Ga State Sales Tax

Welcome to a comprehensive guide on the Georgia State Sales Tax, an essential aspect of doing business and understanding the economic landscape of the state. This article will delve into the intricacies of Georgia's sales tax regulations, providing valuable insights for businesses, consumers, and anyone interested in the state's fiscal policies.

Understanding Georgia’s Sales Tax Landscape

Georgia’s sales tax is a critical component of the state’s revenue generation, contributing significantly to its economic stability and development. The state imposes a sales and use tax on the sale of tangible personal property and certain services, with rates varying depending on the location and the nature of the transaction.

The Georgia Department of Revenue is responsible for administering and collecting these taxes, ensuring compliance with the state's tax laws. It's essential for businesses and individuals to understand the intricacies of these regulations to avoid any legal and financial pitfalls.

Sales Tax Rates and Locations

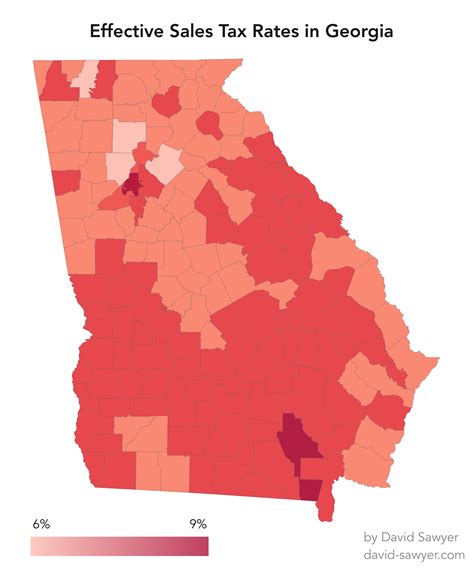

Georgia’s sales tax rates are structured with a base state rate, which is then supplemented by additional local taxes, depending on the specific location of the transaction. The base state sales tax rate is 4%, but when combined with local taxes, the total sales tax rate can vary significantly across the state.

| Location | Total Sales Tax Rate |

|---|---|

| Atlanta | 8.9% |

| Athens | 8.0% |

| Augusta | 7.5% |

| Savannah | 8.5% |

| Columbus | 8.3% |

These rates are subject to change, so it's crucial for businesses to stay updated with the latest regulations to ensure accurate tax calculations and compliance.

Taxable Items and Services

Georgia’s sales tax applies to a wide range of goods and services, including tangible personal property, such as clothing, electronics, and furniture. Additionally, certain services, like repair and maintenance, are also subject to sales tax.

However, there are exceptions and exemptions to these rules. For instance, groceries, prescription drugs, and certain medical devices are exempt from sales tax. Understanding these exemptions is crucial for both businesses and consumers to navigate the tax system effectively.

Compliance and Reporting

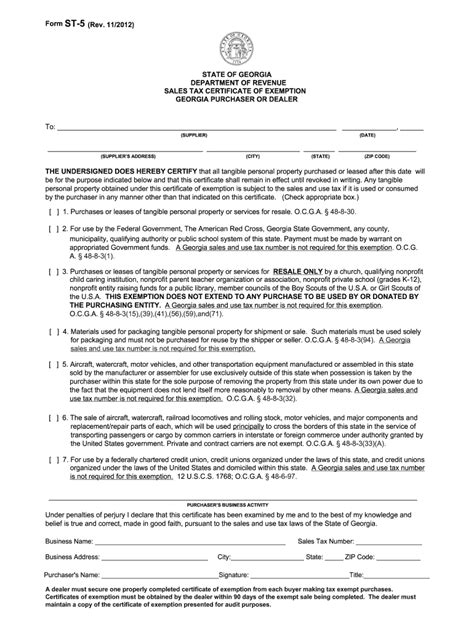

Ensuring compliance with Georgia’s sales tax regulations is a critical aspect of doing business in the state. The Georgia Department of Revenue provides comprehensive guidelines and resources to help businesses understand their tax obligations and responsibilities.

Registration and Permits

Businesses operating in Georgia must register with the Department of Revenue and obtain the necessary permits and licenses. This process ensures that businesses are officially recognized by the state and can operate legally.

The registration process involves providing detailed information about the business, including its legal structure, ownership, and primary activities. Once registered, businesses are issued a unique tax identification number, which is used for all future tax-related communications and transactions.

Tax Calculation and Remittance

Calculating the correct sales tax amount is a crucial step in the compliance process. Businesses must accurately calculate the tax based on the total transaction value and the applicable tax rate for the specific location. This ensures that the correct amount is collected from customers and remitted to the state.

The frequency of tax remittance depends on the business's size and sales volume. Larger businesses with higher sales volumes may be required to remit taxes more frequently, such as monthly or quarterly, while smaller businesses may have a less frequent schedule, such as semi-annually or annually.

