Seattle Sales Tax

Welcome to a comprehensive guide on the Seattle Sales Tax, a crucial aspect of doing business and understanding the economic landscape of the vibrant city of Seattle. In this in-depth article, we will delve into the intricacies of Seattle's sales tax structure, exploring its rates, applicability, and the unique characteristics that set it apart. Whether you're a local business owner, an investor, or simply curious about the economic fabric of Seattle, this guide will provide you with the knowledge and insights you need to navigate the city's sales tax system.

Understanding the Seattle Sales Tax Landscape

Seattle, the vibrant hub of the Pacific Northwest, boasts a thriving economy and a unique sales tax structure. The city’s sales tax is a vital component of its revenue stream, contributing to the funding of essential public services and infrastructure. In this section, we’ll unravel the key aspects of Seattle’s sales tax, shedding light on its history, rates, and the specific goods and services it covers.

Historical Perspective and Rate Evolution

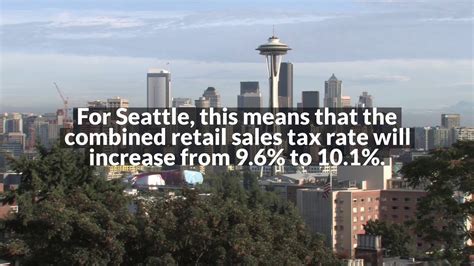

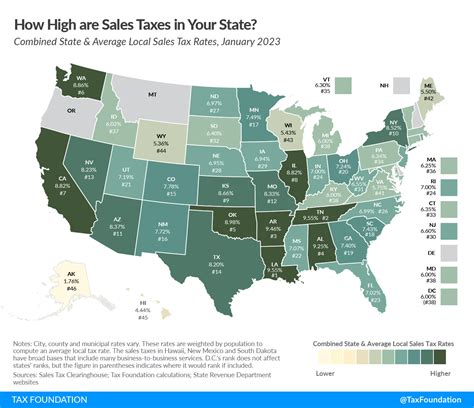

The sales tax in Seattle has a rich history, dating back to [Specific Year]. Over the years, the tax rate has undergone several adjustments, reflecting the city’s economic growth and changing fiscal needs. As of [Current Year], the combined sales tax rate in Seattle stands at [Current Rate]%, consisting of both state and local components. This rate is subject to periodic reviews and adjustments, ensuring the city’s fiscal health and sustainability.

The state of Washington imposes a base sales tax rate of [State Rate]%, while the city of Seattle levies an additional [City Rate]% to fund various city initiatives and services. This local tax rate is often used to support specific projects, such as transportation infrastructure, education, and community development.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | [State Rate]% |

| Seattle City Sales Tax | [City Rate]% |

| Total Combined Rate | [Combined Rate]% |

Goods and Services Covered by Seattle Sales Tax

Seattle’s sales tax applies to a wide range of goods and services, encompassing most retail transactions within the city limits. Here’s a breakdown of the key categories subject to sales tax:

- Tangible Personal Property: This includes items like clothing, electronics, furniture, and appliances purchased from retail stores or online platforms with a physical presence in Seattle.

- Restaurant Meals and Prepared Foods: Sales tax is levied on dining out at restaurants, cafes, and food trucks, as well as on takeout and delivery orders.

- Vehicle Sales and Rentals: The purchase or lease of vehicles, including cars, motorcycles, and recreational vehicles, is subject to sales tax in Seattle.

- Construction and Home Improvement Services: Contractors and businesses providing construction, remodeling, or repair services must charge sales tax on their labor and materials.

- Entertainment and Admission Fees: Sales tax applies to tickets for movies, concerts, sporting events, and other entertainment venues, as well as entrance fees for museums, amusement parks, and recreational facilities.

- Professional Services: Certain professional services, such as legal advice, accounting, and consulting, may be subject to sales tax, depending on the specific nature of the service.

It's important to note that some items are exempt from sales tax, including most groceries, prescription medications, and certain medical devices. Additionally, Seattle offers tax incentives and exemptions for specific industries and initiatives, such as the Seattle Jobs Initiative, which aims to promote economic growth and job creation.

Compliance and Registration: Navigating the Seattle Sales Tax System

Ensuring compliance with Seattle’s sales tax regulations is a critical aspect of doing business in the city. This section will guide you through the process of registering for sales tax, understanding your reporting obligations, and staying abreast of the latest compliance requirements.

