Macon County Property Tax

Macon County, nestled in the heart of North Carolina, boasts a diverse landscape ranging from lush forests to rolling hills. This picturesque county, with its vibrant communities and rich history, also has a vital economic system centered around property taxes. Understanding the Macon County property tax landscape is essential for both residents and prospective homeowners. This article delves deep into the specifics of Macon County property taxes, shedding light on the factors that influence them and providing a comprehensive guide to help navigate this complex yet crucial aspect of homeownership.

Unraveling Macon County Property Taxes: An In-Depth Exploration

Property taxes in Macon County are a key component of the local economy, providing essential revenue for various community services and infrastructure development. The county's tax system is governed by a complex set of rules and regulations, which can sometimes be daunting for homeowners and investors alike. This section aims to demystify these complexities, offering a clear and concise understanding of Macon County's property tax landscape.

The Basics of Macon County Property Taxes

In Macon County, property taxes are levied on all real estate properties, including residential homes, commercial buildings, and land. These taxes are an annual obligation for property owners and are calculated based on the assessed value of their property. The assessed value is determined by the county's tax assessor, who evaluates each property based on its size, location, and other relevant factors.

| Property Type | Average Assessed Value |

|---|---|

| Residential Homes | $180,000 |

| Commercial Buildings | $320,000 |

| Agricultural Land | $120,000 |

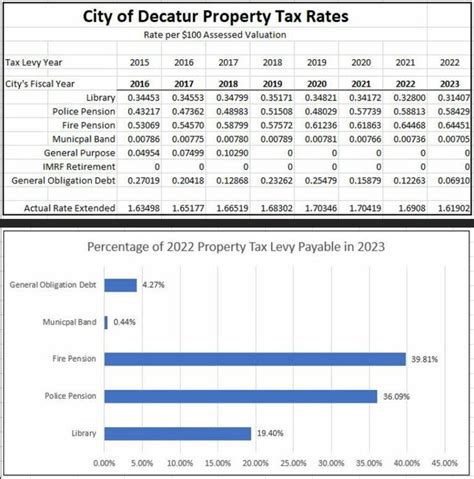

Once the assessed value is determined, it is multiplied by the county's tax rate to arrive at the property tax amount. The tax rate, often referred to as the mill rate, is set annually by the county commissioners and varies based on the budget requirements and the type of property.

Understanding the Tax Rate

The tax rate in Macon County is expressed in mills, with one mill equivalent to one-tenth of a cent. In simpler terms, for every $1,000 of assessed property value, the property owner pays $1 in taxes for each mill the rate is set at. For instance, if the tax rate is 200 mills, a property with an assessed value of $200,000 would incur taxes of $400.

The tax rate can fluctuate annually, depending on the county's budgetary needs and any changes in state laws. In recent years, Macon County has maintained a relatively stable tax rate, which has contributed to the predictability of property tax expenses for homeowners.

Factors Influencing Property Tax Assessments

Several factors come into play when determining the assessed value of a property, which subsequently affects the property taxes. These factors include:

- Property Location: Properties located in prime areas or with desirable views tend to have higher assessments.

- Size and Improvements: Larger properties and those with significant improvements, such as additions or renovations, may face higher assessments.

- Market Value: The assessed value is typically based on the property's market value, which can be influenced by local real estate trends and demand.

- Tax Assessor's Discretion: While the tax assessor follows a set of guidelines, there is some room for discretion, especially in cases of unique properties or when determining the value of improvements.

Property Tax Payment Process

Property taxes in Macon County are due annually, typically by January 5th. The county sends out tax bills to all property owners, detailing the assessed value, tax rate, and the total amount due. Property owners have the option to pay their taxes in full or opt for a semi-annual payment plan. Late payments incur penalties and interest, so timely payment is crucial to avoid additional expenses.

Macon County also provides online payment options, allowing property owners to pay their taxes conveniently through the county's website. This digital platform also offers access to tax records and information, making it easier for homeowners to stay informed about their property tax obligations.

The Impact of Property Taxes on Macon County's Economy

Property taxes play a pivotal role in Macon County's economic ecosystem, providing a significant portion of the county's revenue. This revenue is vital for funding essential services such as public schools, road maintenance, emergency services, and community development projects.

By investing in these areas, Macon County strives to create a vibrant and sustainable community, enhancing the quality of life for its residents. The property tax system, therefore, is not just about revenue generation but also about ensuring the long-term prosperity and well-being of the county's citizens.

How Property Taxes Support Community Development

A substantial portion of Macon County's property tax revenue is allocated to community development initiatives. These funds are utilized to improve infrastructure, support local businesses, and enhance the overall livability of the county. For instance, property taxes contribute to:

- Upgrading public transportation systems, making it easier for residents to commute and access essential services.

- Developing recreational facilities, such as parks and sports complexes, promoting a healthy and active lifestyle.

- Funding cultural events and initiatives, enriching the county's cultural landscape and attracting tourists.

