San Francisco Ca Tax Collector

Welcome to the comprehensive guide on the San Francisco County Tax Collector's Office, where we will delve into the crucial role this office plays in the vibrant city of San Francisco, California. From property taxes to business taxes, we will explore the various responsibilities and services offered by this essential governmental entity. Get ready to uncover the ins and outs of tax collection and management in the heart of the Golden Gate City.

Unraveling the Role of the San Francisco County Tax Collector

The San Francisco County Tax Collector's Office, often simply referred to as the Tax Collector's Office, serves as the backbone of the city's financial administration, overseeing a multitude of tax-related tasks and services. It operates under the jurisdiction of the San Francisco County government, ensuring the efficient and transparent management of tax revenue for the city's operations and development.

Here's a glimpse into the key responsibilities and services provided by the Tax Collector's Office:

- Property Tax Administration: The office is responsible for the assessment and collection of property taxes within San Francisco County. This includes residential, commercial, and industrial properties, with taxes typically due twice a year. Property owners receive their tax bills, known as Secured Property Tax Bills, by mail, and the Tax Collector's Office ensures the timely and accurate distribution of these bills.

- Business Tax Management: San Francisco businesses are subject to various taxes, including the Business Registration Tax and Gross Receipts Tax. The Tax Collector's Office handles the registration and tax payment processes for businesses, providing resources and guidance to ensure compliance.

- Vehicle Registration and Taxes: Vehicle registration and associated taxes are also within the purview of the Tax Collector's Office. Residents must register their vehicles with the office, which then issues registration stickers and collects the necessary taxes.

- Tax Payment Options and Assistance: The office offers a range of payment options for taxpayers, including online payment portals, direct bank withdrawals, and in-person payments at designated locations. For those facing financial difficulties, the Tax Collector's Office provides information on tax relief programs and payment plans.

- Tax Research and Delinquent Accounts: In cases of overdue taxes, the Tax Collector's Office undertakes research and collection efforts. This includes sending notices, conducting audits, and taking legal action if necessary to recover outstanding tax debts.

A Deep Dive into San Francisco Property Taxes

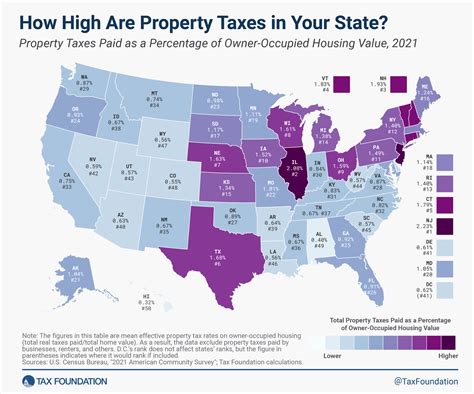

Property taxes are a significant source of revenue for San Francisco County, and the Tax Collector's Office plays a pivotal role in their administration. Let's explore the process and key considerations surrounding property tax assessments and payments.

Property Tax Assessment

The process of property tax assessment involves several steps, including:

- Property Valuation: The Assessor's Office, a separate entity from the Tax Collector's Office, determines the value of each property in San Francisco County. This value is based on factors such as location, size, improvements, and market conditions.

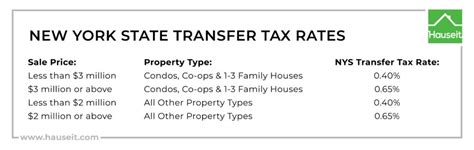

- Tax Rate Calculation: Once the property value is established, the Tax Collector's Office applies the applicable tax rate, which is set by the San Francisco Board of Supervisors. The tax rate is expressed as a percentage and varies depending on the type of property and its usage.

