document the business purpose and nature of the expense. This can be done through detailed notes, calendars, or expense tracking software that allows for adding notes to each transaction.

- Separate Business and Personal Expenses: To avoid confusion and ensure accurate deductions, it's best practice to keep business and personal expenses separate. This can be achieved by using separate credit cards or bank accounts for business transactions.

Leveraging Technology for Efficient Expense Tracking

In today’s digital age, there are numerous tools and technologies that can simplify the process of tracking and managing expenses for realtors. From expense tracking apps to accounting software, these technologies can automate much of the record-keeping process, saving time and reducing the risk of errors.

Expense tracking apps, for instance, can help realtors record and categorize expenses on the go. Many of these apps allow for taking photos of receipts, which are then converted into digital records. This not only saves physical space but also ensures that expenses are recorded promptly, reducing the risk of forgetting or losing important documentation.

Accounting software, on the other hand, can provide a more comprehensive solution for managing business finances. These platforms often offer features like automated expense tracking, tax calculation, and reporting, making it easier for realtors to stay on top of their financial obligations and deductions.

Working with a Tax Professional: Navigating Complex Tax Scenarios

While many tax deductions for realtors are straightforward, there are often complex scenarios that require expert guidance. This is where working with a tax professional can be invaluable. A tax professional with expertise in real estate can provide tailored advice and ensure that realtors are taking full advantage of all available deductions while remaining compliant with tax laws.

Tax professionals can help realtors navigate complex issues such as home office deductions, especially in cases where the primary place of business is not a dedicated office space. They can also provide guidance on maximizing deductions for unique expenses, such as those related to property management or investments. Additionally, tax professionals can offer insights into potential tax savings strategies, such as utilizing retirement accounts or taking advantage of tax credits.

Staying Informed: Keeping Up with Tax Law Changes

The tax landscape is constantly evolving, and it’s crucial for realtors to stay informed about any changes that could impact their tax deductions. This includes keeping up with tax law updates, as well as being aware of new tax strategies and opportunities that may arise.

One way to stay informed is to subscribe to reputable tax resources and newsletters that provide regular updates on tax law changes. Additionally, attending tax workshops or webinars specifically tailored for real estate professionals can be an effective way to stay ahead of the curve and learn about the latest tax strategies. Finally, networking with other realtors and industry professionals can provide valuable insights and tips on maximizing tax deductions.

The Future of Realtor Tax Deductions: Implications and Opportunities

As the real estate industry continues to evolve, so too will the landscape of tax deductions for realtors. Understanding the potential implications and opportunities that may arise in the future is crucial for professionals in the industry to stay ahead and maximize their financial potential. This section explores some of the key trends and developments that could shape the future of realtor tax deductions.

Emerging Technologies and Their Impact on Tax Deductions

The rapid advancement of technology is transforming many aspects of the real estate industry, and tax deductions are no exception. As realtors increasingly adopt digital tools and platforms for their business operations, new opportunities and challenges may arise in the realm of tax deductions.

For instance, the use of virtual reality (VR) in real estate showings and tours could potentially impact deductions for travel expenses. If VR technology becomes widely adopted and reduces the need for physical showings, this could lead to a decrease in travel-related deductions for realtors. However, it could also open up new opportunities for deductions related to the cost of VR equipment and software.

Similarly, the rise of online transaction platforms and digital documentation could simplify the process of tracking and substantiating expenses, making it easier for realtors to maximize their deductions. On the other hand, it may also lead to increased scrutiny and expectations from the IRS for digital records, requiring realtors to maintain even more rigorous documentation practices.

Shifting Market Trends and Their Tax Implications

Market trends in the real estate industry can also have a significant impact on the types of tax deductions available to realtors. As the industry adapts to changing consumer preferences and economic conditions, the nature of real estate transactions and business operations may shift, affecting the types of expenses that realtors incur and, consequently, the deductions they can claim.

For example, if the trend towards remote work and digital nomadism continues to grow, it could impact the home office deduction for realtors. As more clients and colleagues work remotely, realtors may find themselves spending less time in traditional office spaces and more time working from home. This could lead to an increase in the number of realtors claiming home office deductions and potentially affect the criteria and limitations of this deduction.

Similarly, shifts in market demand and pricing could impact the value of certain deductions. For instance, if the cost of living increases significantly in a particular region, it could lead to higher deductions for realtors based in that area, as their home office expenses would be higher. On the other hand, if market conditions lead to a decrease in travel-related expenses, this could reduce the impact of vehicle mileage and travel expense deductions.

Policy Changes and Their Influence on Realtor Tax Strategies

Changes in tax policy and legislation can have a profound impact on the tax strategies and deductions available to realtors. Whether it’s modifications to existing tax laws or the introduction of new regulations, these changes can significantly affect the financial landscape for real estate professionals.

One example is the Tax Cuts and Jobs Act (TCJA) of 2017, which brought about significant changes to the tax code, including modifications to the deduction for mortgage interest. This change impacted realtors who were also homeowners, as it limited the deduction for mortgage interest on new loans to the first $750,000 of mortgage debt. This policy change had a direct impact on the financial strategies and deductions available to realtors, especially those who were considering purchasing a new home or refinancing their existing mortgage.

Similarly, changes in tax policy regarding business expenses could impact the deductions available to realtors for expenses like client entertainment and travel. If the rules surrounding these deductions become more restrictive, realtors may need to adapt their strategies to maintain their financial health. On the other hand, if policy changes lead to an expansion of deductions or the introduction of new tax credits, this could present new opportunities for realtors to maximize their financial potential.

FAQ

What are the key tax deductions available to realtors?

+Realtors have a range of tax deductions available to them, including home office deductions, vehicle mileage deductions, client entertainment expenses, and educational expenses. Each of these deductions has specific criteria and limitations that must be met in order to claim them.

How do I calculate my home office deduction as a realtor?

+To calculate your home office deduction, you need to determine the percentage