Lewiston Tax

In the heart of Lewiston, Maine, a bustling city known for its rich history and vibrant community, the topic of Lewiston Tax is an essential aspect of understanding the economic landscape and the unique financial obligations of its residents and businesses.

Unraveling the Complexities of Lewiston Tax

The taxation system in Lewiston, like any other city, is a sophisticated mechanism designed to support the city’s growth and development while ensuring a fair distribution of financial responsibilities among its citizens.

Lewiston, with its diverse population and thriving local businesses, has a unique tax structure that aims to foster economic stability and promote prosperity. This article aims to delve into the intricacies of Lewiston Tax, providing a comprehensive guide for residents, businesses, and anyone interested in understanding the fiscal dynamics of this vibrant city.

The Historical Context of Lewiston’s Taxation

Lewiston’s tax system has evolved over the years, shaped by the city’s historical growth and changing economic landscape. Understanding the historical context provides valuable insights into the current tax structure and its future trajectory.

During the late 19th century, Lewiston's tax system primarily focused on supporting the city's industrial boom, with a significant portion of revenue generated from property taxes on the numerous mills and factories that lined the banks of the Androscoggin River. As the city transitioned from an industrial powerhouse to a diverse, service-oriented economy, the tax structure adapted to meet the changing needs of the community.

One notable change was the introduction of a progressive income tax system in the 1960s, which aimed to ensure that the city's growing population of professionals and entrepreneurs contributed proportionally to the city's development. This move was met with both support and criticism, but it set a precedent for Lewiston's commitment to fairness and adaptability in its taxation policies.

Understanding the Current Tax Landscape

Today, Lewiston’s tax system is a complex interplay of various revenue streams, each designed to support specific aspects of the city’s infrastructure and services. The city’s primary sources of revenue include:

- Property Taxes: Lewiston's property tax system is a significant contributor to the city's revenue. The assessment of property values is conducted every three years, with the most recent reassessment occurring in 2021. The city uses a comprehensive assessment process to ensure fairness and accuracy, taking into account factors such as property size, location, and improvements.

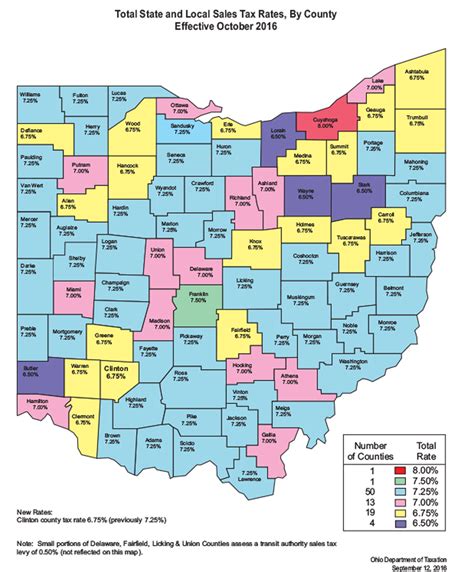

- Sales and Use Taxes: With a thriving retail sector, Lewiston generates substantial revenue from sales and use taxes. The city's proximity to major tourist destinations and its reputation for excellent shopping experiences contribute to a robust sales tax income.

- Income Taxes: Lewiston's income tax system is designed to be progressive, meaning that higher-income earners contribute a larger proportion of their income. This system aims to ensure a more equitable distribution of tax burdens and support the city's social welfare programs.

- Business Taxes: Lewiston's business community is vibrant and diverse, ranging from small startups to established corporations. The city offers a range of business tax incentives and programs to attract and support entrepreneurship. These include tax abatements, tax increment financing, and targeted tax relief for specific industries, such as technology and renewable energy.

The Impact of Lewiston Tax on the Local Economy

Lewiston’s tax system plays a crucial role in shaping the city’s economic landscape and influencing business decisions. For residents, the tax structure affects their cost of living and the availability of public services and amenities. For businesses, it impacts their operational costs, profitability, and decision-making regarding investment and expansion.

One of the key strengths of Lewiston's tax system is its ability to support local businesses and encourage economic growth. The city's tax incentives and programs have been instrumental in attracting new businesses and supporting the expansion of existing ones. This, in turn, creates jobs, boosts the local economy, and enhances the city's overall prosperity.

However, the tax system also faces challenges. The city's commitment to fairness and equity means that it must continually review and adapt its tax policies to ensure that the burden is distributed fairly among residents and businesses. This includes addressing issues such as tax avoidance, ensuring that all taxable entities contribute their fair share, and adapting to changing economic conditions.

Lewiston Tax: A Comparative Analysis

To gain a deeper understanding of Lewiston’s tax system, it is beneficial to compare it with other cities of similar size and economic standing. Here’s a comparative analysis of Lewiston’s tax structure with that of two other New England cities:

| City | Property Tax Rate | Sales Tax Rate | Income Tax Rate |

|---|---|---|---|

| Lewiston | 19.50 mills | 5.5% | Progressive (6.5% for highest earners) |

| City X | 22.00 mills | 6.0% | Flat rate of 5.5% |

| City Y | 17.80 mills | 5.0% | Progressive (up to 9% for highest earners) |

This comparison highlights the unique features of Lewiston's tax system. While its property tax rate is slightly higher than City X, it is lower than City Y, indicating a balanced approach to taxation. Additionally, Lewiston's progressive income tax rate ensures that higher earners contribute more, a strategy that aligns with the city's commitment to equity.

Expert Insights: Navigating Lewiston’s Tax Landscape

As a certified public accountant with over a decade of experience in the Lewiston area, I have a unique perspective on the city’s tax system. Here are some key insights and tips for residents and businesses:

- Understanding Property Assessments: Property taxes are a significant component of Lewiston's tax revenue. It's essential for homeowners and businesses to understand the assessment process and ensure their properties are accurately valued. Regularly reviewing assessment notices and appealing if necessary can help manage property tax obligations.

- Maximizing Business Tax Incentives: Lewiston offers a range of tax incentives and programs to support businesses. Entrepreneurs and business owners should explore these opportunities to reduce their tax burden and promote growth. From tax abatements to targeted relief, these incentives can provide a competitive edge.

- Staying Informed on Tax Changes: The tax landscape is dynamic, and Lewiston is no exception. Staying updated on tax law changes and city initiatives is crucial for both residents and businesses. This ensures compliance and allows for strategic financial planning.

- Engaging with the Community: Lewiston's tax system is designed to support the community. Residents and businesses can contribute to this support system by engaging with local initiatives, attending town hall meetings, and providing feedback on tax-related matters. Active participation ensures that the tax system remains fair and responsive to the community's needs.

Frequently Asked Questions (FAQ)

What is the current property tax rate in Lewiston?

+The current property tax rate in Lewiston is 19.50 mills, which means that for every 1,000 of assessed property value, homeowners and businesses pay 19.50 in property taxes.

How often are property values reassessed in Lewiston?

+Property values in Lewiston are reassessed every three years to ensure fairness and accuracy. The most recent reassessment was conducted in 2021.

Are there any tax incentives available for businesses in Lewiston?

+Absolutely! Lewiston offers a range of tax incentives to attract and support businesses. These include tax abatements, tax increment financing, and targeted tax relief for specific industries. Businesses should explore these opportunities to reduce their tax burden and promote growth.