Virginia Car Sales Tax

When purchasing a vehicle in Virginia, understanding the sales tax process is crucial. The Virginia car sales tax is a significant aspect of the vehicle registration and ownership journey. It's a necessary expense that contributes to the state's revenue and is calculated based on the vehicle's value. In this comprehensive guide, we will delve into the specifics of Virginia car sales tax, providing you with all the information you need to navigate this process seamlessly.

Understanding Virginia’s Car Sales Tax

Virginia imposes a sales and use tax on the purchase of vehicles, which is a percentage of the vehicle’s sales price. This tax is applicable to both new and used vehicles, ensuring that all vehicle owners contribute to the state’s revenue. The sales tax rate varies depending on the location of the dealership or seller, with specific rates set for different counties and cities.

The Virginia Department of Motor Vehicles (DMV) plays a pivotal role in the car sales tax process. They provide guidelines and regulations to ensure compliance with the state's tax laws. The DMV also offers resources and tools to assist vehicle buyers in calculating their sales tax liability accurately.

Calculating Sales Tax: A Step-by-Step Guide

Calculating the sales tax on your vehicle purchase is a straightforward process, but it requires attention to detail. Here’s a step-by-step breakdown:

- Determine the Vehicle's Sales Price: Start by identifying the total sales price of the vehicle, including any additional fees or options. This is the figure upon which the sales tax will be calculated.

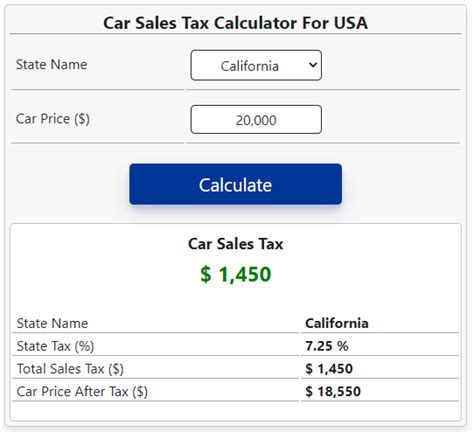

- Identify the Applicable Tax Rate: Locate the sales tax rate for the specific county or city where the dealership or seller is located. This information is readily available on the Virginia DMV website or through the dealership itself.

- Calculate the Tax Amount: Multiply the vehicle's sales price by the applicable tax rate. For instance, if the sales price is $25,000 and the tax rate is 4.3%, the tax amount would be $1,075.

- Add the Tax to the Total: Include the calculated tax amount in the overall purchase price. This final figure represents the total cost of the vehicle, including the sales tax.

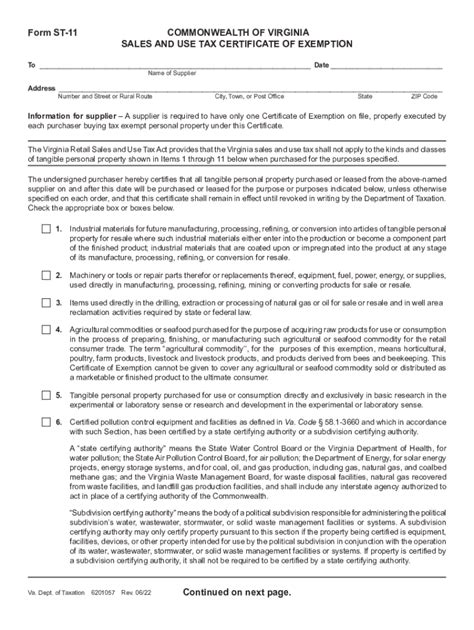

It's essential to note that Virginia offers certain tax exemptions for specific circumstances. For example, active-duty military personnel, disabled veterans, and individuals with disabilities may qualify for reduced or exempted sales tax. These exemptions require proper documentation and adherence to specific guidelines.

Vehicle Registration and Sales Tax

The Virginia car sales tax is an integral part of the vehicle registration process. When registering your vehicle with the DMV, you must provide proof of payment for the sales tax. This is typically done by presenting the sales tax receipt or invoice during the registration procedure.

Failure to pay the sales tax can result in penalties and additional fees. It's crucial to ensure that you understand the tax liability and make the necessary payments to avoid any legal complications.

