Does Oregon Tax Social Security

In the state of Oregon, the taxation of Social Security benefits is a topic of interest for many residents, especially retirees and those planning for their financial future. Understanding the tax implications is crucial for effective financial planning and ensuring compliance with state regulations.

Understanding Oregon’s Tax Policies on Social Security

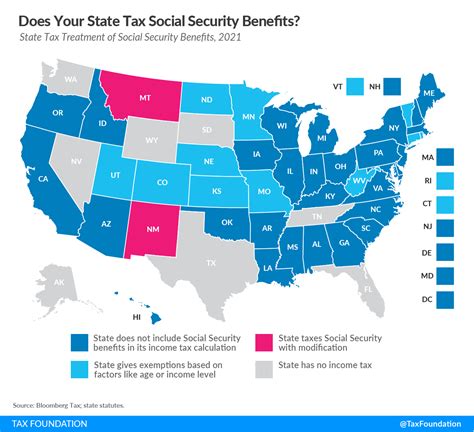

Oregon, like many other states, has specific rules regarding the taxation of Social Security benefits. While the federal government sets the guidelines for Social Security taxation, individual states have the authority to determine how these benefits are treated at the state level. This means that the tax status of Social Security income can vary from state to state.

In Oregon, the taxation of Social Security benefits is governed by the state's revenue department, which enforces the state's tax laws. The state's tax policies on Social Security aim to balance the need for revenue generation with the goal of providing financial security to retirees.

Taxation Based on Income Level

Oregon employs an income-based approach when it comes to taxing Social Security benefits. This means that the state’s tax treatment of these benefits depends on the individual’s overall income, including sources such as pensions, investments, and other retirement income.

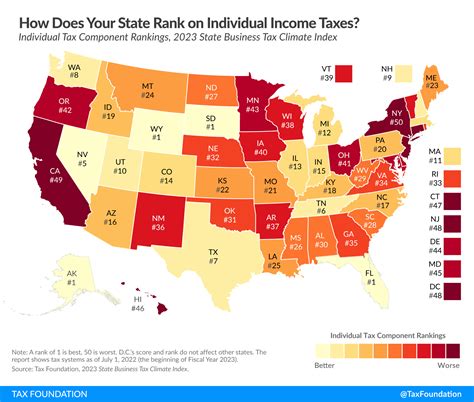

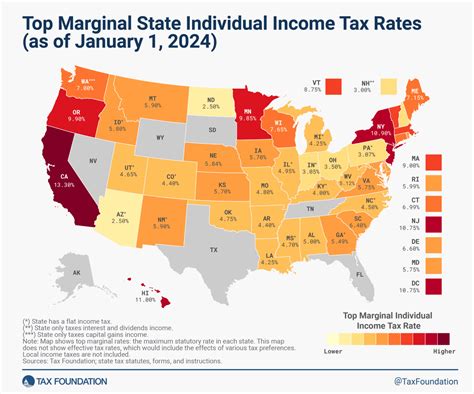

The state's income tax brackets determine whether and to what extent Social Security benefits are taxable. As of 2023, Oregon has six income tax brackets ranging from 5.0% to 9.9%, with the tax rate increasing as income rises. The specific threshold at which Social Security benefits become taxable depends on the taxpayer's filing status and total income.

| Income Tax Brackets in Oregon (2023) | Tax Rate |

|---|---|

| $0 - $4,000 | 5.0% |

| $4,001 - $7,500 | 5.5% |

| $7,501 - $12,500 | 6.0% |

| $12,501 - $25,000 | 7.0% |

| $25,001 - $125,000 | 9.0% |

| $125,001 and above | 9.9% |

For example, if a single filer has a total income of $30,000, including $15,000 in Social Security benefits, the state tax rate applied to the benefits would be 7.0% (the rate for incomes between $12,501 and $25,000). However, if their total income exceeds $125,000, the higher tax rate of 9.9% would apply to the benefits.

Exemptions and Deductions

Oregon offers certain exemptions and deductions that can reduce the tax liability on Social Security benefits. These provisions are designed to provide relief to retirees and ensure that low-income individuals are not unduly burdened by taxes on their benefits.

- Exemption for Low-Income Individuals: Oregon provides an exemption for a portion of Social Security benefits for low-income taxpayers. This exemption is based on the taxpayer's total income, including all sources, and is designed to protect those with limited income from being taxed on their benefits.

- Standard Deduction: Oregon allows taxpayers to deduct a standard amount from their taxable income, which can reduce the overall tax liability. The standard deduction amount varies based on the taxpayer's filing status.

- Medical Expense Deduction: Taxpayers can deduct qualified medical expenses that exceed a certain threshold of their adjusted gross income. This deduction can be particularly beneficial for retirees with significant medical expenses.

Special Considerations for Certain Groups

Oregon’s tax policies on Social Security benefits take into account the unique circumstances of certain groups, such as:

- Disabled Individuals: Social Security benefits received by disabled individuals may be exempt from state taxes, provided they meet specific criteria.

- Veterans: Certain Social Security benefits received by veterans may also be exempt from state taxation, depending on the nature of the benefits.

- Survivors: Social Security survivor benefits may be treated differently, especially when the surviving spouse or child has limited income.