- Tax Bill Generation: Using the assessed value and tax rate, the Tax Collector's Office generates a tax bill, known as the Secured Property Tax Bill, which is sent to the property owner. This bill details the total amount due, the due dates, and any applicable penalties or discounts.

| Property Type | Assessment Ratio | Tax Rate |

|---|---|---|

| Residential | 1% | 0.7747% |

| Commercial | 1.12% | 0.8684% |

| Industrial | 1.12% | 0.8684% |

Property Tax Payment Process

Property owners in San Francisco County receive their Secured Property Tax Bills by mail. These bills are due twice a year, typically in February and November. The Tax Collector's Office offers various payment methods to accommodate different preferences and circumstances:

- Online Payment: Property owners can access their tax bill online through the Tax Collector's Office website and make payments using a credit or debit card, or via direct bank transfer.

- Mail-In Payment: Taxpayers can mail their payments along with the remittance voucher found on their tax bill. The office provides instructions on where to send the payment, ensuring a secure and traceable process.

- In-Person Payment: For those who prefer to pay in person, the Tax Collector's Office has designated payment locations throughout San Francisco County. These locations accept cash, checks, and credit card payments.

Navigating Business Taxes in San Francisco

San Francisco's thriving business landscape is subject to a range of taxes, and the Tax Collector's Office ensures businesses understand their tax obligations and comply with the law. Let's explore the key business taxes and the resources available to businesses.

Business Registration Tax

The Business Registration Tax is a mandatory tax for all businesses operating within San Francisco County. It is levied on the gross receipts of a business, with rates varying based on the type of business and its location. The tax is designed to contribute to the city's general fund, supporting various public services and infrastructure projects.

| Business Type | Tax Rate |

|---|---|

| Retail and Wholesale | 0.176% - 0.588% |

| Services | 0.176% - 0.588% |

| Manufacturing | 0.054% - 0.18% |

Gross Receipts Tax

The Gross Receipts Tax is an additional tax imposed on businesses in San Francisco, calculated based on the gross receipts of the previous year. This tax is applied to businesses with gross receipts exceeding a certain threshold, which is adjusted annually. The tax revenue is earmarked for specific purposes, such as affordable housing initiatives and transportation projects.

| Gross Receipts Threshold | Tax Rate |

|---|---|

| $1,000,000 - $2,000,000 | 0.14% |

| $2,000,000 - $5,000,000 | 0.18% |

| $5,000,000 - $10,000,000 | 0.22% |

| Over $10,000,000 | 0.26% |

Business Tax Registration and Compliance

To register for business taxes in San Francisco, businesses must complete the Business Registration Certificate form provided by the Tax Collector's Office. This form collects essential information about the business, including its legal name, physical address, and gross receipts. The office then issues a registration number, which is required for all future tax payments and correspondence.

The Tax Collector's Office provides resources and guidance to help businesses understand their tax obligations and comply with the law. This includes detailed instructions on tax registration, payment deadlines, and penalties for non-compliance. The office also offers workshops and webinars to educate businesses on the tax process and answer any questions or concerns.

Vehicle Registration and Taxes in San Francisco

Vehicle registration and associated taxes are essential components of the Tax Collector's Office's responsibilities. Let's delve into the process and considerations surrounding vehicle registration and tax payments in San Francisco County.

Vehicle Registration Process

To register a vehicle in San Francisco County, residents must complete the following steps:

- Vehicle Inspection: All vehicles must pass a safety and emissions inspection before registration. This inspection is conducted by authorized inspection stations, and the results are submitted to the Tax Collector's Office.

- Title Transfer: If the vehicle is being purchased, the buyer must obtain a title transfer from the seller. This process involves completing the necessary paperwork and submitting it to the Tax Collector's Office.

- Registration Application: The vehicle owner must complete the Vehicle Registration Application form, providing details such as the vehicle's make, model, year, and VIN number. This form is available online or at designated Tax Collector's Office locations.

- Payment of Fees: Along with the registration application, the vehicle owner must pay the applicable registration fees and taxes. These fees cover the cost of registration, as well as any applicable sales tax or use tax on the vehicle.

Vehicle Registration Fees and Taxes

The fees and taxes associated with vehicle registration in San Francisco County include:

- Registration Fee: This fee covers the cost of processing the vehicle registration and issuing the registration sticker. The fee varies depending on the type of vehicle and its weight.