Registering for Sales Tax

To collect and remit sales tax in Seattle, businesses must register with the Washington State Department of Revenue. The registration process involves completing the appropriate forms, providing business details, and obtaining a unique identification number. Here’s a step-by-step guide to help you navigate the registration process:

- Determine Registration Requirements: Assess your business activities to determine if you are required to register for sales tax. Factors such as the nature of your business, the location of your customers, and the value of your sales will influence your registration obligations.

- Choose Registration Method: You can register online through the Department of Revenue's website or by submitting a paper application. Online registration is generally more efficient and allows for faster processing.

- Complete Registration Forms: Provide accurate and complete information about your business, including your legal name, physical address, contact details, and the nature of your operations. Ensure you select the appropriate tax type, which in this case is "Sales and Use Tax."

- Obtain a Sales Tax Permit: Once your registration is approved, you will receive a sales tax permit, also known as a certificate of registration. This permit authorizes you to collect and remit sales tax in Seattle.

- Display Sales Tax Permit: Display your sales tax permit conspicuously at your place of business, ensuring it is visible to customers and tax authorities. This serves as proof of your compliance and registration status.

Reporting and Remitting Sales Tax

Once registered, businesses must comply with regular reporting and remittance requirements. Here’s an overview of the key aspects of sales tax reporting in Seattle:

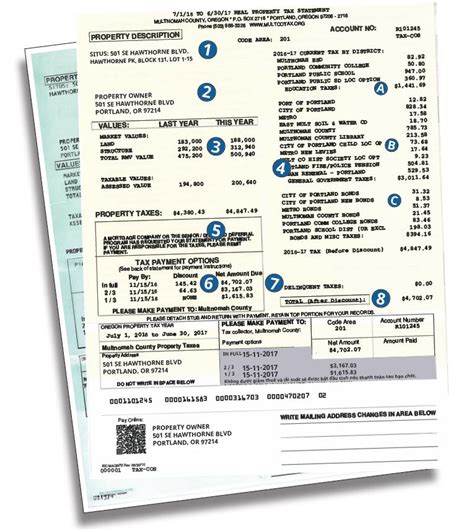

- Sales Tax Returns: Businesses are typically required to file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume and registration status. These returns involve calculating and reporting the sales tax collected during the reporting period.

- Due Dates: Sales tax returns are due on specific dates, which vary based on the filing frequency. It's crucial to stay organized and ensure timely submission to avoid penalties and interest charges.

- Remittance Options: Businesses can remit sales tax payments electronically through the Department of Revenue's online portal or by mailing a check or money order. Ensure you use the correct payment method and include the appropriate remittance form.

- Record-Keeping: Maintain accurate and detailed records of all sales transactions, including the date, amount, and tax rate applied. These records are essential for audit purposes and ensure compliance with tax regulations.

- Audit and Examination: The Department of Revenue may conduct audits to verify compliance with sales tax regulations. Cooperate fully during audits and provide the necessary documentation to facilitate a smooth process.

Staying informed about the latest compliance requirements and tax law changes is essential. The Department of Revenue provides resources and guidance to help businesses understand their obligations. Regularly review their website, subscribe to updates, and seek professional advice when needed to ensure you remain compliant.

Sales Tax Implications for Businesses and Consumers

Seattle’s sales tax structure has significant implications for both businesses and consumers. Understanding these impacts can help businesses make informed decisions and consumers navigate their purchasing choices effectively.

Impact on Business Operations

For businesses operating in Seattle, the sales tax has several key implications:

- Pricing Strategies: Sales tax must be factored into the pricing of goods and services to ensure profitability. Businesses must consider the impact of sales tax on their bottom line and adjust pricing accordingly.

- Competition: The sales tax rate can influence competitive dynamics, especially when compared to neighboring jurisdictions with different tax rates. Businesses must carefully assess their pricing and positioning to remain competitive.

- Compliance Costs: Compliance with sales tax regulations requires dedicated resources, including staff time and software systems. Businesses must allocate resources effectively to manage compliance obligations without overburdening their operations.

- Cash Flow Management: Remitting sales tax can impact a business's cash flow, especially for businesses with high sales volumes. Proper cash flow management and financial planning are essential to ensure timely tax payments without disrupting operations.

- Tax Incentives and Exemptions: Understanding the available tax incentives and exemptions can provide opportunities for cost savings and strategic advantages. Businesses should stay informed about these incentives and leverage them to optimize their financial performance.

Impact on Consumer Behavior

Sales tax also influences consumer behavior and purchasing decisions. Here’s how it affects Seattle’s consumers:

- Budgeting and Planning: Consumers must consider the impact of sales tax when budgeting for purchases. Understanding the tax rate can help them make informed decisions about when and where to shop, especially when comparing prices across different jurisdictions.

