Understanding Maryland Estate Tax: What You Need to Know About Its Financial Impact

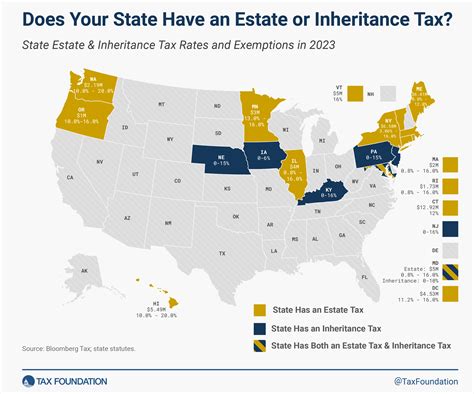

In the complex landscape of estate planning, Maryland's estate tax law occupies a significant position, often influencing decisions about asset distribution, legacy planning, and long-term financial strategy. As one of the few U.S. states with a distinct estate tax that complements federal regulations, Maryland presents unique opportunities and challenges for residents, heirs, and estate planners. Recognizing the nuances of Maryland estate tax laws—and understanding their tangible financial impact—is crucial for anyone navigating the intricacies of wealth transfer within the state. This comprehensive examination aims to decode these legal provisions, examine recent legislative shifts, and provide a strategic framework for effective estate management.

Defining Maryland Estate Tax: Scope, Application, and Key Metrics

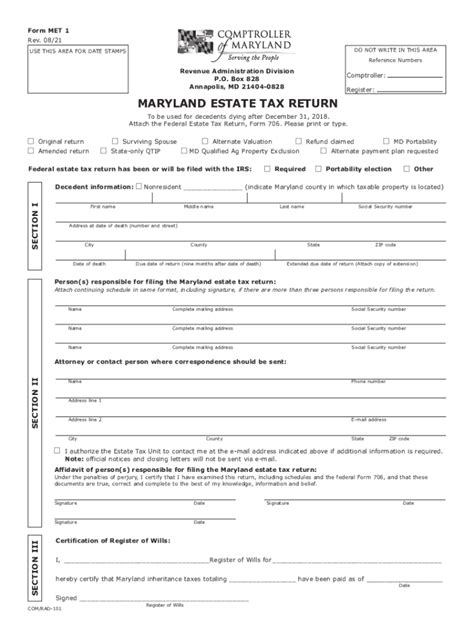

Maryland’s estate tax functions as a state-level levy on the transfer of estate assets upon death, separate from the federal estate tax. Unlike inheritance taxes, which are paid by beneficiaries and vary based on relationship and asset size, Maryland’s estate tax directly imposes a tax on the entire estate value exceeding a specific exemption threshold. As of 2023, this exemption stands at $5 million, aligning somewhat with federal estate tax thresholds to minimize dual taxation but still maintaining unique parameters that can significantly influence estate planning strategies.

Applying a progressive tax rate that can reach a maximum of 16%, Maryland’s estate tax is designed to recoup a portion of the state’s wealth transfers, thereby affecting estates much more sizable than the exemption threshold. The tax applies to gross estates, including real estate, financial accounts, and personal property, with certain exclusions and deductions in place to prevent undue burden on smaller estates or specific categories of assets.

Historical Context and Legislative Evolution

Historically, Maryland’s estate tax has evolved alongside shifting federal policies. Since its inception in the mid-20th century, the state has periodically adjusted exemption levels and tax rates, balancing revenue generation with the goal of preserving family wealth. Recent legislative modifications—primarily in 2019 and 2022—aimed to synchronize Maryland’s estate tax parameters with federal standards, often to streamline tax reporting or minimize double taxation. Yet, these changes also serve as a reminder of the dynamic legislative environment, demanding continuous review by estate professionals and taxpayers alike for timely compliance and optimization.

| Relevant Category | Substantive Data |

|---|---|

| Exemption Threshold | $5 million (2023) |

| Maximum Tax Rate | 16% |

| Asset Inclusion | Real estate, financial assets, personal property, gifts exceeding annual exclusion |

Common Challenges Posed by Maryland’s Estate Tax for Policyholders and Heirs

Despite legislative efforts to simplify, Maryland estate tax presents several hurdles for executors and beneficiaries. Chief among them is the intricate tax calculation process involving multiple asset classes and potential deductions. For instance, real estate holdings in high-value neighborhoods or family farms can trigger significant tax liabilities, often necessitating complex valuation methods and strategic planning to avoid liquidity crises.

Additionally, the state’s tax code imposes nuanced rules about portability and unused exemption carryover, which may trip up unprepared estates. Failure to properly manage these provisions can lead to unexpected tax bills or missed planning opportunities, ultimately reducing the net inheritance received by beneficiaries.

