Trust Tax Rates 2025

The concept of trust tax rates is an essential aspect of estate planning and wealth management, especially when considering long-term financial strategies. As we navigate the complexities of the tax system, it becomes crucial to understand how trust funds are taxed and the potential implications for both grantors and beneficiaries. This article aims to provide an in-depth analysis of trust tax rates, focusing on the year 2025 and beyond, to offer a comprehensive guide for those seeking to optimize their wealth management strategies.

Understanding Trust Tax Rates: A Complex Web

Trusts, as legal entities designed to hold and manage assets for the benefit of another, are subject to a unique set of tax rules. These rules can vary significantly depending on the type of trust, its purpose, and the specific jurisdiction in which it operates. As we look ahead to 2025, it’s imperative to anticipate potential changes in tax legislation and their impact on trust taxation.

The Internal Revenue Service (IRS) categorizes trusts into several types, each with its own tax implications. For instance, grantor trusts, where the grantor maintains certain powers over the trust, are typically taxed as part of the grantor's income. On the other hand, non-grantor trusts are considered separate taxable entities, filing their own tax returns and paying taxes on their income.

Key Factors Influencing Trust Tax Rates

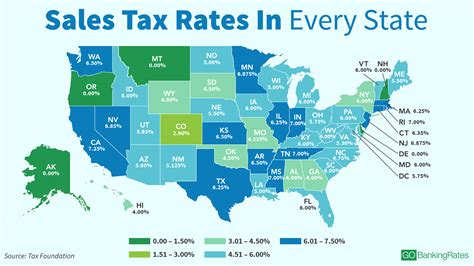

Several factors come into play when determining the tax rates applicable to trusts. These include the trust’s income sources (such as dividends, interest, or capital gains), the distribution requirements to beneficiaries, and the tax rates applicable to the trust’s jurisdiction. Additionally, the size of the trust and the presence of charitable beneficiaries can also influence the tax treatment.

For instance, a trust with significant capital gains might be subject to the capital gains tax, which varies depending on the holding period of the assets and the trust's tax bracket. On the other hand, trusts with a substantial amount of interest and dividend income might be subject to the net investment income tax, applicable to high-income taxpayers.

| Trust Income Source | Potential Tax Implications |

|---|---|

| Capital Gains | Capital Gains Tax, varying by holding period and tax bracket |

| Interest & Dividends | Net Investment Income Tax for high-income trusts |

| Rental Income | Ordinary Income Tax rates |

Anticipating Trust Tax Rates in 2025: A Glimpse into the Future

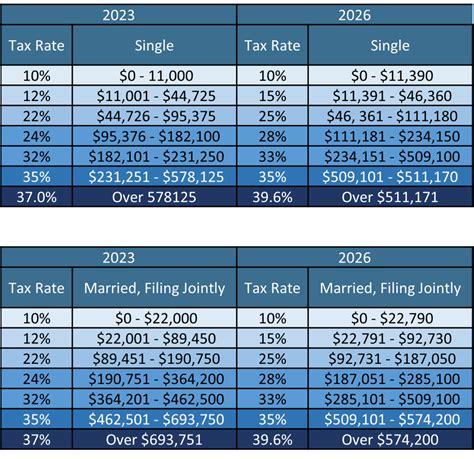

As we project forward to 2025, it’s essential to consider the potential changes in tax legislation that could impact trust taxation. While predicting future tax rates with absolute certainty is challenging, we can analyze historical trends and current legislative proposals to make informed estimates.

Potential Impact of Legislative Changes

The IRS and various government bodies regularly propose changes to the tax code, which can significantly affect trust taxation. For instance, proposals to increase tax rates on high-income earners could indirectly impact trusts, especially those with substantial income or large assets. Similarly, changes to the estate tax, which is closely related to trust taxation, could also have a ripple effect on trust tax rates.