- Investing in green spaces and environmental conservation projects, preserving the county's natural beauty.

These investments not only enhance the quality of life for residents but also contribute to the county's economic growth, creating a positive feedback loop that benefits both the community and the local economy.

Property Taxes and the Real Estate Market

Property taxes are an integral part of the real estate market in Macon County. They influence the affordability of properties, especially for first-time homebuyers and investors. While a higher tax rate may deter some buyers, it's essential to consider the overall value proposition, including the quality of life, amenities, and potential for capital appreciation.

For investors, property taxes are a significant consideration when evaluating potential rental properties. A well-managed property with a reasonable tax burden can offer attractive returns, making it a lucrative investment opportunity. Macon County's stable tax environment and its focus on community development make it an appealing market for real estate investors.

Navigating the Property Tax Landscape: A Guide for Homeowners

Understanding and managing property taxes is an essential aspect of homeownership. This section aims to provide a comprehensive guide for homeowners in Macon County, offering practical tips and strategies to navigate the property tax landscape effectively.

Understanding Your Tax Bill

Receiving your property tax bill can be a daunting experience, especially for first-time homeowners. Here's a breakdown of what to expect and how to interpret your tax bill:

- Property Information: Your tax bill will include details about your property, such as the address, parcel number, and the assessed value.

- Tax Rate and Calculation: The bill will clearly state the tax rate and how it was applied to your assessed value to arrive at the total tax amount.

- Payment Options: The tax bill will outline the payment due date and any available payment plans or online payment options.

- Penalties and Late Fees: Be sure to note the late payment penalties and interest rates, as these can significantly increase your tax liability if not paid on time.

If you have any questions or concerns about your tax bill, don't hesitate to reach out to the Macon County Tax Office. Their team is well-equipped to provide clarification and assistance.

Challenging Your Property Assessment

If you believe your property's assessed value is inaccurate, you have the right to appeal. Macon County provides a fair and transparent appeals process to ensure property owners are treated equitably. Here's a step-by-step guide to challenging your property assessment:

- Research and Gather Evidence: Start by researching recent sales of similar properties in your area. Gather evidence, such as comparative market analyses or appraisals, to support your claim.

- File an Appeal: Submit a formal appeal to the Macon County Tax Office within the specified deadline. Ensure your appeal includes a clear explanation of why you believe the assessment is inaccurate and provide supporting evidence.

- Attend a Hearing: If your appeal is accepted, you will be invited to a hearing where you can present your case. Prepare a concise and well-documented presentation to support your claim.

- Await the Decision: The county's tax review board will review your appeal and make a decision. If your assessment is adjusted, you will receive a revised tax bill.

Maximizing Tax Relief and Exemptions

Macon County offers several tax relief programs and exemptions to eligible homeowners. Taking advantage of these opportunities can significantly reduce your property tax burden. Here are some of the key programs to consider:

- Homestead Exemption: This exemption reduces the assessed value of your primary residence, lowering your property taxes. To qualify, you must own and occupy the property as your primary residence.

- Senior Citizen Exemption: Macon County provides tax relief to homeowners who are 65 years or older. This exemption can significantly reduce the taxable value of your property, making it an attractive option for retirees.

- Veteran's Exemption: Macon County honors its veterans by offering tax exemptions. If you are a veteran or the surviving spouse of a veteran, you may be eligible for this exemption, which can provide substantial savings on your property taxes.

To learn more about these programs and to determine your eligibility, contact the Macon County Tax Office or consult a tax professional.

Conclusion: Empowering Homeowners with Knowledge

Property taxes are a critical aspect of homeownership, and understanding the intricacies of the Macon County property tax system is essential for all homeowners and prospective buyers. By providing this comprehensive guide, we aim to empower individuals with the knowledge and tools they need to navigate the property tax landscape effectively.

From understanding the assessment process to exploring tax relief options, we've covered a wide range of topics to ensure homeowners are well-informed and equipped to make the best decisions for their financial well-being. Remember, knowledge is power, and when it comes to property taxes, being informed can lead to significant savings and a more positive homeownership experience.

What is the average property tax rate in Macon County?

+The average property tax rate in Macon County is approximately 200 mills. However, it’s important to note that the tax rate can vary based on the type of property and any applicable exemptions.

When are property taxes due in Macon County?

+Property taxes in Macon County are due annually by January 5th. However, homeowners can opt for a semi-annual payment plan if they prefer.

How can I appeal my property assessment in Macon County?

+To appeal your property assessment, you must submit a formal appeal to the Macon County Tax Office within the specified deadline. Ensure you provide a clear explanation and supporting evidence for your claim.

What tax relief programs are available in Macon County for homeowners?

+Macon County offers several tax relief programs, including the Homestead Exemption, Senior Citizen Exemption, and Veteran’s Exemption. These programs can significantly reduce the taxable value of your property, resulting in lower property taxes.