Record-Keeping and Audits

Maintaining accurate and detailed records is essential for businesses operating in Georgia. These records should include all sales transactions, the associated tax amounts, and any exemptions or discounts applied. Proper record-keeping ensures that businesses can accurately report their tax liabilities and provide evidence during audits.

Audits are a routine part of the tax compliance process. The Department of Revenue conducts audits to ensure businesses are complying with tax regulations. During an audit, businesses must provide all relevant records and cooperate with the auditing team. Non-compliance can result in penalties and additional legal complications.

Sales Tax for Online Businesses

With the rise of e-commerce, understanding sales tax for online businesses is becoming increasingly important. Georgia has specific regulations for online sales, ensuring that businesses operating solely online are also compliant with tax laws.

Economic Nexus and Sales Tax

Georgia, like many other states, has adopted the economic nexus standard, which defines the criteria for when a business has sufficient connection to the state to be subject to its sales tax laws. This concept is particularly relevant for online businesses, as it considers factors like the number of transactions or the value of sales made in the state.

If an online business meets the economic nexus threshold in Georgia, it must register with the Department of Revenue, collect sales tax from customers, and remit it to the state. Failure to comply with these regulations can result in penalties and legal consequences.

Marketplace Facilitator Rules

Georgia also has specific rules for marketplace facilitators, which are online platforms that facilitate the sale of goods or services by third-party sellers. These platforms are often responsible for collecting and remitting sales tax on behalf of the sellers, ensuring compliance with the state’s tax laws.

Sales Tax Holidays

Georgia, like some other states, offers sales tax holidays, which are specific periods when certain items are exempt from sales tax. These holidays are designed to stimulate the economy and provide relief to consumers.

Back-to-School Sales Tax Holiday

One of the most notable sales tax holidays in Georgia is the Back-to-School sales tax holiday. During this period, typically in late July or early August, certain school supplies, clothing, and computers are exempt from sales tax, encouraging families to stock up on necessary items for the upcoming school year.

Energy Efficiency Sales Tax Holiday

Georgia also offers an Energy Efficiency sales tax holiday, which is typically held in late May or early June. During this holiday, energy-efficient appliances and certain home improvement items are exempt from sales tax, promoting energy conservation and providing an incentive for consumers to invest in energy-efficient products.

Future Implications and Developments

The landscape of sales tax is constantly evolving, and Georgia is no exception. As the state’s economy and business environment change, so too will its tax regulations.

Potential Rate Changes

The sales tax rates in Georgia, both at the state and local levels, are subject to change based on economic conditions and legislative decisions. While the base state rate of 4% has remained consistent, local rates have varied over the years. It’s essential for businesses and individuals to stay informed about any potential rate changes to ensure compliance.

Impact of Remote Work and E-Commerce

The rise of remote work and the continued growth of e-commerce have had significant impacts on sales tax collection. Georgia, like many other states, is navigating these changes, implementing regulations to ensure fair tax collection from remote workers and online businesses.

As more businesses adopt remote work models and e-commerce platforms, the state will need to adapt its tax policies to ensure a level playing field and prevent revenue loss. This may involve revisiting the economic nexus standards and exploring new ways to tax digital transactions.

Simplification and Reform

Sales tax regulations can often be complex and challenging to navigate, especially for small businesses and startups. Recognizing this, Georgia, like other states, is exploring ways to simplify its tax system and make it more user-friendly.

Potential reforms could include standardizing tax rates across the state, reducing the number of tax jurisdictions, or implementing a centralized tax collection system. These changes aim to reduce the administrative burden on businesses and improve compliance.

Conclusion

Understanding and complying with Georgia’s sales tax regulations is a critical aspect of doing business in the state. With a comprehensive understanding of the tax rates, taxable items, compliance procedures, and future developments, businesses can navigate the state’s tax landscape effectively.

As Georgia continues to evolve and adapt to the changing business environment, staying informed about sales tax regulations will remain essential for businesses to thrive and contribute to the state's economic growth.

Frequently Asked Questions

What is the current base state sales tax rate in Georgia?

+

The current base state sales tax rate in Georgia is 4%.

Are there any sales tax holidays in Georgia?

+

Yes, Georgia offers sales tax holidays, including the Back-to-School and Energy Efficiency sales tax holidays.

How often do businesses need to remit sales tax in Georgia?

+

The frequency of tax remittance depends on the business’s size and sales volume. Larger businesses may remit taxes monthly or quarterly, while smaller businesses may have a less frequent schedule, such as semi-annually or annually.

What happens if a business doesn’t comply with Georgia’s sales tax regulations?

+

Non-compliance can result in penalties, interest charges, and potential legal consequences. It’s crucial for businesses to understand and adhere to the state’s sales tax regulations to avoid these issues.

How can businesses stay updated with Georgia’s sales tax changes and regulations?

+

Businesses can stay informed by regularly checking the Georgia Department of Revenue’s website, signing up for their newsletter, and consulting with tax professionals or legal advisors who specialize in state tax laws.