Sales Tax In Santa Clara

The topic of sales tax is an important one for businesses and consumers alike, as it directly impacts the cost of goods and services. In the city of Santa Clara, California, understanding the sales tax regulations is crucial for both local businesses and shoppers. This comprehensive guide aims to delve into the specifics of sales tax in Santa Clara, providing an in-depth analysis of the rates, exemptions, and unique considerations that make this tax system unique.

Unraveling the Sales Tax System in Santa Clara

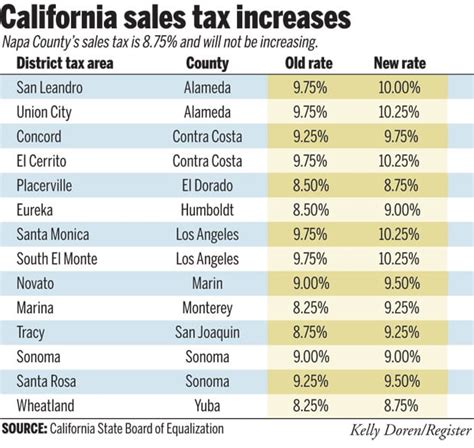

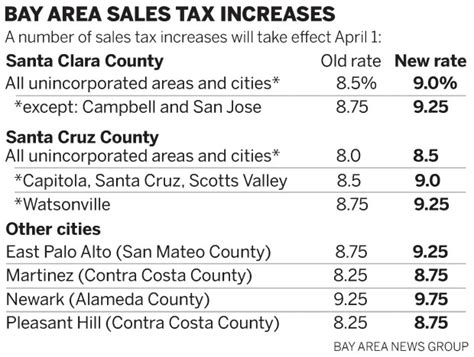

Sales tax in Santa Clara operates under a complex yet well-defined framework, influenced by state, county, and city regulations. The California state sales tax rate currently stands at 7.25%, which serves as the base rate for all transactions. However, this is just the beginning of the story, as additional taxes are often applied at the county and city levels, resulting in a more nuanced tax structure.

County-Level Sales Tax

Santa Clara County imposes an additional sales tax of 0.5%, bringing the total countywide sales tax to 7.75%. This county-level tax contributes significantly to the local infrastructure and services, ensuring the smooth functioning of the region.

City-Specific Sales Tax: A Unique Consideration

The city of Santa Clara further adds its own sales tax, creating a distinctive tax rate for businesses and consumers within its boundaries. As of our latest data, the city of Santa Clara levies an extra 0.75% sales tax, making the total sales tax rate 8.5% for all qualifying transactions. This city-specific tax is a unique feature of the Santa Clara tax system, and it’s essential for businesses to factor this into their pricing strategies and for consumers to understand the added costs.

To illustrate this, let's consider a practical example. If you were to purchase a laptop priced at $1000 in Santa Clara, the sales tax would amount to $85, which includes the state, county, and city taxes. This breakdown highlights the importance of understanding the layered tax structure in Santa Clara.

| Tax Level | Tax Rate | Amount |

|---|---|---|

| State Sales Tax | 7.25% | $72.50 |

| County Sales Tax | 0.5% | $5.00 |

| City Sales Tax | 0.75% | $7.50 |

| Total Sales Tax | 8.5% | $85.00 |

Exemptions and Considerations

The sales tax system in Santa Clara, like many other jurisdictions, includes a range of exemptions and considerations that can significantly impact the tax liability of businesses and consumers. Understanding these nuances is crucial for accurate tax compliance and strategic planning.

Essential Exemptions in Santa Clara

Certain goods and services are exempt from sales tax in Santa Clara, offering relief to consumers and providing clarity for businesses. Some of the key exemptions include:

- Food and Beverages: Prepared meals, groceries, and non-alcoholic beverages are generally exempt from sales tax in Santa Clara. This exemption provides a significant relief for consumers, especially those with limited budgets.

- Prescription Medications: Sales tax is not applicable to prescription medications, ensuring that essential healthcare items are more affordable for those in need.

- Educational Materials: Textbooks, educational supplies, and certain equipment used for educational purposes are exempt from sales tax. This exemption supports the local educational system and encourages learning.

- Certain Services: Some services, such as legal and medical services, are also exempt from sales tax. This exemption recognizes the importance of these essential services and ensures they remain accessible to the community.

Considerations for Online Sales

In today’s digital age, online sales have become a significant part of the retail landscape. When it comes to online sales in Santa Clara, there are specific considerations that businesses must keep in mind to ensure compliance with the local tax regulations.