Impact of Recent Legislative Changes on Estate Planning Strategies

The revisions introduced in recent years, especially the 2022 updates, provide certain relief measures such as increased exemption thresholds and simplified filing procedures, but they also introduce complexity. Statistically, estates nearing the $5 million mark tend to face higher audit scrutiny, demanding rigorous documentation and valuation accuracy. For estate planners, these developments mean re-evaluating asset titling, trust structures, and gifting strategies to mitigate tax liabilities effectively.

| Relevant Category | Substantive Data |

|---|---|

| Exemption Adjustment | Adjusted annually for inflation, currently at $5 million |

| Tax Rate Progression | 0% up to exemption, up to 16% for amounts exceeding threshold |

| Legislative Trends | Recently increased exemption levels, introduced portability options |

Effective Strategies to Mitigate Maryland Estate Tax Liability

Given the potential financial impact of Maryland estate tax, adopting proactive strategies can make a substantial difference in preserving wealth. Here are key approaches that estate professionals and high-net-worth individuals often employ:

1. Lifetime Gifting and Annual Exclusion Utilization

Using the annual gift exclusion limit—currently $17,000 per recipient—can diminish taxable estate size while providing beneficiaries with immediate benefits. When combined with strategic lifetime gifting, this approach substantially reduces gross estate value, especially in light of Maryland’s relatively modest exemption threshold.

2. Establishing Trusts for Wealth Transfer Optimization

Irrevocable trusts, such as grantor retained annuity trusts (GRATs) and irrevocable life insurance trusts (ILITs), can shield assets from estate taxes. These structures facilitate controlled, step-up free wealth transfer, ensuring assets circumvent estate tax calculations. Trusts also allow flexibility in asset management, critical for navigating Maryland’s evolving tax landscape.

3. Portability and Spousal Asset Planning

Maximizing estate exemption portability—allowed between spouses—enables surviving spouses to inherit unused exemption amounts, effectively doubling the estate tax threshold for married couples. Careful titling of assets, combined with estate tax liability tracking, ensures optimal utilization of this provision.

4. Real Estate and Business Asset Valuation Management

High-value real estate often constitutes a significant portion of estate assets. Employing professional appraisals, conservation easements, and charitable remainder trusts can reduce apparent value for tax purposes, resulting in lower estate tax exposure.

| Strategy | Key Benefit |

|---|---|

| Lifetime Gifting | Reduces estate size before death, leveraging annual exclusions |

| Establishing Trusts | Controls wealth transfer, minimizes estate tax, and provides asset protection |

| Portability | Maximizes exemption utilization between spouses |

| Real Estate Optimization | Appraisal and easements lower taxable estate value |

Understanding the Financial Impact: Case Examples and Quantitative Analysis

To illustrate the tangible effects of Maryland estate taxes, consider two hypothetical estates: one just below and one slightly above the exemption threshold. For an estate valued at 4.8 million, the estate tax liability would be zero—assuming no other taxable considerations—leaving the estate intact for heirs. Conversely, an estate valued at 5.2 million would incur a tax of approximately 32,000, given the 16% maximum rate on the 200,000 excess.

Further, estates employing strategic gifting and trust-based solutions can avert these liabilities altogether, translating into significant preservation of wealth—sometimes in the millions of dollars—highlighting the necessity of early planning and expert advice.

| Relevant Category | Data Point |

|---|---|

| Sample Estate Value (Below Threshold) | $4.8 million |

| Estate Tax Liability | $0 |

| Sample Estate Value (Above Threshold) | $5.2 million |

| Estimated Tax Due | $32,000 (16% on $200,000) |

Conclusion: Navigating Maryland Estate Tax with Expert Precision

Maryland’s estate tax landscape, while offering certain opportunities for wealth preservation, remains intricate and frequently shifting. Its impact on estate liquidity and inheritance can be profound, especially as estate values approach or exceed exemption thresholds. Strategic planning—leveraging lifetime gifts, trusts, and taxation laws—can significantly mitigate these effects, safeguarding wealth across generations. Staying informed of legislative changes, employing thorough valuation practices, and collaborating with expert advisors form the backbone of effective estate management within Maryland’s legal framework. Mastery of these elements not only minimizes tax burdens but also ensures the realization of estate objectives with confidence and clarity.

How does Maryland estate tax differ from federal estate tax?

+Maryland estate tax applies to estates exceeding a $5 million threshold with a maximum rate of 16%, while federal estate tax has a higher exemption and a maximum rate of 40%. Maryland’s tax is imposed specifically within the state, whereas federal regulations govern nationwide estates, often requiring coordinated planning to minimize combined liabilities.

Can I avoid Maryland estate tax entirely?

+Complete avoidance is challenging but strategies such as lifetime gifting, trusts, and estate planning can substantially reduce or eliminate Maryland estate tax liability. Engaging professional estate planners ensures these methods comply with current laws and optimize results.

What is the role of trusts in minimizing estate tax impact in Maryland?

+Trusts like ILITs and GRATs allow assets to bypass probate and reduce taxable estate valuations, effectively lowering estate tax exposure. Proper trust structuring, aligned with Maryland law, is essential for maximizing benefits.

How frequently do Maryland estate tax laws change?

+Maryland law updates can occur annually, often around inflation adjustments or legislative sessions. Staying connected with estate professionals and monitoring legislative developments ensures compliance and strategic adaptability.