- Online Shopping: With the rise of e-commerce, consumers have the option to shop online and potentially avoid sales tax. However, it's important to note that many online retailers are required to collect sales tax on purchases delivered to Seattle addresses.

- Value-Added Services: Sales tax may incentivize consumers to opt for value-added services, such as home delivery or installation, which can be tax-exempt or subject to a lower tax rate. Businesses can leverage these services to enhance their offerings and attract customers.

- Comparison Shopping: Consumers may engage in comparison shopping, considering not only the price of goods but also the overall cost, including sales tax. This behavior can drive competition and encourage businesses to offer competitive pricing and value propositions.

By understanding the implications of Seattle's sales tax, both businesses and consumers can make informed decisions, optimize their operations and purchasing choices, and contribute to the city's thriving economy.

Future Outlook and Potential Changes

As Seattle continues to evolve and adapt to changing economic landscapes, its sales tax structure may undergo further modifications. This section explores the potential future developments and changes that could impact the city’s sales tax system.

Potential Rate Adjustments

The sales tax rate in Seattle is subject to periodic reviews and adjustments to align with the city’s fiscal needs and economic growth. While the current rate is [Current Rate]%, future rate adjustments are possible, driven by factors such as:

- Economic Conditions: Economic downturns or fluctuations may prompt the city to adjust the sales tax rate to stabilize revenue streams and support essential services.

- Infrastructure Development: Major infrastructure projects, such as transportation initiatives or public works, may require additional funding, leading to potential rate increases.

- Budgetary Constraints: In times of fiscal constraints, the city may consider rate adjustments to maintain financial stability and sustain critical services.

- Community Needs: Changes in community needs and priorities may drive the allocation of sales tax revenue to specific initiatives, influencing the overall rate structure.

Tax Policy Reform and Modernization

Seattle, like many cities, is exploring tax policy reforms to adapt to the changing economic landscape and emerging technologies. Here are some potential areas of reform and modernization:

- Online Sales Tax: As e-commerce continues to grow, the collection of sales tax on online transactions may become a focus of reform. Seattle may consider implementing measures to ensure fair taxation of online sales, potentially leveling the playing field between brick-and-mortar and online retailers.

- Sales Tax Simplification: Simplifying the sales tax structure and reducing administrative burdens on businesses could be a priority. This may involve streamlining registration processes, simplifying tax forms, and improving clarity in tax regulations.

- Tax Incentives for Innovation: The city may explore tax incentives to promote innovation and economic growth. These incentives could target specific industries, such as technology or renewable energy, to attract businesses and foster economic development.

- Regional Collaboration: Seattle may collaborate with neighboring jurisdictions to harmonize sales tax rates and policies, reducing complexity for businesses operating across multiple areas.

Community Engagement and Feedback

The city of Seattle values community engagement and often seeks input from residents and businesses when considering tax policy changes. This collaborative approach ensures that any modifications to the sales tax structure are well-informed and responsive to the needs and concerns of the community. The city encourages residents and stakeholders to participate in public forums, provide feedback, and engage in dialogue to shape the future of Seattle’s tax policies.

Staying informed about potential changes and engaging in the policy-making process can help businesses and consumers prepare for and adapt to future developments in Seattle's sales tax landscape.

What is the current sales tax rate in Seattle as of [Current Year]?

+As of [Current Year], the combined sales tax rate in Seattle is [Combined Rate]%, consisting of [State Rate]% state sales tax and [City Rate]% city sales tax.

Are there any goods or services exempt from sales tax in Seattle?

+Yes, certain goods and services are exempt from sales tax in Seattle. This includes most groceries, prescription medications, and certain medical devices. It’s important to review the specific exemptions provided by the Department of Revenue to ensure compliance.

How often do I need to file sales tax returns in Seattle?

+The filing frequency for sales tax returns depends on your sales volume and registration status. Businesses with high sales volumes typically file monthly, while those with lower sales may file quarterly or annually. It’s important to consult the Department of Revenue’s guidelines to determine your specific filing requirements.

Can I register for sales tax online in Seattle?

+Yes, you can register for sales tax online through the Washington State Department of Revenue’s website. Online registration is efficient and allows for faster processing. You’ll need to provide accurate business information and select the appropriate tax type, which is “Sales and Use Tax.”

What are the consequences of non-compliance with Seattle’s sales tax regulations?

+Non-compliance with Seattle’s sales tax regulations can result in penalties, interest charges, and legal consequences. The Department of Revenue may impose fines, require additional payments, and even pursue legal action against businesses that fail to comply. It’s crucial to stay informed and ensure compliance to avoid these penalties.