Indirect Tax

Welcome to an in-depth exploration of the fascinating world of indirect taxes. In today's complex economic landscape, indirect taxes play a pivotal role, impacting various aspects of our daily lives and the broader economy. This comprehensive guide aims to unravel the intricacies of indirect taxation, offering a nuanced understanding of its mechanisms, implications, and global significance.

Understanding Indirect Taxes: Definition and Types

Indirect taxes are a fundamental component of the global taxation system, distinct from their direct tax counterparts. Unlike direct taxes, which are levied directly on an individual’s income or wealth, indirect taxes are imposed on goods and services during their production, distribution, or consumption. This tax burden is then passed on to the consumer, making it an integral part of the transaction process.

Within the realm of indirect taxes, there exists a diverse array of types, each with its own unique characteristics and implications. One of the most widely recognized forms is Value Added Tax (VAT), a consumption tax levied on the added value of a product or service at each stage of its production and distribution. This tax is particularly prevalent in Europe, where it serves as a key revenue generator for governments.

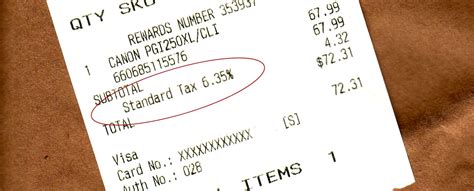

Another notable indirect tax is the Excise Duty, typically applied to specific goods like tobacco, alcohol, and fuel. These taxes are often implemented to discourage consumption of certain products, making them an effective tool in public health and environmental policies. Additionally, Sales Taxes are commonly employed, particularly in the United States, where they are levied on the sale of goods and services at the point of purchase.

Furthermore, Customs Duties play a crucial role in international trade, regulating the flow of goods across borders and generating revenue for governments. These duties are imposed on imported goods, influencing the cost and availability of products in the domestic market. Similarly, Stamp Duties are levied on legal documents, such as contracts and deeds, providing an additional revenue stream for governments.

A Comparative Analysis: Direct vs. Indirect Taxes

Understanding the distinction between direct and indirect taxes is crucial for comprehending their respective roles and impacts. Direct taxes, such as income tax and corporate tax, are imposed directly on individuals and businesses, based on their financial capacity. These taxes are often considered more progressive, as they can be tailored to an individual’s ability to pay.

In contrast, indirect taxes are levied on goods and services, making them less visible to consumers. While this can simplify the tax collection process, it also raises concerns about regressive taxation, as these taxes affect all consumers equally, regardless of their financial status. Additionally, indirect taxes can impact the cost of living and business operations, influencing economic decisions and growth.

The choice between direct and indirect taxation is a strategic one, influenced by various factors such as political ideologies, economic conditions, and societal priorities. Governments must carefully consider the implications of their tax policies to ensure fairness, efficiency, and alignment with their broader economic and social objectives.

The Impact of Indirect Taxes on Consumers and Businesses

Indirect taxes have far-reaching effects on both consumers and businesses, influencing their behaviors, decisions, and overall economic well-being. For consumers, the most immediate impact is the increase in the cost of goods and services. As indirect taxes are built into the price of products, consumers bear the ultimate burden, leading to a potential reduction in purchasing power and a shift in consumption patterns.

This impact is particularly pronounced for essential goods and services, such as food, healthcare, and education, where an increase in tax can disproportionately affect lower-income individuals. However, indirect taxes can also serve as a tool for governments to influence consumer behavior, promoting or discouraging the consumption of certain products through targeted taxation.

For businesses, indirect taxes can significantly impact their operations and profitability. These taxes are often a substantial cost component, influencing the pricing strategies and competitive positioning of firms. Additionally, the administrative burden of managing and reporting indirect taxes can be significant, particularly for smaller businesses with limited resources.

Moreover, indirect taxes can create complexities in supply chain management, as businesses must navigate different tax rates and regulations across jurisdictions. This can lead to inefficiencies, increased costs, and potential compliance challenges. As such, businesses must carefully consider the indirect tax landscape when making strategic decisions, from product pricing to expansion plans.

The Role of Technology in Indirect Tax Management

In today’s digital age, technology is playing an increasingly vital role in the management of indirect taxes. Advanced tax software and platforms are enabling businesses to automate tax calculations, streamline compliance processes, and gain valuable insights into their tax obligations. These tools can help businesses stay on top of changing tax regulations, ensuring they remain compliant and minimizing the risk of penalties.

