Virginia County Property Tax

Welcome to this comprehensive guide on understanding and managing Virginia County Property Taxes, a crucial aspect of property ownership in the state. As a property owner, it's essential to grasp the intricacies of the property tax system to ensure timely payments and navigate potential challenges effectively. This article aims to provide an in-depth analysis, offering valuable insights and practical tips tailored to Virginia's unique tax landscape.

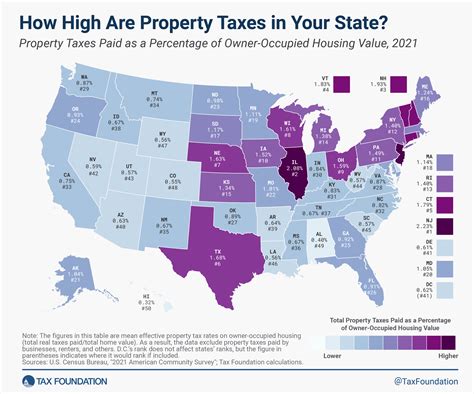

Unraveling the Virginia Property Tax Landscape

Virginia’s property tax system is a complex yet well-structured framework that varies across its 95 counties and 38 independent cities. The state’s diverse geography, ranging from the coastal plains to the Blue Ridge Mountains, influences property values and, consequently, the tax assessments.

The property tax is a primary source of revenue for local governments in Virginia, funding essential services like education, public safety, and infrastructure development. This revenue ensures the smooth functioning of communities and plays a pivotal role in shaping the state's economic landscape.

In the following sections, we'll delve deeper into the specifics of Virginia County Property Taxes, covering assessment processes, tax rates, payment options, and strategies to ensure compliance and financial efficiency.

Property Assessment and Valuation

The foundation of Virginia’s property tax system lies in the assessment and valuation process. Each county and city has its assessor’s office, responsible for determining the assessed value of properties within its jurisdiction.

Assessment Methods

Virginia employs various assessment methods, including the cost approach, income approach, and the most commonly used sales comparison approach. The latter compares the property in question with similar properties that have recently sold in the area, taking into account factors like location, size, and condition.

The assessment process aims to ensure fairness and equity, striving to value each property accurately based on its market worth. However, it's not uncommon for property owners to disagree with the assessed value, leading to potential appeals.

Appealing Your Assessment

If you believe your property’s assessed value is inaccurate, Virginia offers a formal appeal process. Here’s a step-by-step guide:

- Review the Assessment Notice: Upon receiving your assessment notice, carefully review the details, including the assessed value, property characteristics, and comparable sales data used in the valuation.

- Gather Evidence: Collect relevant documents and evidence to support your case. This may include recent appraisals, photos, or comparative sales data.

- File an Appeal: Contact your local assessor's office to initiate the appeal process. You'll typically need to submit a written request, outlining the reasons for your appeal and providing supporting documentation.

- Attend a Hearing: If your appeal is accepted, you'll be invited to a hearing before a board of assessment appeals or a similar body. Prepare your case and be ready to present your evidence and arguments.

- Receive a Decision: After the hearing, the assessment board will make a decision, which may result in a change to your property's assessed value.

It's crucial to act promptly, as deadlines for appeals are typically strict and vary by county.

Tax Rates and Calculations

Virginia’s property tax rates are established by local governing bodies, primarily county boards and city councils. These rates are expressed as tax rates per $100 of assessed value, which can vary significantly across the state.

| County | Tax Rate ($/100) | Effective Rate |

|---|---|---|

| Arlington County | $0.995 | 0.995% |

| Fairfax County | $1.140 | 1.140% |

| Loudoun County | $1.135 | 1.135% |

| Prince William County | $1.260 | 1.260% |

The effective tax rate is the actual percentage of a property's value that goes towards taxes. It's calculated by dividing the total tax bill by the property's assessed value.

For example, if your property in Fairfax County is assessed at $500,000 and the tax rate is $1.140 per $100, your annual tax bill would be:

Assessed Value: $500,000

Tax Rate: $1.140 per $100

Annual Tax Bill: $500,000 x $1.140 / $100 = $5,700

The effective tax rate for this property would be $5,700 / $500,000 = 1.14%.