How to Determine Taxability of Social Security Benefits in Oregon

Determining whether and how much of your Social Security benefits are taxable in Oregon requires a careful examination of your overall income and tax situation. Here’s a step-by-step guide to help you navigate this process:

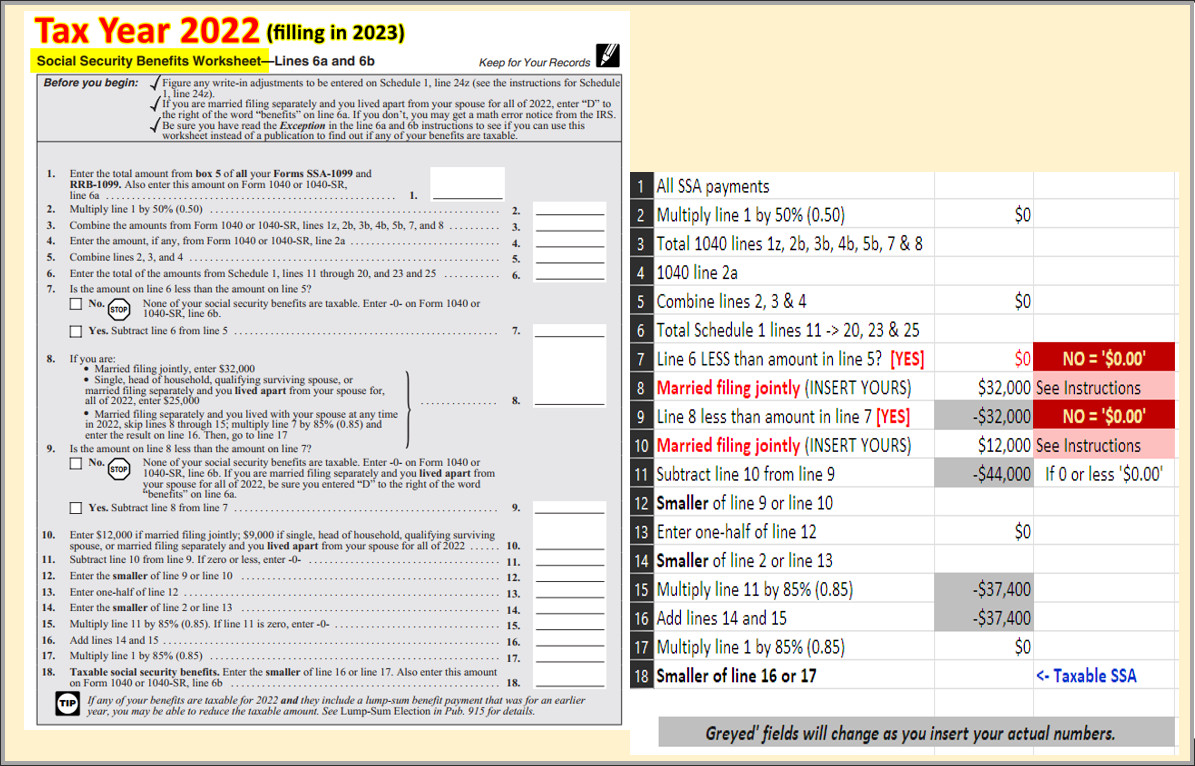

- Calculate Total Income: Start by calculating your total income for the tax year. This includes all sources of income, such as wages, pensions, investments, and Social Security benefits.

- Determine Tax Bracket: Use your total income to identify the appropriate income tax bracket in Oregon. This will help you understand the tax rate that applies to your income level.

- Assess Social Security Benefits: Determine the amount of your Social Security benefits. Keep in mind that only a portion of these benefits may be taxable, depending on your income level.

- Apply Income Thresholds: Consult Oregon's tax guidelines to understand the income thresholds at which Social Security benefits become taxable. These thresholds vary based on filing status (single, married filing jointly, etc.).

- Calculate Taxable Portion: If your total income exceeds the applicable threshold, a portion of your Social Security benefits will be taxable. Calculate the taxable amount by subtracting the exemption amount from your total benefits.

- Consider Deductions: Apply any applicable deductions, such as the standard deduction or medical expense deduction, to reduce your taxable income and, consequently, the taxable portion of your Social Security benefits.

- Compute Taxes: Using the tax rate corresponding to your income bracket, compute the taxes owed on your taxable Social Security benefits. Add this amount to the taxes owed on your other income sources.

- File and Pay Taxes: Finally, file your Oregon state tax return and pay any taxes due. Ensure you meet the state's filing deadlines to avoid penalties.

Conclusion

Oregon’s taxation of Social Security benefits is a complex but necessary process for retirees and individuals receiving these benefits. By understanding the state’s income-based approach, exemption provisions, and deductions, individuals can effectively manage their tax liabilities and ensure compliance with Oregon’s tax laws. It’s always beneficial to seek professional advice to navigate these tax considerations and make informed financial decisions.

How does Oregon determine the taxability of Social Security benefits?

+Oregon uses an income-based approach, where the taxability of Social Security benefits depends on the individual’s total income. If the total income exceeds certain thresholds, a portion of the benefits becomes taxable.

Are there any exemptions for low-income individuals in Oregon?

+Yes, Oregon provides an exemption for a portion of Social Security benefits for low-income taxpayers. This exemption is based on the taxpayer’s total income and is designed to protect those with limited income from being taxed on their benefits.

What are the income thresholds for Social Security benefit taxation in Oregon?

+The income thresholds vary based on filing status and can be found in Oregon’s tax guidelines. These thresholds determine whether and to what extent Social Security benefits are taxable.