Online Registration and Sales Tax Payment

Virginia offers an online registration system, making the process more convenient for vehicle owners. Through the DMV’s online portal, you can complete the registration process, including paying the sales tax, from the comfort of your home. This efficient system saves time and simplifies the entire registration journey.

The online payment system provides secure options, allowing you to use various methods, such as credit cards, e-checks, or even digital wallets. It's a modern approach to managing vehicle registration and tax obligations.

| County/City | Sales Tax Rate |

|---|---|

| Arlington County | 5.3% |

| Richmond City | 5.75% |

| Fairfax County | 4.3% |

| Norfolk City | 6.0% |

| Loudoun County | 5.0% |

Sales Tax and Used Car Purchases

When purchasing a used car in Virginia, the sales tax process remains consistent. The tax is calculated based on the vehicle’s sales price, regardless of whether it’s a new or used vehicle.

For used car purchases, it's essential to obtain a bill of sale from the seller. This document provides proof of the transaction and is necessary for the registration and sales tax process. The bill of sale should include the vehicle's details, such as make, model, year, and VIN number, along with the purchase price.

Tips for Used Car Buyers

- Research the market value of the vehicle to ensure you’re getting a fair price.

- Inspect the vehicle thoroughly and consider having it inspected by a trusted mechanic.

- Negotiate the price and understand the sales tax implications before finalizing the purchase.

- Keep all documentation, including the bill of sale and any receipts, for future reference.

Sales Tax and Online Vehicle Purchases

With the rise of online vehicle marketplaces, many Virginia residents are opting to purchase cars remotely. When buying a vehicle online, the sales tax process remains largely the same, but there are a few additional considerations.

First, it's crucial to verify the legitimacy of the online seller. Ensure that they are reputable and provide clear documentation for the vehicle's history and ownership. Second, understand the sales tax implications for out-of-state purchases. If the vehicle is purchased from a dealership in a different state, you may need to pay sales tax in that state as well as Virginia.

Online Sales Tax Considerations

- Research the sales tax laws in both Virginia and the state of the seller.

- Obtain all necessary documentation, including a bill of sale and any applicable tax forms.

- Understand the shipping and delivery process, as this may impact the sales tax calculation.

- Stay informed about any potential tax exemptions or discounts that may apply to your purchase.

Future Implications and Trends

The Virginia car sales tax system is subject to ongoing evaluation and potential changes. As the state’s economy and vehicle market evolve, so too may the tax regulations. It’s essential for vehicle buyers and sellers to stay informed about any updates or amendments to the sales tax laws.

Additionally, with the increasing popularity of electric vehicles (EVs) and alternative fuel vehicles, there may be specific tax incentives or rebates offered by the state. Keeping an eye on these developments can provide significant savings for environmentally conscious vehicle owners.

Stay Informed, Save Money

By staying updated with the latest sales tax regulations and trends, Virginia vehicle buyers can make informed decisions and potentially save money. Whether it’s understanding tax exemptions, exploring online purchasing options, or staying aware of EV incentives, knowledge is power when it comes to navigating the Virginia car sales tax landscape.

How often are sales tax rates updated in Virginia?

+Sales tax rates are typically updated annually or semi-annually, depending on the jurisdiction. It’s important to check the Virginia DMV website for the most current rates.

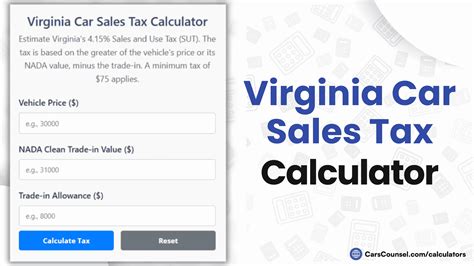

Are there any online tools to calculate sales tax?

+Yes, the Virginia DMV provides an online sales tax calculator on their website. This tool allows you to input the vehicle’s sales price and location to determine the exact tax amount.

What happens if I sell my vehicle privately in Virginia?

+If you sell your vehicle privately, you are responsible for collecting and remitting the sales tax to the Virginia Department of Taxation. This process involves completing the appropriate tax forms and providing proof of sale.