Tax Relief Programs

Virginia offers various tax relief programs to eligible property owners, including:

- Homestead Exemption: Reduces the assessed value of your primary residence by up to $2,000.

- Land Use Assessment: Provides a reduced assessment for agricultural, horticultural, or forestry land.

- Senior Citizen Relief: Offers a reduced tax rate for homeowners aged 65 and older.

Eligibility criteria and application processes vary, so it's essential to consult your local assessor's office or a tax professional for specific details.

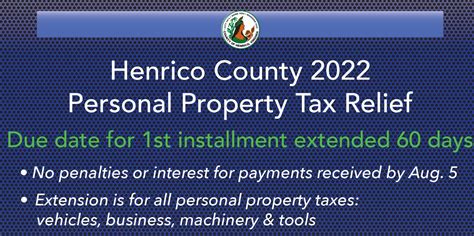

Payment Options and Due Dates

Virginia offers a range of payment options for property taxes, including online payments, direct debit, mail-in checks, and in-person payments at designated locations.

Payment Due Dates

Property tax bills are typically sent out in late summer or early fall, with a due date set for the following spring. Failure to pay by the deadline may result in penalties and interest charges.

It's crucial to note that due dates and payment options can vary by county, so staying informed about your local tax office's policies is essential.

Payment Plans and Deferrals

For property owners facing financial difficulties, Virginia offers payment plans and deferral options. These programs allow eligible taxpayers to spread their tax payments over a more extended period or defer payments under specific circumstances.

To apply for these programs, you'll need to contact your local tax office and provide documentation supporting your financial situation. Each county may have its eligibility criteria and application process, so detailed research is advisable.

Strategies for Effective Tax Management

Managing your property taxes efficiently can significantly impact your financial well-being and peace of mind. Here are some strategies to consider:

Stay Informed

Keep yourself updated on tax rates, assessment processes, and due dates specific to your county. This knowledge empowers you to plan and budget effectively.

Explore Tax Relief Options

Research and understand the tax relief programs available in your area. Applying for relevant programs can reduce your tax burden and provide much-needed financial relief.

Appeal Your Assessment

If you believe your property’s assessed value is inaccurate, don’t hesitate to appeal. A successful appeal can lead to significant savings over time.

Consider Long-Term Strategies

For those planning to own property in Virginia for the long term, consider investing in energy-efficient upgrades or improvements that may qualify for tax credits or reduce future tax liabilities.

Seek Professional Advice

Complex tax situations or unique property circumstances may warrant seeking advice from a tax professional or financial advisor. They can provide tailored guidance based on your specific needs.

Conclusion

Understanding and managing Virginia County Property Taxes is an essential aspect of responsible property ownership. By staying informed, proactive, and strategic, you can navigate the tax landscape effectively, ensuring compliance and optimizing your financial position.

FAQ

How often are property assessments conducted in Virginia?

+Property assessments in Virginia are typically conducted every year. However, some counties may conduct reassessments at different intervals, such as every two or three years. It’s best to check with your local assessor’s office for specific details.

Can I pay my property taxes online in Virginia?

+Yes, most counties in Virginia offer online payment options for property taxes. You can typically find the payment portal on your county’s official website. However, some counties may have specific requirements or deadlines for online payments, so it’s advisable to check their website or contact the tax office for detailed information.

What happens if I miss the property tax payment deadline in Virginia?

+Missing the property tax payment deadline in Virginia can result in penalties and interest charges. The exact consequences may vary by county, so it’s crucial to understand the specific policies and penalties in your area. Late payments may also impact your credit score and lead to potential legal actions, including tax liens or foreclosure.

Are there any tax breaks or exemptions available for seniors in Virginia?

+Yes, Virginia offers tax relief programs specifically for senior citizens. The Senior Citizen Real Estate Tax Relief Program provides a reduced tax rate for homeowners aged 65 and older. However, eligibility criteria and the amount of relief vary by county. It’s advisable to contact your local tax office to understand the specific requirements and benefits available in your area.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Absolutely! If you believe your property’s assessed value is incorrect, you have the right to appeal. The appeal process involves submitting a formal request to your local assessor’s office, providing evidence to support your claim, and potentially attending a hearing. It’s important to act promptly as there are specific deadlines for filing an appeal. For detailed instructions and guidelines, consult your county’s assessor’s office.