Furthermore, technology is facilitating real-time tax reporting and analysis, allowing businesses to make more informed decisions and adapt their strategies accordingly. For instance, by integrating tax data with sales and inventory management systems, businesses can optimize their pricing and supply chain operations, improving overall efficiency and profitability.

The use of technology in indirect tax management is not only beneficial for businesses but also for tax authorities. Automated systems can enhance transparency and efficiency in tax collection, reducing the scope for errors and fraud. This, in turn, can lead to increased tax revenues for governments, enabling them to fund essential public services and infrastructure projects.

| Indirect Tax Type | Impact on Consumers | Impact on Businesses |

|---|---|---|

| Value Added Tax (VAT) | Increases the cost of goods and services, affecting purchasing power. | Impacts pricing strategies and competitive positioning. |

| Excise Duty | Influences consumption patterns, particularly for targeted goods. | Adds to production costs and influences supply chain decisions. |

| Sales Tax | Raises the cost of purchases, affecting budget planning. | Increases administrative burden and impacts cash flow. |

| Customs Duty | Increases the cost of imported goods, affecting availability and affordability. | Influences import decisions and supply chain strategies. |

Indirect Taxes in the Global Economy: A Comprehensive Overview

In the interconnected global economy, indirect taxes play a pivotal role, influencing international trade, investment, and economic growth. The diverse landscape of indirect taxes across countries creates a complex web of regulations and compliance requirements, impacting the flow of goods and services across borders.

One of the key challenges in the global context is ensuring tax compliance and preventing tax evasion. With businesses operating across multiple jurisdictions, the risk of tax avoidance and fraud is heightened. Governments and international organizations are continually working to enhance cooperation and information sharing, aiming to create a more transparent and fair tax environment.

Furthermore, the impact of indirect taxes extends beyond national borders, influencing global supply chains and trade patterns. The imposition of tariffs and duties can disrupt the flow of goods, leading to increased costs and potential trade tensions. On the other hand, the harmonization of indirect tax systems can facilitate smoother trade, promote economic integration, and foster global economic growth.

The Future of Indirect Taxes: Trends and Predictions

As we look ahead, several trends and predictions shape the future landscape of indirect taxes. The continued digitization of the economy is expected to drive further innovation in tax management, with advanced technologies playing an increasingly central role. Automation, artificial intelligence, and blockchain are poised to revolutionize tax processes, enhancing efficiency, transparency, and compliance.

Additionally, the growing emphasis on environmental sustainability is likely to influence the design and implementation of indirect taxes. Governments may explore new taxation models, such as carbon taxes or eco-friendly product levies, to promote sustainable practices and discourage environmentally harmful behaviors. This shift could significantly impact industries and consumer choices, driving a greener economy.

Moreover, the ongoing debate around tax fairness and corporate responsibility is expected to shape future tax policies. The call for a more progressive tax system, particularly in the context of indirect taxes, is gaining traction. This could lead to reforms that alleviate the burden on lower-income individuals and promote a more equitable distribution of tax obligations.

In conclusion, indirect taxes are a vital component of the global taxation system, influencing consumer behavior, business operations, and the broader economy. As we navigate the complexities of indirect taxation, a deep understanding of its mechanisms and implications is essential. By staying informed, leveraging technology, and adapting to evolving trends, individuals and businesses can successfully navigate this intricate landscape, ensuring compliance and optimizing their economic strategies.

What is the primary difference between direct and indirect taxes?

+Direct taxes, like income tax, are levied directly on individuals or entities based on their financial capacity, whereas indirect taxes are imposed on goods and services, with the burden ultimately borne by the consumer.

How do indirect taxes impact the cost of living for consumers?

+Indirect taxes increase the cost of goods and services, potentially reducing purchasing power and influencing consumption patterns, particularly for essential items.

What role does technology play in indirect tax management for businesses?

+Technology, including tax software and platforms, helps businesses automate tax calculations, streamline compliance, and gain insights for strategic decision-making.

How do indirect taxes influence global trade and economic growth?

+Indirect taxes, such as tariffs and duties, can impact the flow of goods and services across borders, influencing trade patterns and economic growth. Harmonization of tax systems can facilitate smoother trade and integration.