- Sales Tax: If the vehicle is being purchased, the buyer must pay sales tax on the purchase price. The sales tax rate is determined by the city and county where the vehicle is being registered.

- Use Tax: For vehicles purchased out of state or from a private seller, a use tax may be applicable. This tax is similar to sales tax and is calculated based on the purchase price of the vehicle.

| Vehicle Type | Registration Fee | Sales Tax Rate | Use Tax Rate |

|---|---|---|---|

| Passenger Vehicle | $36 - $48 | 8.5% | 8.5% |

| Commercial Vehicle | $42 - $100 | 8.5% | 8.5% |

| Motorcycle | $24 - $48 | 8.5% | 8.5% |

Assistance and Resources from the Tax Collector's Office

The San Francisco County Tax Collector's Office understands that tax payments can be a complex and challenging process for many taxpayers. To ease the burden and ensure compliance, the office provides a range of assistance and resources.

Payment Plans and Tax Relief Programs

For taxpayers facing financial difficulties, the Tax Collector's Office offers payment plans to help manage tax debts. These plans allow taxpayers to pay their taxes over an extended period, reducing the financial strain. The office also provides information on tax relief programs, such as the Senior Citizen's Property Tax Postponement Program, which allows eligible seniors to defer property tax payments until the sale of their home.

Online Resources and Payment Portals

The Tax Collector's Office maintains a user-friendly website with a wealth of resources and information. Taxpayers can access their tax bills, make payments online, and track the status of their payments. The website also provides detailed instructions and FAQs to guide taxpayers through the various tax processes.

Customer Service and Support

The Tax Collector's Office prides itself on providing excellent customer service. Taxpayers can reach out to the office via phone, email, or in person to seek assistance and clarification on tax-related matters. The office's staff is trained to handle a range of inquiries, from simple questions about payment due dates to complex issues surrounding tax assessments.

Future Outlook and Developments

As San Francisco continues to evolve and grow, the Tax Collector's Office is poised to adapt and meet the changing needs of the city and its taxpayers. Here are some key areas of focus and potential developments for the future:

- Digital Transformation: The Tax Collector's Office is committed to enhancing its digital services and infrastructure. This includes further development of its online payment portals, mobile apps, and electronic filing systems to provide a more convenient and efficient experience for taxpayers.

- Tax Reform and Simplification: With the city's complex tax landscape, there is an ongoing effort to simplify and reform tax policies. The Tax Collector's Office is actively engaged in these discussions, working with stakeholders to streamline tax processes and ensure fairness and transparency.

- Community Engagement: The office recognizes the importance of engaging with the community and building trust. It aims to increase outreach efforts, hosting town hall meetings, and participating in community events to educate taxpayers about their rights and responsibilities.

- Environmental Sustainability: In line with San Francisco's commitment to environmental sustainability, the Tax Collector's Office is exploring ways to reduce its environmental footprint. This includes initiatives to promote paperless transactions, encourage electronic payments, and reduce the use of physical tax documents.

Frequently Asked Questions

How can I pay my property taxes in San Francisco County?

+You can pay your property taxes through the Tax Collector’s Office website, by mail, or in person at designated payment locations. The office accepts payments via credit/debit card, direct bank transfer, or cash/check.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes may result in penalties and interest charges. If taxes remain unpaid, the Tax Collector’s Office may initiate collection efforts, including sending notices, conducting audits, and, in extreme cases, taking legal action.

How do I register my business for taxes in San Francisco?

+To register your business for taxes, you must complete the Business Registration Certificate form provided by the Tax Collector’s Office. This form can be found on their website or obtained at their office locations. Once registered, you’ll receive a registration number for future tax payments.

Are there any tax relief programs available for low-income taxpayers?

+Yes, the Tax Collector’s Office offers several tax relief programs, including the Senior Citizen’s Property Tax Postponement Program and the Disabled Veterans’ Property Tax Exemption. These programs provide assistance to eligible taxpayers, reducing their tax burden.

Can I renew my vehicle registration online?

+Yes, the Tax Collector’s Office allows online renewal