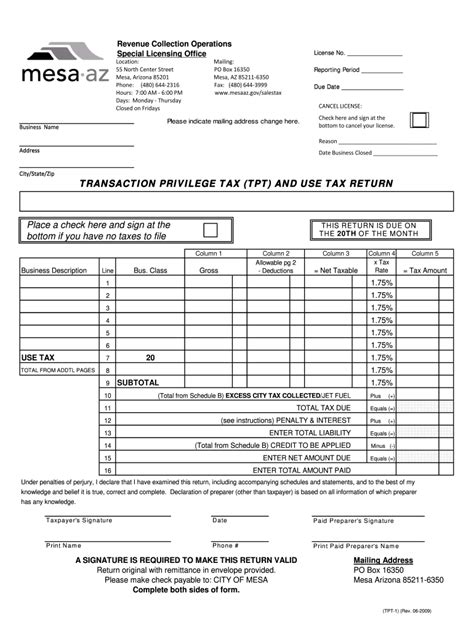

Santa Clara follows the Marketplace Fairness Act, which requires online retailers to collect and remit sales tax for transactions that are delivered to addresses within the city. This means that even if a business is located outside Santa Clara, if it ships goods to customers within the city, it is responsible for collecting and remitting the appropriate sales tax. This regulation ensures a level playing field for local businesses and promotes fairness in the e-commerce landscape.

Taxable Services

While many services are exempt from sales tax, there are certain services that are subject to taxation in Santa Clara. These include:

- Lodging: Sales tax is applicable to hotel stays and other forms of temporary accommodations.

- Entertainment and Leisure: Tickets for movies, concerts, and other entertainment events are subject to sales tax.

- Certain Professional Services: Some professional services, such as accounting, consulting, and certain types of legal services, are taxable.

Strategies for Businesses

For businesses operating in Santa Clara, understanding the sales tax system is crucial for effective tax management and strategic planning. Here are some key strategies that businesses can employ to navigate the complex sales tax landscape:

Utilize Sales Tax Software

Investing in robust sales tax software can significantly simplify the tax compliance process. These tools can automate tax calculations, ensure accurate tax collection, and streamline the tax remittance process. By leveraging technology, businesses can save time and reduce the risk of errors, leading to more efficient tax management.

Stay Informed about Rate Changes

Sales tax rates are subject to change, and it’s essential for businesses to stay updated on any alterations. Whether it’s a change at the state, county, or city level, businesses must be aware of these modifications to ensure compliance. Subscribing to tax alerts and regularly reviewing tax resources can help businesses stay informed and adapt their strategies accordingly.

Leverage Exemptions Strategically

Understanding the exemptions and considerations in the sales tax system can provide opportunities for businesses to optimize their pricing strategies. By structuring their offerings to take advantage of exemptions, businesses can potentially reduce the tax burden for their customers and stay competitive in the market.

Collaborate with Tax Experts

The sales tax system in Santa Clara, and indeed any jurisdiction, can be complex and nuanced. Engaging the services of tax experts or consultants can provide valuable insights and ensure that businesses are fully compliant with all regulations. Tax professionals can offer tailored advice, help navigate complex scenarios, and provide peace of mind regarding tax obligations.

Conclusion: Navigating the Santa Clara Sales Tax Landscape

Understanding the sales tax system in Santa Clara is a critical aspect of doing business in this vibrant city. With its unique combination of state, county, and city taxes, along with a range of exemptions and considerations, the sales tax landscape in Santa Clara requires a careful and strategic approach. By staying informed, leveraging technology, and seeking expert advice when needed, businesses can effectively navigate this complex tax environment and ensure compliance while optimizing their operations.

Are there any upcoming changes to the sales tax rates in Santa Clara?

+As of our latest information, there are no imminent changes to the sales tax rates in Santa Clara. However, it’s always a good practice to stay updated with local tax authorities and news sources to be aware of any potential future modifications.

How often do sales tax rates change in Santa Clara?

+Sales tax rates can change periodically, typically in response to legislative decisions or local economic considerations. While there is no set schedule for rate changes, it’s important for businesses and consumers to stay informed about any alterations that may impact their operations or purchases.

Are there any specific guidelines for online businesses regarding sales tax in Santa Clara?

+Yes, online businesses that deliver goods to addresses within Santa Clara are required to collect and remit sales tax under the Marketplace Fairness Act. This ensures fairness in the e-commerce landscape and compliance with local tax regulations.