For instance, if the estate tax exemption were to decrease, it could lead to a higher number of trusts being subject to estate tax, thereby impacting their overall tax strategy. Conversely, an increase in the exemption amount could provide more flexibility for trust planners.

Historical Trends and Current Rates

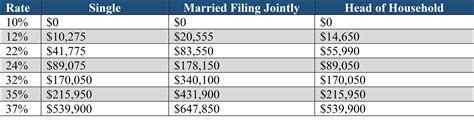

Analyzing historical tax rate trends can provide valuable insights into potential future rates. For example, over the past decade, the top marginal tax rate for trusts and estates has remained relatively stable, hovering around 37%. However, there have been periodic adjustments, such as the Tax Cuts and Jobs Act of 2017, which temporarily reduced tax rates for certain income brackets.

As of the current tax year (2023), the highest income trusts are taxed at a rate of 37% on ordinary income and capital gains. This rate is expected to remain the same for the foreseeable future, unless there are significant legislative changes.

Strategic Planning: Optimizing Trust Tax Rates

Given the complexity of trust tax rates and the potential for legislative changes, strategic planning is essential for trust grantors and beneficiaries. By implementing effective tax strategies, trusts can potentially reduce their tax liabilities and maximize the value of the trust for beneficiaries.

Key Strategies for Tax Optimization

There are several strategies that trust planners can employ to optimize tax rates. These include:

- Income Distribution Planning: Trusts can strategically distribute income to beneficiaries, taking advantage of lower tax brackets. This can be particularly beneficial for trusts with multiple beneficiaries, as it allows for a more efficient tax strategy.

- Charitable Contributions: Trusts can make charitable contributions, which are typically tax-deductible. This not only reduces the trust's taxable income but also supports charitable causes. Additionally, some trusts can benefit from the qualified charitable distribution rules, which allow for direct distributions from an IRA to a charity.

- Asset Allocation and Tax-Efficient Investments: Trusts can optimize their asset allocation to include tax-efficient investments. For instance, investing in municipal bonds, which are typically exempt from federal taxes, can reduce the trust's taxable income.

- Trust Splitting: In certain cases, splitting a trust into multiple trusts can provide tax benefits. This strategy can help reduce the overall tax burden by distributing the income and assets among different tax entities.

The Role of Professional Guidance

Given the complexity of trust tax laws and the potential for significant financial implications, seeking professional guidance is often crucial. Estate planning attorneys and certified public accountants (CPAs) specializing in trust taxation can provide valuable insights and strategies tailored to the specific needs of the trust.

These professionals can help navigate the intricate world of trust taxation, ensuring compliance with current tax laws and optimizing tax strategies to benefit the trust and its beneficiaries.

Conclusion: Navigating Trust Tax Rates with Confidence

Understanding trust tax rates is an essential aspect of effective wealth management and estate planning. By staying informed about current tax laws and anticipating potential changes, trust grantors and beneficiaries can make informed decisions to optimize their tax strategies.

As we look ahead to 2025, it's crucial to remain vigilant about legislative changes and their potential impact on trust taxation. With strategic planning and professional guidance, trusts can navigate the complex web of tax laws to maximize their value and benefit their beneficiaries.

What is the current top marginal tax rate for trusts in 2023?

+

As of 2023, the highest income trusts are taxed at a rate of 37% on ordinary income and capital gains.

Can trusts benefit from charitable contributions?

+

Yes, trusts can make charitable contributions, which are typically tax-deductible. This reduces the trust’s taxable income and supports charitable causes.

How can trusts optimize their tax strategies through asset allocation?

+

Trusts can optimize their asset allocation by including tax-efficient investments, such as municipal bonds, which are exempt from federal taxes, thereby reducing taxable income.

Is professional guidance necessary for trust tax planning?

+

Yes, given the complexity of trust tax laws and the potential financial implications, seeking guidance from estate planning attorneys and CPAs specializing in trust taxation is often crucial.